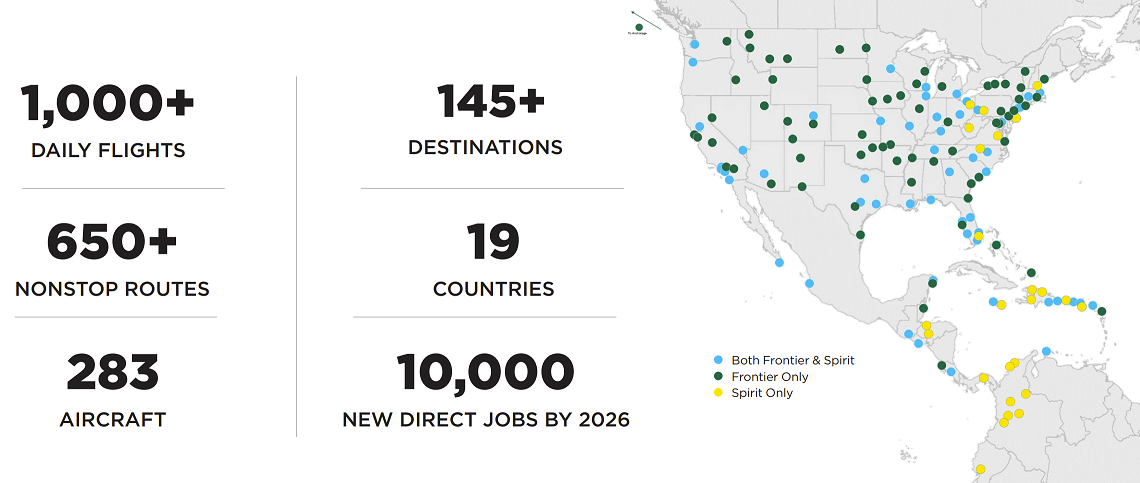

Spirit Airlines and Frontier Airlines have announced that they are merging. Combined they’ll offer 1000 daily flights and serve 145 destinations in the U.S., Caribbean, and Latin America and the transaction is expected to close in the second half of 2022.

This is effectively Frontier taking over Spirit,

- Frontier equity holders will own 51.5% of the combined company

- Spirit shareholders get Frontier stock and cash

- 7 of the combined company’s 12 directors will be named by Frontier

Frontier is run by ex-Spirit people. Bill Franke, the former Chairman of America West and current Chairman of Wizz Air, is Chairman of Frontier, a position he previously held at Spirit. Franke will head the combined company. Frontier CEO Barry Biffle was marketing chief at Spirit as well.

Spirit and Frontier have, in many ways, very similar products. The new Spirit Airlines frequent flyer program is largely modeled in Frontier’s. Frontier doesn’t have Spirit’s ‘Big Front Seat’ and lacks internet, and of course it’s too early to know how a combined carrier would approach these things. Frontier is the most aggressive at offering status matches, perhaps in the history of the world.

The Biden administration has signaled an aggressive approach to anti-trust. They’re even suing to stop the American Airlines-JetBlue partnership (not merger) that the government itself had just approved. However neither Frontier nor Spirit are the single dominant player currently in any single market. And consolidation among lowest-fare providers won’t necessarily mean higher fares. A stronger airline that’s able to expand more would mean more low fare competition for legacy airlines.

“A stronger airline that’s able to expand more would mean more low fare competition for legacy airlines.”

A stronger low-fare carrier is probably better for consumers than two weaker ones. I still don’t think some of the larger mergers should have been allowed to happen but I think this one makes sense.

This is huge news and portends serious pressure on the Big 3.

If they don’t call the airline ‘Frontier Spirit’ it will be the biggest missed naming opportunity in business history.

It tells you volumes about how well they compete against the legacy/global and low cost carriers that they have to merge in order to continue to have an impact.

And, no, JetAway, the biggest growth from both Spirit and Frontier has been in markets where Southwest and JetBlue are the largest – FLL, MCO, and LAS. A stronger ULCC segment is much more of a threat to the LCCs.

B6 & AS, you’re next.

Higher Prices is what it means. History has taught us that they will promise lower prices and better service, and yet we will get neither.

@Tim Dunn-the past is not a guide to the future.

Great news! One less airline to avoid 😉

Two are better than One…

With respect to the employees..

Is the combined carrier going to be renamed “you get what you pay for” airlines?

You see the legacy carriers as at risk because you choose to ignore the facts that show that ULCCs have grown the most in leisure oriented markets such as Florida and LAS which are dominated by LCCs – while ULCCs have garnered low percentages of traffic in legacy carrier hubs.

The reality is that the ultra low cost carriers have not had quite the success as some people think. ULCCs tout their low costs but it comes at very low service quality including oodles of fees and add on costs, tight seats, and deteriorating customer service – all the things that legacy carriers have had to fight in the public and governmental eyes for years. Legacy carriers have actually done a better job of competing w/ ultra low cost carriers than LCCs. Southwest and JetBlue have much less product differentiation with ULCCs than legacies do – no longhaul international, no first class, no lounges. And legacies have created economy basic fares which compete w/ ULCCs. And legacy carriers also operate out of hubs where they have lots of mass which they use to successfully compete against ULCCs. Just look at the number of seats that Spirit or Frontier have out of Denver or Detroit or Dallas against their legacy competitors – it is a minority of seats. ULCCs do better out of markets where they don’t have to compete directly against legacies.

40 years into deregulation, the legacies are a whole lot more durable than alot of people gave them credit for.

Sprontier? Fririt? Frontirit? I just hope they continue the big front seats. Its the only reason I fly Spirit and the reason I don’t like to fly Frontier.

Andrew Lock says:

“If they don’t call the airline ‘Frontier Spirit,’ it will be the biggest missed naming opportunity in business history.”

When contemplating a corporate merger of organizations with shoddy customer services like Spirit and Frontier Airlines, please consider the acquisition of Marriott International. With a stellar portfolio trifecta of corporate crap, I am confident this new organization would evolve to become worthy of using the Bonvoyed or Bonvoy moniker.

I haven’t flown Frontier in probably 20 years and have never flown Spirit… Needless to say it really couldn’t care any less about this story.

Interesting…..

Let’s hope we get the in-flight experience of Spirit (internet access, Big Front Seats, wine in a can, accommodation policies that are more generous than AA) and the frequent flyer program of Frontier (credit card elite status that means something, etc.).

Best of both worlds is a possible outcome!

This does mean that AA will not be the third worst airline anymore, they will be the second worst. We will soon be #1 baby, “Going for Great”!

If you are an exisisting stockholder, I am assuming there will be a $50 processing fee + $25 convenience fee + $5 internet fee + $13 stock transfer fee to receive the new shares.

Didn’t realize Frontier was mostly ex-Spirit.

Hope they retain that Frontier ‘f’ logo mark – the yellow Spirit is just dreadful – and reading the release the ‘greenest airline’ tagline implies they’ll stick with Frontier colors.

FrontierSpirit would be fun as Andrew says.

As long as it they keep applying downward pressure on airfares I’m all for it.

Frontit is the new name of course…

Bill Franke, American West. How did the US airline industry become American West?

What will happen to the miles earned on Spirit and Frontier programs to be used to fly with?

@Norman – eventually we can expect them to be combined

@Robert +1. I have no intention of ever flying a ULCC. I know several people who flew Spirit and every one to a person said they would never do so again.

I am not even sure how much effect their fares have on the legacy market (or WN) as the others always have higher fares. Plus I do not do connections when avoidable (which is most of the time).

Totally agreed with @Alan’s comment above. Less competition always means higher fares, less upgrades, crowded planes,.. the list goes on and on, and none of these is a good thing for consumers. This is a big win for the 3 legacy carries and other carriers. I am not sure how some even commented “this (merger) made sense”.

@T – Your line of thought is more applicable if one of a few competitors disappears from the market. Not necessarily true in this case. A bigger ULCC potentially has more power to open up fare wars with bigger carriers.

“10,000 + new jobs…” LMAO, like that ever happens in eliminations. Ahem, “mergers”.

It’s shocking that F9 is buying out NK. NK is the larger of the two with more planes and more daily flights. Seems odd, but stranger things have happened. F9 staff taking over NK operations won’t be good for NK employees or passengers. All the bad stuff at NK started with the folks who are now at F9.

God I hope they keep the Spirit Big Front Seats- its the only reason I fly Spirit.

This Merger sounds like a good move for both Carriers but it could also trigger counter moves by other players, namely Southwest, United,JetBlue or Alaska. A merged SPIRIT/Frontier would be a serious threat to SWA in battling them for the low fare customer in key markets like Las Vegas/Orlando/Chicago/Texas/South Florida and SPIRIT has not been hesitant in taking on SWA and the Big Three Airlines in markets like DFW,Houston either. The Feds may let this Merger succeed but it may also put other Carriers in play in the process and makes smaller Carriers such as Alaska,JetBlue,Hawaiian and even Allegiant more vulnerable. There has been a battle ongoing in Denver between UAL and SWA and either could be tempted to acquire Frontier to eliminate a competitor and also thwart a potential ULCC headache that a combined Frontier/SPIRIT could become. Should be interesting to observe.

I would rather crawl to my destination on broken glass than ever fly Frontier again.

Two terrible airlines merging to form one big pile of you know what