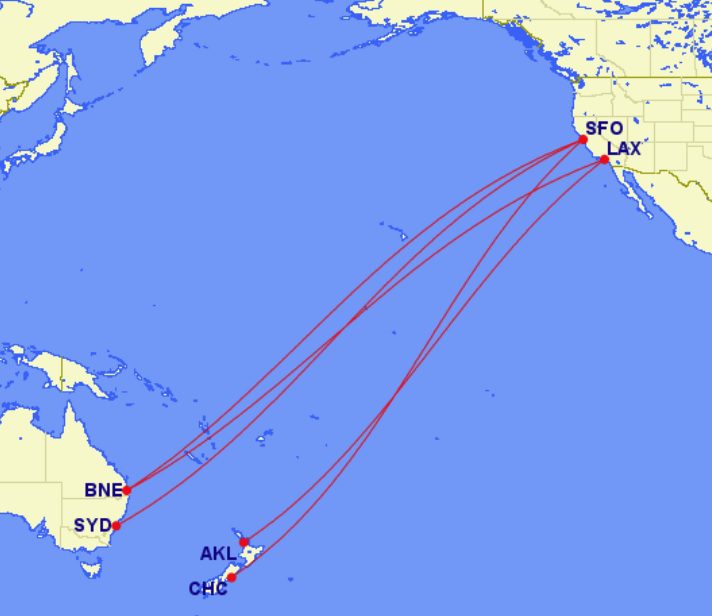

United Airlines is the largest U.S. international carrier, the largest Pacific carrier, and is doubling down on being the largest U.S. airline between Australia and New Zealand by adding several new routes and increasing capacity on several of their existing routes.

New and expanded routes:

- San Francisco – Christchurch three times a week with a Boeing 787-8 starts December 1 (peak winter). Air New Zealand used to serve U.S. – Christchurch and planned prior to the pandemic to do it as part of their joint venture with Qantas, but no one has ever made this service work. Air New Zealand ended its service 17 years ago, so perhaps the time is right.

- Los Angeles – Auckland four times a week with a Boeing 787-9, complementing their year-round San Francisco service starting October 28.

- Los Angeles – Brisbane will complement its San Francisco non-stop starting November 29 with three weekly flights using a Boeing 787-9.

- San Francisco – Brisbane goes daily effective October 28 using a Boeing 787-9 increasing its existing service.

- San Francisco – Sydney goes double daily with Boeing 777-300ERs effective October 28 increasing its existing service.

- San Francisco – Melbourne moves to a larger Boeing 777-300Er starting October 28.

United was unique among peers in not suspending service to Australia during the pandemic, and with partnerships with Air New Zealand and now Virgin Australia they’re able to connect passengers Down Under as well as across the United States.

Together they compete with the American-Qantas partnership, which at this point is skewed heavily towards Qantas. Delta has expanded its own service slight, but lost its Virgin Australia partnership to United (and to Air Canada). Of course United’s premium cabin product lags that of both American and Delta, in my view both in terms of seat and food.

Great news although not being 7 day/week can make these less likely to succeed.

I’m excited to hear that United is expanding its service to Australia and New Zealand. This will give more options and flexibility for travelers who want to visit these beautiful destinations. I’m especially interested in the new non-stop service to Christchurch, which is a gateway to the stunning South Island of New Zealand. I hope United will also launch more flights to other cities in the region, such as Melbourne, Perth, and Wellington. Thank you for sharing this news!

It’s about time. Needing to go to Australia in the next 2 months and biz fares are up to $15K with American and Qantas. Even Premium economy is close to $9K. Crazy. While the new routes won’t help me for the upcoming trip, it will help in future ones as we should see the fares come down now

@Amin, doesn’t Wellington airport have operational constraints that would make a nonstop to the US impossible? Also, market’s likely too small.

MEL is well served by UA already, and is getting a capacity boost in N/H winter with 77W service from SFO.

Perth is probably too far for a nonstop and no plane has the range to fly SFO or LAX to PER.

I’m not sure Christchurch makes that much sense, most of the tourist activities center around Queenstown, which needs a connector flight anyway. But maybe there will be some excess business award inventory released at saver levels rather than 500K each way.

It’s funny how a lot of the routes AA was suppose to launch have now been launched by UA. Not just Oceania routes, but Europe routes too. AA’s long haul network is just a laughing stock at this point now. They have surrendered everything to UA.

Wat to go , Scottie “The Destroyer”! 😉

@Jared Agreed. AA is just a skeleton of its old self. Not that it was the best even before pandemic to begin with, its footprint was still much smaller than UA, but still…

Hard to complain about the seat and food when the others barely have any flights that go down under.

Waiting on Tim Dunn’s copypasta with bated breath

Thanks for the news!

Delta fly an old LAN A-350 to AKL. United’s is worse?

Gary took a more balanced approach to reporting on UA’s expansion in the S. Pacific than Ben other than to note that Delta increased its service to SYD by 3X/week in the southern summer that just ended and that is on top of the increase in the number of seats on its A350-900s vs. the B777-200LRs that DL previously used to Australia.

It is also clear that there really is no clear correlation in the US-OZ market between having a partner or not. The reason for the increased demand on US carriers is because of capacity shortfalls by Qantas, Virgin Australia and Air New Zealand

The increased capacity to fly the S. Pacific is coming from China where the allocated amount of US carrier capacity is much, much less than pre-covid; AA, DL and UA are all now allowed only 4 flights/week and they are all flying their allocation. UA has lost its dominant position to China and they will not return to that level because China is not going to subsidize their carriers and throw capacity into the marketplace and won’t allow US carriers to do that either.

DL’s A350-900 average fleet age is less than 4 years on average; the oldest A350-900 is an ex-Latam aircraft that has been parked for most of its life and was delivered in late 2015; UA’s oldest B787-9 is older than Delta’s oldest A350.

Other than the 767s – of which the average fleets are similarly aged for DL and UA, the oldest fleet type in the US carrier widebody fleet is UA’s 777 fleet. INCLUDING its relatively young 777-300ERs, UA’s 777 fleet in total is over 20 years old on average; its oldest 777-200ER is 25 years old.

The 777 is far less efficient and cost-effective in every metric than even the oldest A350. Given that Delta is likely to order the A350-1000, that order will further extend Delta’s lead as having the youngest and most cost-efficient widebody fleet among US airlines. and 787s might also be part of that order, including 787-10s which is a very cost effective plane.

you really don’t want to go down the rabbit hole of arguing about fleet age if you are United or are a fan of them or trying to even argue their cause against any other airline.

125k miles in coach for the nonstop flight vs. 44k for a connection. That’s crazy.

Arguing average fleet age when the comparison is A350 vs. 787 is laughable.

I am curious to see if DL would be inclined to swap out of the LATAM A350 product with United entering the market, albeit on a less-frequent schedule.

you didn’t read very well.

DL’s average A350 fleet age is younger than United’s B787 fleet age.

UA’s oldest 787-9 is almost a year older than DL’s oldest A350-900 (an ex-Latam and one of the earliest A350s off the line – which incidentally is not even in service.

As stated above, United isn’t any position to talk about fleet age of ANY fleet any time soon – and even when they are, their debt and lease levels will be so much higher than anybody else that it will be obvious which airlines took a more balanced approach to fleet management – and it won’t be United.

The ex-Latam A350s will get retrofitted probably in the 2024-2026 timeframe, maybe before.

DL is also adding a new generation of cabins including a new premium seat and more of them in deliveries that might start w/ A330-900s as soon as this year but certainly by the time of the A350-900 deliveries in 2024-2026

Even in a comparable configuration, the A350 seats more passengers than the comparably sized B787 which gives the cost advantage to the A350.

as for product of the ex-Latam A350s, let’s not forget that just 1/3 of the business class passengers don’t have direct aisle access, United had a 6 abreast business class for years after DL didn’t have it any longer and no one thought it was the end of the world, and the big difference is that the ex-Latam A350s don’t have Premium Select (premium economy) but they do have the most seats of any new generation aircraft in the US carrier fleet which gives DL a significant cost advantage even over a UA B787-9

@Tim Dunn “Even in a comparable configuration, the A350 seats more passengers than the comparably sized B787 which gives the cost advantage to the A350.” That’s great, if you can fill it at sufficiently high yields. It is (roughly speaking) more costly to operate an A350 than a 787.

Delta has left the competition in its dust because of the planes it hasn’t ordered yet. You idiots. You morons. You absolute buffoons.

trip costs are higher for an A350 but seat costs are lower for the DL A350 compared to AA and UA’s B787-9s. There are only 40 seats more on the DL A350-900 (DL config) vs. the UA 789. DL is rumored to be reconfiguring the fleet to remove 20 seats which will make the total still 20 seats higher but with very comparable configurations (DL will have more premium economy and coach)

The lowest widebody in the US carrier fleet on a per seat basis is the UA 787-10

that data ALL comes directly from the DOT. It is not an opinion.

no, Dan, Delta doesn’t have the cost advantage because of airplanes it will buy but because of the ones it retired (all 777s and some 767s) during the pandemic and replaced w/ new generation A330NEOs and A350s.

Adding A350-1000s and possibly B787s, esp. the -10, will ensure that Delta maintains its cost advantage relative to AA and UA as well as other foreign carriers.

We don’t know the percentage of each model of 787s that UA will actually order (they do not provide that breakdown) but their CASM will go down slightly w/ each new 787-10.

The big drop in CASM will come when they start REPLACING their massive 777-200/ER fleet w/ 787s but that will cut their growth.

UA boasted about its ability to regrow after the pandemic because it didn’t retire aircraft and yet other airlines esp. DL have now replaced all of the widebody aircraft they retired and have more efficient aircraft now.

and UA will spend more to update its fleet to comparable levels of technology and cost effectiveness in the rest of this decade.

You either pay now or later. UA just chose later. DL chose earlier.

You sure do move the goalposts a lot. Anyway, your commitment to the bit is admirable if a bit perplexing. Whatever gets your rocks off.

And United will have a newer WB fleet when it retires the 777s, replacing them with the 100+ 787s on order. The see-saw swings back the other way. In the meantime, United will operate just shy of 4x Delta’s frequency to Australia/New Zealand.

This reminds me… is Tim Dunn the former worldtraveler of A.net? The verbosity and bizarre fixation on all things DL, regardless of its relevance to a particular discussion, seems about right.

fixation is making statements that you simply cannot justify.

We have absolutely no what of knowing what UA’s fleet age will be when it retires its 777-200/ERs. They have more 777-200/ERs and 767s than they have 787s on order.

Delta already has 34 new delivery A330-900s and A350-900s due for delivery in the next 3 years – 1/3 of UA’s massive 787 order – and DL hasn’t committed to retiring any widebodies in that time period.

And that is BEFORE a new order which won’t be as large as UA’s but doesn’t need to be – DL has already replaced 30 widebodies.

and it is AA that has the potential to have the youngest and most efficient widebody fleet because its 787 orders come close to replacing its 777-200ER fleet. DL and UA both have 767s to retire.

Truth is truth regardless of who says it and where. If you disagree w/ the facts as they are laid out, you should be able to refute them.

what you and others want is the ability to crow about whatever you want w/ no one to provide any factual counterpoint.

specific to the S. Pacific, DL and UA, once again are the two US carriers that are growing including on the west coast. The same is true globally.

@GKK

Yes, he is that former A.net member. Also had a few other handles there as follow-ons trying to circumvent his ban before his writing style & IP address were banned by the site mods.

I’m pretty sure that’s not the definition of fixation, but I digress.

Anyway, at the risk of feeding the troll, it’s the 777-200ERs that will sooner require replacement (the first 77W was delivered in June 2017, a few weeks before Delta took its first A350), 74 of those, plus 53 767s. That’s 127 frames.

United has 100 firm 787 orders and 100 options; plus orders for 35 A350s. 135 firm orders, 100 options. Those are the facts. Now, spin away!

@MaxPower… fun! I knew I recognized that style. It is… shall we say… unique?

I forgot all about worldtraveler! I must have repressed the memories. Either that or the transition from “worldtraveler” to “Tim Dunn” was so seamless that I didn’t even notice the handle changed.

And Tim, as Gary pointed out, seat costs without the revenue to go with it can work against the carrier. Otherwise all airlines would be flying 787-10s on every domestic and international route around the world.

and please excuse my error… 45 A350 orders. 145 total firm orders.

I absolutely LOVE IT when I become the center of the discussion instead of the topic. You people are your own worst enemies.

I opened TWO stories on two different sites today to find comments invoking my presence. And I still write on yet another site and get paid for it. In some cases, like most recently, handsomely.

And the chances of Delta placing an order for Boeing widebodies is FAR, FAR higher than United taking delivery of A350s. and if UA does take delivery of A350s, it will just confirm DL’s choice as being very good.

Boeing will be all over UA’s backside getting them to order the 777X if DL passes on that model – which appears might be the case – in favor of 787s. UA will fall for the 777X just because it will be the biggest new generation aircraft -never mind that there is more than enough data to show that the A350-1000 has better real world costs than Boeing claims for the 777X, which has yet to carry a single revenue passenger.

If Gary is worried about DL getting 40 more passengers on an A350-900 vs. a UA 787-9, he should have night sweats thinking about the need for US carriers, with their multiple hubs, profitably filling the nearly 400 seats on a 777-9

“Truth is truth regardless of who says it and where. ”

Tim… god knows why you feel the need to turn a United Route release into some weird comment diatribe about Delta but speak with facts.

Delta has a widebody fleet age of about 15.9 with 34 total more widebodies on order, total. Delta may have an upcoming widebody order. They may not. But taking credit for their fleet age and widebody efficiency by a rumor of a future widebody order is ridiculous. You really think Delta is keeping their ~27 year old 763s around with a future widebody order? Given production slots, those 45 planes are going to be absolutely ancient if they aren’t replaced. Delta has 156 widebodies today. Barely 70% of United today.

United has a widebody fleet age of 16.3. BARELY above Delta with an order book of 147 widebodies. And they aren’t having to work with Airbus or Boeing for production slots. They have those delivery slots confirmed. Delta does not in your hypothetical future order you keep citing. Plus 50 XLRs that will likely fly some Deep South Latin or TransAtlantic making a new international order book of 197.

United will continue to be massively larger than Delta internationally. And obviously will have a lower fleet age within a few short years, at most, given their actual order book not a theoretical one. But who even cares. As many have posted. Fleet age “wins” by airlines is a constantly moving target. And a depreciated asset is sometimes worth much more than fuel savings on the income statement.

“I absolutely LOVE IT when I become the center of the discussion instead of the topic. You people are your own worst enemies.”

Just making sure people know your history, Tim, lest anyone be deceived by your deceptive use of data. You have a long track record of personal attacks, misuse of data, and being banned by independent moderators given both those tendencies.

My presence was involved on this thread as it was on two other sites this morning. If you were half serious about not hearing from me, then you would convince other people to quit using my name.

Delta’s widebody fleet is younger but more significantly. It is far more fuel efficient. The A330 300 is more fuel efficient than the 777-200ER

You and others desperately want to think that united will grow nonstop without being challenged and that is simply not realistic. All I am here to do is to point out that united operates in a highly competitive environment and Delta will ensure that it gets a piece of whatever action United thinks it can get.

And United will have to spend massively more to replace its aged fleet. It’s own financial statements confirm that.

Imagine actually paying someone to write in such an obnoxious, self-righteous tone? I hope he gets it out of his system in posts on message boards or comments to blog posts…

@ Gary

Thanks for the information – this is useful for those of us who travel between Australia and the USA on our points / miles…;)

For any Australian based readers this is a welcome development given the ability to redeem Virgin Australia Velocity points for (“classic awards”) seats on UA flights. Velocity points are relatively easy to accrue for local members.

I doubt that one single such member will be gnashing their teeth over the fleet strategies of different airlines – rather relieved at the additional opportunities. That debate is utterly irrelevant.

It was a most inspired move for Velocity to hook up with UA instead of DL (for whatever reason). And conveniently VA award inventory shows up on the UA website, which is able to put together quite complex itineraries including VA sectors off the bat.

FWIW QF recently bumped my wife and I from business class award seats on their morning LAX-SYD B787 service (redeemed on Alaska miles) onto the evening UA B787 flight and I was pleasantly surprised – moving through their terminal (avoiding TBIT) was a breeze, the lounge was comfortable, the in-flight experience was fine (not sure about the breakfast, but hey) and because QF had accessed J class inventory to accommodate rebooking, we accrued Velocity point and status credits as well by adding our VA FF numbers to the booking despite being on AS FF redemptions!

UA miles have also become more “valuable” since they have become redeemable on SQ business class for routes such as CNS-SIN and DRW-SIN.

I don’t doubt that the DL product is worthy of patronage (and I do buy the occasional DL flight when it is cost effective to do so), but SkyMiles has never attracted my loyalty (unlike being active in AA, UA, AS, etc).

I would happily fly UA again across the Pacific.

I’m just here to see Tim Dunn cry about Delta.

platy,

there are some of us that see airlines for ALL that they are – not just what we can get from them.

American, Delta, United, Qantas… the lot… are for-profit companies.

Again, I was invoked into the conversation.

And multiple people talked about fleet.

The simple reality is that there are multiple ways to manage fleet – but UA has not invested in its fleet and then trumped that it did NOT retire aircraft during the pandemic and so had more capacity to return. And yet actual new aircraft delivery schedules show that Delta has more NEW widebody deliveries coming in the next 3 years than any other US airline.

The reason why United continues to add more new routes now is because they can’t fly much at all to China and are using those planes to start new international destinations.

Being #1 in the S. Pacific is a far less lofty success than being #1 across the entire Pacific, esp. the far larger E. Asia market.

Let’s see what it all looks like 3 years from now when UA starts receiving its 787s – even though their latest 10K annual report does not provide aircraft deliveries by fleet type and year until 2024 – and UA receives just TEN new 787s while Delta will receive 34 A330NEOs and A330-900s.

We have no idea if the next 92 787s will be delivered in 2025 or 2032 or how many per year.

UA is growing primarily because of capacity reallocation. Delta will be growing because of new aircraft deliveries to a much greater degree.

Great news for UA flyers!!

I couldn’t care if UA was pulling aircraft out of a magician’s hat. Its real capacity added at desirable Oceana routes.

Delta may or may not add. I hope folks fly them and bring prices down. Good luck for seeing airlines in totality .

For some of us, a value of miles is very important and you can’t argue UA>AA>>DL

With respect to aircraft orders- it’s laughable

1. UA orders airplanes- oh you will be in too much debt

2. UA doesn’t order airplanes- you have oldest airplanes

3. UA orders some airplanes- you should have ordered more, lack of Vision/ still ordered one too many

UA, you just can’t win 😉

@ Tim Dunn

Yes, absolutely you were invoked into the conversation and, arguably, there are several posts which offer nothing of substance, rather only personal attacks, which is most unfortunate. Many herein lack an evidenced based and well reasoned perspective and get their knickers in a knot when challenged by such.

Yes, of course, these airlines are for profit companies and it can be interesting to take a wholistic view on such matters.

That said, the consumer viewpoint is also a valid perspective and part of that mix, especially when trans-Pacific airfares are ridiculously expensive (reflecting demand and opportunity for airlines, perhaps?) and opportunities for award flights lacking for most loyalty members. All businesses depend on sales to their customer base….;)

I’m not stepping my toes into the water here who is the most dominant profitable carrier to Down Under

I flew First Class on American here to Sydney on a Web saver award about 98k which is a great deal.The seat wasn’t too comfortable and the food disgusting

But I’d happily do it again for under 100k.

I canceled the return and booked

Qantas First on the A380 on Alaska Miles the best most comfortable big bird to ever fly.

United and Delta @ their 300 to 500 k one way redemptions can go suck an egg

Hopefully they find a ton of suckers to fly their mediocre business class

It will not be me!

platy,

thanks for your usual logical summation of the conversation.

StarGoldUA,

I don’t think it’s a question of “damned if you do, damned if you don’t” or where the planes came from but it does add necessary perspective to big, flashy expansion announcements.

It is great to see that the S. Pacific is seeing as much demand and that US carriers are capturing more of it than they have in a long time, if ever, but let’s also keep in mind what is NOT said in these announcements which is very shifting global networks and also shifting capacity between US and Australian airlines. Gary has covered attempts by other airlines including Qatar to capture more demand. The US-OZ market is larger and easier for US carriers to capture than the fragmented OZ-Europe market which involves much greater distances. I’m not sure that the pricing including award pricing will be that much different but there are noticeable shifts in capacity and the real question is how long it can be sustained. There is no doubt that in the US-NZ market, US carriers will carry a much higher percentage of traffic than they have in the past.

@Jared Houser – “It’s funny how a lot of the routes AA was suppose to launch have now been launched by UA. Not just Oceania routes, but Europe routes too. AA’s long haul network is just a laughing stock at this point now. They have surrendered everything to UA.”

I’ve contended that AA would rue the day Scott Kirby was unceremoniously shown the door by Parker. And not so much so due to Kirby being a qualitative transformative airline industry figure (though I do watch what he’s attempting to do at UA with interest). Quite simply, his insiders’ knowledge of AA has afforded him an opportunity to cherry pick the most lucrative route opportunities.

Though difficult to overlook economic factors moving forward in terms of forward planning, IMO, the worrisome facet is Kirby has yet to unleash a full scale competitive response. Just wait until he gets those additional airplanes.

The current management of AA is seemingly satisfied with the ongoing hybridization into what pre-merger US was: a focus and effort in those regions where the carrier has scale, but very little – outside of pricing initiatives – for those regions where it is stagnant or ceding market.

Unfortunate that LAX has seemingly been relegated to network afterthought.

aaway,

Scott Kirby is opportunistic but he is also egotistical. Read the earnings transcript from today, and he said that UAL alone has solved problems that the rest of the industry cannot figure out.

The simple reality is that AA has a much more comprehensive domestic network – one which United would die to have. AA has the best coverage of the big 3 in the south where population is growing – and they are also correcting alot of international “we have to fly there for strategic reasons” which you and I know full well that Scott Kirby justified as necessary when he was at AA.

AA does need to find balance but let’s not forget that UA has the largest concentration of hubs in the northern US where demand is growing the least. People often say that UA has hubs in the biggest metro areas – but those are also the most competitive.

Also on the earnings call, UA explained that the reason why their revenue was short for the first quarter is because business travel which is heavy in the middle of the winter – November through Feb and March – is not near as strong as it used to be. They specifically noted that UA is not strong in Florida – which offsets business travel – and UA is actually #7 of the big jet US airlines in Florida- only larger than Alaska.

American will report soon but it is clear that international revenue can only offset so much other revenue; Delta saw an increase in revenue. American may be slow in growing/regrowing international but their domestic revenue is strong and expected to remain so. They are more profitable now than they have been for years.

If AA has any qualms about Kirby leaving, it is probably that they did not push back harder on Kirby’s assumptions that AA had to serve international markets where they did not make money for years.

Tim, if we compare earnings call from both DL and UA so far, it seems to me that analysts are believing whatever Kirby is serving them, and that’s his job. To get people to invest in Company.

UA lower than expected loss and full guidance going forward

DL missed estimates and on the wrong side of it but also feeling good about rest of year.

Both are feeling good about future bookings for summer and beyond.

What I read here is there is plenty of pent up demand and as long as you can pick the right routes, they will be profitable as people are willing to fly everywhere.

In my own experience, UA has lesser amount of wide bodies between hubs now than they did 3 months ago. They have planes and are rightfully deploying them abroad when possible.

Flying UA to Sin and Lhr recently, I was glad to have confirmed biz seats because the upgrade have lower probability of clearing than powerball.

My only experience on DL was when I missed a UA flight to Central America and UA bought me a last minute biz seat on DL. That was last seat available in sold out cabin.

Point is, you could throw darts on map and pick routes and they will likely work. Too much demand and at least at present, if you have Jets to deploy, you will be fine.

@Tim Dunn alludes to one very good point that isn’t really being discussed here. It’s that this SoPac expansion by UA is largely due to the fact that UA has too many widebodies for northern winter. While the other US airlines have been retiring widebodies as new aircraft are delivered, I have read that UA has not. This is OK for northern summer — transatlantic business will be fantastic this year — but not so great for UA when it’s not summer. They also have a fleet to fly to Asia, particularly to China, that they can’t really utilize. So, voila — SoPac expansion it is!

Some people here said fares from the USA to Australia are very high now, and I don’t know much about that. If it’s true, perhaps this expansion will work. But I’m always skeptical of expansions premised more on available aircraft than demand.

chopsticks and StarGold get it

UA specifically said that the reason why they missed earnings and they knew it in advance (and revised their guidance several weeks ago) is because they do not have the presence in Florida which remains strong in the winter and they are seeing less business travel in the peak seasons.

UA is the only airline so far that has said its total revenue is down – everyone else has said in guidance or earnings (DL is the only other airline that has reported so far – thus the comparisons) that its revenue was on target. Florida IS offsetting the business weakness and international lull in the Northern Hemisphere.

A UA exec on the earnings call today specifically asked if this large S. Pacific expansion was because UA does not have near as much leisure to offset its international network and they acknowledged as much but said it will take years to restructure their network to have more leisure in the dead of winter to offset pure business which is not coming back to the same degree.

UA has touted that it didn’t retire aircraft and yet

1. They have more aircraft available due to flights they cannot serve to China (due to restrictions) and HKG (due to the market) than Delta retired aircraft.

2. Delta has replaced its widebody aircraft that it retired already.

Finally, DL missed its earnings because it paid $750 million in one-time payments due to its new pilot contract. No other airline – UAL included – has allocated money for retro payments although UA did pull forward some of the labor expenses knowing they will have to increase pilot rates at some point. They just have not likely come close to covering all of the increases in part because they don’t have a signed pilot contract so cannot know what it will cost.

It is enjoyable to talk w/ people that understand what is at stake and know the details….

thanks much you two!

correction – a Wall Street analyst asked about the (motives behind the S. Pacific expansion…)

one final thought.

Kirby specifically said that international is very strong and probably passing domestic in strength.

Many analysts said throughout the pandemic that low cost carriers would have an advantage during the recovery and yet as a group not all outperformed legacy carriers, a point I have made repeatedly esp. on the other site where I am an analyst/contributor.

Legacy carriers waited for the return of international travel while low cost carriers are dependent on high volume and growth; the legacies STILL served the domestic market and deployed widebodies on domestic routes. As noted, those are now flying international routes again.

US carriers are in a better shape than many foreign carriers.

UA had an advantage by not retiring aircraft AND having aircraft from China and HKG but it has used up the aircraft it will have until a large number of widebodies come in which will be in more than 2 years. DL is in growth mode with significant CONFIRMED widebody deliveries over the next 3 years while AA is stagnant. If China reopens quickly, much of this expanded flying will have to end or airlines will give up route authorities (but I don’t think that will happen).

all of this helps put this big UA expansion in the S. Pacific in perspective

I find this expansion to AU/NZ by United to be a bit outlandish. These are, after all, mature markets with a limited population (unless you count the kangaroos and koala bears).

In the meantime, United leaves SE Asia mega-destinations such as Bangkok and Kuala Lumpur unserved, and Manila only reachable from the US mainland on its own metal via a double transfer through Micronesia.

I know the above cities may be considered low-yield… But Christchurch?…

@Tim Dunn – “Scott Kirby is opportunistic but he is also egotistical. Read the earnings transcript from today, and he said that UAL alone has solved problems that the rest of the industry cannot figure out.”

Brief response – seems as if you’re diminishing the man’s airline industry bonifides when using attributes such as “opportunistic” and “egotistical”. Not that I have an affinity for him, but I’d lean more toward ‘astute’ and ‘analytical’. Egotistical is amusing. Outside of the sports realm, I can’t think of an industry that’s had more egocentric individuals in positions of leadership.

“American will report soon but it is clear that international revenue can only offset so much other revenue. American may be slow in growing/regrowing international but their domestic revenue is strong and expected to remain so. They are more profitable now than they have been for years.”

“If AA has any qualms about Kirby leaving, it is probably that they did not push back harder on Kirby’s assumptions that AA had to serve international markets where they did not make money for years.”

Brief response – No, AA achieved higher revenue in 2022 than ever. AA was more profitable on a net basis (and had higher margins) the first three years after BK than anytime since. The recent revenue gains are a result of the aggressive scheduling posture undertaken by AA as a result of having to service all that debt. Nothing extraordinary.

For accuracy sake – Though AA managed by US has been a subject of poor stewardship, Kirby (and Nocella) actually inherited L-AA’s international growth plans from none other than wunderkind Vasu Raja. In fairness to Raja, I’m certain that the growth plan was not predicated on restoration of near-to-scale pre-bankruptcy wages by Parker.

@chopsticks – “….this SoPac expansion by UA is largely due to the fact that UA has too many widebodies for northern winter. While the other US airlines have been retiring widebodies as new aircraft are delivered, I have read that UA has not….”

An underutilized fleet of widebodies is a relatively recent phenomenon for UA versus network peers. If you recall, UA’s fleet of 52 B777-200s was grounded for nearly a year-and-a-half (Feb. ’21 to May ’22) due to safety concerns. Half of that fleet was again subject to short-term grounding in Fall ’22.

So, UA wasn’t as compelled to make stark fleet decisions due to financial considerations. In fact, I suppose the gravity of having a grounded fleet in some sense became a lark as it gave UA time to assess how competitors (*cough* AA *cough*) fleet decisions would affect their (its) network on a short-term forward basis.