Former White House Chief of Staff and former Chicago mayor Rahm Emanuel is known for saying ‘never let a crisis go to waste.’ It’s an opportunity to push an agenda. So as the airline bailout train leaves the station some people are advocating the consumer protection rules that they wanted anyway. Others (like Alexandria Ocasio-Cortez) want the financial reforms they want anyway.

The American Prospect wants to nationalize the airlines recycling the same poorly thought-through arguments that Robert Kuttner, the Prospect‘s co-founder and co-editor trotted out in the wake of the United Airlines David Dao episode in 2017.

The author throws a litany of complaints about airlines at the wall: checked baggage fees, basic economy tickets, stock buybacks, and mergers.

Oddly they complain that buybacks “goos[ed] the stock price to the detriment of investments in equipment, worker pay, and passenger comfort” while failing to realize that airlines never achieved higher valuation levels that they hoped for (so much for goosing share price), that airline employee pay has been rising over the last decade, and even complaining about airline debt – which has been used in large measure for “investments in equipment.”

The Prospect piece lays all complaints about airlines at the feet of ‘deregulation’ which it fails to understand, when in fact airlines have their own regulator in the Department of Transportation that other businesses do not answer to. Airlines are far more regulated than most industries. It helps to begin what deregulation actually did,

- Stopped having the government decide who flies where

- Stopped having the government set prices

The regulated era entailed the Civil Aeronautics Board keeping prices high, blocking ‘ruinous competition’ and ensuring airline profits. Far from a competitive marketplaces, federal regulation entailed enforcing an oligopoly.

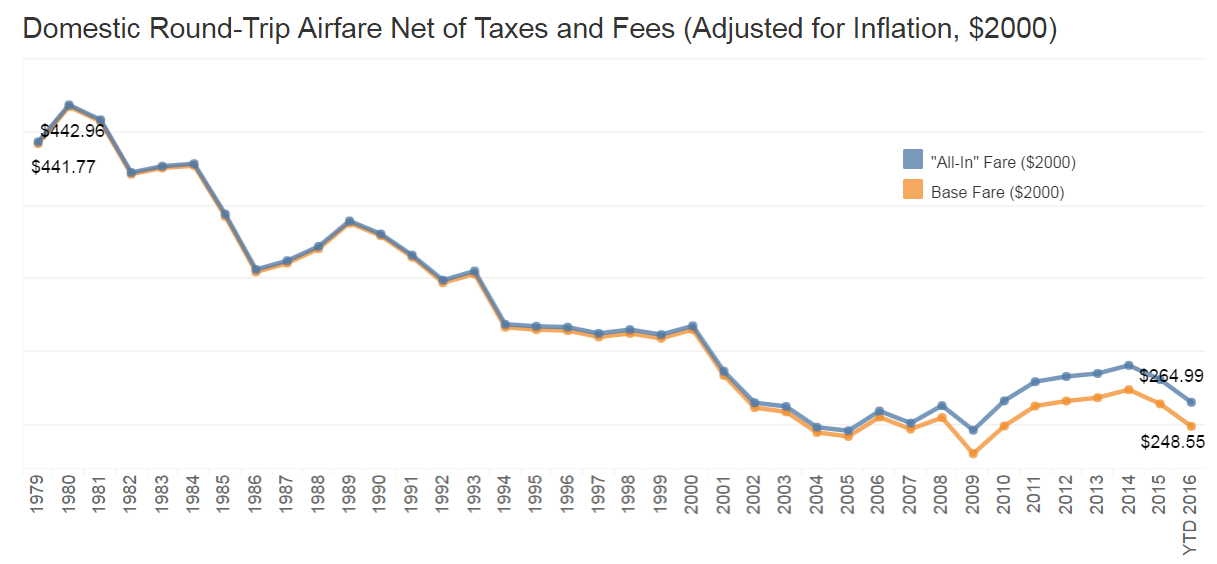

Since deregulation real prices have fallen even including fees. Airlines have gotten safer. And the idea that airlines had a golden past is somewhat silly. Consumer advocate Ralph Nader took his airline overbooking complaint to the Supreme Court complaining that federal regulators blocked compensation.

Sure, meals were better back then – prices were high and airlines couldn’t discount to compete for customers, so they competed on amenities. A return to the regulated era means fewer people flying and higher prices, but unsaid in the piece but implied in complaining that airlines are polluters (and explicitly argued by Kuttner in the past) is that fewer people should be able to fly, because there ought to be less flying.

Oddly while arguing against bailouts for the industry they want to put even more money on the line by taking over the entire thing and assuming full responsibility: “the operations and the debt obligations of the major carriers” which includes more debt that the airlines are seeking in funding as well as ongoing costs and risk of losses.

And what’s to suggest that a nationalized airline, actually run by the government (“airlines will be again treated as public utilities”), means better service – when an airline isn’t answerable to customers, just to politicians?

To be sure, airlines can be made better. We should make competition legal and stop blocking new airlines from gaining access to valuable airport gates and slots. Government has been getting in the way of competition. The answer isn’t for going to eliminate all competition entirely.

Either we let companies go bankrupt, and then we set conditions to give them loans, or we need to take ownership if we give them money. Anything else is playing favorites between companies. Why can’t Breeze get a bailout, even though they haven’t flown yet? How about any other airline startup. Why do the EXISTING companies get money, but competitors don’t? The situation we are in now is going to PERMANENTLY change the way this country (and every other one) operates. We CANNOT think that things are just going to return the the ways they were months ago after TRILLIONS of dollars is given out of tax money to anyone who comes asking.

Yes Gary, we know where your bread is buttered. I don’t want to nationalize anything, but I also don’t want to give these clowns a dime. If they go bankrupt, so be it. Thats the way every normal business is treated. It sure must be nice to work for a ‘too big to fail’ business. No matter how stupid you are, how poorly you treat your customers (WN excepted) you get taken care of.

Stock buybacks have to stop. It is a waste of capital. Any company that did buybacks, needs to be put at the back of the line for assistance! Instead of paying off debt(many companies borrowed to buyback stock), paying employees more, or investing in the infrastructure, they pissed the money away on executive bonuses and stock buybacks! Americans should be screaming and yelling about these taxpayer ripoff artists NOW!

TARP made money for the government. This should be an investment in exchange for preferred debt and/or equity, and power.

Also, United tried to leave me in Guatemala this week when they cancelled all their flights, because my ticket purchased many months ago was Basic Economy. Refused to reaccommodate on another carrier that was still flying, so I had to buy my own ticket home. _That_ should be illegal, and is the kind of change that could/should be forced through a taxpayer investment.

@John B. Nearly all public companies do stock buybacks. Further, capital is defined as debt + equity + cash. Capital is unchanged by a stock buyback. The company is just swapping come cash or debt for equity.

@Gary. Excellent post. Bravo.

Trump nationalizes the airlines. That’s a good one.

Stock buybacks are nothing more than the manipulating of stock prices for the enrichment of the executives who are not talented enough to actually use the excess cash to create increased revenue/earnings.

Thought experiment, outlaw all exec compensation based upon EPS or stock price targets, or force them to take the buyback amounts out of published EPS reporting, and see how quickly stock buybacks stop happening.

Right now I would bet that those stock holders at AA would have loved to have gotten those excess retained earnings as $33/share in dividends (if AA would have distributed that $15B of cash spent on stock buybacks) over two years a little bit more than the 5.29% extra equity that has now declined by 80% over the same time period.

@efs183. For illustration. Suppose one has a taxable stock account.

He buys Company X stock and does an auto reinvest of dividends. If Company distributed “Ordinary” dividends it would be counted as ordinary income to the IRS, to be taxed at a taxpayers annual tax rate. For example, if one had a dividends of $100, but was in the 30% tax bracket, taxes annually would be $30 on the dividend annually.

By comparison, if Company Y (which is identical to Company X except it does buybacks instead of dividends). The increase ownership in the company would not require reinvestment by your stockbroker. Therefore, there would be no annual income taxes. However, since the only things that are inevitable are taxes and death, there would be a capital gains tax (usually lower than an income tax) when the shares are sold.

Banning buybacks makes rhetorical sense (evil corporate greed, git em) rather than being justified on a rationale sense.

As others have said, stock buybacks are really just a more tax-efficient (for the shareholder) way to pay dividends. And if you’re anti-dividend and anti-buyback, why should anyone buy stock in the first place? Stock has value because of the potential for future cash flows, and buybacks and dividends are really the only way that happens (short of an acquisition, which isn’t likely for many large companies).

I agree with most of what you said Gary, but do think some consumer protections could be warranted – if taxpayer (consumer) dollars are used to bail out airlines, it’s not totally unreasonable for taxpayer representatives to ask for something in return

@Bill Bauer “Yes Gary, we know where your bread is buttered. I don’t want to nationalize anything, but I also don’t want to give these clowns a dime.”

I’m genuinely confused because it sounds like we are in agreement.

Dont bail them out. Nationalize them when they hit bankruptcy. Run them through the pandemic. Auction them(/the pieces) off to the highest bidder once travel starts to pick up again.

The water in my faucet runs all the time and my electricity is on all the time, but when I reach my mobile phone there are tons of places where there is no signal or my calls drop. I prefer pragmatism to theory — give me the reliability of water and electricity, not of mobile phone service. I don’t care that water and electricity are “nationalized” utilities and mobile phone service is provided by a “competitive” industry.

Flying positively sucked, the US3 took advantage of customers, and if “nationalization” makes it more human, so be it.

Yes, nationalise them. Airlines are key public services. The private sector has shown itself to be incapable of running them in the public ( and national) interest, regardless of the country. They are too invested in stock price increases ( for reasons of self-interest) and sleazy deals with banks and credit card providers.

Clear out this swamp full of shysters and hand control to those sworn to act in the public interest; they couldn’t be worse…

Once the Federal Government nationalize one industry, it becomes a precedent, which turns in a procedure, a slippery slope where the government owns many of the means of production. Not a pretty picture.

lets take over ANY business that needs government money. let the government pick what company will make something or provide what service. let the government pick who will work at the company. let the government pick your wages. let the government pick your level of education. let the government pick where you live. we dont need banks. we dont need the stock market

Your supposition is where the flaw lies.

Only ~14% of US households have direct stock holdings outside of pension, trusts, and other tax deferred instruments. So the vast majority of taxpayers who are holding the bag on any corporate bailouts are really are not affected.

An of that ~14%, you only get taxed at capital gains rates if you hold that stock 61 days out of the 121-day period that began 60 days before the ex-dividend date.

High dividend tax rates only affect a fraction of a percent of investors. The whole buybacks vs dividends logic is pretty much a red herring. The primary purpose of buybacks is to enrich executives and investment firm, not the shareholders. This is a classic case of the incentive structure not lining up with the long term health of these companies.

Nationalizing any industry only makes sense to Bernie bros, as socialists are normally pretty weak on both math and history. Seems we have an infestation here.

@Kirk. +1. The word “infestation” gave me a chuckle.

I am about as far away from a Bernie Bro that is out there. But companies should not be able to socialize risk but then privatize profit. If the government becomes the buyer/lender of last resort, then the govt the money should be attached as Senior non-voting preferred shares, and or all other debt being subordinated. The government gets paid first in chp 7 or 11, all the other debt holders and stock holders can suck it. No stock buybacks until every cent is paid back to the govt plus interest at prevailing Aa3 rates. (which is a effing gift considering airline bonds are junk)

Why don’t these airlines pick themselves up by their bootstraps, get a job and stop asking for government handouts?