I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

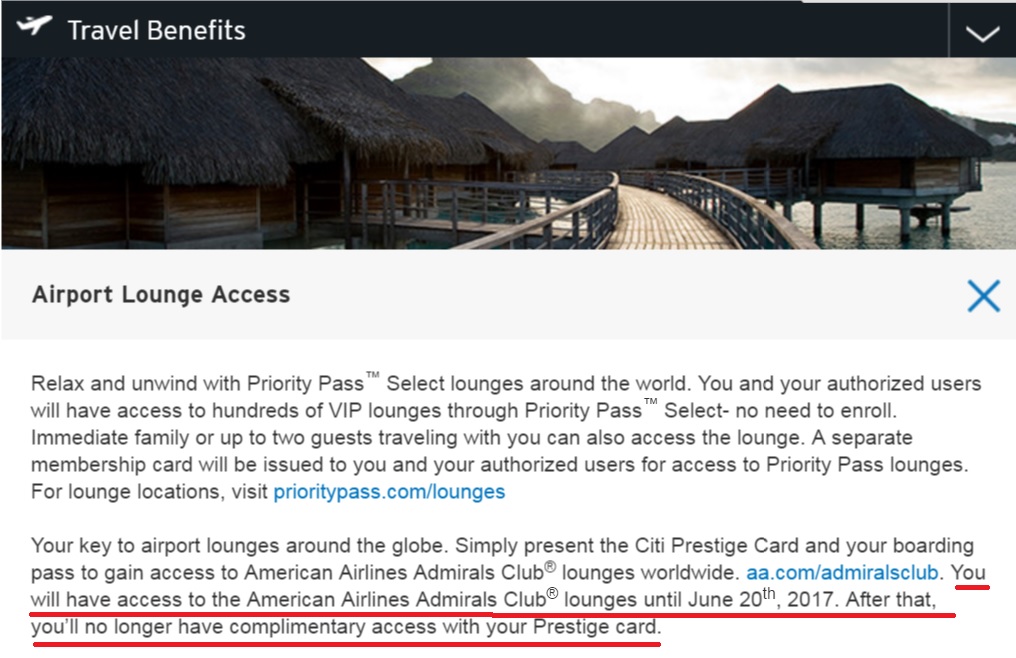

Citibank has posted to the Citi.com website that the Citi Prestige Card will offer access to American Airlines lounges (when flying the airline) until June 20.

That’s 11 months’ notice that the American Airlines lounge access benefit will end, which is reasonable, although hopefully Citibank will proactively communicate this to cardmembers as well as posting it to their website.

Last week American struck a new credit deal with Citibank and also with Barclaycard. Neither card issuer will get to be the exclusive co-brand partner of the world’s largest airline.

Citibank clearly was unwilling to meet American’s price for exclusivity. And Citibank lost several things to Barclaycard relative to the status quo in this deal.

- Exclusivity in issuing new American AAdvantage cards

- The right to market through certain channels, such as inflight

And now they lost the right to offer Admirals Club access to their own-branded premium card, and instead will only be able to offer access to American’s lounges via the Citi® / AAdvantage® Executive World Elite™ Mastercard®.

Putting Green, American Airlines Club Austin

It will be interesting to see whether Citi adds any new benefit in place of American lounge access or not. But as I’ve been saying for some time, the value proposition of this card is too good as it is now, so it cannot last.

Fortunately, getting the card now still comes with all of the great benefits — including this one for the next 11 months.

The card is expected to see some changes today, and those have been speculated to be a change to the signup bonus (either fewer miles or higher spend requirement) and a possible end to new cardmembers receiving double points on dining. We’ll know soon enough, but I’d still get the card while the current offer is on the table.

(HT: @PointsToPointB via Miles to Memories)

Thoughts on whether some pro rata refund or courtesy credit/points will be offered to those who signed up recently and paid the annual fee expecting 12 full months of Admirals Club access but are now getting 11?

“That’s 11 months’ notice that the American Airlines lounge access benefit will end, which is reasonable, although hopefully Citibank will proactively communicate this to cardmembers as well as posting it to their website.”

I don’t think it’s reasonable at all. I just paid $450 for an annual fee, and I don’t think it’s unreasonable at all to expect to receive the advertised benefits for the full year that I paid the annual fee for. If they refund me 1/12th of my annual fee then I’ll say it’s reasonable.

Honestly, if you want a credit card for Admirals Club Access, the Executive AAdvantage card may have always been the better option.

People like the Prestige because of the effective $250 annual fee, but authorized users cost $50/ea. The Executive AAdvantage Card is truly a $450 annual fee, authorized users are free and if you already have an AA card with an annual fee, you can cancel that to effectively reduce the fee of the Executive AAdvantage card.

I think the Executive AAdvantage card is good for a household where one member has elite status, and another doesn’t. The non-elite member can be the primarily card holder to get the pseudo-elite perks, and the elite member can be an authorized user for the lounge access.

The Citi self-branded credit card line-up has always been weird, and now it’s gotten stranger. There’s really little reason to get a Prestige card now. I know some people play around with the “4th night free” hotel benefit, but I suspect most cardholders never use this niche benefit. The only other unique benefit is getting 1.6 cents per mile for buying AA revenue tickets. Given AA’s poor award inventory — and the return of cheap junk fares — this is often a better way to “fly for free” on AA than redeeming AA miles. But will this benefit stay? It seems unlikely.

Meanwhile, the Citi Premier card, which is probably the best all-around card for frequent travelers to put spend on (it suffers from bad transfer partners — but I get value transferring to Etihad during bonus periods) seems to be dying. It hasn’t had a sign-up bonus in months. Weird. I wonder if Citi will now rejigger these products. For the moment, it seems like they’ve taken their eyes off the ball.

The loss of the AA lounge sucks but honestly, if the lounge, no 2x points in dining and higher minimum requirement is all that is changing… i’m still going to keep my card when it comes up to renewal in September. Prestige is basically a $200 annual fee card for that I can get 4th hotel night free, 3 rounds of golf, best Priority Pass plan given out by any credit card.. plus 1.6cents redemption toward AA flights. It is still the best premium card out there.

Gary,

Why didn’t you mention this yesterday when you were pushing sign ups of this card? Every other blog was mentioning it. You just wanted your $$$$

In my opinion is not reasonable.

It is bad to lose benefits but I couldn’t care less for access to Admiral’s Club. There is nothing special about those lounges and since I have access to Amex lounges and Priority Pass lounges I don’t need to waste my time with AA.

The platinum Amex card just got stronger relative to the Prestige card and Citi executive Advantage card which are all $450 cards.

Gary, the 50k/$3k spend offer is still in place…so much for your warning heading imminent change coming to the offer. What is your next “foregone conclusion”? Are you now going to get your peeps to sign-up for another card to access the club?

This card makes less and less sense for me. Rarely do I have a 4 night hotel stay, even on business trips. Now no access to AA lounges. Glad I didn’t apply for this card the other day…

THE SKY IS FALLING!!! SIGN UP NOW!!! 50K WILL BE GONE TOMORROW!!!! OMG IM A THOUGHT LEADER!!!!!

…….woops! I was wrong! Give me your $$$$ though

@Jon wait — are you asking why I mentioned it this morning and not last night? [If so, simple answer: I was at a work event last night.] I’m not sure how this would affect the decision to sign up one way or the other, given that the benefit stays with the card for the next 11 months?

The 4th night free is a “niche” benefit? Maybe for many; definitely not for me. In my first 7 months of having the card I’ve saved $1,700 on that benefit alone. Could I have manufactured some of that, used Hotwire or Priceline, bought Hotel.com gift cards at a discount, etc? Yes, but it is a heck of a lot easier to get that 4th night this way. I just got back from Disney and Orlando and saved $650 on the 4th night free staying on property. In Feb, I had 8 days in NY and split the stay between 2 hotels, saving another $680. Even if I could be a better consumer, cut the $1,700 in half and the cards is worth $850 to me. For the person that wants 1/12 of their fee back (ridiculous), do you promise not to use any other benefits during that month since you’re requesting the entire month. No points, 4th night free, golf, etc. Sounds like the wrong card for most of you. I also have the Amex Business Plat but will be giving that up since 4th night is my “golden ticket.”

@ Gary – sleazy

@Jon your comment? Yes it is.

This certainly dilutes the value proposition of this card. The questions becomes what is Citi going to do to make up for this? If they are following the AMEX lead probably not much . At this time this seems to be the only announced change, but I’d imagine there are a few more to come. Hopefully we’ll know very soon.

In the mean time, I still see enough value in the card to retain it even with the loss of the AC access in June. Hopefully there’ll be an expanded TY points transfer partner program – maybe even including AA.