SimplyMiles lets you earn American Airlines AAdvantage miles for transactions with a variety of merchants when making the purchase using a Mastercard that’s been linked to the site.

They host numerous ‘Mastercard Offers,’ sort of like Amex Offers. But Mastercard doesn’t have the direct consumer relationship that Amex has with its closed loop. So they’re going after American AAdvantage customers, and of course American’s U.S. co-brand consumer and small business cards are Mastercards.

I earned 7 million miles with their year-end bonus promotion. Some people have reported earning close to double that.

With SimplyMiles American benefits by selling miles, and Mastercard is buying those at a discount. The year-end 5x bonus promotion was ‘partially funded’ by American what I assume is that Mastercard is buying these miles at a bigger discount than usual.

- Let’s say (for round numbers) that Citi buys miles for credit card spend at ~ 1.5 cents

- But up front initial bonuses cost them less, since American wants to incentivize attracting new cardmembers – growing the number of AAdvantage cardmembers means growing the number of miles the bank buys from them. So call it a penny apiece for those miles.

- American is selling miles in each case at a ‘discount’ but still at a profit. When they award miles for flying, they book a penny of liability for that mile, and when they sell miles to third parties they book about an eighth of that. Their ‘cost’ for a mile is somewhere between those two numbers, probably on the higher end of the scale.

- Since this is a joint venture, I’d assume Mastercard is buying these miles (at least for the bonus offer) at something closer to the ‘up front initial bonus’ rate. The 5x holiday bonus was meant to attract attention to SimplyMiles (it sure did!) and make it sticky, which means more mileage sales in the future.

The charity here isn’t buying the miles. Mastercard has chosen to raise money for them, and they’re supporting that … they do take an administrative cut and forward the rest of the money to the charity.

Mastercard does not disclose what the administrative cut is, and whether it’s always the same (whether they take a bigger cut in this case or not). There may be state charitable solicitation registration filings that could be FOIA’able and which would reveal that information. I am confident, however, that the charity is not coming out of pocket to fund this.

For something like Amex Offers it’s usually the merchant that’s funding the offer to encourage transactions. That said each deal is different.

- For instance when Amex has an offer with Hilton or Marriott they may be using dollars that are included in the cobrand deal that they’re required to spend on marketing.

- And they may have some other budgets to spend and encourage transactions (for instance, promoting small business spend with an Amex since customers have traditionally not thought of Amex as accepted at small stores, and small shops haven’t accepted Amex as much and Amex invests in changing that).

Mastercard could have agreements with some large merchants that require them to spend some money promoting the brand as part as well.

And Mastercard, just like Citi and Barclays, has to spend money promoting American AAdvantage credit cards in some fashion as part of the co-brand agreement.

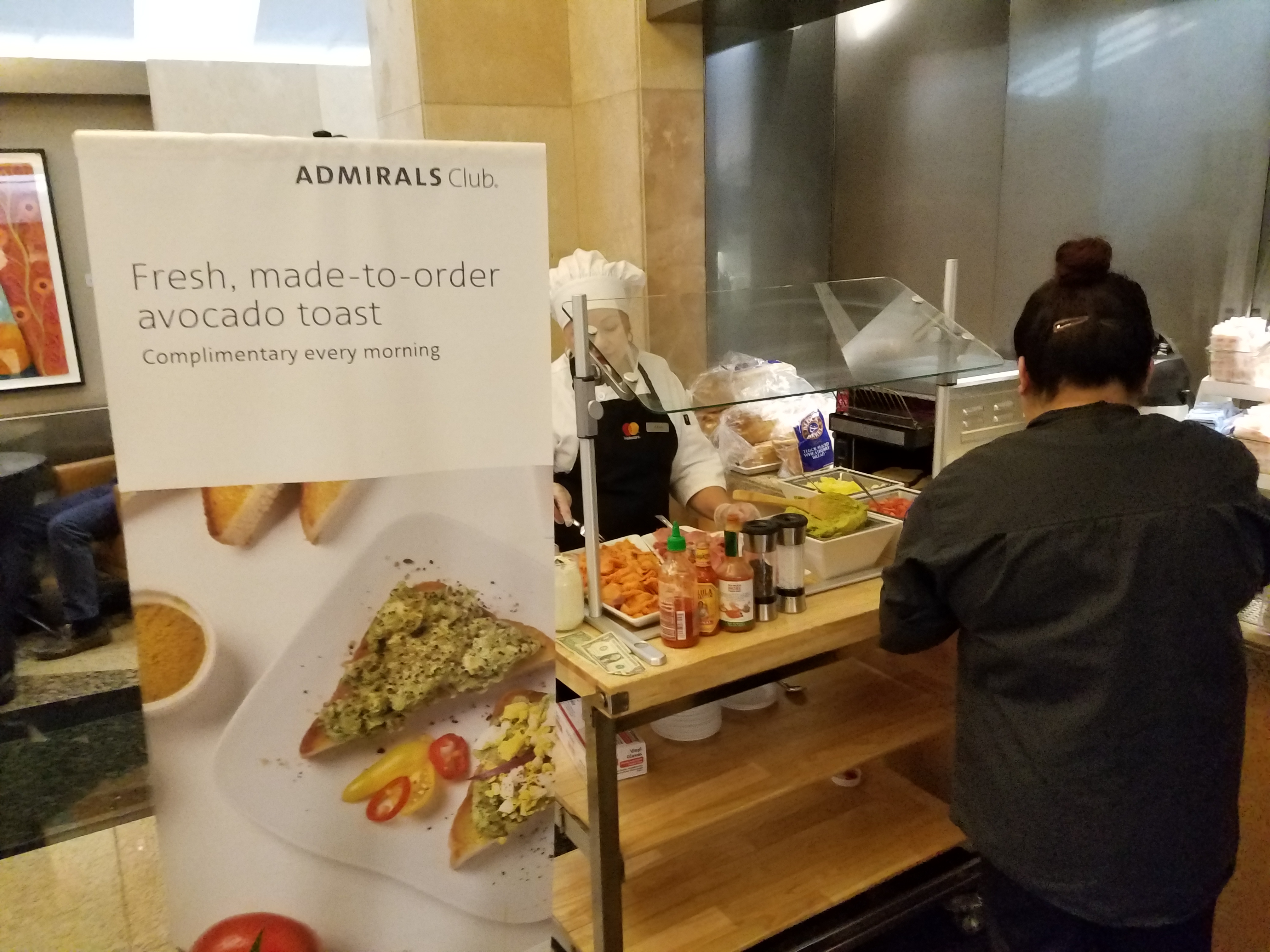

Since the premium Citi Executive card comes with Admirals Club membership, Mastercard is actually the one that funded guacamole and avocado toast in the lounges. You can see the Mastercard logo on the front of the chef’s jacket:

They’ve also done cooking and golf demonstrations at airport gates.

I don’t know the details on the deal between American and Mastercard for SimplyMiles (whether some of the cobrand marketing dollars gets spent here) or whether they were able to spend some of that money in making good on the 5x promo ‘beyond what had been budgeted’.

If I had to make a wild (!) guess on how much Mastercard had to spend above their budget on this promo I’d say $10 – $20 million. There was a budget to run this through December and they ended it on 12/14. The budget ran out probably some time over the weekend (perhaps on the 12th), not exactly clear when. So how much more is Mastercard on the hook for the Monday and Tuesday morning transactions that are being honored?

All in all, think of SimplyMiles as like Amex Offers, promoting choosing a Mastercard for your spend and using it at specific merchants, and making incremental purchases with those merchants. And Mastercard accesses its customers through its partners, since customers don’t deal with Mastercard directly the way they deal with Amex directly.

Some folks are worried that all the miles printed with the SimplyMiles promotion will lead to an AAdvantage devaluation. That simply misses the scale of the AAdvantage program. To be sure you should be betting on a devaluation (after 2022) anyway. However SimplyMiles is immaterial to this calculation>

There are around a trillion AAdvantage miles outstanding. This deal didn’t move the needle on that, and American is almost certainly getting compensated for the miles by Mastercard – above cost.

It would be interesting to see a graph illustrating how many AAdvantage points are generated each year.

My understanding is AMEX actually pays for the AMEX offers — in the sense the business still gets the full transaction value less regular fees. They more use it as a marketing tool for customers (ie merchants) and work with them to craft an offer.

many miles ordinarily accrue to people who use them for domestic awards or other low-value redemptions, if they use them at all. in terms of the # of people who play our game with large account balances chasing a limited number of seats for international premium awards during optimal travel seasons, i do wonder if this may make an impact.

@ABC – I’ve got a spreadsheet with many years of data, but AA stopped releasing nearly as much info ~ 5 years ago, perhaps we’ll get it all back now that the program is leveraged

@AdamH – yes, the business still gets the full transaction value less regular fees, and how each offer gets generated is different, but it’s often the merchant paying [in one form or another] for access to amex customers

I’m still in awe that some people spent/donated $50k+ to buy miles with this offer.

Even if a trillion miles already exist, the vast majority are in tiny accounts which can’t redeem for expensive awards, if anything.

Your argument that this SM promo doesn’t move the needle is invalid in my opinion. They’ve just minted multi-millionaires who will create huge demand for awards. That demand moves the needle. Scarcity leads to price increases. The way MA handled this promotion is baffling.

When are all these miles supposed to be in my account… I donated $1000 in time and not even 1 mile was deposited yet? I used a Visa card to donate?

I wonder how much that conservation charity raised on this offer?

Do any of the players in all this get a charitable deduction?

At the end of it, Amex cards fund DL, Chase Visa cards fund UA & SWA and now MC (citi+Barclays) funds AA. AS, JetBlue etc are more peripheral players – one with Visa one with MC.

The planes are flying us around so the banks can profit

My understanding of large mileage sales was that the big banks buy money below 1c each e.g, during the Great Recession; so at the most 1c during normal times

While the initial sign up miles bonuses costs are lower, 0.5c – net cost is almost zero to bank –

e.g., 99$ fee, 5k spend (generates 150$ interchange fees of which 100 goes to bank)

= 200$ cash sale to bank before bonuses and many don’t get spend done on time

Bonus even 50k miles (10x the spend usual offer) = 0.5c sale to airline = 250$

Unless offer is exceptional, even when you sign up cards for bonuses only, you still pay 0.5c to get the miles – the SimplyMiles Conservation deal just allowed us to bypass a whole lot of signups

The bank may be paying you and other bloggers more for the ad placement and shilling than they are paying the airline for the miles – I suspect if they pay you 50$ and the airline 50 – at most 100$ for new customer acquisition

I’m expecting the entire blogosphere to attempt similar justifications over the coming days. They’ll talk about how “in the grand scheme of things” it’s not a big deal. But they all will neglect that there amount of miles distributed is usually over time (ie months and years), where now a glut of a few hundred million miles are being introduced in the span of a week or two.

The fact is, that redemptions are already terrible. This is a bloodbath on the redemption side.

@Alan Bachand – if you used a Visa card and this is a Mastercard funded program you likely will get zero miles. On the other hand you have a nice charitable donation so that should make you feel good!

@AC you need to re-read Alan Bachand’s post. Then you may see the humor!

Who’s paying for all of those bazillions of SimplyMiles? Ha! To the extent this promotion generates losses, that’s easy — we are the o0nes who will pay. Like credit card fraud and other commercial theft, any losses will be passed on to consumers. TAANSTAFL (There Ain’t No Such Thing As A Free Lunch)!

The harder questions involve the ethics of reaping a windfall from an unintended bargain (akin to theft) and causing the early termination of a promotion that many might have wanted to participate in. I hope those who gorged themselves will donate the miles to worthy causes.

@ Jon — Few hundred million? It wouldn’t surprise me at all if one person alone purchased 40-50 million. The number of miles issued through this promotion is undoubtedly greater than 1 billion, but 1 billion is ONLY 0.1% of 1 trillion. It really won’t matter much….

AA has already devalued. Oct 14th HND-LAX Web Special 240k versus 300k anytime “changeable” award. .

Sure partner awards are, and have been the best redemptions using these miles and they probably will go up soon. But to suggest a special fare 4xs the price of JAL J at 60k is even more ludicrous than UA charging 180k on their equally inferior J product when you could fly ANA for 1/2 that.

The people who actually pay for their goods and plane tickets! Why is this such a mystery to you people?

If AA are able to get banks to pay out 1.5c per mile, then they are clearly smarter than I thought. @Gary, is this a number with some data behind it or just an arbitrary figure to illustrate your calculations

Yes indeed, how will all you greedy schemers report your chairitable donation on your tax return? The proper way is to deduct the value of your miles received against the donation to the third pary charity. If I was in your shoes, I would value each mile received at at no less than 1 cent. Yes, yes I know, you did not actually receive anything directly from the charity (tell that to the IRS and see how far that gets you). Taking advantage of the stupidity of MasterCard and Ameican Air to gain millions of AA miles is one thing; but trying to fraudulently (you knew that you received something of value for your charitable donation) screw Uncle Sam by claiming the full donation as a tax deduction is potentially a much more serious matter.

You missed the promo too??

@Dougie

Uncle Sam screws us all the time as its existence is the result of coercion and not consent. I don’t blame people for taking advantage of a good opportunity that presents itself nor deducting what they deem sensible.

I wish I could have taken advantage of this promo. I didn’t because I don’t see myself flying at all for at least 6 months due to capricious regulations that pop up and or change at any minute. This craziness has continued for nearly 2 years and I rather continue cashback and converting miles to cash until things change.

You might want to stop bragging about it, Gary. You know, for the rest. You do realize that this could end up being taxable if the government gets wind of this? Some have a potential capital gains bill of an easy valuation of $100k+ on this deal. I’m sure there are some pissed off people at MC that would love nothing more than to throw away very one under the bus.

@Stuart. First, I am not taking a charitable deduction for the donations to Conservation International. Second, I purchased a good on sale. Third, how would I realize capital gains? The IRS taxes miles that are awarded as prizes, not miles that are purchased in arms-length transactions.

When do you think the flight cancellations will start to crack down?

I’m skeptical of the scale. I got to the website in time but the best deals (the donation to CI) weren’t there. Clearly targeted. But why target a charity? It seems all the bloggers were targeted, but somehow I wasn’t and many others weren’t as well. This doesn’t seem like it was a mistake. Call me skeptical.

I’d like to know the distribution of miles across accounts — how many accounts have a balance sufficient to redeem, say, two business class awards across the pond? How many miles are in those accounts cumulatively? Then compare that against the number of miles issued in this promo and see just how much of an explosion or bloodbath there really is.

The fact of the matter, as others have pointed out, is that a tiny fraction of all accounts have enough miles to chase the kind of premium seats this group would generally want. Giving some of these accounts millions upon millions of additional miles chasing what are probably a very similar number of seats in inventory overall simply must lead to either availability issues or a rise in price. Maybe both.

Gary, why not take the tax deduction? Charities are required to provide a statement per the IRS of a quid pro quo donation. If CI doesn’t do that, then this isn’t viewed as a quid pro quo. CI is a huge nonprofit, they aren’t going to make a mistake in this regard. I don’t see how this donation would be different than any other time people get points when using a credit card for donation to church or any other nonprofit.

For all those worried about a AAdvantage devaluation, I’d say don’t lose sleep over it. With dynamic pricing, it doesn’t really matter for AA awards. Where you will see a devaluation is on partner awards. I’d say AA would likely devalue to make it’s partner awards equal to that of UA which consistently prices its partner awards above it’s saver level awards. AA has the crappiest actual airline product. Their frequent flier program is middle tier slotting above SkyRubles but below MileagePlus. Gutting their frequent flyer program makes little sense. Having said that, not all airline management is rational.

@Gary. I would expect nothing less than for you to argue your case on this, but the reality is that for an investment of around $30K you obtained a value of around $300K in exchange. That is going to raise eyebrows, especially if you keep bragging about it. The first rule in these things is keep your mouth shut. Further, it may open the door yet again to committees taking another look at FF programs given all the changes since the last time they threatened to find a way to tax them. We have always walked a fine line, and while taxing redemptions has been ruled out in the past this was specifically in the classic sense of fly and get rewarded. And I doubt anyone cares if you gain a few thousand miles for a purchase given your own valuation of miles. But this is clearly a massive gain for many and a whole different story. It far exceeds the standard exchange of free flights for loyalty. Finally, in some ways, it could be argued you did win a contest. It was a thinly veiled charity raffle with the best prize return ratio seen in history, lol. Just because it benefited a non-profit doesn’t make it less suspicious to those who want their cut, namely the Government.

Stu nails a real possibility. The government deciding to tax airline mileage redemptions at .001 cents per mile collected by the airline would be reasonable. Thats $50.00 for redeeming 50,000 miles. If your AA account does indeed get an additional $300k of miles, then claiming the $3k charity donation as a tax deduction could “raise eyebrows” at the IRS. Large donations to the charity in on that deal will be flagged for an audit. That audit likely could include a demand from you (or maybe even from AA directly) for your AA account transaction history. Potentially a big can of worms for many.

@Dougie. Rather than think about the value of miles I specifically look at the cost of flights as comparison. An example, there are still many decent redemptions out there with AA for around 60K-80K in business class. Figure the value of each of those (if bought on the open market for cash) was around $2500.00 on average. Divide that average redemption cost into 7 million miles and there is a very clear gain of hundreds of thousands of dollars in comparable value.

I suck at math, but even I could argue this one.

Others might debate that devaluation is real and the gain is much lower. Sure. If booking mostly high cost redemptions on high yield premium flights that you might have to pay 150K miles for one business class seat during peak season. However, the counter argument could be that those flights were also double the comparable cost in cash. So either way you choose to look at it there is no way to hide the fact that this was a significant gain in value with the cumulative of many tens of millions of dollars on the table.

This opportunity has not been taken advantage of by huge numbers, let alone being understood by folks outside of this hobby. I wonder if there is a stock market play in all of this? Short MA and buy some AAL?

@Stuart,

Wonder how your valuing 7 million miles to be worth 300k, which implies 4.3 cents per mile, which is way over what even AA directly sells miles for at full price without one of their frequent sales.

I believe when Citi issues 1099 statements doe AA miles issued related to Checking account bonuses, the value is based on 2 cents per mile, based on which 7MM miles should be worth at most 140k.

@Luke

A fair question that I think I outlined above. Rather than using formulas of value for a mile in the old manner (as this promotion was anything comparable to the old manner) I simply looked at an average cash cost of an overseas one way business class ticket (in this case $2500.00) and the somewhat available AA redemptions of 60K-80K for a redemption on that same flight. Divide that into 7M and the math is there. I even think I was conservative. And yes, as I pointed out, some would argue many redemptions approach 200K miles, but the counter to that is those flights are very likely also valued at much higher than $2500 in comparable cash cost.

@Stuart,

By your logic if we buy AA miles for any less than 4.3cpp, such as their current promo at 2.1 cents per mile, we are supposed to pay taxes based on “doubling” our return right off the bat.

Not all redemption are of such high value, I’d think majority of redemption especially from those who aren’t gamer pros will redeem for much worse, such as happy to redeem a Chicago to Nashville ticket for 25k miles that could’ve been bought for 100 bucks!

Can only take a charitable deduction if you get a receipt from the charity acknowledging your donation BEFORE you file your tax return. For non-cash donations the receipt must state what was donated and that there was no benefit received by you from the charity. If the donation value is over $5,000 for non-cash donations you must have someone value the gift that can appraise the gift that is NOT related to you and will sign the form 8283 Non Cash donation. Basically what you are going to say to the IRS is come audit me. These valuations have to be sent to the IRS with your return.

Well, good news! I did receive all 24 billion miles for my $100 million donation [damn, typing those transactions in at 9999.99 for days (all 10,001 of them) caused carpal tunnel syndrome– ].

On the negative side, I’m unable to find seats to Doha for all 141,752.18 of my closest friends, and I forgot about the $7.85 tax each way, which adds up to ~$2.25 million.

Any suggestions?

@Dougie I can’t see the government deciding to tax awards (airlines or otherwise). There are so many of these rewards programs and if every rewards program had to issues 1099s, it would basically eliminate much of the industry which I believe is a multi-billion dollar industry.

@TomRPI. Sorry, but no. If that was the case do you think Gary and Ben would be dancing happy dances of glee and joy over this deal and in Gary’s case incessantly blogging about it? No, the majority of these people, the savvy on redemptions, will easily yield massive gains on this. In Gary’s case, as much as $250K or more over the buy-in depending on how he uses them. And it won’t be from Chicago to Nashville as you cite , lol.

As a CPA I am surprised you are not recognizing the danger in this. Especially the bragging that is just bringing more attention to those who raise eyebrows. Gary is putting everyone at risk for a big surprise.

@Ceric. I agree with you given the classic sense of mileage programs. This was exactly why the Government elected not to during past inquiries. But the problem is that with promotions like these the gains are far more significant and the programs becomes much more complex. Things like this, and Gary’s going on about it for weeks like a bragging schoolboy, is exactly what gets us all in trouble in the end.

Put this into perspective: Can you imagine if this were a donation to charity that gave you a guranteed bonus of two brand new Porsche’s for just a $30K buy-in? Because, yes, that’s basically what this is. Whether you drive them or not.

how can i buy a million aa miles?

@Stuart

I’m sure there are some in the government that would love to tax people even more and start to tax credit card rebates, coupons, loyalty programs, you name it. I just think from a practical standpoint it would basically end many of these programs. Imagine a house parents getting a 1099 for using a coupon at the grocery store for discounted eggnog. People would go nuts.

Credit Card offers with Amex went crazy this year for people to get 20% back on their spend for the initial signup bonus. FrequentMilier went through some of the various Amex stacking promotions. This is also a huge amount of money returned on spend and I would argue much more valuable for the average person since those points can be cashed out. AA miles could also be argued to be worth zero since they can close your account at anytime. AA has said the miles have no value and people definitely don’t own them. In the scenario where someone wins a car, the title of ownership is transferred to the person, but that isn’t happening here.

I just can’t see the government coming up with a way to tax rewards. Right now, they don’t even have a way to tax cash tips unless people report it. Manchin killed the idea of the IRS viewing everyone’s bank accounts.

We are all on notice though. If rewards are ever taxed, it would crush the hobby. It would also wipe out several hundred billion dollars in value across the economy since rewards are such a part of the American lifestyle now. I’m looking at you CVS….. Would my free toothpaste get a 1099? Target circle promotions? Where would it end…..

I Donated $1000 for that Mastercard Promo and STILL didn’t get ANY MILES whatsoever… Did everyone receive their miles yet? It’s been 2 months now???