Last month I learned that the Westin Fort Lauderdale Beach Resort was charging guests a 2% fee to pay by credit card. Marriott literally has its own branded credit cards and this franchise was charging guests more to pay with one of their Marriott Chase Visa cards or Marriott American Express cards than to pay with cash.

Within 45 minutes of flagging the issue for Marriott, I was told that the chain was in the process of ensuring that the property ceased the practice.

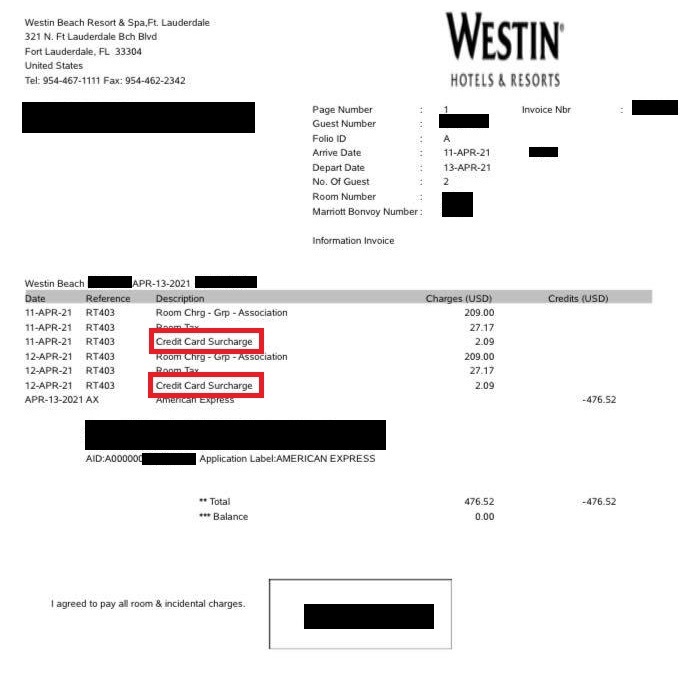

The hotel no longer charges a 2% fee to pay by credit card. They are charging a 1% fee fee to pay by credit card instead. A reader shared a folio on checkout from this property Tuesday morning.

To be clear this surcharge is not about the cost of processing credit card transactions. It’s a way to squeeze guests for a surprise extra charge that adds up across every guest room every night. Guests didn’t bring checks with them on their trip, and aren’t going to go through the hassle of finding an out of network ATM while on vacation.

Indeed, when a guest pays by credit card the hotel doesn’t risk making incorrect change, doesn’t have to store cash at the front desk, doesn’t risk employee theft, and doesn’t have to deal with depositing large sums of cash at the bank. Credit cards save the hotel money, not to mention the 10-figure credit card deal Marriott has with its issuer banks.

Credit: Westin Fort Lauderdale Beach Resort

That this hotel can continue to get away with fleecing guests for weeks after Marriott committed the practice would end highlights exactly what’s become wrong with Marriott over the past several years.

Marriott was known above all for consistency. They didn’t promise a lot, they always delivered a highly consistent product. Since acquiring Starwood that’s flipped. They rolled out a loyalty program that promises a lot more than Hilton does. But it’s on-the-ground delivery from hotels where they fall short, every hotel seems to do whatever it wishes with little standards enforcement at the chain level.

The Westin Fort Lauderdale Beach Resort isn’t even alone adding a credit card surcharge in Marriott’s system. The Fiji Marriott Resort Momi Bay, Westin Denarau Resort Fiji, and Sheraton Samoa Beach Resort all list 3% credit card surcharges on the Marriott website, and the chain hasn’t yet explained whether these properties have been given special dispensation to do so.

Time for a meet-up at the hotel and have everyone pay in pennies after calling the local media. Checkout time should be a hoot. Fight fire with fire.

My first call would have been to AMEX, and they surely would have smacked that merchant down.

As a longtime SPG loyalist I was very nervous about the Marriott merger, but honestly I have been pleasantly surprised by most policies they have implemented since the merger. IMO they thoughtfully addressed numerous complex policies. If I have one issue with Marriott, you just nailed it. SPG was great at requiring hotels to comply with the rules, and member hotels were penalized if they didn’t. They also empowered SPG Lurker and his team to advocate for members. I had several issues resolved while standing at the front desk. I recognize that we are in the middle of a global pandemic, and I will cut everyone some slack now, but Marriott needs to enforce their rules and they can’t allow hotels to get away with these shenanigans.

Why doesn’t this surprise anyone? The private ownership/equity capital groups are pushing and pushing Marriott to maximize income. There are properties that fly the Marriott flag today that Bill nor the “old man” would ever agree to. ( I grew up in DC and my family were friends with the Marriott family and did business ( real estate). ) SO what are guest going to do stop staying at these hotels that are ripping them off? How about the Laylow in Honolulu?

Nope until someone at Host International grows a set nothing is going to happen. This property and its owners will simply find another charge to tack on.

All Hilton Resorts charge $25 per day. Honest. You can call Hilton Parc Soleil Orlando, Hilton Sea World, Hilton Tuscany. They give a daily voucher for a Starbucks coffee. How wonderful. Now these are the resorts. Not the hotels.

Charge card transaction fees are unlawful in Florida. They are also against credit card merchant agreements. Everyone who stayed here should file a class-action lawsuit. The Florida attorney general’s consumer protection division should be all over this.

Gary you confuse Marriott with a company that GAF about its end users and tries to have any degree of consistency among its brands

In Australia most hotels tacked on a fee for credit card use. To add insult to injury, I went a a Hilton in Melbourne where they not only charged for using a VISA or Mastercard

.. they refused to accept my Hilton Aspire card.

easy solution: you scan your folio and send it to your credit card issuer and ask for that fee to be reimbursed as it is against the merchant terms. the real problem is the complacent consumer who can’t be bothered for the $4.18 fee.

http://www.leg.state.fl.us/statutes/index.cfm?App_mode=Display_Statute&URL=0500-0599/0501/Sections/0501.0117.html

“A seller or lessor in a sales or lease transaction may not impose a surcharge on the buyer or lessee for electing to use a credit card in lieu of payment by cash, check, or similar means, if the seller or lessor accepts payment by credit card. A surcharge is any additional amount imposed at the time of a sale or lease transaction by the seller or lessor that increases the charge to the buyer or lessee for the privilege of using a credit card to make payment.”

I paid the 3% fee at the Fiji Marriott. Seems silly that a hotel would pass that charge on. That’s the cost of doing business.

One percent of $209.00 is $2.09. Two percent would be $4.18. Apparently Marriot is not good at math or your article stinks!!!

There should be a Reddit group to gather TA reviewers and bombard the property’s page with bad reviews. They will get the message quickly. Not just this property, but all properties that don’t comply with program rules and benefits.

You don’t know what you’re talking about. You should research before making an article. The brand is requiring all Marriot franchise owners to go with their credit card processing company and not their own.

@FNT Delta Diamond

You mean you expect attorney generals like this former Florida AG to take this up?

Florida attorney general Pam Bondi, who previously made headlines when it was revealed that Trump’s namesake charity had made an illegal donation to her campaign. Afterward, Bondi’s office declined to pursue claims against Trump University for fraud.

As rude as this is,, CC fees are not unlawful in Florida. Please quote a statute.

Okay:

The 2020 Florida Statutes

Title XXXIII

REGULATION OF TRADE, COMMERCE, INVESTMENTS, AND SOLICITATIONS

Chapter 501

CONSUMER PROTECTION

View Entire Chapter

501.0117 Credit cards; transactions in which seller or lessor prohibited from imposing surcharge; penalty.—

(1) A seller or lessor in a sales or lease transaction may not impose a surcharge on the buyer or lessee for electing to use a credit card in lieu of payment by cash, check, or similar means, if the seller or lessor accepts payment by credit card. A surcharge is any additional amount imposed at the time of a sale or lease transaction by the seller or lessor that increases the charge to the buyer or lessee for the privilege of using a credit card to make payment.

So we have unlawful credit card surcharges imposed upon thousands of guests. That’s class-action. Where are the trial lawyers?

This resort is managed by the HEI company. My ex worked there. They are notorious for being cheap and shady according to my ex Seems like complaints should be made to the HEI corporate office

Semantics. Dana’s Railroad Supply v. Attorney General, State of Florida (11th Circuit, 11/4/15) found the law you quoted to be unconstitutional. You can have 2 price lists in FL: CC and cash. This hotel is probably just sloppy in applying it.

That is also why fools who rely on their CCs that give them “3X funny money points for gas purchases!” actually lose money when the gas station tacks on a dime for CC usage. I guess you don’t live in Florida.

This is awesome who also loves additional credit card surcharges also where is the resort fee that’s missing

This is easy to do: Just raise your prices 2% and offer a 2% cash discount. Of course we know why they don’t do this – the hotel wants to hide the real cost of the room, just as it does with bogus resort fees.

I went to a restaurant in Mexico that offered a 10% cash discount. Of course we know why they do that – tax evasion. One would not expect that at a Marriott property LOL

Everything in Fiji will charge a credit card surcharge. That is a practice borrowed from Australia and New Zealand and corporate can’t do anything about it. Hyatt, IHG, and just about any brand (even Four Seasons and One&Only) in that part of the world will charge it and there are laws in Australia explicitly permitting businesses to do this and that local regulation overrides any provision they might have in their standard franchise agreement that would say the opposite. This is however strange in the US and should be stopped.

The Fiji & Australia hotels have been allowed to because that’s the standard in those countries.

Recently had a bad experience at a Marriott. We had reservations and showed up from the West Coast on the East Coast at 1 am and no one was at the desk. All the hotels on the area were sold out. 3 of our group slept in the van and the others tried to get a little in the lobby, which wasn’t cleaned properly. No one showed up until 7 am. I called corporate and they could do NOTHING. They couldn’t offer a room, comp us rooms there, contact management. They could only offer points. If only I was a reward member!

When someone finally showed up, they were the only one on duty and couldn’t clean a room until she got out breakfast. Not her fault, poor hotel management flying the Marriott brand and making them look like crap and there isn’t a thing they can do about it. Why would I ever join their rewards program?

Is this disclosed on Marriott.com? Is it fraud if such a charge isn’t disclosed?

The Florida law various posters are clueless about.

“Florida has a law prohibiting credit card surcharges, but that law was held unconstitutional by federal courts. Therefore, merchants in Florida may add a surcharge to credit card purchases.”

I’m down to show up and pay in pennies. They have a suite for 479.5 lbs of pennies per night. Sounds good to me.

Ive worked for this company for over 2 years and they do not care about the guests at all. They sell timeshare preview packages to places like Westin St John, Hawaii, Westin Mission Hills, Westin in Scottsdale that they know the customers will not ever get in because of availability. Its disgusting how greedy they are. They are trying to make up for all their losses from the pandemic. Corrupt sales agents over the phone and especially in person because you either produce or you don’t have a job so they will be vague and non transparent..Heard countless request of refunds because people dont want to risk their life for a vacation. Marriot says we gave you complimentary extension until Dec 2021…You either use it or lose it, we dont care if youre high risk!!!! They are also overcharging because in 2021 they raised the price of packages over $200 for Hawaii alone. Agents are losing their jobs for not dialing enough to get people to travel and sales agent not selling their ripoff packages…Word of advice. Stay at a Air BNB entire place instead. You’ll save more money to spend with youre family and build memories instead of rewarding overpaid agents to do their evil. Run…

Time to ditch my Marriott travel card!

Get use to it. Many more will fall in to make up for lost time. I wont support them.

Hotel franchise agreements hold a number of stipulations that would otherwise be unconstitutional to impose via the law. That said, this is more about Marriott and other large hotel chains letting their franchisees get away with whatever they want.

Nowadays I really don’t care to bother looking at full-service hotels anymore. When I have the option, I just choose to do smaller B&Bs or home rentals managed by local agents. I get to save myself the bother of worrying what type of room I’ll get (did I score a “suite” upgrade?!?!) or whether I’ll get some sub-par “free” breakfast. Good riddance.

I travel frequently in New Zealand. I just book the hotel online with Kayak/Orbitz etc., and pay the travel agency directly. Voile, no surcharge.

Mostly Indian owned (Patal last names) Marriott properties you will find all shady business.

Credit cards fees in the US have been legal for at least two years. No merchant can legally prohibit it any longer.

There is a limit though, they can’t charge more than bank charges them.

VFTW I guess doesn’t travel international. If they did, they’d know CC fees are the norm in the Oceanic region.

@Terry – great, but then you get no elite benefits.

@flyerco – being ALLOWED to charge these fees doesn’t mean that MARRIOTT should permit a hotel to charge someone extra for paying with a Marriott credit card

RICO>….Your an idiot!! and a liberal we get it!!! politics in everything for you Hope ur happy with DEMENTED Joe

@dee – for the record, you’re an idiot as you don’t understand it’s not “your an idiot”

Thank you Prez Biden for your amazing leadership after four dark years!

@Gary – in this part of the world nearly everyone, not just hotels charge surcharge for credit card payment. You’re trying to impose US norms on other countries. If it wasn’t norm across board in this part of world I could see your point.

I rent RV frequently in NZ. If I wait to pay when I’m in NZ I pay surcharge. If I pay before I arrive in NZ I don’t.

Every Marriott/Hilton property I’ve stayed at charges .Its clearly posted at checkin. You can get around by authorizing card and then paying cash at checkout.

Marriott should dump this property immediately and members should stop using this hotel.that sends a clear message to the hotel and members. The hotel gets more business by using Marriott’s reservation service and the CC fees they pay are a tax deductible business expense. Drop the CCs with their pages of conditions and ever useless points. As soon as I can use up my points, Marriott is off my list Let’s go back to using travelers checks which are usually free if you keep a large enough bank balance. That should floor the clueless front desk people and you won’t have to lug around all those pennies.

Checked out of this property yesterday– same basic issue and Marriott is largely uninterested in discussing it and have “highlighted your concerns and requested follow up with you directly from the hotel leadership team.” Since the Hotel implemented it themselves I suspect they will but just fine with continuing the practice. I reviewed my printed reservations and found that the fee was not disclosed on those reservations. Marriott also just responded to a direct question about the policy generally with this:

“Marriott supports the hotel’s policy, following the laws of the land, and credit card rules and laws. We suggest allowing the hotel opportunity to review and address your concenrs. You may also contact your credit card company if you have questions about surcharges. Kind regards!”

So Looks like Marriott Lied to Gary or is Lying to me now — I expect we’ll see even more of this given Marriott’s position as articulated to me. (Spelling error in the original message from Marriott on facebook.

@Ryan: I feel like a response of “Given how egregious this is and how it reflects on your company as a whole, I sincerely don’t think they deserve that right as nothing they say short of reversing the charge will be acceptable to me” is not unfair (especially since this implicitly erodes the value of Marriott’s CC partnerships…most gas stations, for example, treat a co-branded card the same as cash).

As to the overall situation…setting the pennies idea aside (the idea of handing them a bunch of rolls of quarters and pointedly ripping the rolls as you hand them over comes to mind; so does bringing some bundles of 100 $1s but pointedly ripping the bundling strap so the poor schmuck at the front desk has to hand-count it all, or just doing that on five or six bundles and forcing them to sort out the change) I’d like to see the front desk react to some folks paying for a stay with $100s (since unlike a gas station, I don’t think they could reasonably refuse the bills) and have to make like $98 in change several times in a row (since they couldn’t use the $100s from the first few folks to make change, it would likely clean out any drawer they had).

Finally? I won’t lie, but I think a major theft or robbery right after a lot of guests have done so would also be poetic given the situation. What was it a robber once said about why he hit banks? “Because that’s where the money is.”

@Gray – Hotel can refuse to take cash. In fact most high end hotel nowadays do refuse cash. Very few countries (including US) require companies to accept cash. Those that do generally have limits on smaller denominations.

I’m surprised the guest was able to get out of the resort fee in the folio you posted. But maybe it was negotiated in the group rate.

I’m surprised the hotel doesn’t call it something else. Like pandemic surcharge, or reservation fee. Something more generic.

I used a 7 night certificate here. I always liked the Westin brand.

Is pre paying the stay w cc an option when booking on site/app?

@Maggie – yes. Prepaid should have no fees applied.