IdeaWorks has revived its award availability survey for U.S. airlines, which they haven’t done since before the pandemic in 2019. The five year shift they find is fascinating. In general miles are worth less, though American Airlines miles especially are worth more.

This is work they’ve been doing for many years. I’ve criticized the methodology in the past, and they’ve made improvements. This piece, based on their five page description of the work, appears to be their most nuanced yet.

- They’re looking at availability and cost of award travel, with searches done in March for travel in June through October across each airline’s busiest routes. These routes are all domestic.

- This isn’t perfect – different carriers release their lowest award pricing at different times, and without knowing the full list of routes it’s hard to say if there are seasonal effects impacting the results. And they don’t look at close-in bookings for last minute travel where the value of miles may be different.

- Author Jay Sorensen tells me that the full detail is in a report that’s available for sale to airlines, which means I’m not in a position to fully evaluate the methodology. Nonetheless the findings – or at least direction and magnitude of changes – match adjustments made to the programs over the past five years.

Sorensen looks at redemptions of an airline’s miles for economy travel, using the airline’s own routes. That means it doesn’t consider premium cabin awards and doesn’t consider partner awards. The savviest of flyers will be getting more value than what’s outlined in the IdeaWorks report, but this still reflects how most members experience their programs. His two major takeaways:

- Miles have been devalued redemption prices have “increased significantly since 2019 and, moreover, by 7 points above the rate of inflation for the same period.” The comparison to inflation understates matters since paid airfares have grown much more slowly than inflation. Comparing to inflation is the wrong metric for this reason.

Mileage/point prices have climbed 28% overall since the last survey five years ago. The US Consumer Price Index has increased 21% during this period, and this can explain some of the increases posted by frequent flyer programs. The primary reason is the larger flow of miles/points from co-branded credit card accrual, which created more demand and prompted airlines to increase reward prices.

- Rebate on paid travel has fallen dropping “overall more than half from 2019” driven in part by basic economy fares which earn less than standard fares

How Many Points Does Each Airline Require For An Economy Reward?

With the caveats that the routes tested for each airline are different (they’re among each airline’s heaviest traveled routes), the piece finds that for each airline except American Airlines the number of miles required for an award has gone up since prior to the pandemic.

Credit: IdeaWorks

I don’t think it’s entirely fair to compare the number of points required for redemptions across programs like JetBlue and Southwest with American, United and Alaska. However Southwest is pretty notable here as the lowest.

While the number of points required for redemption on Southwest has nearly doubled in this study, they’re still the lowest, even though they offer 6-12 points per dollar spent on tickets (without status) compared to a standard earning rate of 5 points per dollar on their largest competitors and Southwest also doesn’t have basic economy fares, and so doesn’t offer fares with reduced earning.

You can’t redeem Southwest’s points for international business class travel, but there’s a reason why about twice as many people per flight are using points on Southwest compared to other U.S. carriers.

Southwest did did devalue their points 6.5% during the pandemic and another 4% this year for a total of 43% in 12 years – but there’s still a lot of value here.

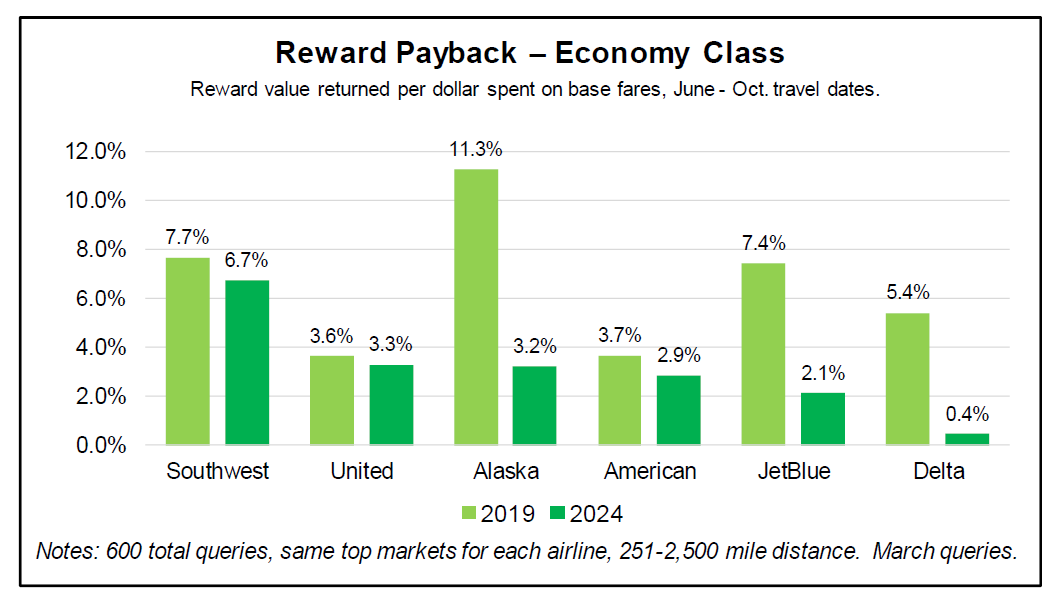

How Much Of Your Ticket Spend Does Each Frequent Flyer Program Give Back To You?

With higher award costs, outstripping the rate of increase in paid fares, we’re seeing lower payback from each frequent flyer program. Much of the reduction can be found resulting from the introduction of basic economy fares. JetBlue and Alaska Airlines in particular didn’t begin rolling out these fares until 2019, and IdeaWorks is comparing to date from early 2019.

Credit: IdeaWorks

Anyone who is intentionally collecting Delta SkyMiles over another currency should question the life choices that brought them to this place.

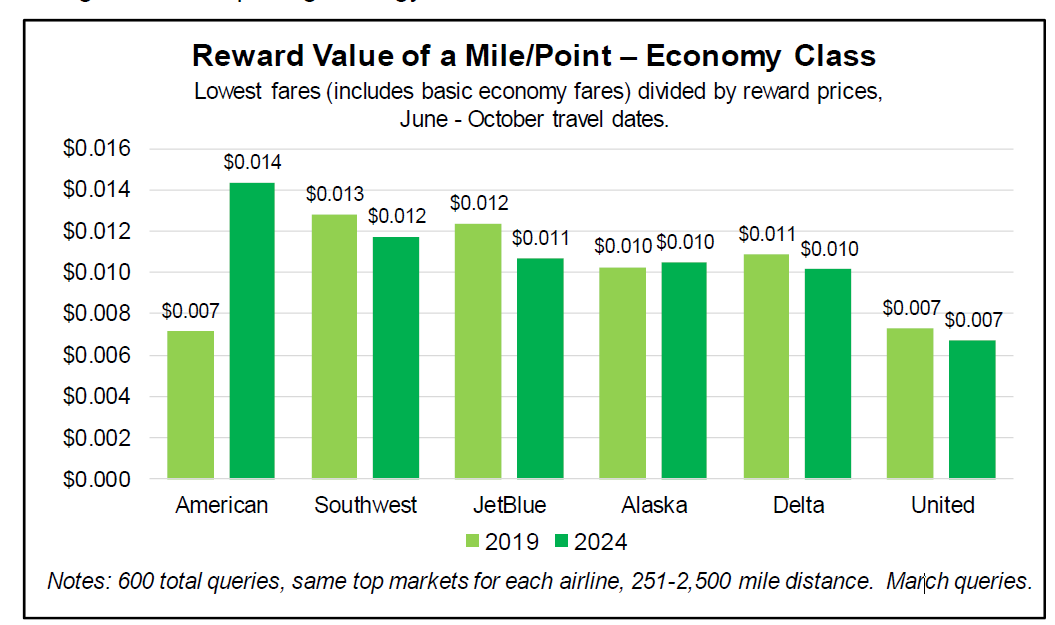

How Much Travel Does Each Airline’s Points Buy?

Sorensen avoids a common mistake when looking at the value of an airline’s miles. He doesn’t claim that a mile is ‘worth’ 1.4 cents because it buys 1.4 cents worth of travel. That’s a claim that would require considering alternative uses of money (cash can buy things other than airline tickets), time value and risk of holding the currency (are miles more likely to be devalued by an airline than your money by the Fed), and how many miles you already have (whether miles put you over the top towards an award – or whether you have too many or too few for the additional miles to be spendable any time soon).

Instead he simply says, here’s how much each airline’s miles buy you in travel in economy on their busiest routes.

The value of each airline’s miles, used this way, is either flat or down – except American Airlines AAdvantage miles which appear up quite a lot. That’s consistent with the approach American’s Chief Commercial Officer Vasu Raja outlined at the ariline’s Investor Day: that their competitive advantage is their frequency program, they need it to be sticky with customers, and they have no intention of devaluing their points.

Credit: IdeaWorks

The value of Delta miles is down but that seems to match a policy change – that in order to get their lowest redemption prices you have to hold their co-brand credit card. Everyone else pays more. (They call this “TAKEOFF15”.)

Notably United does something similar, with cardmembers and elites having access to lowest pricing – but this isn’t new or a shift and United’s results are flat.

I certainly value Alaska miles at more than a penny. I also value them more highly than Delta, JetBlue or Southwest’s points. But that’s because the entire value of the program from my perspective has always been reasonably priced awards on partner airlines. Redemption on Alaska has never been very good, and the IdeaWorks data supports this.

Delta is also interesting because basic economy is not just a shift that reduces earn value in most programs, but Delta also books the cheapest coach redemptions into basic economy.

While United may offer standard earning for basic economy (until recently American did as well), United has the greatest restrictions for basic economy travelers – no carry-on bag, no ability to check in online if not checking a bag. But their awards don’t book into basic economy, so even these domestic coach awards from United may be relatively better than they look when compared to Delta.

What Does This Mean For Loyalty Programs

Sorensen seems to posit that too many miles (from credit cards) have been chasing too few seats.

[T]he larger flow of miles/points from co-branded credit card accrual, which created more demand and prompted airlines to increase reward prices.

You’d think that since airlines are being paid by banks for these miles, they’d simply flow through to have the loyalty program purchase the seats. The margin airlines make is their choice, not some inexorable result of co-brand credit card deals. Here’s how much it costs an airline to produce a mile.

It’s certainly true that the accounting for miles sold to banks has airlines booking less liability for future travel than when those same miles are earned from flying. But that’s just an artifact of accounting rules. Under ASC606 airlines cannot play the same accounting games with miles sold with tickets that they can when selling those miles to third parties.

Sorensen calls for a return to program roots, lamenting the shift of frequent flyer programs becoming so focused on credit cards. (Former American Airlines CEO Doug Parker used to refer to AAdvantage as “the card program.”)

Airlines may someday regret relinquishing so much marketing power to their bank partners. Frequent flyer programs are losing sight of their mission. The best programs seek to build consumer loyalty, boost member communication, and generate cash in equal measure. But these programs are well along the path of becoming just travel reward delivery tools for co-branded credit cards—and cash delivery tools for airline income statements. They can be much more.

Accrual of miles/points for buying tickets from the airline should continue to be the top priority.

I’m not sure this is really apples-to-apples, though: “Accrual of miles/points for buying tickets from the airline should continue to be the top priority. Consumers who spend $1,000 on flight tickets have far more positive impact on an airline’s income statement than those who charge $1,000 at Walmart on a co-branded credit card.”

Indeed, $1,000 in revenue from a ticket is far lower margin than $1,000 revenue from a co-brand deal. And it’s $1,000 from the bank rather than $1,000 spent at a different retailer on the card that I think is the more relevant comparison.

In 2021 American Airlines claimed a 52% margin on AAdvantage. Their margin selling tickets is about 1/10th of that. So while I’m sympathetic to the call to return to roots as actual frequency programs, I don’t think it’s fair to suggest that the economics strongly favor this.

How Should You Use This Data?

Sorensen doesn’t look at premium cabin redemption. If you’re redeeming for coach your credit card spend at least shouldn’t be focused on airline miles, since you’ll generally do better with the highest index cash back products. This doesn’t look at partner redemption. It doesn’t look at international travel. But it’s a useful look at what the average customer is getting back from their rewards program, since most people do use their points for domestic economy travel.

@ Gary — I don’t nderstand how one would get 0.4 for Delta payback? That makes no sense. If a base member spends $10,000 on airfare and earns 50,000 miles, that should cover a Delta ticket worth $500. That is a 5% payback. Furthermore, these results make no sense for ANY of the airlines.

@Gene – they do make economic sense. You have to understand the metrics. Don’t think they are including credit card bonuses in determining value but, instead miles earned by flying (assume base or non-elite level which understates the payback for most people) and that value alone.

@Gary – I have posted numerous times when people whined about “devaluation” that is was simple economics between prices of tickets going up and also, more importantly, the huge number of points released by co-branded ticket offers (as well as hoarding during COVID due to much lower travel levels). Many have replied to me that it doesn’t apply but good to see my view if validated. Airline and hotel points are like any other currency, when you significantly increase the supply the overall value of the currency goes down. Another reason to use points when you can instead of hanging on to them.

No premium cabin data and convoluted summary data – not much use out of this

The ‘value per mile’ metrics put out by the personal finance and mile/point sites are more relevant as flawed as they seem – and that’s what Vaja used in his investor presentation

@ AC — My 5% number for Delta does assume base flyer.

As someone who has primarily redeemed points for domestic travel for the past 3 years, I find this information to in line with what I’ve found. United award tickets are always the most expensive, so expensive that I find no benefit whatsoever in using their miles for domestic travel. I used to find that having their cobrand cards gave me better flight options and cheaper prices, but now it seems impossible to find anything coast to coast (my primary travel pattern) for less than 32,500, even off peak. AA has a lot of promo rates where I’ve been able to fly coast to coast for under 10K each way. I’ve picked up amazing value with their program domestically. Delta, when paired with a cobrand, can be somewhat useful domestically, especially if Delta is your preferred airline. Certainly I’ve found their prices to be much better than United’s, but obviously Delta has completely destroyed any upper end value in their program. JetBlue’s best value is redeeming miles for cheap flights. The more expensive the flights, the worse the value per point you get.

@Gene – Delta basic economy fares don’t earn miles at all, so I assume this is a function of basic economy often being the lowest fare when doing these searches. So there’s a lot of zero mileage-earning going on.

Another drawback of this methodology is that the price of award airfares is, in some cases, not just miles. It is also availability. Low award prices in the graph 1 may reflect rationing in those programs not using dynamic reward pricing..

Gosh, I hope some brilliant person responds in the comments telling us all how everyone’s thinking about miles/ points values are all wrong and everyone else is an idiot who can’t understand the deep math behind their unassailable conclusions, because Gary said something about how he “values” Alaska points as greater than a penny.

Fill in an Oscar Wilde quote if you wish. “Sarcasm….”

@ Gary. Interesting article that is completely opposed to my recent experience this week, although I do note you state: “Sorensen doesn’t look at premium cabin redemption.” Since I don’t fly coach, his data really doesn’t help me, esp. Internationally.

I just paid 840K miles for a round-trip PHX-LHR in First outbound via LAX, direct back from LHR in Business. A year ago, these tickets would have cost me, at worst, half those points. I did check the $US cost, there is some increase — hundreds of dollars, not thousands. But nowhere near the points cost increase. One leg was pretty much the same cost as the other.

For those who don’t fly AA much, the difference between First and Business isn’t much typically, if you avoid BA codeshares. Yes, I also know direct can be painfully more expensive sometimes that legs with a stop.

Here I am painfully hoist by my own petard after observing that I planned to use up my AA points then freeboot, I suppose AA has decided to help me.

Looking on the bright side, I got status match in Flying Blue to AA EXP (thx @Gary), my Flying Blue Cr card comes this week and they’re a transfer partner for CapOne. AND, Thrifty Traveler reports AF Bus class seats available to CDG for reasonable miles. I am seeing some Frog’s Legs in my future. (I am still not over AF’s commuter airline being called HOP. Some of you will get that, some won’t).

PS: HOP’s Business class service in an Embraer 190, no less, surprised me. Big thumb’s up for them, FWIW.

Well score one for AA – something special in the air.

@ Gary — What’s basic economy? 😉

I’m aware that just because something works for me it doesn’t necessarily work for you. That said, it pains me to think of what alternative uses were out there for the 840K AA used for one 1st/Business roundtrip to Europe. That could easily be used for $25K worth of domestic coach travel.

Since one has to spend money to obtain miles, can we posit that the cost of miles have really gone up by the 21% CPI + the 28% increase in miles’ cost = 49% total increase for each mile?

United at the bottom of the pack, as expected.

I’m a newbie to all this points for travel stuff, mainly because I’m not a guy who flies for business. Even so, I have advanced calculus under my belt but I’m having trouble parsing out a clear message here. I’ve been doing a lot of reading on the web about the value of points and how best to use them; this article seemed to offer an analytical approach but still, it seems confusing.

Here’s a confusing part: “ While the number of points required for redemption on Southwest has nearly doubled in this study, they’re still the lowest, even though they offer 6-12 points per dollar spent on tickets (without status) compared to a standard earning rate of 5 points per dollar on their largest competitors and Southwest also doesn’t have basic economy fares, and so doesn’t offer fares with reduced earning.”

You shift from talking about redemption to talking about the rate of earning. And? I guess I’m not smart enough to follow. Sorry.

Advantage has a lot of great domestic redemptions. I have booked a number of great domestic first fares for my family. They also have a lot of lower redemption cost awards that require a 6+ hour layover. This separates out fliers by price sensitivity. It has worked well for me with schedule changes, but offering undesirable routings for low miles likely helps them rank better. United has its value spots as well, short haul regional routes that have very high cash prices tend to have very good redemption prices. United also has very reasonable premium economy mile redemptions on transcon routes with 3 classes of service.