As a general matter I think any airline whose operations are being run by Scott Kirby is going to get worse not better for customers in terms of passenger experience. At the same time there’s no one in the industry I’d rather listen to because he’s earnest and thoughtful and lays out more clearly than anyone else his belief about how his business, and the broader industry, works.

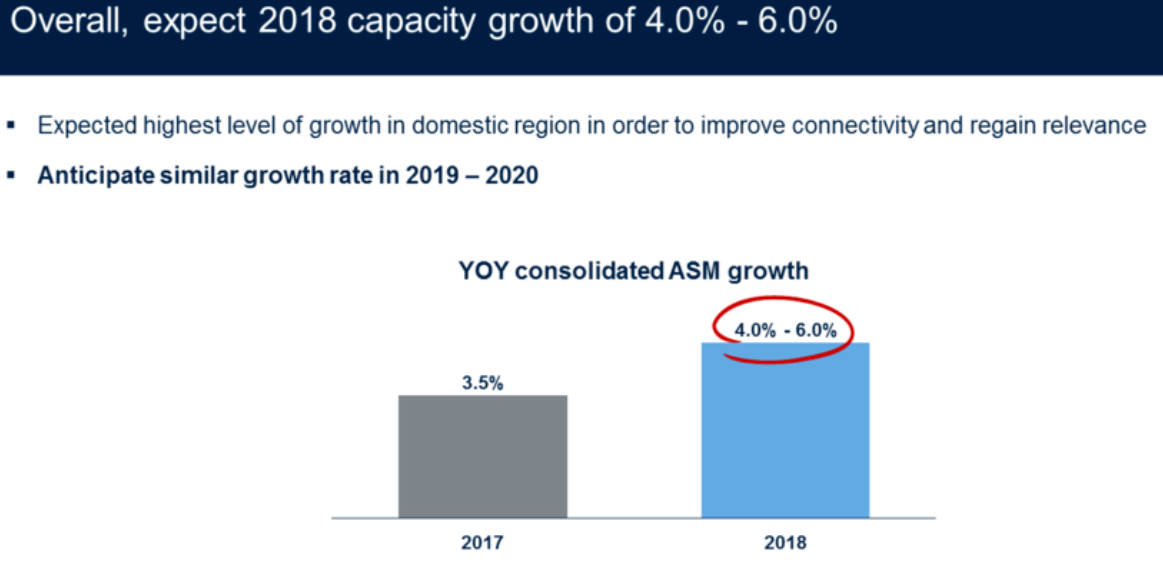

In United’s investor event this afternoon he laid out United’s assets both in terms of domestic network and positioning to acquire high yield premium cabin international business. Kirby walked through airline economics, United’s positioning, and marginal analysis with a primary goal of convincing investors it is okay for United to grow.

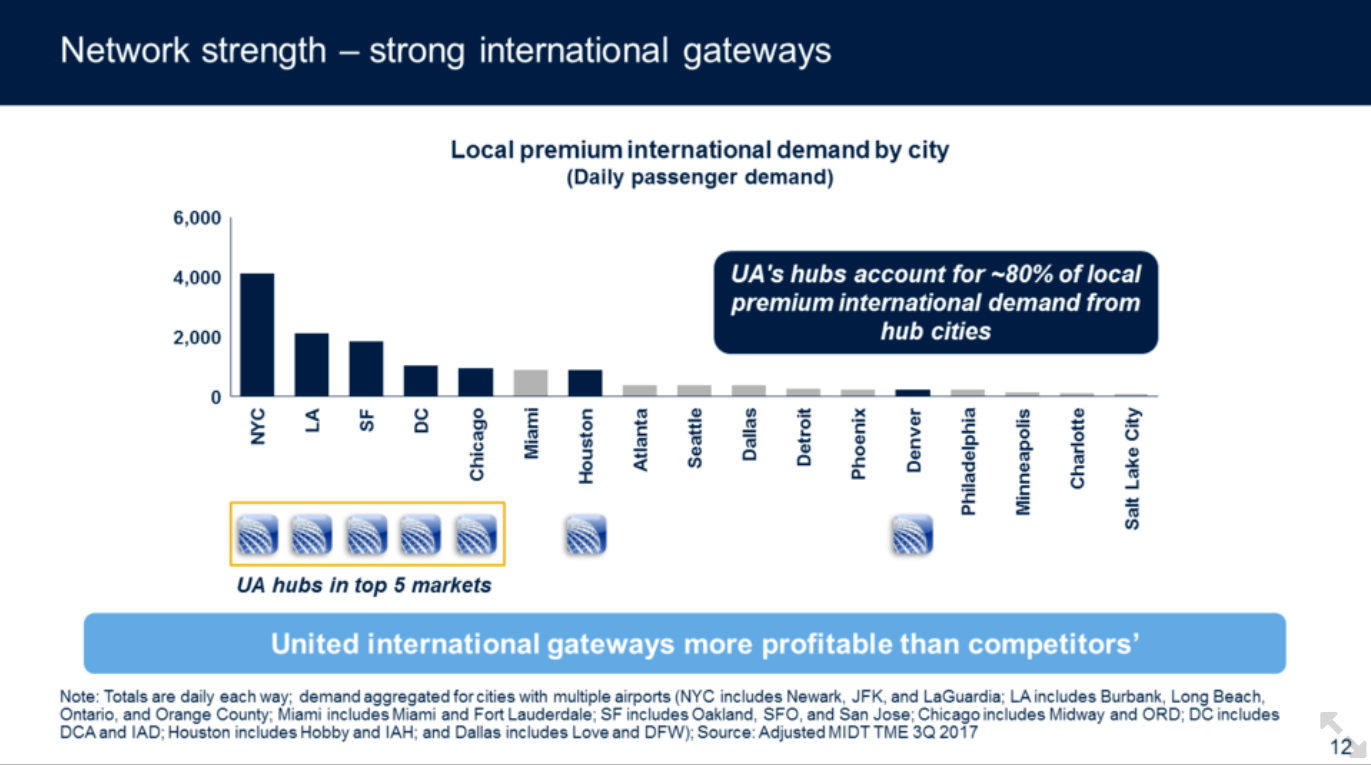

He outlined United’s hubs in the most important US cities for premium cabin demand.

Kirby makes the point as well that they’re in the best alliance or the alliance with the most potential. The Star Alliance is largest although it isn’t necessarily the alliance with the best positioning of its hubs outside of Air China in Beijing and ANA in Tokyo.

- A major challenge for Star is weakness in London. oneworld has British Airways, and Delta owns 49% of Virgin Atlantic. Star is weak in Paris and Hong Kong.

- oneworld is weak in mainland China which is why American bought a small stake in China Southern. Chinese premium traffic is an important growth area, there’s a reason that American Express opened its first international Centurion Lounge in Hong Kong — and we can expect Asian growth from Amex as well.

Scott Kirby observed about their domestic hubs that “It’s rare we’re overflying our own hubs.” Probably the very first thing I learned in the airline industry decades ago was that you don’t make money overflying your own hubs, a challenge American Airlines has with Los Angeles (legacy American) and Phoenix (legacy US Airways) and with New York JFK (legacy American) and Philadelphia (legacy US Airways).

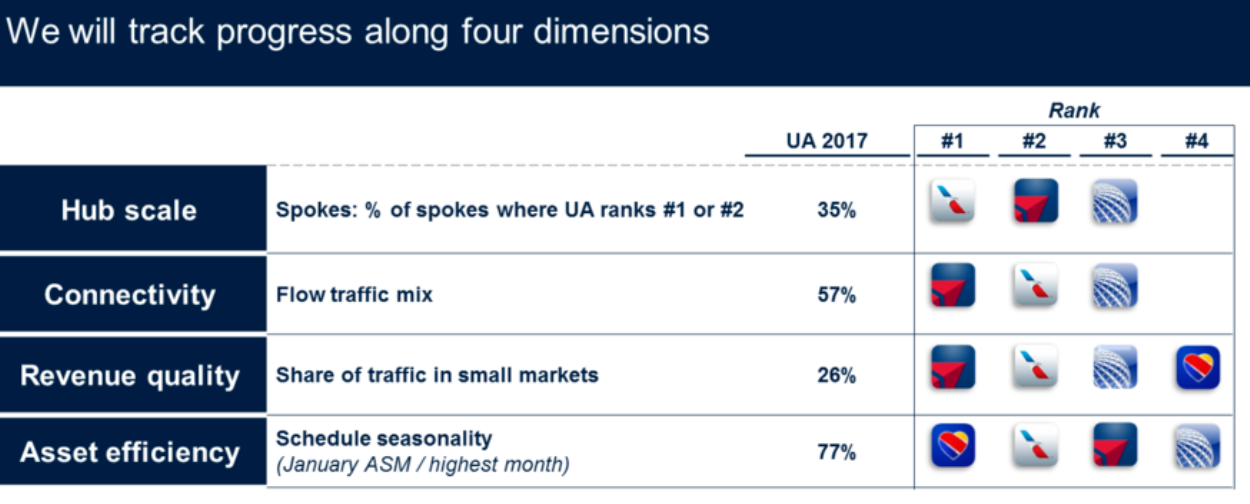

He explained both the position of their hubs and the economics of growing a hub, spreading fixed costs across more flights and seats and driving more people through hubs supporting existing connecting flights.

He argues that connecting itineraries are more profitable. That has turned conventional wisdom on its head. It used to be that non-stop flights earned revenue premiums and connecting traffic was filler. However small cities don’t usually have much ultra low cost carrier competition. Carrying passengers out of those markets means carrying them at ‘higher than Spirit’ fares.

He also reiterated a point he made in October – growing domestically means more credit card customers. Selling miles is more profitable than flying, but you need to fly so people think they need your product.

Further making the case that growth is necessary for an airline rather than shrinking, he points out that pulling regional jet capacity out of small markets loses premium traffic from those markets, sends those regional jets into larger markets where passengers prefer competitors with bigger planes, and reduces the value of the network overall. He tosses out that United shrunk capacity because of investor pressure. Here he’s trying to sell growth to investors who have been vehemently anti-growth.

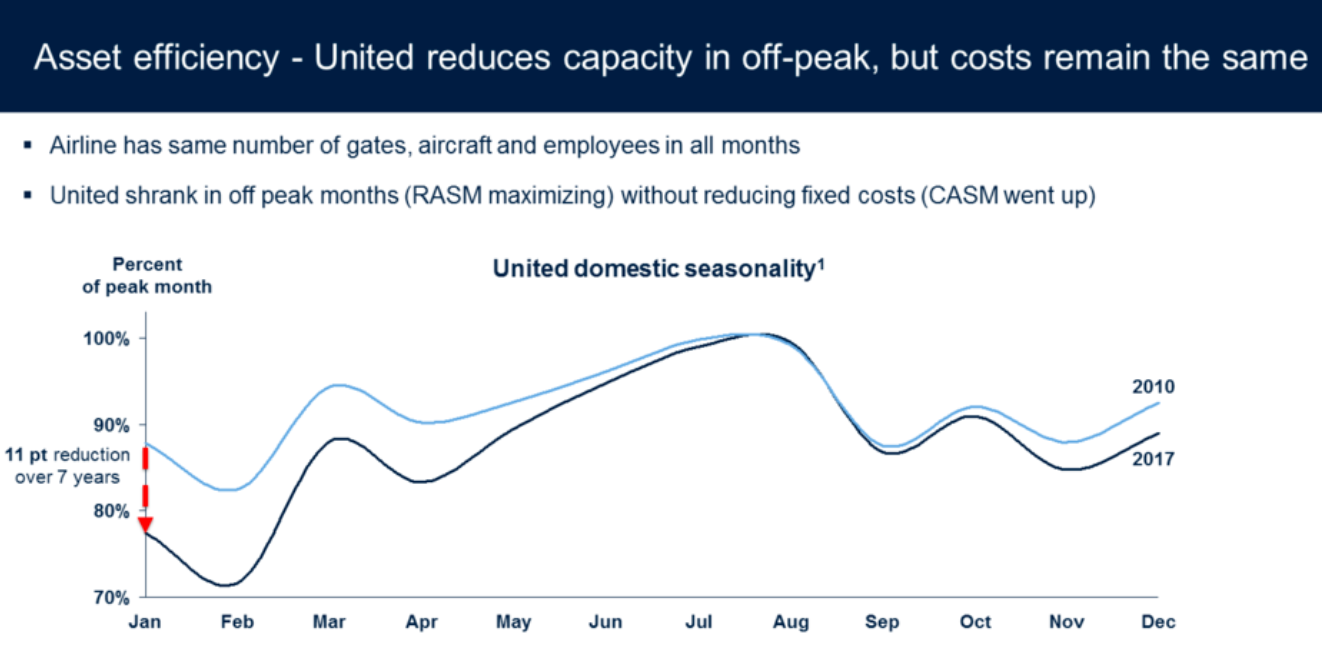

Making the case even against shrinking during slow season — revenue is down in January and up int he summer — he suggests that flying even with low revenue is good because non-fuel costs are mostly fixed. You have planes, gates, and people on the books anyway. So when United pulled back capacity they retained high average revenue but average costs were high too. He’s really explaining marginal analysis — something I emphasize on the blog and that many investors have a hard time with.

Given Kirby’s focus on growing the network of the airline, he laid out their metrics going forward to “Make United Great Again” and drive margins.

That means growth, and Kirby ends the discussion saying he believes in consolidation and cutting unprofitable flying. So he asks for trust that this isn’t the opportunity, that United needs to grow and get back to the level of flying they had been doing before they made network cuts in recent years.

To be sure growth that’s not simply matching competitors and defending hubs, so if investors show confidence in this presentation it will signal a departure from the pure and mindless capacity discipline focus that analysts are sometimes criticized for.

Good post Gary – fun read.

I know it’s just economics but it still feels a bit strange that the big carriers make more money flying to 5-10 gate airports to connect those folks then big city non stops.

Kirby’s main focus is on domestic travel here. He thinks UA was stupid in shrinking domestic connectivity, and now wants to grow it to better compete with AA and DL. Investors so far don’t seem to like it — growth is pretty much a dirty word for legacy carriers — but I suspect Kirby is correct. United IS domestically undersized, and can make more money but beefing up its network. This is one case where airline profitability and customer satisfaction align.

Tilton, former CEO of United before Jeff Smisek did Parker a favor by appointing Jeff Smisek to run the show. UA ended JFK which helped out AA and they cut about 100 flights out to LAX which also helped AA. And they decided to cut and run from their mini hub in SEA once Delta announced build up plans. United had the wrong CEO and he really hurt the company and employee morale but he really helped out AA with all of the cuts that they did.

And Kirby was at AA at the time of United’s cuts and laughed at them. Now Kirby’s at UA and United is in a tougher spot. It’s harder for them to grow at LAX right now. They can’t regrow SEA.

CLE should have stayed a hub but now it’s too late. LCC’s have moved in. UA has expensive long time employees there and all of that real estate that they still have to pay for in CLE.

They can’t get a lounge anywhere in JFK even if they found some slots to return.

They do have ORD where AA already received permission to build 5 extra gates.

United lost the favor of the NY/NJ Port authority when they publicly criticized them, something that an airline just doesn’t do. United will not get any favors in EWR/NYC.

DCA is bigger than IAD and DCA is eating IAD’s lunch. And United’s crown jewel hub, SFO will be a battle ground with the AS/VX merger. United is under assault in all of it’s hubs. They fell that they have to grow.

Stock dropped 6% after hours based on this growth talk. I agree that UA need to expand domestically to better spread costs, but clearly some investors don’t.

DCA is not eating IAD’s lunch. DCA can’t grow. Subway being extended to IAD. IAD is becoming bigger and bigger player. The two airports are run by same authority and work together . The head of DCA was moved to higher paying bigger job at IAD

Maybe it’s just me, but wouldn’t growth in the domestic market be a good thing for an airline as massive as United?

I could be wrong, but I think that domestic growth would provide a lot more feed for international flights.

I’m not an economist or a businessman, so I could very well be wrong.

Mike – DCA is eating IAD’s lunch for domestic capacity whether you want to admit it or not. Airlines want more out of perimeter slots but Virginia Congressman won’t allow it because it will take more passengers away. And the silver line to Dulles, It’s still way too far away. People want DCA not IAD.

2016 passengers totals

DCA – 23,595,006

IAD – 21,969,094

I lived in DC for years and I know. People used to fly to DCA-PHL-Europe or DCA-EWR-Europe rather than trek out to Dullas

And IAD is mostly international. So DCA is surely eating IAD’s lunch. Everyone is/was fighting to get into DCA, no airline is fighting to get into IAD. IAD has plenty of room. DCA has no room for any other carrier.

IAD is alive because of international traffic

DCA is for all the rest and DCA is eating IAD’s lunch.

Skyteam isn’t strong in London or Hong Kong either (the DL/VS JV doesn’t count here). And it’s not like oneworld is printing cash left and right out of Paris.

You can say Star is “weak” at LHR, but Star has nonstop connectivity from LHR to 14 airports in North America (once DEN commences), which is rather comprehensive when accounting for none in Star hubs there. I think 26 out of 27 Star Alliance carriers fly out of LHR (only missing Shenzhen Air), and has nonstops to ~50-55 destinations the last time I checked.

@Wonderful Wanda : funny how you seem to “conveniently” forget that AA is self-imploding at JFK and getting so desperate that they’re flooding that airport with useless JFK-PHL on CRJs. Funny how you love troll about UA’s lunch being eaten when AA at NYC is in even worse shape …. like not being able to hold on JFK-ZRH. You think those bankers would fly LGA-PHL-ZRH ???

i like UA’s new strategy. I always wondered what Smisek’s end game was…you can always cut revenue, the trick is to cut revenue at the same pace as the revenue comes off the books. IT NEVER WORKS, not in airlines, not in widgets. The rev and expense lines cross rather quickly, and you can’t chase the cost down the rat hole fast enough. it didn’t work with Smisek because it has never worked.

@henry LAX, I believe Copa Airlines do not fly to LHR, either. Interesting enough, Shenzhen Airlines will be flying SZX-LHR starting Oct 30th, making Copa the online Star Alliance member airlines to not serve LHR.

@PITBoy — That’s correct, Copa doesn’t fly to LHR since it’s just a bit outside the max range of a 737 from PTY.