I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

I recently covered the Manchester United Credit Card from Cardless. It’s a surprisingly great no annual fee cash back card delivering 5x on rideshare and streaming services as well as at bars and restaurants on days that the team plays.

You don’t get this kind of return in these categories from many cards, and you can stack it with a rebate of $5 on Peacock Premium streaming each month you put $500 spend on the card.

Credit: Cardless

Something else that made the card intriguing is that is comes from a brand new card issuer, Cardless, and their strategy seems to be a bit different from other issuers.

Cardless Can Issue More Rewards Cards With Smaller Brands

There hasn’t been a major new card issuer launch since Capital One in 1994. Competition, though, is good for consumers. Big banks build on legacy tech stacks, and are… big banks. The largest issuers of rewards cards have a hard time making small card portfolios work for them, although Chase is going to be launching an Air Canada card and even announced they’d work with Instacart as they reach for new cardmembers and spend.

Still, the largest airline cards are likely doing over $100 billion a year in transaction volume, and even the small international airline cobrands are doing a few billion.

Without legacy costs and tech, new companies can make more cards work, partnering with more niche brands. That means more rewards cards, which again, is good for consumers. And it means more variety in rewards offerings. It’s good for smaller companies, too, which have a shot at a proportional piece of the revenue that has only been available to large brands.

The closest we come today is Bank of America issuing cards with Susan G. Komen and several larger universities, although their Asiana card appears to no longer be available.

By Bringing In Different Investors To Fund Each Card, Cardless Can Approve More Credit Types

Cardless is interesting because they aren’t both issuing the card and funding transactions themselves, the way that a bank would. They put together a consortium of lenders that finances different segments of their customers – super prime, prime, and even subprime.

This is better for approvals. They’ve built out their own customer approval metrics from scratch. Here’s how they describe that process,

[W]e purchased historical, anonymized archived credit bureau data containing over 2,700 credit attributes. We bought this data on 1.25 million applicants who received similar bankcard products to the Cavs card between April 2017 and June 2018 with a two year performance window.

Once we created the synthetic dataset, we set to work building a credit model. Our dependent variable was whether the accountholder had a serious delinquency on their credit card within their first two years of card ownership.

They took 700 for predicting credit risk, ran regressions, and winnowed down to 101. They go into a lot more model, I love the transparency around this, and explain why they believe they do a better job predicting credit risk than a traditional credit score. I’d give them a shot even if you aren’t getting approved for traditional rewards cards.

Easier To Customize Rewards

Brand new tech makes it easier to customize rewards. Having more cards, which working with smaller brands allows, means offering different combinations of targeted rewards. More options can mean picking the perfect card for your spend instead of needing half a dozen different cards to get the right bonus categories.

What would your ideal rewards card look like? We’re already seeing Cardless offering different cash back and benefits mixes for their different cards in the sports co-brand space. They’ve mentioned to me in the past imagining letting customers pick their own bonused categories, and even changing those categories at whim. It’s hard to imagine a legacy issuer doing something like that.

Whenever a bank shares the details of a new product, I ask one simple question: who is this card for? If I get back something like “millennials who prefer experiences over things” well you know just how well the card is going to do.

Marketing for credit cards is really no different than marketing any other product. In fact the best marketing is the worst enemy of a bad product, because then customers know about it. Sure, a product may do ok without delivering much value to consumers. But to really be a winner it has to solve a need that consumers have. The product needs to offer them something that they don’t already have with existing products.

To succeed in the crowded credit card space, issuers need to figure out how to give customers more along some dimension than what’s offered by current choices. With lower overhead costs, lower legacy costs, and new tech it should be possible to rebate more to the customer – and that creates a world of creative opportunities. Competition is a good thing.

Ground Up Mobile-First Experience

Is your driver’s license still valid for only four years? Many states now issue drivers’ licenses valid for 8 years. In 1999, New Zealand moved to ten-year expiration. A former New Zealand cabinet minister told me the story. He said he asked why licenses expire at all, aside from checking in at points when someone’s vision or driving ability might wane? And the answer he got was that the paper licenses used to be printed on degraded, so they needed a regular replacement cycle. So they moved to plastic licenses and ten year expiration.

There’s a lot in the credit card business that works the same as it has for decades, because it’s always been done this way. Banks tend to be conservative, in part because they’re heavily regulated. But when you start from scratch it’s easier to think fresh about process.

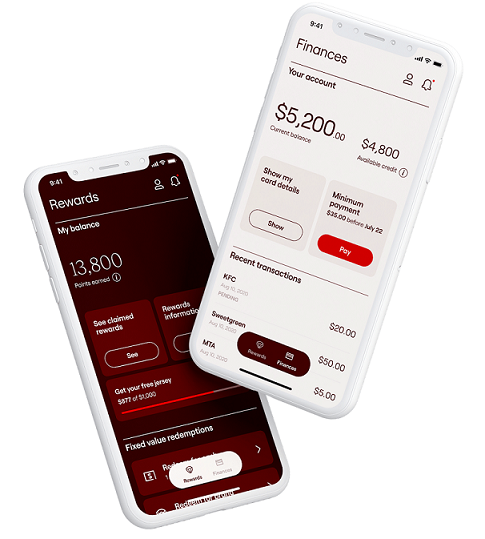

Cardless is aptly-named because you’ll primarily access your card account through their mobile app. That’s where you get your card number, which isn’t printed on the physical plastic they give you for times you need to actually swipe something. The Apple Card already proves mobile-first works.

Credit: Cardless

When you are approved for a card, such as the new Manchester United Credit Card, you get access to your account immediately. The card doesn’t have numbers on it. If you lose your card and need to replace it, there’s no need to change your account numbers – and along with it the hassle of changing automated recurring bill payments to it.

Bottom line is that the new Manchester United Credit Card from Cardless is a really interesting no annual fee cash back card, worth a look and a place in many of your wallets. And I’m looking forward to seeing what Cardless and FinTech broadly can do to bring new options in the next few years.

The Asiana card may have been dropped because Korean Air is taking over Asiana, perhaps? It was supposed to have been completed this year or next, but is now 2024…

Gary, I applied for the card upon reading and the number to call to receive an update is (888) 227-2537. It connected me directly to American Airlines. How is this possible?

FYI for any non-ManU fans, the free ManU shirt is actually a $119 voucher to Fanatics.com and you can use for anything.

If you love football the last credit card you should get is the Man United card.

#glazerOUT

Um, no. Apple card is a joke. Just another way Apple sucks money out of its users. The Manchester United card, give me a break. Too specialized, benefits are cash back, there is always the conversion factor….not for everyone. How many Americans do you think really want this card?

@Gary Chase is partnering with Instacart, not instagram.

@Scott – typo corrected thanks

Great blog entry and informative.

Speaking of driving licenses, wasn’t it the case that NJ licenses used to be good for decades?

@JohnB

The Apple Card primarily benefits those who take advantage of the 12 months 0% financing for Apple products. Apple benefits because they will sell more than they would have. For consumers, something that would be a drag ($1000 for a phone or iPad Pro) becomes a trivial charge broken down by 12. Customers re not being ripped off. They re receiving high quality devices they want.

Just a note that rideshare is now showing downgraded to 2%, not the 5% listed in the piece…

Would be interested in trying a card from this company. I’m rooting for them, but It looks like they’ve struggled to add more partners in the 2.5 years since this was posted.