The new Curve card is beginning to roll out. It lets you link other credit cards and choose which one you pay with, and it,

- Can give you rewards on top of the card that you’re charging to

- Lets you change which card you’re charging after the fact

The rewards you earn are 1% for the first six months, on top of your usual rewards, and this can be extended by referring friends to get a Curve card. That part is great.

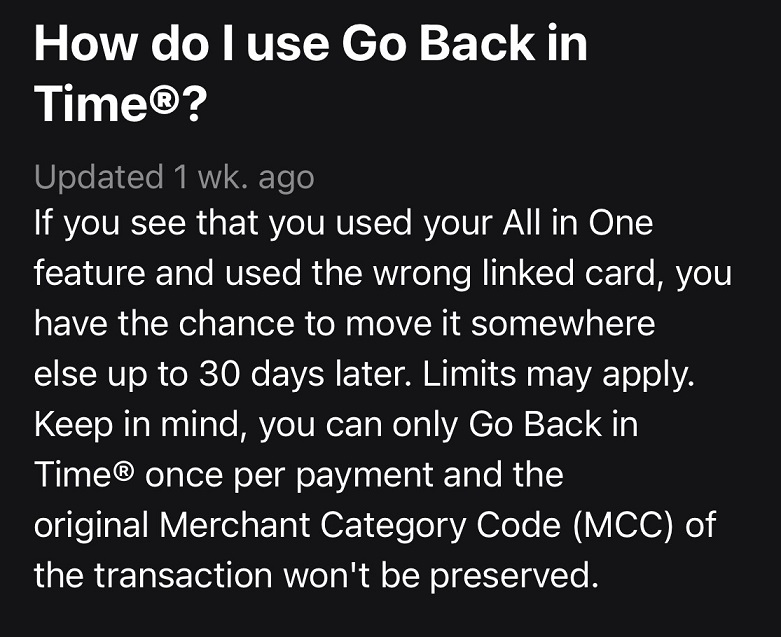

Their ‘go back in time’ feature lets you re-assign transactions to different cards even after you’ve made a charge. That should be amazing because in theory it would let you re-assign a major purchase to a new card to help meet an initial bonus offer basically letting you round up your last 30 days of charges from before you got that new card, and it would let you re-assign charges to a card that offers a bigger category bonus.

From time to time we all put a charge on the wrong card. We may also have a spouse or partner that isn’t going to pay as much attention to category bonuses as we do. This potentially saves relationships because that partner can use whatever card they wish, then we just re-assign charges to the card with the biggest bonus later!

The one known drawback is that Curve has no support for Visa or American Express, just Mastercard, Diners Club and Discover at this point. However the hoped-for ability to ‘re-assign’ charges to take advantage of bonus categories is something that they warn new cardmembers is not going to work. Instead they explicitly warn that the merchant code that triggers category bonuses doesn’t get preserved when re-assigning charges to a different card.

We’ll have to wait for re-assignment data points from early cardmembers to verify this is true, but they’re warning that it won’t work which discourages use so my base case is to assume we won’t have one of the hoped-for benefits of the card on a consistent basis.

(HT: Justin D.)

Use a UK address..no Forex charges and Mastercard.

what about using to charge reimbursable “airline charges” on premium cards with that feature? would they still know it’s for gift cards? or would you still have to prove it’s for incidentals? my understanding is so long as they’re not keyed as gift cards or fares they’re okay.

I presume they essentially pay off the bill for the “old” card and put a fresh charge on the “new” card and have to use their MCC for it.

So yeah, it’s not as great but as long as they let me create an algorithm to route the charges the way I want, I’m ok with not using the “go back in time” feature. After all, such a feature does not exist now so we’re not losing anything.

I’m more concerned about their inability to work with Visa and Amex and hope they can solve it.

@Alex I assume Smart Rules is what they want you to use instead. You can route to a particular card based on MCC or transaction amount