Programs issue too many miles. There aren’t enough award seats, especially with planes flying full. They need to either increase the number of award seats or increase the cost of each seat, otherwise you just have frustrated members who can’t redeem.

At the same time programs don’t need to spend as much marketing to fill planes when planes are already full. But that’s an argument for reduced earning, not for changing redemption prices.

Programs with set award prices (award charts) usually devalue in a predictable way.

Thirteen years ago on Flyertalk I outlined a simple model of why we can expect frequent flyer programs to devalue over time.

I explained that frequent flyer miles are a currency, but they are printed by a single company and there’s no independent central bank or other body whose job it is to defend the value of that currency.

Eccles Federal Reserve Building By AgnosticPreachersKid, used under CC BY-SA 3.0 via Wikimedia

When programs ‘print miles’ but the number of redemptions available doesn’t increase proportionally, prices will have to rise.

Milton Friedman…showed the world that inflation is a monetary phenomenon — increase the supply of money in the economy, and the general price level will rise.

The famous and deceptively simple formulation of this is: mv = pq

m = quantity of money

v = the speed at which money circulates in the economy

p = general price level

q = quantity of goodsFriedman argued that the speed at which money circulates is, generally speaking, constant. Folks plan over time for their spending needs. On the whole, if people get paid on Friday they don’t spend all their money on Saturday but spread the spending out until their next payday. (Obviously this isn’t universally true, but on a macro level it winds up being true.)

The upshot of this famous formulation is that when m goes up, p or q needs to go up. If the quantity of goods remains constant (q), that means that p (price) must rise and you have inflation.

I think that this simple formulation is helpful in thinking about loyalty programs.

If m = miles, v = the speed at which folks redeem awards, p = the price of awards, and q = the supply of available award seats, then…

Sometimes the speed at which awards are redeemed goes up. For instance, when loyalty program members are uncertain about the future of their points. There is a common belief that when United declared bankruptcy, there was a ‘run on awards’ — people believing that they needed to cash in now while the airline and the loyalty program was still around.

But on the whole, the fact that 8% or so of seats go to award redemption (over time and across programs) suggests that v is usually stable.

That means that if m — the quantity of miles or points — goes up, then one of two things has to happen:

Either the quantity of award seats have to become more available, or the price of awards has to go up. Otherwise there will be a shortage.

…And since it’s so much easier to accumulate miles than at any time in the past — as programs sell miles to all comers, and miles have become such a popular phenomenon and useful marketing tool — the quantity of miles is ever increasing. It’s profitable to the airlines to sell miles.

That means one of two things happens:

* The quantity of award seats goes up

* The price of awards goes up

I said that means we’re going to see devaluations. And we have, in fairly predictable patterns.

They don’t really happen during recessions (to a large extent only Hilton devalued during the Great Recessions), and not just because you don’t want to anger customers when few people are buying your product. Seats and rooms are empty so there’s not a ton of pressure on your inventory. Prices of that inventory are down. But when the economy comes back and seats and rooms fill up, inflationary pressures return.

How have mileage programs actually performed, and are devaluations not as bad as they seem?

American’s new award chart goes into effect March 22. United’s big devaluation was two years ago (which does make me worry it’s been almost long enough to hit us again).

- Economy awards haven’t devalued much at all.

- Price increases for first class awards are more or less nuts.

- But I wonder if, like Goldilocks, pricing of business class awards after devaluations are just right?

In some ways even Delta’s changes aren’t as bad as they might seem, Delta SkyMiles just makes themselves so hard to trust.

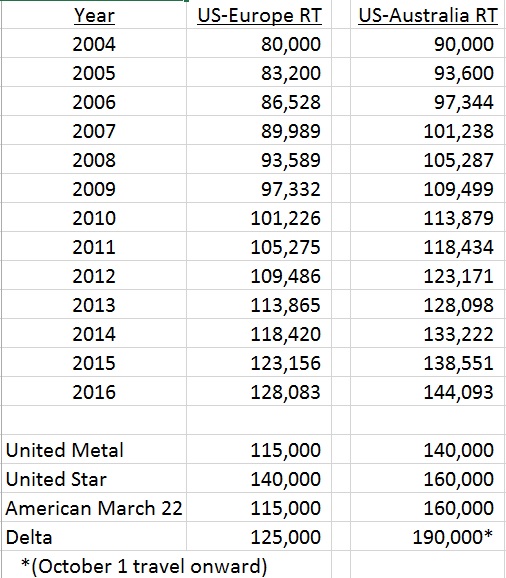

What I thought I’d do is look at how award pricing has changed over the past decade, and compare it to a reasonable rate of inflation. (in other words, if mileage programs operated on a sort of inflation targeting). I decided to look at Europe and Australia business class awards.

These are somewhat stylized numbers. United had a 90,000 mile business class award between the US and Australia for a long time, and actually raised that price in October 2006. Delta (and Northwest) at the time charged 150,000 miles for that same award (United’s rulebuster-style standard award was 150,000 miles back then). So starting at 90,000 miles in 2006 may be too low — but that will only reinforce my point.

Let’s see how standard pricing in 2006 with 4% annual inflation compares to current (and known future) pricing:

The reason that devaluations seem so dramatic is that programs devalue award charts all at once, rather than making annual minor adjustments.

Of course some business class award pricing is absurd. What used to be known as ‘double miles awards’ or rulebuster awards have gone up a lot more than saver awards have. And Delta does things like this.

But in the limit we see some fairly standardized price increases, albeit in a dramatic step-up rather than gradual way.

Is that fair? No, not really. Unlike cash, members can’t earn a rate of return on their miles. Miles aren’t like money. You can’t use them for whatever you wish, such as flights on competitors or to pay your mortgage (though Aeroplan lets you use miles to pay off student debt). And you can’t invest your miles in stocks or mutual funds.

That’s why the advice I gave in 2003 remains true today:

I’m not saying that we should all burn our miles with abandon. But I am saying that the best way to enjoy these programs and capitalize on their superior value propositions is to redeem miles as you earn miles. Waiting simply means that past earnings will buy less in the future.

Nonetheless, devaluations may at least be predictable.

Very sound advice. Revenue Based Redemption schemes are also worth considering, as I’m confident that’s where we’re headed. When it does, miles will still lose value over time, but their inflation rate will be pegged to the dollar’s.

Your suggestion that devaluations are not so dreadful is aimed pretty much at your US readers. It’s a totally different story for your non-Us readers, particularly Australians.

In the US many of your miles are coming virtually for free, via signing up to new credit cards offering big bonuses to sign-up, and keep churning. In Australia, for example, this is not possible due to the credit reporting system, whereby your credit raring would be shredded if you kept applying for multiple credit cards (you would start getting ‘Declined’ pretty quickly too!)

So, we have to BUY miles, with cash. Because of where we are, most redemptions are for long-haul flights (unlike the US where 96% are for domestic redemptions often in economy), meaning we have to BUY many more miles to get places. The only way this disparity could be remedied would be to offer targeted higher bonus miles sales to non-US accounts, as Avianca LifeMiles did recently.

I’m guessing this would not interest the US airlines execs who famously cannot see beyond their own end-of-year bonuses. All fine and dandy while the US economy splutters along and the $US looks in fair shape, but come the inevitable recession, as it will, these guys will need to actually have to earn their gimongous salaries by doing a bit of lateral thinking!

Clearly award prices have greater rates of inflation than money. How is it then possible for Titans to claim that the value of the points are preserved? In recent years your buddy OMAAT has managed to find HIGHER skypesos values (skypesos/USD) than in the past.

IMHO, miles should retain the value they held when they are earned, lower the value when earned at a lower rate.

With all the miles being so much easier to get and more lucrative sign up’s it isn’t all too bad. Now with that being said Alaska still doesn’t make it easy to accrue their miles with cc and partners.

@glenn t, under what circumstances does buying miles make sense for an Australian? When I lived in Oz, I was a member of American, since their crediting was the best for Qantas miles. However buying miles never made any sense.

With devaluations on America, they are still much better than Qantas. There is no need to credit your miles to your local airline in the world of alliances. Qantas has always been terrible value for redemptions. ie SYD-JFK return is 256,000 Qantas miles for business class, and the new American chart 140,000 miles in business.

Card-issuing banks should want to preserve the value of the miles. Banks pay for the miles under long-term contracts. Banks expect to lure customers with the promise of one mile per dollar spent.

Devaluation from here would seem to require banks’ cooperation. Banks would need to negotiate a much lower price per mile and they would need to award two miles per dollar of ordinary spending. If this happens the credit card miles game can continue as long as the public prefers it to Citi Double Cash and the like.

Good analysis, Gary. I have a couple of points to make however. Real US inflation between 2004 and 2016 has not been 4%. Using the CPI inflation calculator – http://inflationdata.com/Inflation/Inflation_Calculators/Inflation_Calculator.asp, 80,000 (dollars) in 2004, would be equal to 100,335 (dollars) in 2016.

I like the formula mv=pq where v and q are relatively constant. That means that when m goes up (the airlines print more miles by selling them to Amex, etc.), then p (the price of an award ticket) must go up. That’s all well and good, but for most people, it’s a sucker’s game, and the airlines are really screwing over the ordinary flier in order to make more money. They way they make more money is to sell more miles to the credit card companies (e.g. the Amex $2 billion dollar a year deal with Delta). This is free money for the airlines (especially if they keep q constant! Sell miles (i.e. print money), get more income. The airlines win BIG, the credit card companies also win if they can get their customers to spend more or they acquire more new customers. The ordinary traveler gets screwed because the award ticket price goes up, up, up. The only travelers who win are the ones who can keep up (i.e. acquiring more and more of these newly printed miles), so they can afford to buy the award tickets — I guess that’s you — and a few of us readers. I would bet that over 90% of the fliers cannot get free trips, and that’s why the airlines are scrambling to make 1 mile = 1 cent at the SkyClub for a drink or something — at least they can make the customer feel like he is getting something. Is there a limit to how much money an airline can make from a third party (credit card company) who is paying them to print miles that most of the fliers or credit card customers cannot use for free travel? I think there is. I think this will all end if the ordinary airline traveler concludes he’s being conned about the free travel. And as you have advised, if all it comes down to is getting 1 cent per mile on merchandize, people will soon figure out which credit cards give you 2 or more cents rebate on each dollar spent, and the airline credit cards will crash. The airlines themselves have caused a majority of this inflation — by their greed — wanting more and more money — by simply printing miles for money.

Gary, one flaw that I see in your devaluation table is the 4% inflation rate. We haven’t had that inflation rate in decades. This shows the devaluations to be considerably worse than actual inflation. I think Mike Murphy has an excellent idea. The chart for spending your miles should be determined by when they were earned. That would be fair to all parties by allowing devaluations while still preserving value for the customer on prior earnings.

@LuckyOz~ buying miles makes perfect sense when it’s the only way to get them! You do need to wait for a sale with 30%-60% (more if Avianca or United) bonus miles to sweeten the buy somewhat.

Don’t muddle things up with QF miles. They are generally terrible value for redemptions, agreed, but easier to acquire with ,say, AMEX Discovery, other retailers offering QFF miles, and Qantas Epiqure. I am doing JFK-DUB in J on Aer Lingus for 53,000 QF miles plus $19 soon. I thought that was reasonable value, for Qantas.

Good analysis, Gary. I have a couple of points to make however. Real US inflation between 2004 and 2016 has not been 4%. Using the CPI inflation calculator – http://inflationdata.com/Inflation/Inflation_Calculators/Inflation_Calculator.asp,– 80,000 (dollars) in 2004, would be equal to 100,335 (dollars) in 2016.

I like the formula mv=pq where v and q are relatively constant. That means that when m goes up (the airlines print more miles by selling them to Amex, etc.), then p (the price of an award ticket) must go up. That’s all well and good, but for most people, it’s a sucker’s game, and the airlines are really screwing over the ordinary flier in order to make more money. They way they make more money is to sell more miles to the credit card companies (e.g. the Amex $2 billion dollars a year deal with Delta). This is free money! Sell miles (i.e. print money), get more income. The airlines win BIG, the credit card companies also win if they can get their customers to spend more and more on their cards or they acquire more credit card customers. The ordinary traveler gets screwed because the award ticket price goes up, up, up. The only travelers who win are the ones who can keep up (i.e. acquiring more and more of these newly printed miles using sign up bonuses, spending, etc), so they can afford to buy the award tickets — I guess that’s you — and a few of us readers. I would bet that over 90% of the fliers cannot get free trips, and that’s why the airlines are scrambling to make 1 mile = 1 cent at the SkyClub for a drink or something — at least they’ll get something. Is there a limit to how much money an airline can make from a third party (credit card company) paying them to print miles that most of the fliers or credit card customers cannot use for free travel? I think there is. I think this will all end if the ordinary airline traveler concludes he’s being conned. And as you have advised, if it all it comes down to is getting 1 cent per mile on merchandize, people will soon figure out which credit cards give you 2 or more cents rebate on spending, and the airline credit cards will crash. The airlines themselves have caused a majority of this inflation — by greed — wanting more and more money — by simply printing miles.

Gary, AA has posted their economy earning rate @ 5 miles per dollar spent although they only say this will be “in the second half of 2016” so I am concerned about booking past June since I don’t know if they will give us any more warning of a “Drop-dead American” date.

I cannot find online a good recent comparison of how the programs stack up for value as of AA’s final devalue and wonder if I benefit from switching to JetBlue for it’s nonstop on my routes I flew AA for 40 years to get full miles, or to Southwest for refundability which is also important to me. Can you publish a comparison on the Earn rate for each airline which includes Economy for the 99% too? Thanks.

Milton Friedman has nothing to do with it. Loyalty programs MUST devalue because too many points awarded that are not redeemed — called liability — are real money that counts against their bottom, and is in hundreds of millions of dollars. Awarded points must be used/redeemed/forfeited before a company can claim as revenue the portion of sales that was awarded in points. That is why points must expire, inactive account must be closed, and you are encouraged to use your points to purchase a whole host of others good. But none of those point-draining activities are as effective as devaluations because: (a) when members know devaluation is coming, they will rush to cash out their points, and (b) of course, awards cost more so that more points are required, decreasing the company’s liability fast…

It is really that simple. No need to invoke Friedman to understand why devaluations will ALWAYS occur 🙂

Maybe we can appoint Ben Bernanke as Chairman of the Points & Miles Central Bank and get ourselves into a points & miles liquidity trap?

@DCS loyalty programs do not need you to redeem for merchandise (real expense) so that they can recognize revenue (that they’ve already received). Points expiration isn’t about ‘a rush to cash out points’ and devaluations aren’t mean to encourage greater redemptions (if they were, Delta would give advance notice). Although they do let the program recognize substantial revenue (again, cash they have already received)

Here’s a concrete example (from the last post in which @ Gary invoked Friedman):

In their 2013 Form 10-K United, provided the following information that explains why their two devaluations that year were as severe as they were:

_________________________________________________________________________

The following table summarizes information related to the Company’s frequent flyer deferred revenue liability:

– Frequent flyer deferred revenue at December 31, 2013 (in millions) $ 4,904

– % of miles earned expected to expire 20%

– Impact of 1% change in outstanding miles or weighted average ticket value on deferred revenue (in millions) $ 57

___________________________________________________________________________

Got that? UA’s FF deferred revenue at December 31, 2013 (in millions) was $ 4,904 million, which is $4,904,000 or almost $5 BILLION! No wonder they devalued their award charts so drastically effective February 2014!

If there was any doubt that loyalty programs’ primary reason for devaluing their points/miles is to decrease their “liability”, the preceding should leave none.

@Gary — We went over this before. “Honest accounting” demands it, and there was a knowledgeable person posting then who confirmed it. Books cannot be cooked to hide liability!

I had to teach Friedman’s mv=pq at the height of monetarism in the 70s.

It was put into practice in the subsequent decades and found to be too simplistic: the “Chicago School” ended up with egg on its face.

The feedback between miles, price, speed and quantity of awards is more complex because Friedman’s assumption that v is constant was the weak point in the theory. USUALLY it is, but in uncertain times, no.

AAdvantage has cleverly increased v by signalling the devaluation (particularly now) and in doing so decreased their future liabilities, ie the number of miles in circulation. If their recent sales of miles has been lucrative (m) and the supply of seats is restricted (q) then higher prices will pay off.

From Mar 22, it’s a new ball-game.

Will members jump ship, shut their wallets, etc or will AAdvantage be forced to play with award pricing through tweaks to earnings or bonus sales (cf Lifemiles’ recent 150% bonus).

As for Credit Card miles, welcome to the world of one lifetime churn per Amex,

or Central Bank regulation (cf Australia where banks have to now levy charges for miles).

We live in uncertain frequent flyer times!

“Economy awards haven’t devalued much at all.”

While the number of miles needed to redeem economy class award tickets may not have increased as much as for business or first class, the constant shrinking of economy seats (in both width and seat pitch) plus the proliferation of charges for baggage, meals, etc. definitely equates to significant devaluation, IMO.

No it is much much much worse than that

I used to be able to fly where I wanted to when I wanted to and even sometimes chose the carrier, routing and get free stopovers

Now I need to book 330 days in advance to get my third choice of carrier to take me part wash to a second choice destination, only to see my flights get cancelled , schedules change, pay all kinds of fees.

@DCS, I don’t buy it. I live in ATL and have lots of friends who work at DL throughout the organization. I don’t know accounting wise how DL allocates the revenue/liability for the miles they give passengers for actually flying, but here is what I’ve been told about the miles they sell to Amex, Hertz, etc. They sell those miles at about 2 cents a piece and value them at about 1 cent a piece on the liability side. A clear profit here. But if they are not allowed to claim that profit until the miles are used, but must carry the liability on the books while waiting for the miles to be used, the answer is simple. They should make more award seats available and those miles will be used, and they will get the liability off their books. They should stop making award trips less than 3 weeks prior to departure much much much more expensive than level 1 seats. If there are empty seats seats within a few days a flight, they should open those seats up for award travel at reasonable rates – which they stopped doing years ago. All of the moves Delta has made away from these suggestions they have made voluntarily of their part for the purpose of an ever higher and higher profit, and then they say, oops, we have to many Sky Miles out there, we have to devalue them to get the liability on our books down. They want to sell more seats to make more profit, making it harder to get award seats, and then they say, oops, we have too much liability on the SkyMiles end, we have to screw the SkyMiles people and devalue to make this all work out. Delta did it all by themselves – it’s called greed and the shit rolls downhill to their loyal fliers.

@Don in ATL — It does not matter whether you buy it or not, as it looks like you learned nothing since the last time this very topic was discussed and you made similarly irrelevant comments.

If you do not believe that there’s such thing as loyalty points liability you just need to read the Form 10-K (the MANDATORY annual financial report to the SEC in which one cooks at one’s peril) of any company that runs a loyalty program.

Here’s the relevant portion from Hilton HHonors’ 2014 Form 10-K:

“Hilton HHonors DEFERS revenue received from participating hotels and program partners in an AMOUNT EQUAL TO THE ESTIMATED COST PER POINT OF THE FUTURE REDENPTION OBLIGATION. We engage outside actuaries to assist in determining the fair value of the future award redemption obligation using statistical formulas that project future point redemptions…etc…etc…” [text capitalized for emphasis; see more below]. That is the definition of “liability” or “deferred revenue”.

That stuff about HHonors is from the last thread on the same topic on this site back in August 2015. It is what you should have read and understood back then. First, there was this from someone who actually knew what s/he was talking about:

_____________________________________________________________________________________________

Flyer Fun says: August 23, 2015 at 10:50 am:

Airline financial statements are audited by accounting firms in accordance to US General Accounting Standards, International Reporting Standards (IFRS), or some equivalent. In addition, for companies filing with the SEC, the SEC has additional requirements. People go to jail for dishonest accounting (see Enron) and major accounting firms go out of business for the same (see Arthur Anderson). So in other words, the accountants at the airlines and the auditing companies decide how miles appear on the income, balance sheet, and cash flow statement. Since I doubt that anyone wants to go to jail for the Frequent Flyer program, intentional “sleight of hand” is minimal.

___________________________________________________________________________________________

Then I had posted the following comment, complete with the excerpt from Hilton’s Form 10-K above

DCS says: August 23, 2015 at 4:10 pm

@Flyer Fun — +1. Clearly and succinctly stated. Loyalty points are part of a multi-billion dollar industry. Loyalty accountants would be cooking the books at great peril if they treated miles and points as Monopoly (the game) or funny money. In fact, if you look in the annual financial report of companies that run a loyalty program, you will generally find a section on how they estimate their liability. Here, for example, is how it is described in Hilton’s 2014 financial report (Form 10-K):

Hilton HHonors

Hilton HHonors defers revenue received from participating

hotels and program partners in an amount equal to the

estimated cost per point of the future redemption obligation.

We engage outside actuaries to assist in determining the fair

value of the future award redemption obligation using

statistical formulas that project future point redemptions

based on factors that require judgment, including an estimate

of “breakage” (points that will never be redeemed), an

estimate of the points that will eventually be redeemed and

the cost of the points to be redeemed. The cost of the points

to be redeemed includes further estimates of available room

nights, occupancy rates, room rates and any devaluation

or appreciation of points based on changes in reward prices

or changes in points earned per stay.

__________________________________________________________________________________

G’day!

In fact, companies that run loyalty programs do not even hide the fact that they WILL devalue. See it clearly in Hilton’s Form 10-K:

“The cost of the points to be redeemed includes further estimates of available room nights, occupancy rates, room rates and ANY DEVALUATION or appreciation of points BASED ON CHANGES IN REWARD PRICES or changes in points earned per stay.”

Like I said, there is no need to try to sound scholarly by invoking Milton Friedman about something that is quite trivial to grasp.

@DCS, I did not deny the existence or the importance of the liability of loyalty points. (Please re-read what I wrote.) Yes, there is liability from all those circulation points. And there are many ways to decrease this liability. One way is to devalue those points (as Delta is doing), which screws the loyal customers. Another way is to actually get them off the books by making more award seats available at reasonable prices (the prices the customers were expecting when they started collecting points) so people can use those points for award travel. Delta chooses which way to get the liability down and they choose devaluation. Delta chooses to print miles and sell them to third parties for money – profit, thereby flooding the market with points (inflation), and then they squeeze the customer by devaluing. If they never printed that extra money (points) in the first place, there would be less points in circulation, less liability, and they wouldn’t have to devalue. I don’t know how you can say I “do not believe that there’s such thing as loyalty points liability.” I don’t disagree with a profit motive, but in the quest for more profit, they are selling points, creating more liability, creating inflation, then they devalue to realize realize the profit from selling those miles. Of course they are allowed to do whatever they want with their program, but it’s not quite moral or fair in my mind.

Don in ATL — I cannot speak to the other beef that you may have. My post was about why every loyalty program MUST devalue their points over time, which honest accounting forces upon them. Issuing points that do not get redeemed fast enough ties up billions of the company’s bottom line and becomes unsustainable after a while. Devaluation is their “pressure valve.”