At the airline’s Media and Investor Day in 2017, then-CEO Doug Parker famously declared that they would ‘never lose money again.’

He announced a bet he’d made on the airline’s stock price. It would hit $60 by November 2018. It didn’t get above the $40s by then, and he paid out the bottle of wine.

American Airlines Group shares made it into the high $50s in January 2018, and began to decline. They were below $30 prior to the pandemic. And they’ve continued their downward trajectory, even as other airlines returned to trading at pre-pandemic prices.

Parker’s presentation at the time described the airline as being like an annuity. They were, effectively, on autopilot to earn $3 billion to $7 billion per year and would average $5 billion annually into the future. There’s been 20% inflation since then – just staying even with where they were seven years ago should mean annual profits of $6 billion!

Yet current CEO Robert Isom’s compensation package describes $2.5 billion as the current airline’s target, with $4 billion net profit now considered a home run – earning him the greatest possible bonus. As George W. Bush once said, “the soft bigotry of low expectations.”

It was actually that September 2017 event which turned out to be an inflection point for the airline’s stock, which began cratering mere months later.

Some might call declaring that you’ll never lose money again “tempting the wrath of the whatever from high atop the thing” (someone should’ve told Parker to “go outside, turn around three times and spit”). But several things happened to expose the airline to the reality of the mistakes they’d made.

- The stock turned weeks after introducing a new domestic product that the CEO hadn’t even tried, and wouldn’t bother experiencing for more than six months after their primary consumer-facing experience was already in the market. The airline hadn’t even built a mockup of the cabin before selling it.

There were several things wrong with it beyond the obvious reduced passenger space, decreased padding in seats, elimination of seat back entertainment screens and smaller lavatories. The galleys didn’t work. The lavatory doors banged into each other. Sinks splashed back at customers.

Half the first class seats lacked underseat storage, and didn’t even have the device holders offered in coach in lieu of screens. Bulkhead first class was so miserable customers turned down upgrades.

Planes that they paid to retrofit needed to be retrofit again to fix some of these shortcomings. Internal data showed the airline’s frequent customers moving away from them.

- American had been riding a wave of low oil prices. Airlines are an easy insider trading bet for oil company executives (not legal advice!). Prices turned, and debt-laden American was highly vulnerable.

- Interest rates began rising, up until the pandemic, exposing the folly of essentially levering up the balance sheet to fund $12.4 billion in stock buy backs (at an average price of nearly $40 per share).

A cynic might suggest that this was done to buy into selling from executive 10-b6 plans. Doug Parker sold more than $150 million in AAL shares between 2014 and 2019. At one point he was selling between $4 and $11 million per month, with a peak of over 400,000 shares sold at a time.

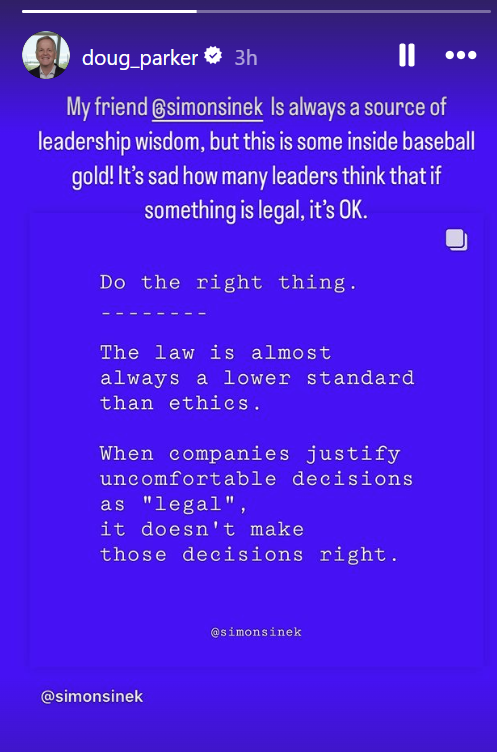

This was on Doug Parker’s Instagram story on Friday. It struck me as ironic, with American having taken $10 billion out of taxpayer pockets during the pandemic (the company is worth less than even that today). But I might as well leave it here discussing his corporate stock buybacks alongside the sale of his own shares.

- Of course, American’s labor costs have only gone up. They agreed to a mechanics deal just before the pandemic that failed to even get legacy US Airways and American workers on the same health plan, let alone allow for the sort of outsourcing that other airlines do regularly. They signed record deals with pilots and flight attendants. But they haven’t grown revenue in order to swallow this.

- A high cost airline needs a strategy to earn a revenue premium, and American’s focus had been competing with lower-cost and fare airlines. As current airline CEO Robert Isom put it back in 2018,

[T]oday there is a real drive within the industry and with the traveling public to want to have really at the end of the day low cost seats. And we’ve got to be cognizant of what’s out there in the marketplace and what people want to pay.

The fastest growing airlines in the United States Spirit and Frontier. Most profitable airlines in the United States Spirit. We have to be cognizant of the marketplace and that real estate that’s how we make our money.

We don’t want to make decisions that ultimately put us at a disadvantage, we’d never do that.

Flying to and from Sydney in first class last summer they didn’t even have an Australian wine on board either flight and their Chardonnay was an $8 bottle. Their new amenity kits have largely the same contents in premium economy, business and first class. At least they’ve stopped handing out cardboard boxes in business class.

@AmericanAir come on! Really? pic.twitter.com/f1NClr1l8w

— NC Man (@NCMan2020) January 14, 2024

- Their operational performance has regularly lagged the industry in many ways. At times they’ve flown more reliably, but even then they’ve consistently involuntarily denied boarding to more passengers than any other airline and mishandled more bags, too. And while they’ve been focused on exact on-time departures (rather than arrivals, and been concerned more about missing ‘D0’ by a minute than by a hundred minutes) they’ve declared investments to improve to be too expensive.

In his first meeting with employees officially as incoming CEO, Robert Isom told them not to spend a dollar more than they need to, a message he reiterates.

There’s no clear vision on how a high cost airline can generate outsized returns without delivering a premium product customers will pay more for. They aren’t trying to turn themselves into a low cost carrier (just hold the line on some costs). They aren’t trying to become a global airline, leaving most international flying to their partners.

At their most recent investor day, they presented a strategy of serving more markets conveniently across the Sun Belt (for which there’s no real moat, and where their network isn’t that much better than others); offering a better loyalty program; and reducing distribution costs and generating greater ancillary sales by kicking the behinds of travel agencies and cutting back on corporate contracts.

They moved too quickly pulling back on sales, and pushing agencies to adopt technologies that didn’t always work, although in the long-term their thesis about where they need to go is probably right. So they scapegoated Vasu Raja, the outspoken face of the plan but don’t really have anything in its place. Even if Raja’s vision had flaws, it was a vision and they now seem to lack one.

American Airlines has been the single carrier with the greatest potential to be better than it is today for many years. Their shortcomings are clear. But they have lacked leadership.

Their last CEO oversaw what appears to be the single greatest destruction in shareholder value inside or outside of bankruptcy in the history of the airline industry.

- Early in Doug Parker’s tenure the company’s market cap reached $37 billion. It’s now just over $8 billion. I’ve been unable to find any airline, ever, that’s destroyed $30 billion in shareholder value.

- Even looking at the fall of the top airlines in the country’s history, Pan Am’s peak market cap in current dollars was approximately $16 billion and TWA approximately $11 billion. Delta’s market cap from peak to trough during the pandemic (from which it recovered!) was less than American’s decline to present.

Parker retired and chose his successor. The airline was just kicked out of the S&P 500. Yet there’s no clear direction for where they go today. Meanwhile, Delta and United stock now trade for about what they did before the pandemic.

Here recently they’ve shifted to profit centeic decision versus customer centric. Specifically choosing to use fedex for the majority of their delayed luggage and gambling with roadie in several stations. My company is 5 star rated ( most customers get their bag within 4 hours of it becoming available with 24 hr local dispatch) fed ex is 2 to 4 days and roadie has horrible customer service ( higher incidents of pilfering and no way to talk to folks) I am hoping they make a change soon

AA management has been absolutely awful since the merger. One bad decision after another for years, and the BOD doesn’t seem to care, shoveling bonuses at the CEO despite abysmal results.. Sad to see what has happened to a once very good airline. Looking at the problems the LCC’s are having, it is hard to understand why management has worked so hare to emulate them, rather than benchmarking Delta or even United.

Feel bad for the hub captives who have no choice. Living in NY and LA, I have choices but stuck with AA for so long (14 years as Plat and then Plat Pro)… some form of Stockholm syndrome or something. Finally jumped ship last fall to DL where I will be making Diamond this year and never looked back.

Parker exemplifies the long term boomerang/opportunity cost of stock buybacks, especially for company with a current market cap of ($8B), now less than the cash ($12B) wasted on buybacks for absolutely nothing in return.

Just think of the things AA could do with that money today, pay down debt, enhance it’s premium product, brand, anything.

Not sure which board and C- suite has been the worst for the last two decades, Boeing or American.

[beats deadhorse]

American needs its own version of Elliot Investment Management to come in and clean up the top corporate ranks and the company strategy.

It seems that American Airlines has used every opportunity to cheapen their product. Maybe they should have used some of that stock buyback money to buy a refinery like Delta did. Even though stock buybacks often waste money, having a lot of cash on hand can make a company ripe for being bought with their own money.

leading with the IG post would have helped establish the context of the article which otherwise feels like just a rehash of past articles.

the past 23 years of AA history can be summarized as:

1. tried to avoid chapter 11 which most of the airline industry used post 9/11 but never adequately restructured and had huge cost disadvantages for five years that set the downfall of AA esp in competitive markets.

2. NYC was the epicenter of AA’s downfall which is ironic given that AA was formerly HDQd in NYC and because DL closed its DFW hub in order to beef up NYC. DL’s revenue gains over the past quarter century have been heavily driven by AA’s failures and loss of high value passengers.

3. Parker was solely focused on lining his pocket and never cared about making AA viable, exactly what many saw would happen when US took over AA.

4. AA has engaged in one failed strategy after another and never achieved its goal with the US merger of being a global competitor to DL and UA.

5. AA has probably crossed the point of no return in being able to compete on the same basis as DL and UA. DL has more network overlap and a better track record for seizing on other airline failures to grow. Even if AA realized tomorrow what is wrong and tried to fix it, DL and UA are strong enough that they will not allow AA to regain what it has lost and AA doesn’t have the finances to fight to return.

AA might end up in Chapter 22 but it i more likely that it will continue to operate with low margins and deteriorating performance until the industry as a whole faces another macroeconomic crisis which will precipitate massive government help that will keep AA alive and DL and UA happy to have a weak competitor.

It feels like youve written this article dozens of times. Why now again?

And enough with this “they didn’t build a mock up!” Thing. I’ve worked at plenty of airlines and really only seen mock ups/ demonstrations for premium products. This is something you’ve made up

This is 100% attributable to a complete failure of leadership. Nothing more; nothing less.

They need an effective leader who can work across dysfunctional cultures and bring about real change. They need to do what Starbucks just did: hire an effective leader and give him carte blanche.

My suggestion: Go get Ben Smith from Air France. Pay him whatever he wants. Then let him remake the management team.

Well written article, Gary ! For sure we appreciate your effort in pulling this all together.

So much for the efficiency of Wall Street in replacing poor performing CEOs.

It would be a very interesting story to understand how he was able to hold that position for so long while destroying all of that value.

And why is that Lufthansa had to pay back their Covid government loans but AA and other US airlines didn’t. What kind of socialism is that?

I think AA is not in a position to get out of its predicament on its own. Aside from a management shake up, the one life rope I see is a merger with Jet Blue. This would allow AA to get back into the NY/BOS to Florida market that they destroyed. It will also effectively redo the previous Jet Blue alliance to fill their flights to Europe.

JFK terminal 8 is so underutilized these days. They must be loosing a fortune there with all the empty gates and empty shops. I don’t know if they could squeeze Jet Blue traffic into this terminal but it would offer massive cost reductions to consolidate terminals in JFK.

Endlos,

US airlines received grants to keep people employed and that was not repayable; other countries including Germany have socialized systems so what was given to airlines was far different.

David,

the typical “allow two companies that both have more than their own fair share of strategic failures to merge” won’t fly.

AA and B6 both destroyed strong market positions all by themselves. The American people shouldn’t be held hostage to the possibility that AA and B6 can figure out their failures together when they haven’t been able to do so separately – and couldn’t even create a legal partnership.

There doesn’t need to be any other mergers in the US and it is highly unlike there will be other than within the ULCC sector.

My dad was an executive at American Airlines a long time ago and used to always fly it. Over time it has gotten worse and worse and eventually moved to Delta for the profitable travel. It is them or Southwest. I put in American in the bucket with Spirit,Frontier and Allegient which are MY no fly list.

American lost $30b in value, roughly 78% by your math

Frontier lost over 80% at its trough

@Timm Dunn

Germany has a better social system for the unemployed and programs like “Kurzarbeit” which have been copied since by other countries and companies but in this case Germany is consistent. socialism isn’t for corporate profits.

It’s no fair to the US tax payer or to other companies for the matter when a select few (the airlines) get bailed out, their risk socialized and worst of all not expected to pay back money they got from the tax payer.

So this has been written by Gary before. So?

Repeating it just demonstrates that American’s operations are still off the rails with no clear path to fixing the underlying issues.

I liked the summary and context

@internet airline, irrelevant, some have lost less value but 100% by wiping shareholders in bankruptcy. Does not change that no airline has destroyed more shareholder value – ever – than AA.

Keep the flight attendants recycling the over poured orange juice. That will fix this mess.

Endlos,

the US pumped trillions of dollars into the economy including thousands of dollars to most taxpayers.

Airlines got a small fraction of what was spent by the US government to keep the economy from failing. I will agree w/ you that much of it was not necessary; I disagree strongly w/ you that airlines received anything that other entities in the US also got.

and to Gary’s point, AAL’s market cap was comparable to DAL’s right after AAL emerged from bankruptcy and has fallen dramatically since.

It doesn’t take long to wreck your Balance Sheet but it takes a very long time to restore it.

@Jason “I’ve worked at plenty of airlines and really only seen mock ups/ demonstrations for premium products. This is something you’ve made up”

You don’t know what you are talking about . Otherwise it must be AA COO David Seymour who made it up https://viewfromthewing.com/americans-new-domestic-interior-was-such-a-disaster-they-now-build-cabin-mockups-for-testing/

Parker (former American Airlines CEO) should have been in jail after his 3rd DWI. Instead the BOD let him ruin a once great airline!

Good thing the brilliant and capable B.O.D. showered riches on Parker for his inspired performance, and continues to richly reward his successor geniuses for their amazing business acumen and insightful decisions.

Great summary.

Another stark reminder of how Americans have become gullible to untruths. Parker said any lie it took to gain personally: the lie that cost him a mere bottle of wine allowed him to extract over $130m, and had he spoken the truth he most definitely wouldn’t have. We’re witnessing the orange geezer and cronies doing the same, and more, and getting away with it from a vast swath of voters.

The lesson: lying to Americans works.

I think I read something on today’s discussion board, somebody asking how in the world could you write that SW has happier employees than United and AMERICAN???

Well it must be the fault of the Flight Attendants. Gary and American always find a way to blame everything on the crews. js……….

More proof buybacks are shortsighted and driven by short term-ism. Literally burnt the money and their shares are worth less today than a decade ago.

Some companies like Apple and nvidia can produce and buy back stock. GE, AAL, Boeing etc all wasted fortunes buying back stock and are total shit today. Great investment by them.

Parker didn’t seem to realize that at some point labor would want much bigger wages and the airline likely could not raise fares to the point of covering those higher wages. It’s hard for an airline CEO to not to realize how over capacity the industry really is.

When are the stockholders going to get smart and kick out the board of directors. It is inconceivable that a board could be so detached and incompetent.

Cleanup in row 36. Gary has beaten this dead horse into a puddle of glue so thick, the FA’s are stuck in the aft galley playing candy crush.

Thankfully I retired before America West took over and ruined their third airline.

I was banned from AA’s FF program and had 350K points confiscated due to some mismanagement on the part of Citibank (I was allowed to open multiple credit cards to earn the bonuses).

So In the past 5 years or so I haven’t been on an AA flight, and i enjoy hearing all the bad AA news. I guess those points wouldn’t have resulted in pleasant flights anyway.

1. The board of directors do not care the CEO is running the airline into the ground!

2. Isom signed off on that disaster with the travel agencies but he assumed no responsibility for his actions.

3. In order for AA to succeed they need a new board of directors and CEO. Until that happens the airline will continue to be ran as small minded. You take a CEO of a small carrier and make the CEO of a large carrier they don’t have the mentality to run AA you have to think big.

4. AA is too top heavy if you don’t know what that means they have too much management. Currently, fined for not taking care of their disabled passengers. 25 million plus an extra 25 million if changes are not implemented.