I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

I’ve applied and gotten approved for the Miami Marlins Credit Card. I wrote about why I was excited for this card – it unlocks some great experiential redemption opportunities like throwing out a ball at a Major League game and making announcements in the stadium, and I was amazed by how little spend it would take to get there.

Until now the card – and other cards from new rewards card company Cardless – weren’t available to me, because I’m not an iPhone guy. That changed and I jumped on the opportunity.

Cardless Cards Are Now Available For Android

Android is the most popular phone operating system globally by far. In the U.S. though the market is close to evenly split with Apple. Until now, products from the new rewards credit card company Cardless were only available to iOS users. That limited access to about half of U.S. consumers (though some people have iPads and not iPhones).

Now their suite of cards is available to Android users with the introduction of their Android app. I’m an Android guy. I do not own any Apple products, and haven’t since the early iPods. So I’ve been unable to apply for their best offers – until now.

I went ahead and applied for the Miami Marlins Credit Card because I love the value of transferring points from that card into the Marlin’s own program and the possibility of redeeming them to throw out the first pitch in games, to play catch on the field, and to make announcements during games too.

The first thing I noticed is how optimized their application is for mobile, although you can easily apply on a desktop or laptop too. You do need your phone to confirm a phone number via text at the start of the application.

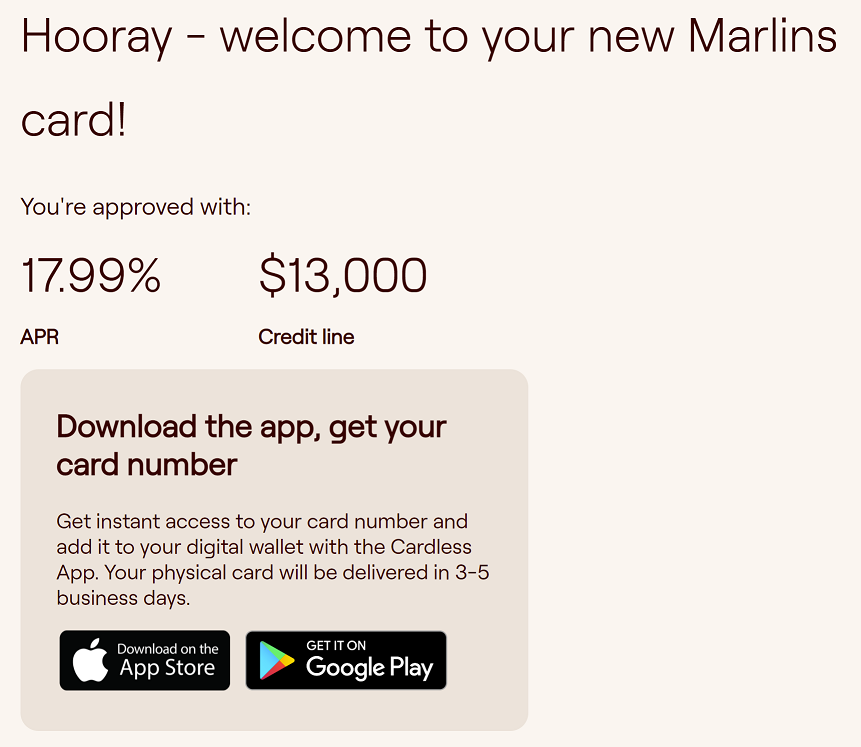

I applied and was approved instantly. I don’t remember the last time I got an instant approval for a credit card.

- Cardless says they outperform other issuers on approvals. They’ve built out their own customer approval metrics from scratch.

- Instead of funding transactions themselves, like a bank that issues cards generally does, they rely on a diverse set of lenders to cater to different segments of customers. That means each card can be for more people.

I’d give them a shot even if you aren’t getting approved for traditional rewards cards.

The Cardless Suite Of Cards

So far Cardless has three rewards cards to choose from. While I was excited by the Miami Marlins Credit Card, the Manchester United Credit Card is the strongest cash back product. All have no annual fee.

Manchester United Credit Card (Review)

- Initial Bonus: 25,000 points after spending $2,500 in three months

- Earning: 5x on rideshare; 5x on streaming services (Netflix, Spotify, Apple Music, Hulu “and similar digital streaming services”); 5x at bars and restaurants on days that the team plays; 1x on everything else

- Statement credit: Each month you spend $500 on the card you earn a statement credit for reimbursement of charges for NBC Universal’s Peacock Premium service up to $5.00 for the coming month.

Miami Marlins Credit Card (Review)

- Initial bonus: 25,000 points after spending $2,500 in three months

- Earning: 5x on Marlins tickets and 5% back on concessions at their ballpark; 3x on dining, food delivery, gas and drugstores; 1x on everything else

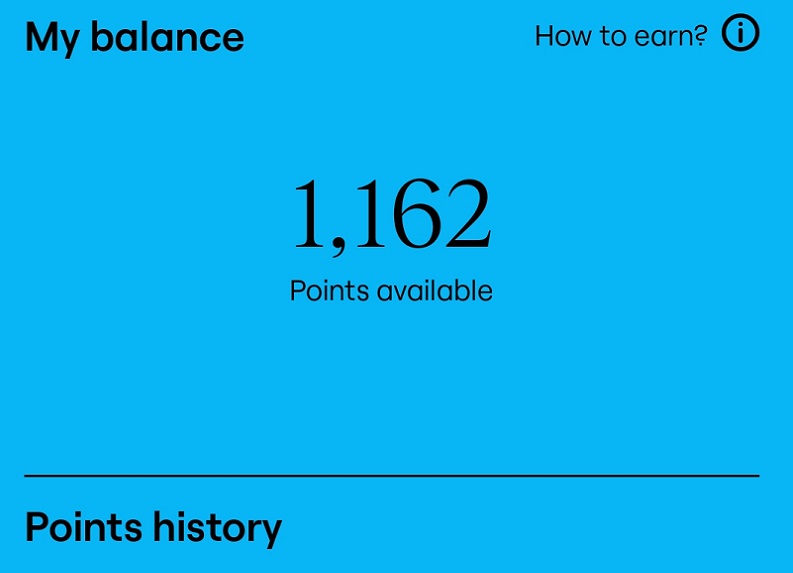

- Points transfer: 10:1 into the Marlins’ Home Run Rewards program, which opens up some fantastic experiences at reasonable prices such as (this month) throwing out the first pitch or making an announcement at a ball game.

Cleveland Cavaliers Credit Card

- Initial bonus: 25,000 points after spending $2,500 in three months

- Earning: 10x at the Cavs team shop; 5x on Cavs season tickets and on streaming services; 3x on other Cavs tickets, dining, grocery and delivery; 1x on everything else

- Experiential redemptions: such as “meeting your favorite players, team-signed balls and jerseys, or even being an honorary benchwarmer”

Using Your New Cardless Rewards Card

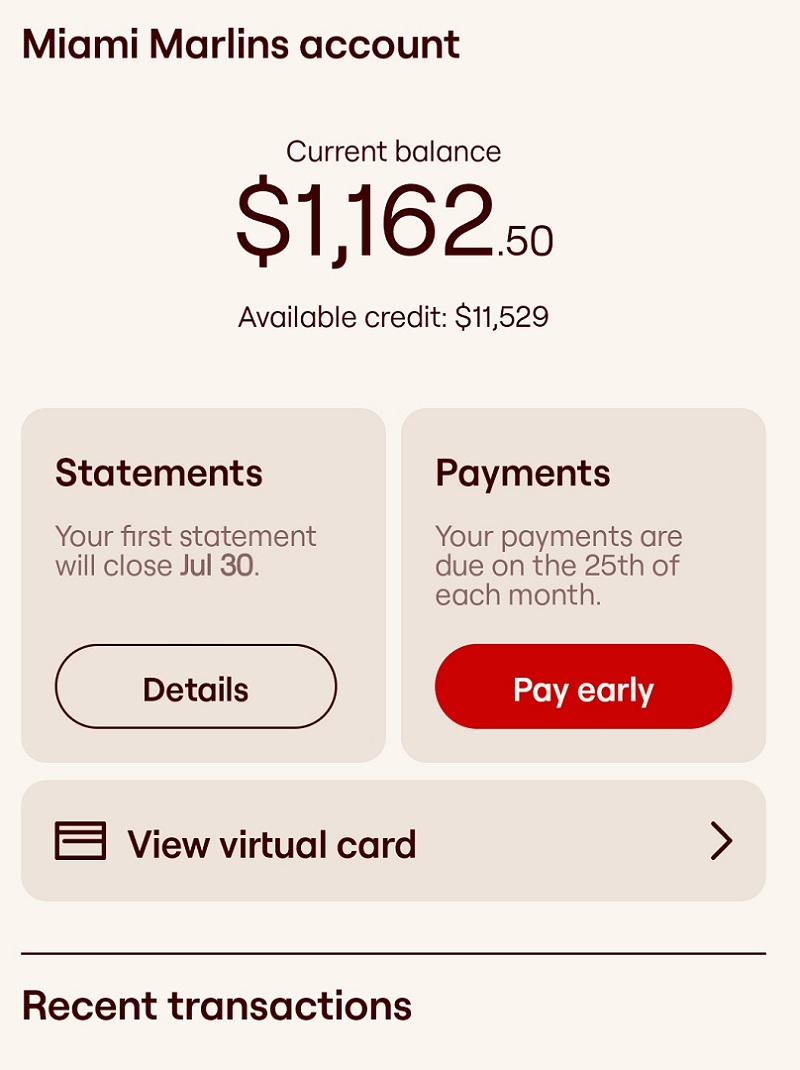

Cardless issues Mastercards that are available immediately on approval. You don’t wait for a physical card in the mail. If you lose your card, you don’t have to replace it and update all of the accounts (like Uber and Lyft) where your card is the default payment choice – because they don’t print account numbers on the card, when was the last time your card was run through an imprint machine that needed numbers on it?

The Cardless app is really intuitive. You can pull up virtual card details, see your transactions, and make payments easily.

I really like that you don’t have to wait until your statement closes to access your points. They post to your account as you make transactions.

I was skeptical of an app-based card, but you still get a physical card. And you can even change your account number without replacing the card. Clearly if you’re an Android user it’s time to start paying attention to Cardless products as they come out.

Is it really worth a pull vs all the big signup offers avail today.

Show me some 3-5 cent per ‘point’ earned value redemptions for last minute seat upgrades at the game – like perishable premium cabin rewards – and 100k level bonuses – and we’re talking.

As much as we complain about airline miles – they still offer 3-5 cent per point value rewars if you’re flexible and savvy.

Complete Waste. Life is already too complicated. If I get a new card, it must have a massive bonus or forget it. And then, I will need to dump one of my other cards.

I had a horrible experience with this company. They only are set up to take payment through their third party vendor which requires you to provide your bank password and ID saying trust us. I called to inquire how to transfer money to then without providing my bank password and they offered no method at all. I tried to cancel by phone and they would not accept and said I would need to escalate without transferring me to anyone. I mailed a check for the payment to the address on the electronic bill more than a month a go and it has not registered on my a count which is being charged interest and is “late”. I will send another check via tracked method but this company already wasted a lot of my time. Avoid them unless you feel comfort giving your financial institution password to them or the referral company

@Marriott Marty – for what it’s worth this is not ‘any’ third party vendor they’re using to link your bank account, it’s Plaid https://en.wikipedia.org/wiki/Plaid_(company)

So far I am pleased with cardless. I signed up for the Manchester United 50,000 point bonus worth 1 cent during the limited window advertised here. I thank Gary for featuring it. I got the $90 fanatics gift card after spending 1K and got the $500 statement credit after spending 3K. The bonus and rewards tracker are very simple and easy to see. Like many have said, the sign up process was the most streamlined and painless as any in the 10 years I’ve been applying for cards.

It’s a good card for ride sharing. Restaurants would be nice if it wasn’t just for game days. In this community, we are oriented toward maximizing sign ups and rewards. Others who don’t have the established credit don’t have the ability to get the top cards or have the 4K spending needed. If cardless offers the highest approval rate, good for those who will have expanded access to credit.

I do question how the card is marketed. The founder is a points and miles enthusiast, however, the card won’t make money for the bank with us just taking advantage of the sign ups and not using the card otherwise. I suspect cardless is using this community to build a solid reputation and will then hopefully market it very well to the sports fans who are lured by the chance to do these experiences or by team merchandise (through fanatics). These people aren’t running spreadsheets as to the best card to use for every category. If cardless can get the teams to push this card with stadium advertising and on social, it has potential.