I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Update 12/1/22: Bask Bank Mileage Savings Accounts now offer 2 American AAdvantage® miles per $1 saved annually.

With a Bask Savings Account you earn 1 American Airlines AAdvantage® mile per dollar saved annually. The account has no fees. And earning these miles can make a lot more sense than earning interest right now.

Here’s how it works:

- If you have a $10,000 average daily balance in the account, you’re going to earn 10,000 miles for the year. If you have a $12,000 average daily balance in the account, you’re going to earn 12,000 miles for the year. Mileage-earning is paid out monthly so a $12,000 deposit means about 1000 miles per month (months with 31 days in them will earn a few miles more, months with fewer days will earn a bit less).

- Using this referral offer if you deposit at least $10,000 by September 30, 2020 and maintain that much as a minimum daily balance for 90 consecutive days within the first 120 days after opening your account, you’ll earn 5000 American Airlines AAdvantage® bonus miles.

- This is on top of Bask Bank’s usual offer of 1,000 AAdvantage® bonus miles with a $5000 minimum daily balance for 90 consecutive days within 120 days of opening an account.

There are several reasons I think it makes a lot of sense to be earning miles with a Bask Savings Account right now. (I have a funded account with them now myself.)

Earning Miles Makes The Most Sense In A Low Interest Rate Environment

Even when interest rates were higher at the beginning of the year, a Bask Savings Account was an attractive alternative to earning regular interest. Right now I think it’s even more so. Put another way, the Fed Funds rate has been cut about 1.5% since the beginning of the year – but you still earn 1 American Airlines AAdvantage® mile per dollar saved annually when you save with Bask Bank. That rate hasn’t changed.

I’ve publicly valued AAdvantage® miles at 1.4 cents apiece. So I view earning one mile per dollar (without factoring all of these bonuses) as being like earning 1.4% annual percentage yield on a savings account.

The week of August 3, 2020 the FDIC reported that the industry average annual percentage yield on a savings account was 0.06%. I view Bask Bank, then, as being over 23 times better than that.

Let’s assume you deposit $10,000 in a Bask Savings Account and leave it there for a year. You’ll earn 10,000 American Airlines AAdvantage® miles, plus if you used my referral link to open your account, you’d earn another 5,000 bonus miles as well for a total of 15,000 miles. At $0.014 cents in value apiece that’s a $210 return or 2.1% APY.

Now let’s talk taxes. Bask Bank’s terms and conditions say “[m]iles are currently valued at 0.42 cents per mile, the equivalent of 0.42% APY” Assuming that doesn’t change over the next year, earning 15,000 miles would generate a 1099 tax reporting form showing a value of $63.

- If you value 15,000 miles at $210 as I do, and pay taxes on those miles at $63 with a hypothetical income tax rate of 32% you’re paying $20.16 in taxes and netting $189.84.

- Forget the average 0.06% APY that savings accounts pay, let’s assume you could earn 1.8% APY in a high yield savings account. That’s $180, on which a 32% tax rate would be $57.60, for a net of $122.40.

In this example you’re doing more than 50% better with a Bask Savings Account after taxes than with a 1.8% APY return savings account – if you can even find one with today’s low rates.

Miles That Are Even More Relevant In New York, Boston, Pacific Northwest And Bay Area

Since April it’s been possible to earn American Airlines AAdvantage® miles flying Alaska Airlines and vice versa. The partnership the two airlines announced in February fills a gap in American’s route network, building their presence on the West Coast (especially in the Pacific Northwest and San Francisco Bay Area).

You could already use American’s frequent flyer miles to travel on a oneworld alliance® partner like Cathay Pacific or Japan Airlines from San Francisco to Asia with a qualifying ticket. You can also get to San Francisco on Alaska Airlines as part of the same award ticket, and generally without spending additional miles.

Similarly, if you’re traveling on a British Airways ticket from Seattle to London, and you get to Seattle on Alaska Airlines, both flights can be credited to your AAdvantage® account.

American Airlines is in the process of growing its relevance in the New York, Boston, and Florida markets as well, announcing a new partnership with JetBlue last month. While not many details of the new partnership have been released, there will be codesharing of flights between the two airlines and a frequent flyer relationship as well.

The ability to earn and redeem with American Airlines for travel on JetBlue adds to the strength of American in the cities where JetBlue is strong.

Together these are some of the largest cities in the country. If you’re in one of these markets, American’s program has become more relevant to you this year with these new partnerships. So earning with a Bask Savings Account makes even more sense than before.

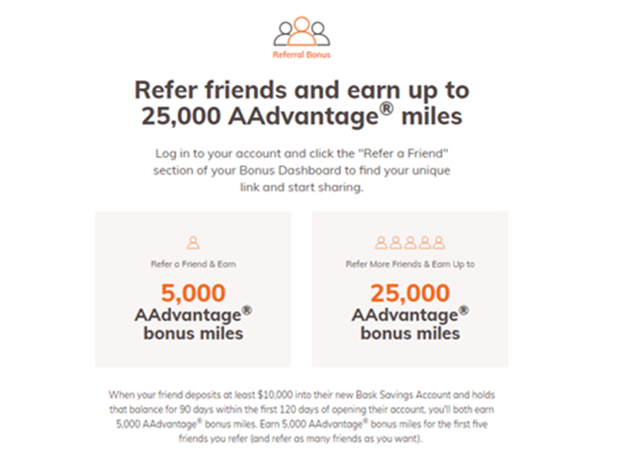

You Can Earn Up To 25,000 Miles Referring Friends And Family – But That Opportunity Ends Next Month

Bask Bank has a referral offer or ‘member-get-member’ offer for introducing new customers to the Bask Savings Account. The referral offer ends September 30, 2020.

Once you open a Bask Savings Account you are eligible to refer friends – earning 5,000 miles for up to five friends for a maximum total of 25,000 AAdvantage® bonus miles. And the friends you refer get access to the additional bonus offer for new customers, too, that they wouldn’t have going straight to the Bask Bank website.

While you’re limited to earning miles for 5 successful referrals, you can refer as many people as you want and they’ll all be eligible for this better offer, which is why I’m making my referral link available.

The better offer – and your ability to pick up an additional 25,000 miles through referrals – is only available through the end of next month, making this the perfect time to open a no-cost Bask Savings Account.

Bask Bank and BankDirect are divisions of Texas Capital Bank, N.A. Member FDIC. The sum of your total deposits with (i) Bask Bank; (ii) BankDirect; and (iii) Texas Capital Bank, N.A. are insured up to $250,000. Additional coverage may be available depending on how your assets are held. I’ve been a BankDirect customer since 2003.

Referral Bonus valid through September 30, 2020 and Account Opening Awards valid through December 31, 2020. Accounts must be funded within 90 days of opening.

AAdvantage® bonus miles are awarded within 10 business days upon meeting offer qualifications and may take 6-8 weeks to post to your AAdvantage® account.

The value of this offer will be reported to the IRS and the recipient is responsible for any federal, state or local taxes on this offer.

@ Gary — It seems that Bask had horrific timing with these accounts. I wonder how long until they have no choice but to lower the return or add fees?

@Gene – for what it’s worth I think lower rates are why we see initial bonuses ending, I’m hopeful that the low costs of servicing these accounts compared to that of a traditional bank make continuing to offer this strong rate of return worthwhile.

Is there a cap on earning? With traditional APYs well below 1%, there is some appeal to transfer and maintain a large balance (say up to FDIC limit) so long as it’s still 1 mile per dollar (even with the $0.42/mile interest liability).

There is no cap on account balances earning miles

Signed up at the end of February. Received the bonuses and keep $1,000 in the account so I earn just over 80 miles each month. If the uncertainty around future travel wasn’t so prevalent I would deposit more.

Before summer ends? What? Did you schedule this post a week ago or more?

@AZTravelGuy – I wrote the post several weeks ago (see dates on comments), I bumped it with ‘final week’ in the title because the September 30 end date is coming.