I receive compensation for content and many links on this blog. Be aware that websites may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. Citibank is an advertising partner of this site, as is American Express, Chase, and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Plastiq.com is a service that will charge your credit card and mail checks on your behalf. (With some vendors they also make electronic ACH payments.)

Their usual fee for this is 2.5%. It’s worth it to incur that fee if you’re earning a signup bonus with the credit card charges, or you’re meeting a spending threshold for a bonus.

However I generally advise that it’s not worth it for the ongoing miles without a spending bonus. You don’t want to incur a 2.5% fee to earn 1 mile, you’re buying that mile at 2.5 cents. No mile is worth that.

This may be totally obvious but for business spending companies can generally write off the fee. If you’re paying business bills via Plastiq.com your net cost is 2.5% minus (2.5% * your marginal tax rate).

A sole proprietorship in the top tax bracket paying tax at the top marginal rate (and not qualifying under recent tax reform for the lower corporate rate on pass throughs) will pay a net rate around 40% in federal taxes. To that person the ‘cost’ of Plastiq is about 1.5 cents per dollar, something that can be easily worth it with a well-crafted card strategy.

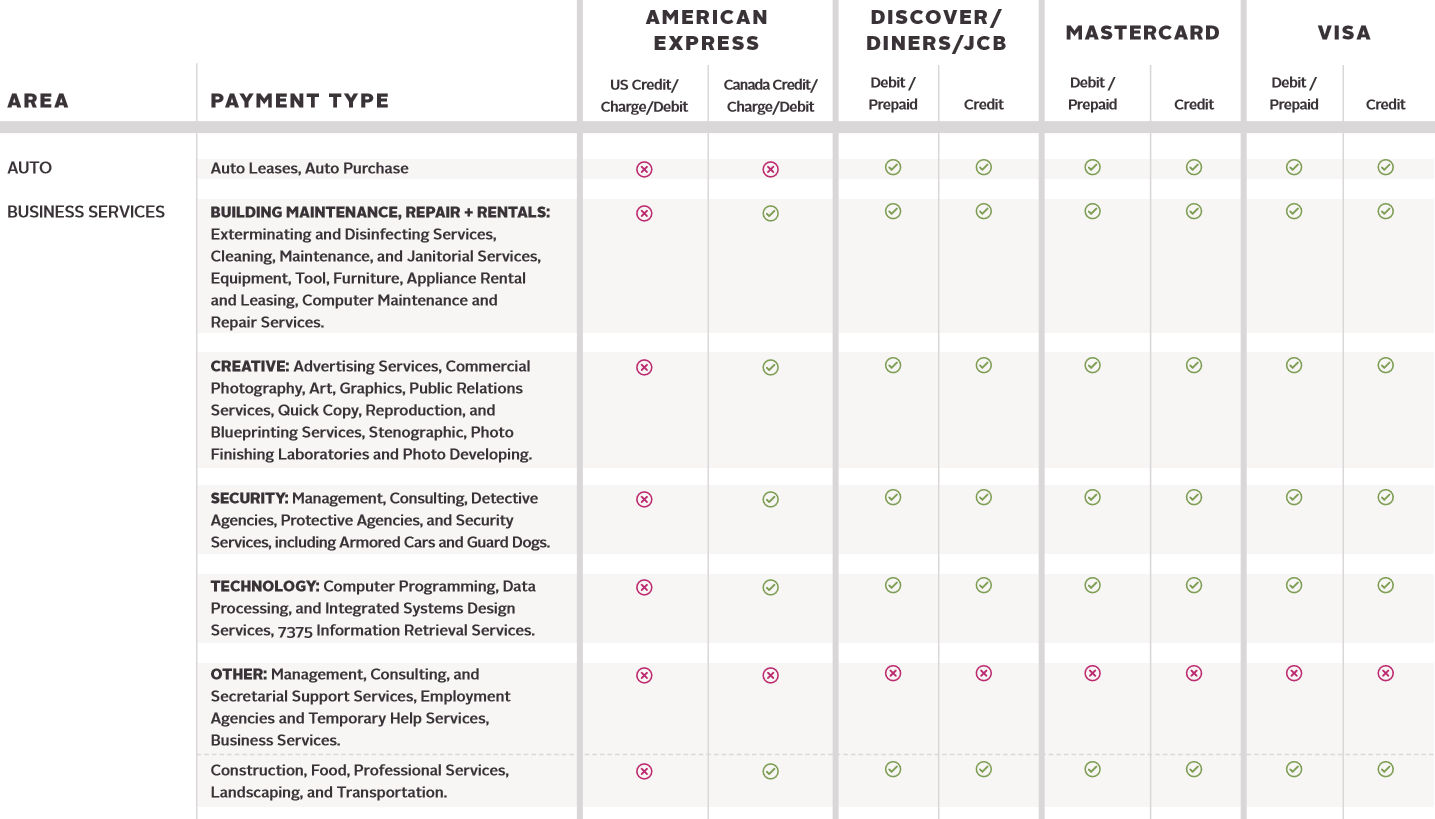

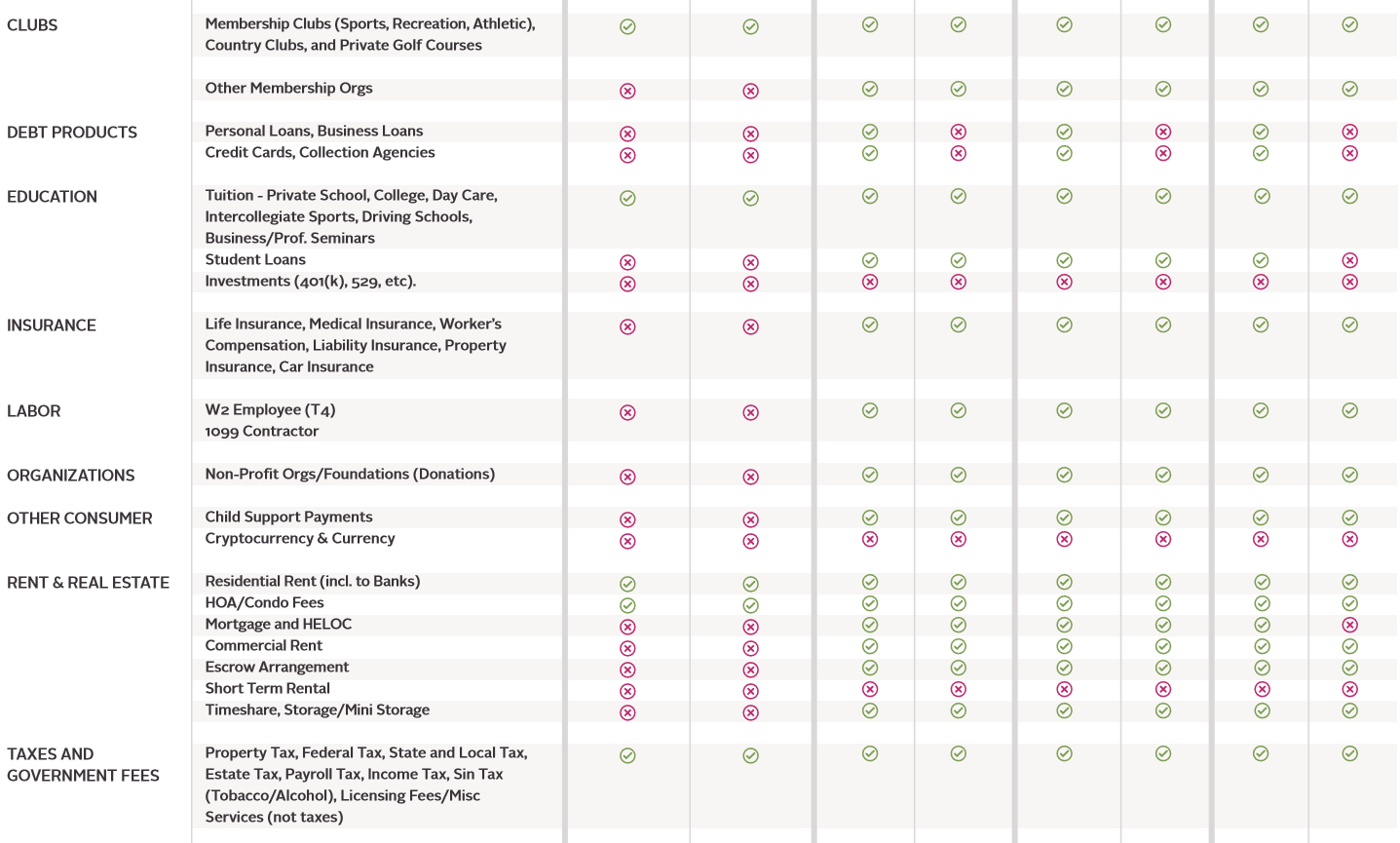

Plastiq doesn’t let you use every card for each kind of charge, though. Some payment networks are persnickety about paying off a mortgage, for instance, with a credit card but is fine with paying rent.

To cut down on the confusion Plastiq created a chart to show which type of card (Visa/Mastercard/American Express/Discover/Diners) can be used for each type of payment. Red x’s are no, green checks yes. Overall American Express is more restrictive than other issuers, and you’re able to pay a residential mortgage with Mastercard credit cards, but not Visa credit cards.

I’m not sure that chart is accurate. Visa debit for a mortgage does not work. If it should, Plastiq needs to fix it.

One more thing needs to be noted. Unless the payment you are making is the same amount reoccurring every month, it might be more hassle than it is worth.

Heads up: Plastiq has been down since last night. Attempts to sign in display a giant “off button” with a message that the website is offline for improvements.

Saying that no mile is worth 2.5 cents is not completely true. Better to say that miles are seldom worth 2.5 cents. I fly Seattle to SIN fairly often. 75,000 miles each way business class on United, which, at 2.5 cents, is $3,750 return. You can almost never beat that, and I have never beaten it with a good schedule.

Interesting. I use my Hyatt Visa to pay my student loans every month even though the chart says that’s not possible.

But thank you for posting this, Gary. It’s very useful reference.

We use it for business. The math you had is accurate to a point. I equate it as follows:

Business ticket 2500

Cost to me 5000 (before taxes )

Plastiq – need 80000 points – have to spend 80,000 at 2.5% = $2000.

Great chart by Gary.

The only thing I’d like to add is that most Visa’s will restrict you to how much you can put on Plastiq to 20% (which is almost always what the “cash advance” amount to your credit card is).

So if you have a credit limit of $2,000, that means that the most you can put on Plastiq at any given time is $400 (under this scenario). Once you make the $400 payment to your bank, you can continue to spend on Plastiq again. This is an important note because it might mean making multiple payments during the month to my credit card rather than waiting for the end of the billing cycle to make the full payment or being “rejected” by Plastiq and not understanding why.

It’s been a minor inconvenience to manage but in the end, as long as you’re conscious of this 20% limit and are paying it down before you process another payment, the process is relatively smooth.

My referral code is 656912, and using it gives you 500 fee-free dollars on your first transaction.