I used to think that miles would always be worth at least a penny. But even that’s not a guarantee. Like most things in US aviation, Delta is at the forefront — including with devaluations.

It’s useful to think of miles as a currency. They’re a proprietary currency with no currency board or independent central bank. And there’s a huge incentive to devalue, to monetize the debt.

Last week I was telling a past award booking client they’d do better using their American Express points to buy flights to Europe they wanted to gift their friends than transfer those points to Delta and redeem an award. That’s because they could use their Amex points at a penny apiece, but Delta wanted too many miles to even get that.

Matthew wrote about this phenomenon.

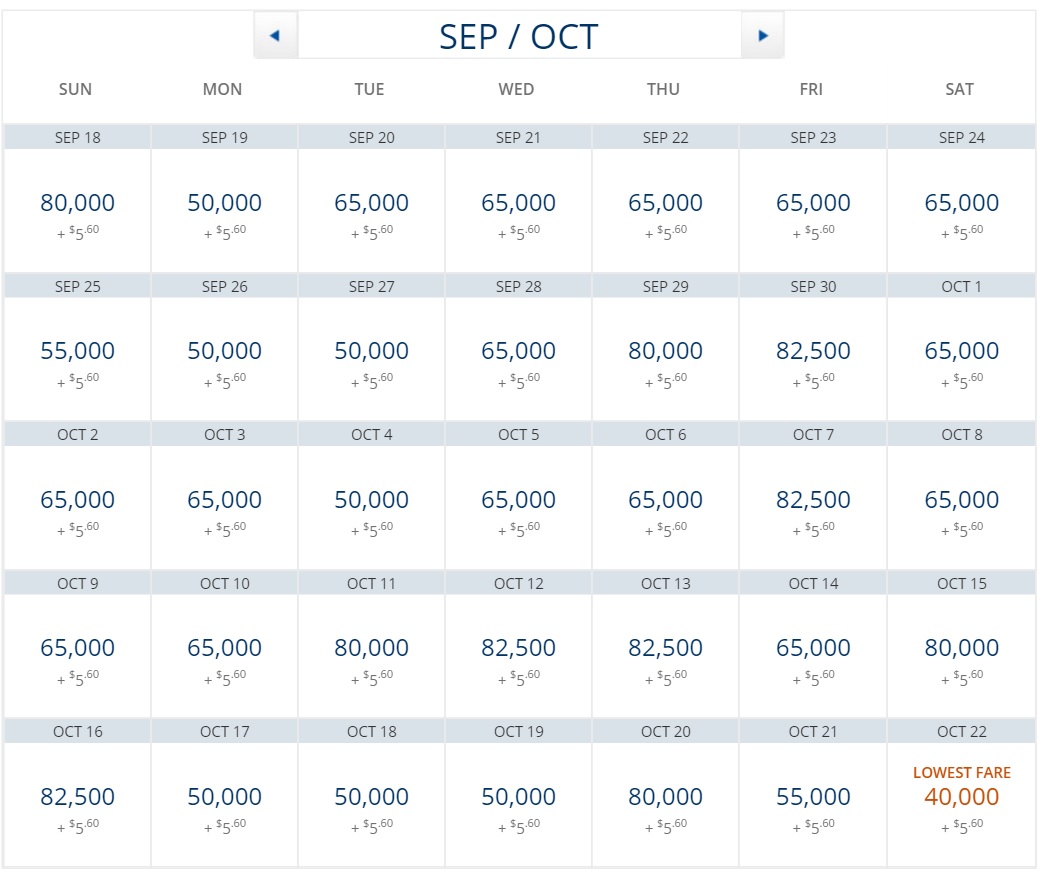

Let’s look at a simple award calendar for one-way Los Angeles – Honolulu in first class. Most days awards run around 62,500 and up. There’s one saver ward available on the calendar at 40,000 miles.

You’d think that 80,000 mile awards (82,500 even!) are going to correspond to really expensive tickets under Delta’s faux-revenue based program, right?

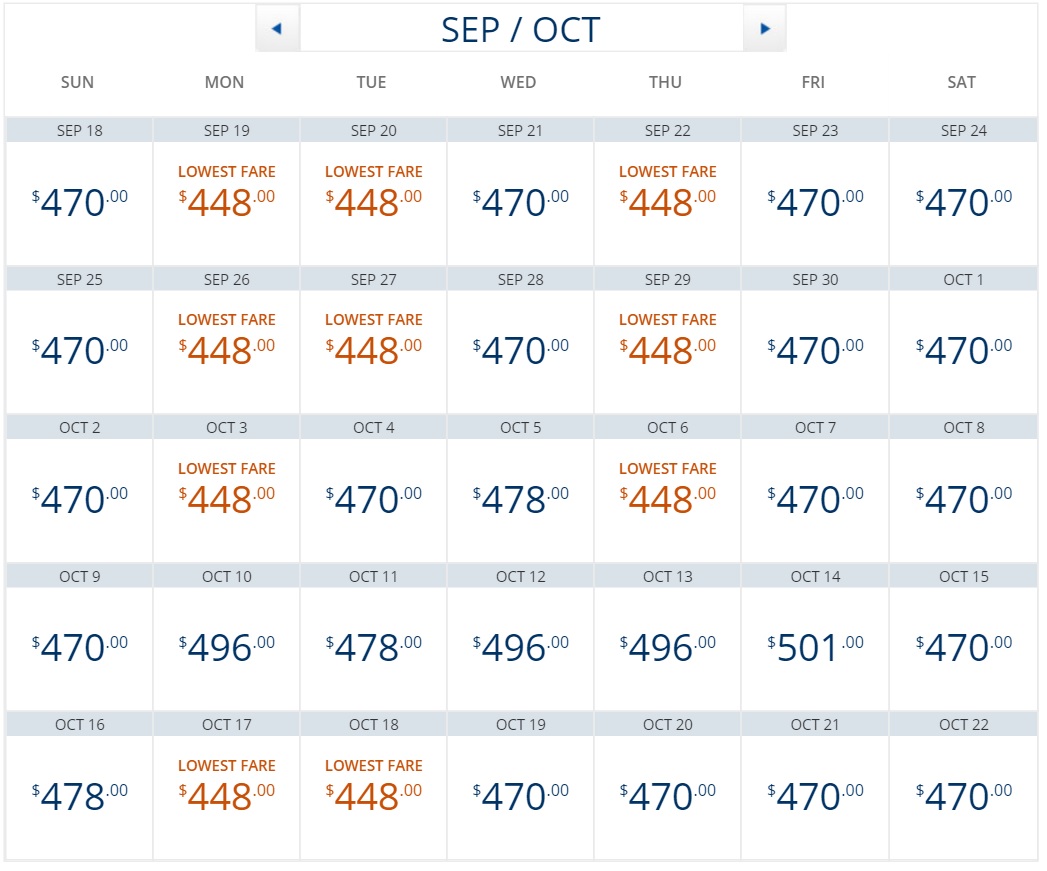

So I simply flipped over to “money” rather than “miles” and got this pricing:

In fairness to Delta, I went looking for a more expensive ticket closer to high season, figuring you could get better value for this expensive award pricing in December.

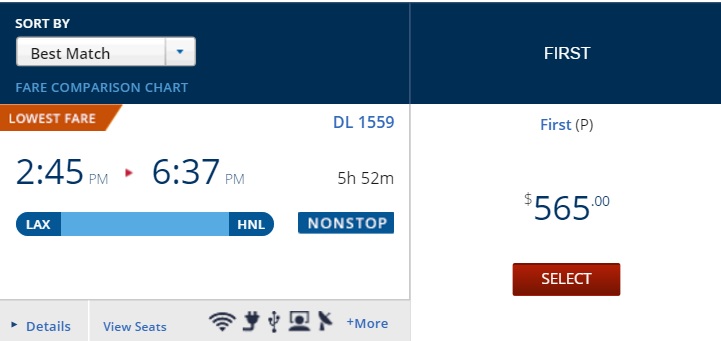

I got the one-way ticket price to go up to $565:

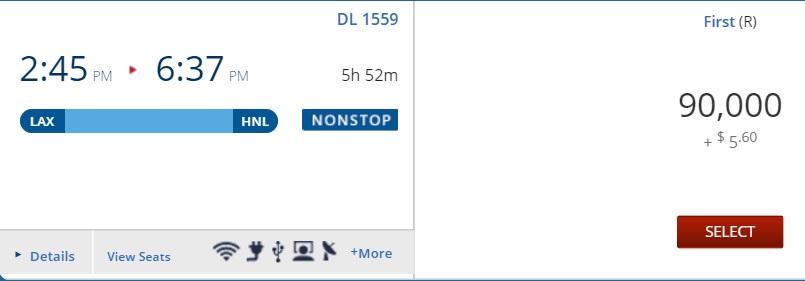

How many miles did that cost?

90,000 miles to save $560 and not earn miles, those SkyMiles are worth 6/10ths of a cent apiece.

On that rare one day in the calendar where you could book a one-way for 40,000 miles — you can hunt for a needle in that haystack — to get your miles up to a penny in value.

At Delta you can certainly still get a 2 or 3 cents per mile redeeming for international premium cabin travel at the saver level, and Delta’s transatlantic award availability is reasonably good compared to their US competitors. When they’re running redemption sales you can do well (although not always), and redeeming miles for partner travel you can do similarly well even though Delta continues to increase award prices without notice.

Delta wants you to use your miles for Dom Perignon in their club and in the future perhaps for haircuts.

They are trying to create the perfect company town. They pay out SkyMiles, and then set the prices of goods in their company-owned store. And here’s the thing, they have a monopoly in this town. So while they tell you you’re getting 1 cent per point (as though that’s a good thing!) redeeming miles for Dom Perignon, that’s based off of Delta’s inflated prices. $250 for a bottle of Dom Perignon is nuts, and so is 25,000 miles.

In the past airlines would offer retail choices as a mileage redemption option, and would try to price as close to a penny apiece based on the street price of the item. They’re buying something real and selling it to you, and they get some leverage buying in bulk (usually through a third party), which is why you don’t get 2, 3, or 10 cents a mile for those redemptions.

The goal of retail options was to provide an alternative to customers who didn’t want to redeem for travel (which was to remain the core of the program) and to provide a relief valve for the high demand for limited saver award seats. The goal wasn’t to get people not to even bother with travel redemptions, and it wasn’t to overprice the retail.

Perusing Delta’s SEC filings, they share in their most recent 10-K:

At December 31, 2015, the aggregate deferred revenue balance associated with the SkyMiles Program was $3.9 billion . A hypothetical 1% change in the number of outstanding miles estimated to be redeemed would result in a $29 million impact on our deferred revenue liability at December 31, 2015

If that 1% increase in the number of outstanding miles is redeemed for the same things they’re being redeemed for now, just at a higher mileage price, then Delta is able to recognize $29 million for no additional cash outlay.

The downside of course is that existing customers who have accumulated those miles may feel they are getting less value from Delta and might become less likely to give revenue to Delta in the future (either ticket purchases or mileage-earning transactions). In theory that should be reflected in a downward adjustment to goodwill. But it’s not obvious enough that this will happen.

- Several months into Delta’s revenue-based program, survey data suggested that less than 1 in 4 program members even knew that changes to the program had been made. Perhaps that is why Delta removed award charts, if they don’t even have to announce changes many consumers won’t be aware of them — and go blindly on buying tickets and engaging in mileage transactions with the program only learning what their miles are worth in the future when they go to redeem.

- American and United have devalued their own programs, so there’s less of an obvious gap between Delta and their competitors. Delta may be able to remain on the forefront of reducing the value of their miles if other programs continue to ‘manage by doing what Delta does’.

In fact Delta is earning a revenue premium and doesn’t believe SkyMiles is the reason. That suggests they’re doing well in spite of devaluations to the program. Which seems like a Green Light on Virginia Avenue to keep doing this:

When I fly Delta I have my miles put on Flying Blue, because I travel enough on AF/KLM routes that I know I will use them (such as the 62.5K saver awards TATL).

I was at a SkyClub in ATL last week and all the drink items were giving 2 cpm value for using miles. Could be a recent change.

Parker’s recently made American almost as bad.

It’s the banks’ fault. Why do they keep paying whatever the airlines demand for almost worthless miles? (Especially when their own reward cards are often better deals). The mile purchases by banks is a huge portion of airline profits and they should have excellent bargaining power to stop this nonsense.

OK, um?…..Just shows that you need to compare your options. If you aren’t smart enough to do that, then you deserve what you get.

Wow, the cartoon is wrong on alms every single point.

The creator of that should take a serious look at where we would be without the Fed. Geez.

One flies an airline to make profits in a business—-spend vacation travel is really a small percentage. For profits, that requires either physical objects, energy (oil, gas, coal), or to spend/invest an excess. Today, all of this Marc Zuckerberg, Eric Schmidt, Facebook, Google, digital counterfeiting of content, etc., crap makes flying not very much required—no one flies to buy/trade Apple, Amazon, Google, Netflix garbage.. This is why we’re seeing “Premium Economy Class”, the clear sign of no one flying any more, no extra seats to fill, thus cutout the seats and fly less people.

The oligopoly airlines are making passengers the 3rd reason for cuts. The first expense, fuel. Now that fuel dropped huge, the second expense are employees. Now that the mergers have taken place and the boardrooms consists of the same people for the 4 major airlines, the third expense are passengers themselves. Cut out the free-riders, make the socialists that look like cavemen stay on the train, and remove the “lower middle-class” so that the remaining employees can have the increase costs in healthcare (caused by that racist liar Obama), and the pensions for the retirees.

Frankly, I don’t mind the socialists off the plane. Donald Trump will fix it, won’t he? lol

Prior to the internet it was much harder for airlines to identify “short comings”(from an airline’s bottom line perspective) in their loyalty programs. But with all the travel hacker bloggers out there broadcasting any potential “shortcomings” of a program to the world, they are helping the airlines, credit card companies, and hotels etc quickly identify ways to increase their bottom line by eliminating, changing, or manipulating the terms of their loyalty programs. I am sure the airlines and banks really appreciate the free service/intelligence that travel bloggers provide them with.

I am convinced that all airlines now have a full time staff member reading travel blogs all day long to identify any “imperfections” in their program that they can immediately eliminate in order to increase their bottom line. The staff member’s #1 responsibility is to identify any opportunity to increase the bottom line of the airline by saving a few dollars here and there. There is ZERO regard for the customer and all benefits that do not directly increase profitability are to be eliminated. What’s left are teaser benefits that can be used by the marketing department to create the illusion that they care for or appreciate our business. Bait and switch is becoming the standard practice for airline disloyalty programs.

When an airline practices disloyalty tactics and gets away with it. The executives of the other airlines follow suit to improve their bottom line so that they can make more money for the company and in turn increase their personal performance bonus. These short term gains are then leveraged to get even higher pay packages for themselves. Most companies have simply become nothing but tools for its high level executives to manufacture great performance bonuses for themselves. Short term profit gains are important not just for performance bonuses but for promotional opportunities or to get better job offers from competing firms.

The above are why the loyalty programs are just getting worse and worse every year. The executives are not planning to stay there for the next twenty years, so who cares what is in the long term interest of the company or its customers.

How much for Krug – I prefer over DP 😉

American is worse. No question about it. This blog is full of Gary’s negative attitude about Delta but he never tries to be balanced about his opinion. At least he’s not Mr. Crybaby “Rene” who writes like a grumpy old man.

Use of the term “saver awards” is inappropriate when there is no published award chart. How about referring to “redemption at the lowest known level” or “redemption at the lowest level listed on DL’s last award chart”

Also I find it odd that you buy hook, line and sinker the management lie about flyers not caring. The only people who fly DL now are those who are stuck at hub fortress and/or price insensitive. Nobody savvy flyer would knowingly pay a premium for a product that is marginally better (in terms of operational excellence) or requires additional fees to achieve the same level of service (i.e. paying for E+ seats when they are free to UA Gold, etc.). Not to mention getting miles that are far less valuable than UA, AS or even AA, for many reasons.

Finally, further to your Hawaii example, I have never had difficulty finding UA flights to Hawaii in Sept/Oct at the 40k (is it now 45k?) level for economy seats, particularly for those who can plan a few months out. F seats are admittedly harder to find though hardly worth the premium on what amounts to a transcon (38″ pitch v. 36″)

Gary — Two points:

1. You omit that Delta Amex holders can always get at least 1 cent per mile for flights (and earn MQMs) using pay with miles. That’s still not a good deal, but it sets the floor at 1 cent, not 6/10 of cent.

2. Who cares what Delta charges to buy non-flight products with miles? It’s an option and if someone wants to pay the inflated miles price, then it’s money in Delta’s pocket. If someone doesn’t want to pay with miles, they can always pay in cash and are no worse off than if Delta didn’t offer the option.

With all that being said I continue to get good redemption on Delta. MIA-LHR widely available for example, in coach and Upper Class. I got MIA-FCO at low level in business.

Any time somebody posts they cant do anything with Delta miles here are my redemptions over the past few years

ATL-JNB Business class LOW LEVEL!

LAX-SYD Virgin Business Class LOW LEVEL

MIA-LHR Many times Upper class low level

MIA-FCO Alitalia This Sept Low Level Business Class

There always seem to be some sweet sports.

What about East Coast USA to HNL?

Given the flat rate for intra USA awards they can be more point efficient when trans-continental travel is involved.

e.g. I see JFK-MSP-LAX-HNL on Sep 25th for $831 or 82,500 miles and $5.60

I see the same issue on AA. ABSOLUTELY no saver awards in First/Business available in 2017 for routes I am interested in. Out of the two, I’d rather go Delta because they have better service, cleaner planes, etc.