U.S. Customs and Border Protection is engaged in a “pre-Christmas crackdown” on passengers carrying cash out of the country with an apparent focus on Washington Dulles airport.

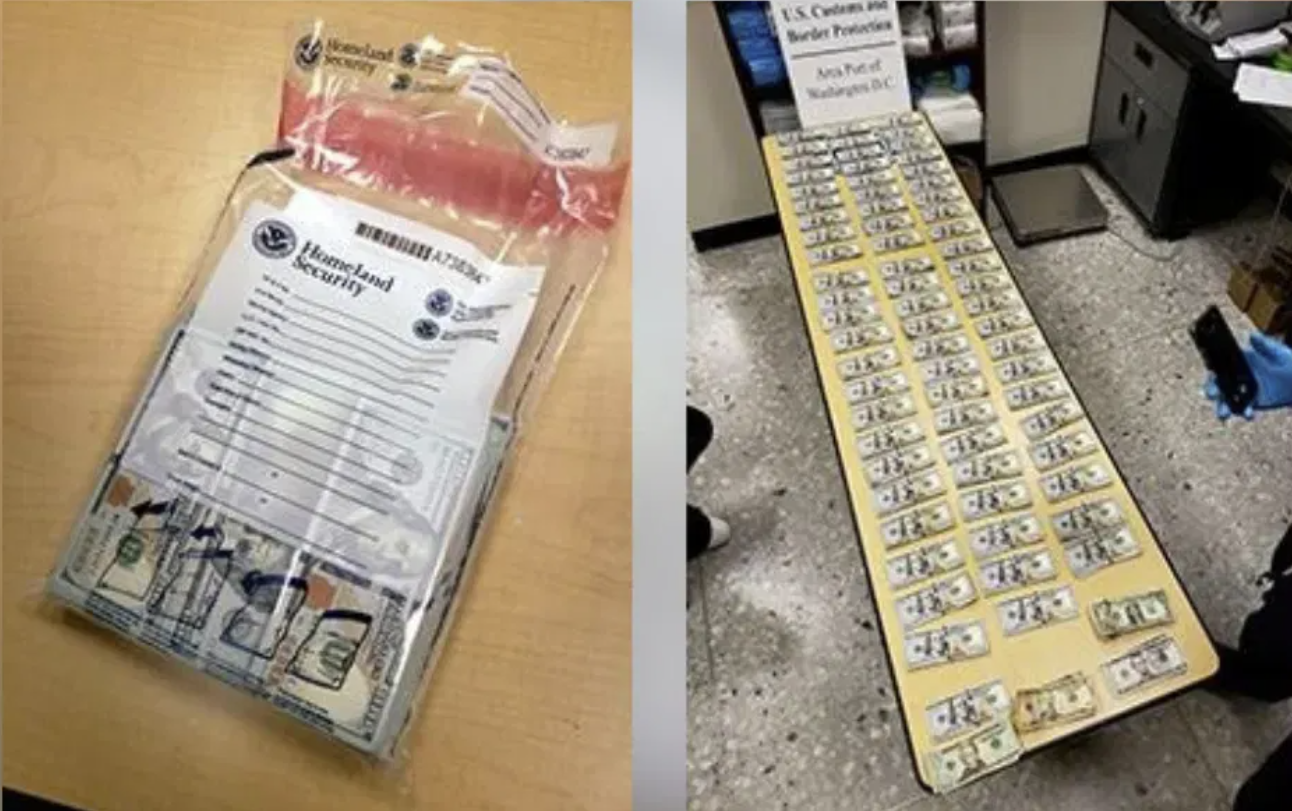

On Thursday they seized $68,000 from a family flying United Airlines 612 to Lagos, Nigeria after searching their bags. They were carrying $68,216, and authorities left them with $216 and allowed them to continue their travels.

Credit: Customs and Border Protection Seizures At Washington Dulles

It’s widely known that you have to declare when you’re bringing over $10,000 in cash into the United States. You disclose this on your customs declaration form, and then must file form fincen 105. If you’re traveling as a family, under one customs declaration, then the $10,000 limit without disclosure applies to the combined cash being carried by everyone in the family.

Much less well-known is that it’s even required that Americans carrying cash out of the United States have to declare it if it’s in excess of $10,000. That’s true even though there’s currently not ‘departure immigration’ clearance when leaving the United States. Most passengers think that getting on an international flight out of the U.S. is no different than getting on a domestic one, and wouldn’t have any idea where or how to declare their cash even if they knew they had to do it.

- You can find a customs officer at your international departure airport

- Or complete FinCen form 105 online, especially important if you’re flying out of an airport like Washington National which has international flights but no customs facility. (International flights returning to the airport are limited to destinations with US immigration preclearance, and also are subject to the 1250 mile perimeter rule in any case.)

Washington Dulles is one of the airports where this receives the greatest enforcement, or at least where there are the most stories of seizures – and it’s almost always cash held by passengers departing the country (and it’s almost always minorities and often heading to Africa where it’s often easier to deal in cash).

Credit: Customs and Border Protection Seizures At Washington Dulles

Hours after seizing $68,000, CBP at Dulles seized $56,000 from two passengers flying Qatar Airways to Doha.

- They actually declared they were taking cash out of the country

- But the amount they listed was too low, $30,000 when the two passengers combined were actually carrying $42,000 with them. (It’s likely that the $30,000 was an approximation of what the one was carrying, and the other held somewhat less than $10,000 which they thought was below the threshold.)

- And they didn’t include cash in their checked bag.

The government kept the money, the passengers continued on their journey, and CBP says the only thing they did wrong was fail to correctly fill out the form.

“These are two currency seizures that could have been completely avoided had the two parties truthfully reported all of their currency to Customs and Border Protection officers,” said Marc E. Calixte, Area Port Director for CBP’s Area Port of Washington, D.C. “CBP urges all travelers to fully comply with our nation’s laws during inspection, including U.S. federal currency reporting law.”

I previously wrote about a woman departing Houston who had the money she was taking to Nigeria to start a medical clinic seized. She simply didn’t know that she was required to fill out a form to bring the money with her when leaving the country. There was no accusation she’d broken any other rules other than the paperwork.

Most of the cash from departing passengers is found by money-sniffing dogs. That’s entirely separate from cash seized at airports by the Drug Enforcement Agency, over the period 2007–2016 the DEA seized a total of $3.2 billion in cash with “zero convictions tied to this money.” The government just keeps most of it.

Taking $86K to Nigeria (the original scam country) probably wasn’t for legitimate purposes anyways, ESPECIALLY if they’re not declaring it. You get specifically asked, so you can’t claim forgetfulness.

Ah, government seizure laws. How this is constitutional I will never understand. Once seized they have to prove that the money had a legitimate source and intended use which can take about 6 months. Then you have the profiling issue. Shall we discuss racism in our law enforcement ranks?

Given Janet Yellen’s “temporary inflation,” this law soon may ensnare all of us innternational fliers.

Remarkable side note about the DEA taking cash with zero convictions.

I thank this blog for the heads-up.

Daniel, you don’t get specifically asked when departing the US.

Just like taxes, the government likes taking your money.

It also covers any transaction in cash over $10,000. When I worked at an auto company, we had a dealer who sold a new vehicle for cash and did not report it. He was convicted of a felony for failing to report, and lost his dealer license and franchise.

It should be user friendly by posting a prominent poster at security, having a question that is automatically asked at the check in kiosk or if an airline agent manually checks your passport.

I’m extremely cautious about this. Traveling to Japan several times a year I’m not worried about the $10,000 U.S. limit but the 1,000,000 yen limit. With the exchange rate elevated I’ve got to be careful. I left 16,000 yen in my desk last trip just to be safe since I’m also carrying some dollars. I’ve thought about taking just dollars but getting free exchange through my bank is the best deal and the areas I visit outside tourist areas has limited exchange opportunities. My biggest concern is getting a U.S. customs agent who can’t do a conversion. .

Cash? What’s cash? :-). I’ve forgotten what it looks and feels like since I do everything electronically nowadays.

@derek +1

Warning people about this odious practice seems the absolute minimum that any country with even a pretense of being civilized should do.

I don’t really understand why everyone is so worked up about this every time it is raised. Ignorance of the law is not a defense. That is the case with speeding, not paying your taxes, “borrowing” merchandise from stores, or leaving the country with massive sums of government currency.

If the people pounding the table about this non-issue got whacked over the head with a 2×4 and the perps went free because they claimed to have no idea it wasn’t illegal, I’d imagine they would be singing a different tune.

As to the constitutionality, the use of dogs to sniff in a public space is well-established law courtesy of the Supreme Court.

The problem CW, is that it’s not illegal to travel or of the country with more than $10k. I travel internationally quite a bit and I expect the airlines, TSA, etc. to inform me of special requirements. It’s absolute BS when there isn’t even a place to report when there is a requirement to do so.

@CW: Maybe ignorance of the law isn’t an excuse, but not having criminal intent is absolutely a defense against criminal charges.

But, seizing money at the border isn’t the result of a criminal prosecution. The government doesn’t say, “The law is you have to declare currency, so we are charging you with failing to declare this currency, here’s your court date.” The government just takes all your money. THAT shouldn’t be permitted.

@DW: “Use the online Fincen 105 currency reporting site or ask a CBP officer for the paper copy of the Currency Reporting Form (FinCen 105)”. You’re welcome.

I would think that people flying around with tens of thousands of dollars for perfectly legitimate (of course) purposes would have legal / financial advisors, or at least know how to use google, but I digress. Also, the airlines are not the ultimately responsible party for ensuring regulatory compliance, e.g. with visa requirements.

Look, I’m not a huge fan of this who cheers when people lose their money. However, what I do know is that personally when I’m doing something that involves a lot of risk, such as working with huge sums of cash, I perform the necessary diligence and / or consult experts in the applicable field to ensure I’m minimizing that risk. And I would expect people who are engaging in law-abiding behavior to do similarly.

jns–right on!!!!

Do some research into Civil Asset Forfeiture. It is used by government agencies and police to take your money. Be careful carrying cash, even a few thousand can be seized for no reason.

If you can’t take the $80k to Nigeria how do you make the good faith payment to claim the one million they are holding for you ?

One bizarre thing about the $10,000 rule is that it has not been adjusted for inflation.

The most current FinCen 105 form was created in 2003 and the amount at that time was still $10,000. Surely the value of $10,000 should be adjusted for inflation.

Ignoring inflation makes more people unintentionally violate the rule and have their money unfairly confiscated.

Many immigrants are ignorant of the law and they carry their life savings from their homeland to live out the remainder of their life in the U.S. only to have their money seized by the U.S. after they arrive here.

Ahh the US, the genuine empire of evil …

Stalin is so proud of you, fat comrades !

@CW: “Ignorance of the law is not a defense.”

That was a reasonable premise when the the complete federal statutes were the size of a (small) magazine. But with there now being over 30,000 separate laws it’s not reasonable to expect any single human being to know all of them. It’s estimated that the average American unknowingly commits three federal felonies a day. See https://www.amazon.com/Three-Felonies-Day-Target-Innocent/dp/1594035229

Why do people carry so much cash? They can just transfer money online. 80,000 is too much cash to carry anywhere and the risk of losing.