The preferred place to pay quarterly estimated federal taxes, and taxes due with a form 1040 return, is usually PayUSATax.com which charges a 1.82% fee. That may be worth it if you’re earning 2% back or more with your credit card.

And it’s especially worthwhile if you’re working on a credit card’s initial bonus offer, or you’re trying to hit a card’s spending threshold for a big reward or elite status.

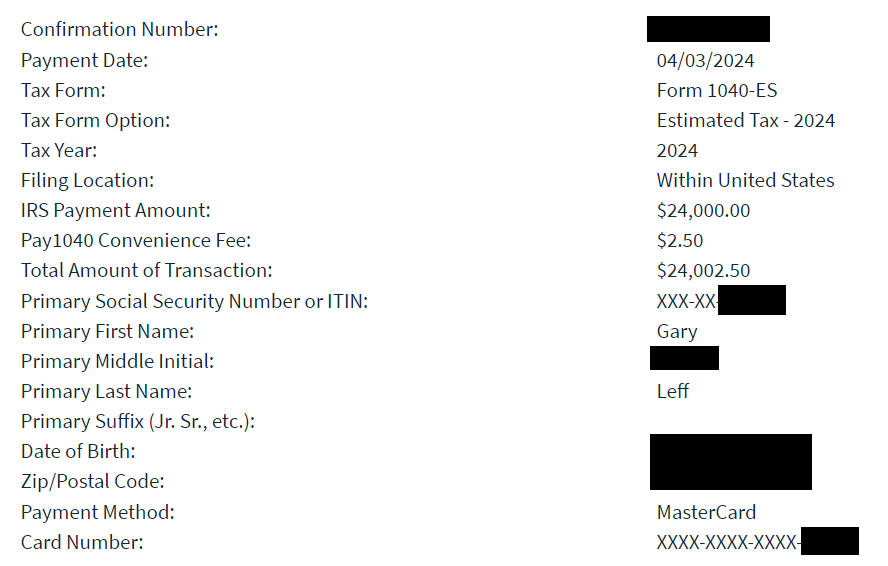

This morning, though, I made a tax payment at Pay1040.com which advertises a fee that’s five basis points higher (1.87%). Only perhaps they’re running a temporary special on payments via credit card, because although I charged the fee to a Mastercard credit card, they showed me that they would be adding just $2.50 to my bill and in fact the receipt they provided to me shows a fee of just $2.50.

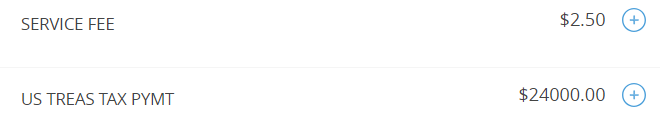

It occurred to me that perhaps they charged their usual amount, and just had an issue with the way they were displaying pricing and receipts? But I checked my card’s pending transactions and indeed the service fee shown was a flat $2.50. For avoidance of doubt I did not charge my tax payment to a debit card.

It appears that I will be earning rewards from $24,000 in spending at a cost of $2.50 – instead of $448.80 (which is what 1.87% of $24,000 comes to). That’s a savings of $446.30.

I have no idea how long this will last, or if it will replicate for others, but thought I should pass this experience along as soon as possible.

Guessing this really only applies to self employed. Because if you’re on a W2 you could never owe 24k in taxes without penalty. The most you can under-withhold from your paychecks over a year is just 1k without penalty, afaik.

Seems like a one off then a promo.

This is what it says for me:

“You will select a payment method at the time of the transaction. Select Next to save your liability.

The convenience fee for this service is $2.50 for consumer/personal debit cards, or 1.87% of the tax payment amount for credit cards and all other debit cards (minimum of $2.50).”

Maybe it incorrectly identified your credit card as a debit card?

Didn’t work with a Doublecash for me.

Not working on any my cards, mastercard or otherwise.

What card did you use? Not working for a Venture X or AA Plat.

Just tried to pay my estimated taxes at Pay1040 and they wanted to charge me 1.87%, not a $2.50 flat fee

Didn’t work for me either. Tried MC, Visa, 2024 estimated and 2023 current year. Shame.

Thanks Gary. Any chance you can let us know what bank that your card was issued from? I tried using a MasterCard, AMEX, Visa, and all showed the fee as a credit card. -not the $2.50 debit fee.

Maybe the bank you used is coding as DEBIT instead of CREDIT currently.

Guessing this really only applies to self employed. Because if you’re on a W2 you could never owe 24k in taxes without penalty. The most you can under-withhold from your paychecks over a year is just 1k without penalty, afaik.

Not so at all – dividends, capital gains etc can drive payments well beyond what is withheld on your w2. Of course you have to pay estimated taxes over the year to avoid a penalty

Nonetheless this is not working with MC, Amex or Visa, alas

@Don, incorrect. For the feds, if you withhold 90% of your prior year’s taxes, no penalty. Only in your taxes are $10k does your withholding difference have a maximum of $1k

Whelp…. That’ll be dead in 3…2…1….

Did you pay with a debit card ? Or tell us what CC you used.

Manny, He said it’s not debit. The image shows it was some Mastercard. I’d normally guess Citi DoubleCash or a BOA card w/Platinum honors. Otherwise I’d deduce he’s finishing a sign-up bonus or wanted 24k loyalty points with an AA MC to speed up elite status.

can someone figure out how to do this? which card?

Not anymore.

That’s a once in a lifetime treat. What I’d like to know is why would you choose the processor that charges 1.87% over the one that charges 1.82% in the first place. I’m about to charge my taxes for the first time and am curious if Pay1040 is somehow better to use than PayUSATax.

Thanks.

Tried with Amex and M/C. Didn’t work with either. Thanks for posting. It was worth a shot.

Don – as others have said that’s incorrect. There’s no limit to how much you can overpay. If you time it right and have a simple tax return (unlikely to be manually reviewed) you can even earn points/hit a bonus without being out any cash up front:

Make a big overpayment on Day 1

File taxes on Day 2

Get refund around day 23

Statement closes day 28(ish)

Payment due around day 50 (depends on issuer)

Under this scenario you’d have a few weeks ‘ cushion but should receive your refund before the cc payment is due.

Obviously for some reason the site recognized your card as a personal debit card number. I don’t think anyone else is going to be so lucky.

No dice for me. As Mantis said, your card is likely miscoded. Probably some obscure credit union. And to those commenting on the amount, people often overpay taxes in order to MS. Doing 6 figures is not unheard of!

@Rico – not better, I was having an issue with accessing the other site

didn’t work… tried a chase card and an AMEX

@Ltl I have heard of people overpaying IRS. I think its crazy for any large overpoayment. FIrst you are paying 1.82% to buy points miles? I know there could be strategies beyond that. Anyway I think its playing fire with huge overpayments for somebody with a simple return. Some average guy owns little or nothing and overpays his return by 20-30K. Dont be surprised if eventually somebody asks where did that green come from? I have heard of people overpaying by as much as 200K.

Gave it a try and it didn’t work with the cap X card

Loophole plugged. Tried Delta amex and AA mastercard.

I tried with my piece of card and got the usual fee.

What he is seeing on his credit card statement is the pre-authorization amount. Kinda like the restaurant charge you see before the tip is included. The $2.50 amount was “pre-authorized” because it is the minimum mandatory charge for the service.

However, the full $448.80 will be charged once the final transaction is posted, and that amount WILL be shown on the credit card statement.

I had the exact same thing happen to me in late Feb this year. I didn’t see a promo but I figured it must be one that I missed. Perhaps it was, as others suggested, an incorrect identification of my card as debit rather than credit. The card I used was an old Mastercard (account dating back decades) Barclays Amercian Airlines Silver Aviator.

To those saying it’s not worth it when there’s a 1.87% fee… consider that in addition to cards where signup or elite bonus thresholds are in play, a card such as the new Robinhood one (3% cash back, no cap) makes a ton of sense if you can charge enough.

In addition to paying estimated taxes in advance, there are also scenarios where self-employed can underpay (in good faith – you don’t always know what your company will make in the upcoming year) and have to catch up. Yes, there’s a small fee for this, but it’s very cheap and some of us view it as a loan where we get a better return than the fees/interest we owe Uncle Sam.

Does anyone have suggestion for a traditional W2 wage earner — i have been very good at hitting nearly zero owed for a number of years and was happy with my batting average — now after entering the points and miles game, realize a deficit is not a bad thing esp for a SUB. If I want to hit say $15k tax payments, can I say in March 2024 pay $15k to my current year taxes (i.e. 2023) and then file immediately after for 2023 noting the overpayment?

So true, Mooper.

On a tax year where I still owed $42000 they charged me something like $1200 for not paying it sooner. But, I had placed the $42000 on Bitcoin and it went from $16k to $30k so I paid the taxes, the fees, the new taxes on the $20k I had made, and still had some nice change to take the wife on a vacation.

I should also divulge that I make enough that had Bitcoin went south I could have covered it without an issue. I just prefer to keep money making money, even if it means a small loan with interest from Uncle Sam.

@Jonathon: Correct.

This happened to me a time or two. Aviator Silver.

Gary, for the love of God, don’t post things like this. You’ve very likely ruined this for many people who discovered it on their own.

Did Gary intend to publish this article on April 1 and it got pushed a couple of days later?

Weird no one clicked through to find out why. It’s only for Visa, and it is a flat $2.50. Click on special offers and Visa. It’s all there in black and white.

Great reasons to pay taxes with your Visa Card

Low Flat Fees

Pay taxes owed with your Visa Consumer/Personal Debit and you will only be charged a low flat fee of $2.50.

Of interest, there is nothing in law requiring W2 earners to pay their taxes through withholdings. The law requires payment through either quarterly filings OR withholdings of a certain amount. In other words, you can choose to pay quarterly instead of through your payroll as long as you are still paying the required minimum. Personally, I’ve never found it worth the trouble to pay cold, hard cash in fees for points that may not be used for a while, given the very tight spread we are working with here. However, as Gary said, this can be especially useful to make up the required spend for a bonus offer.

This is nothing new, the service charge has always been separate. Even when I paid my registration. It’s been going on for years, always been this way.

@Andy11234 – while what you say may be true, but the only way to get your withholdings down to very low/zero is to furnish a false W4 form to your employer, which in itself is a crime. So tread carefully.

I just tried it with my Barclays AA MasterCard and it worked. I looked at the credit card authorization and it was the amount I paid plus $2.50 service fee. I took screenshots of the screen before hitting submit showing the amount. As well as the final receipt showing the amount.

This was done on April 4th.

@George West – that’s for debit..

It was your debit card, not credit card. i try pay today with my couple credit cards and still it was 1.82% charge.

@Antony Chipounov – nope. I’ve done it successfully two more times since this, and others in this thread have as well

Gary, was your $2.50 on the Barclay’s AA card as well, or one of the other AA cards?

Just checking. What was the final analysis on this.

Was it a one time fluke, or is it a thing with a particular processing and card combo?

@Paul Louis Davis – not a fluke, continued to work for several folks and for me