I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

SoFi’s free money offer is just too good. It’s quick and easy, all online, and they give you money. It’s a finance product that’s really aggressive getting new customers. It has no fees of any kind, and they’re offering a pretty good 1.6% APY in interest. And they even reimburse all ATM fees for withdrawls, so it’s convenient for pulling out cash anywhere. There’s no hard credit pull when you sign up, either.

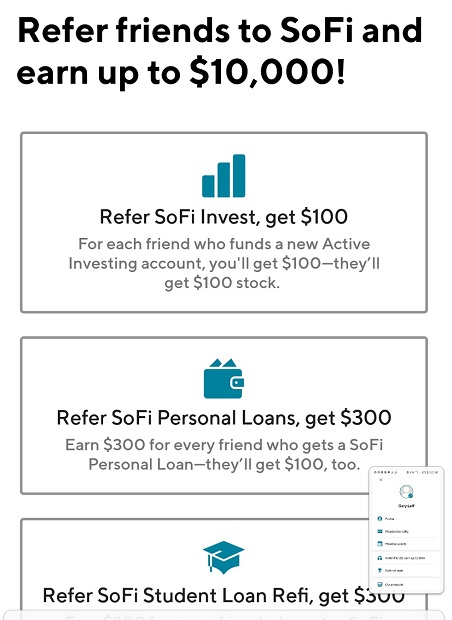

And they’ll give you money for getting your friends and family to sign up – up to $10,000 a year.

Big SoFi Signup Bonuses

Most importantly there are two accounts you can sign up for. Each has a nice sign up bonus. And each one lets you refer friends and family and earn more cash doing so — they sign up, they earn money, and you earn money when they do it. Rinse, repeat with more friends and more family (and your friends and family do this, too). If you’re still getting along with your family after Thanksgiving this is a great project that everyone can rally around.

- SoFi Money: Deposit $100, receive a $25 bonus. Everyone you refer who funds a new SoFi money account gets you another $25 as well, up to $10,000 per year.

- SoFi Invest: Deposit $1,000, receive $100 to invest. Everyone you refer who funds a new SoFi Invest account gets you another $100 as well, the same cap applies.

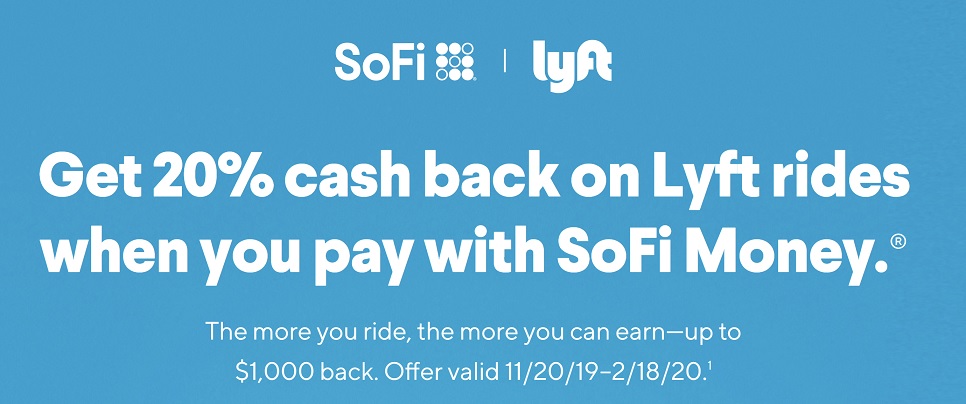

Big Lyft Bonus, Too

That’s good enough on its own, but would you believe they’ll give you up to $1000 back for Lyft spend too? Add your SoFi Money debit card to your Lyft profile and make it your default payment method. You’ll get 20% back on Lyft through February 18, 2020, up to $1000 (you won’t max out on the promo until you’ve spent $5000 in the next 3 months which is unlikely for most).

How to Do This

Opening the accounts takes just a few minutes. Getting your signup bonus takes just a few days. Referrals show up quickly as well. Your debit card should come in a week, and ATM fee reimbursements should process right alongside the withdrawal transaction fee.

Sign up online for SoFi Invest and for SoFi Money, then once you’ve created your account you will want to download their app (either from the app store or Google Play store) because you’ll want to pull up your profile in order to find your referral link and start referring friends and family.

All of the free money they’re giving away has to be the deal of the year. Investors have started demanding a path towards profit from startups, not just user growth, so let’s take advantage of their investors’ money while we still can.

SoFi has a policy of not offering this account to anyone who isn’t a permanent resident or citizen of the US, however they only perform this check *after* collecting all of the personal details they would need to offer service.

They’re pathetic and discriminatory.

@UA

Either you meet the requirements or your don’t. There is nothing discriminatory about it.

They may be pathetic, but that’s not discriminatory.

@ Gary — I’d rather be buying Track-It-Back tags. After all the devaluations, those miles are still worth more than the purchase price!

I thought this was a miles and points blog

How can they afford to do this and what happens when this Ponzi scheme collapses?

Too scammy looking for me. The idea of “free money” is pretty well worn, people have been promising it forever and it usually ends in tears (@Andrew, that is what happens when the Ponzi scheme collapses). The idea that somehow I will accrue $10 K from referrals $25 at a time is a bit rich. Whether tulips, the Lost Dutchman Mine, or sidewalk Rolexes, if it seems too good to be true, it likely is. Free money falls into that bucket.

More travel blog, fewer scammy money games. That is what we have r/CreditCards for.