The Blue Business® Plus Credit Card from American Express now has an initial bonus offer. Most of the time it hasn’t. Frankly, the card is too good, and extra points should get you to pay attention.

Credit Cards

Category Archives for Credit Cards.

Bilt Rewards Raises $150 Million, Hits $3.25 Billion Valuation – Critics Still Doubt

Bilt is valuable because they have access to valuable customers – young urban professionals, upwardly mobile – that everyone wants to reach and fails at. They have that access where they live and they built a valuable and engaging program to reach them.

In other words, they’ve come up with a novel approach to the distribution problem that everyone is struggling with.

Bilt Devalues Rent Day Points-Earning Effective October 1

Each month they offer double points on the 1st for spending with their co-brand credit card. All non-rent spend doubles, and that doesn’t mean just an extra point. Dining earns 3 points per dollar with their card, so earns 6 points per dollar on the first. Travel earns 2 points normally, so earns 4 points on the first.

Bilt Rent Day: Virgin Cruise Deal, Blade Helicopter Party, And Discounted Fine Dining

Bilt’s monthly Rent Day deals have been revealed, and this month they have an offer on Virgin cruises; a Blade helicopter party; fine dining access at a discount; along with the usual double points on their credit card, SoulCycle offers and a game show to win cash for rent.

I really like the dining deals. I prefer when they have 100%+ transfer bonuses to airlines and status deals. But you don’t get those every month!

New Rise Credit Card To Make Tuition Payments Rewarding (‘Bilt For Tuition’)

Rise has opened the waitlist for a new credit card designed to reward tuition payments – whether K-12 private school, university or graduate school. The idea is to reward payments that don’t usually make sense by credit card, since most schools tack on a fee to pay by card.

Wells Fargo Launches Expedia Credit Cards, And Your Hotel Stays Could Cost Almost 30% Less

Savings on stays is the interesting play with Expedia’s OneKey Rewards, and the easiest way to earn status that yields that savings is by having one of their new credit cards from Wells Fargo.

Bilt Is Dropping Their Legacy Credit Card Portfolio, I Just Applied For A Wells Fargo Card And Got A Bonus

I first got the Bilt Rewards Mastercard in November 2021. When the program launched they were with another bank, and launched with Wells Fargo in March 2022. Wells didn’t buy the back book. I suspect the lack of revolve by cardmembers – early adopters like me aren’t a super profitable bunch! – led to this decision.

So there have been Bilt credit cards from two different issuers, although all new cards over the past 27 months have been Wells Fargo cards.

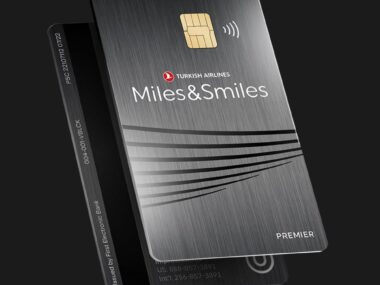

New Turkish Airlines U.S. Credit Card: Sleeper Hit Or Major Disappointment?

I hadn’t even realized there was a new Turkish Airlines Miles&Smiles Premier Visa Signature® Credit Card for U.S. customers until reader M.E. flagged it for me. And it’s sure a strange one!

Amex’s $400 Million Power Play: How Tock Deal Fits Into New Super App To Change Dining Forever

American Express is assembling its travel and lifestyle super app. Cardmembers spend a lot on restaurants, and those with the disposable income to go out at upper-end restaurants are a lucrative segment.

Meanwhile, embedding a card brand into the dining ecosystem, and leveraging a platform to deliver restaurant reservations and experiences to guests, is a way to win loyalty. At least that’s the bet.

WSJ: Wells Fargo And Bilt Rewards Contract Details Too Generous With Customers, Locked In Until 2029

I love reading these insider details, almost as much as the players involved probably hate their being published.

I think both sides come out really well here – Wells Fargo aggressively experimented, found something wasn’t working, and pulled back while they retooled. Meanwhile Bilt Rewards has a lucrative program in place for a long time that consumers benefit from.