As a Senator, Joe Biden represented Delaware and his most important constituents were big banks. However when he became Vice President, the Obama administration was supportive of limiting credit card interchange rates (the swipe fees charged to merchants) and Biden was supportive. Democrats generally have been supportive of legislation that would limit how much credit card companies could charge to process transactions.

- We saw what happened to rewards debit cards when the Durbin Amendment to Dodd Frank eliminated the profits from debit cards. Rewards debit cards disappeared.

- When a bank makes less money on a transaction, they’re going to spend less to incentivize that transaction.

- Interchange limits reduce the value of credit card rewards.

The 2016 election took any limits on interchange fees imposed at the federal level off the table. The 2020 election could reverse the political dynamic.

Frequent Flyer Programs Would Stop Being Cash Cows For Airlines

Airlines have raised substantial sums on the basis of their loyalty programs, from the $5.5 billion American Airlines pledged the AAdvantage program against with the U.S. Treasury to the $9 billion Delta raised in private markets backed by SkyMiles.

These programs are so lucrative because of the money banks pay airlines for frequent flyer miles to reward to customers. If that revenue dries up, because it no longer makes sense to spend so much on miles, the likelihood of paying back those loans drops. Airlines could literally lose ownership of their frequent flyer programs to creditors.

Put it this way: if a merchant pays 2 cents for every dollar charged, the bank has costs to process the payment, and they might spend a penny for a frequent flyer mile. The rest is profit, and they hope to make money on APR (interest cates charged to customers who don’t pay off their cards in full).

But if all of a sudden merchants are only paying 1 cent per dollar charged, banks can no longer pay airlines 1 cent out of each dollar.

The run up in prices charged by airlines for co-brand deals is a relatively recent phenomenon while co-brand deals themselves are now ~ 34 years old. Legislation could reverse the trend.

We Have A Model For What Happens To Rewards Cards When Government Regulates Interchange

Europe and Australia have regulated interchange rates, and their credit card rewards programs are much less lucrative.

In 2002 Reserve Bank of Australia introduced new credit card processing rules that went into effect a year later.

- capping interchange fees on four party card networks (i.e. Visa and MasterCard)

- merchants were allowed to pass these fees on to consumers

The goal was to get consumers to use cards less by reducing rewards incentives. Unsurprisingly, here’s what happened.

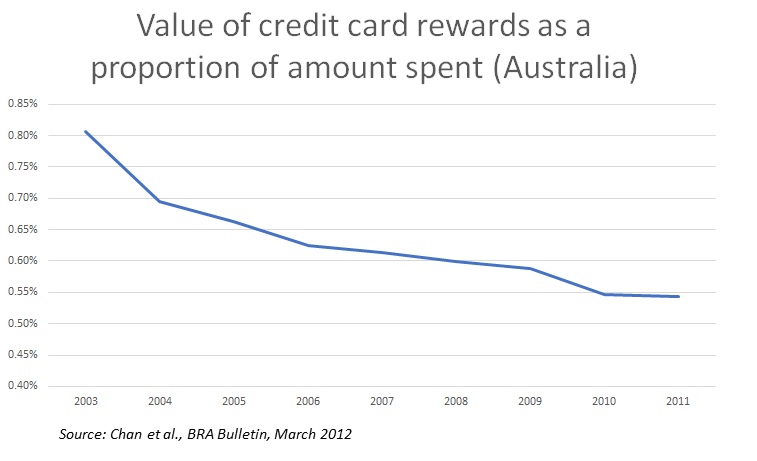

- Interchange fell by 50% – and the return on spending through rewards fell by one-third.

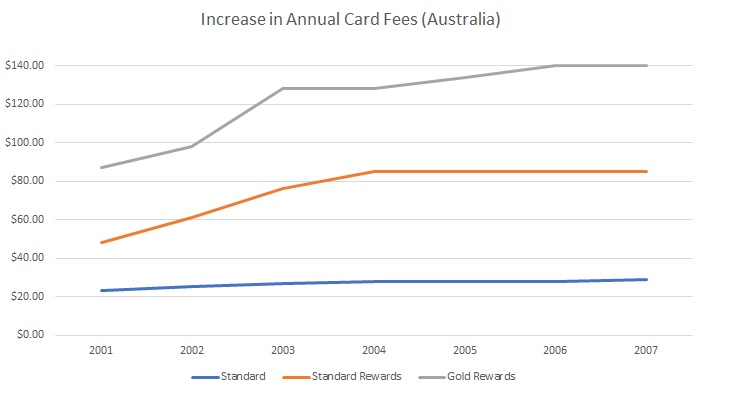

- Rewards card annual fees went up – and the effect was most pronounced for premium rewards cards.

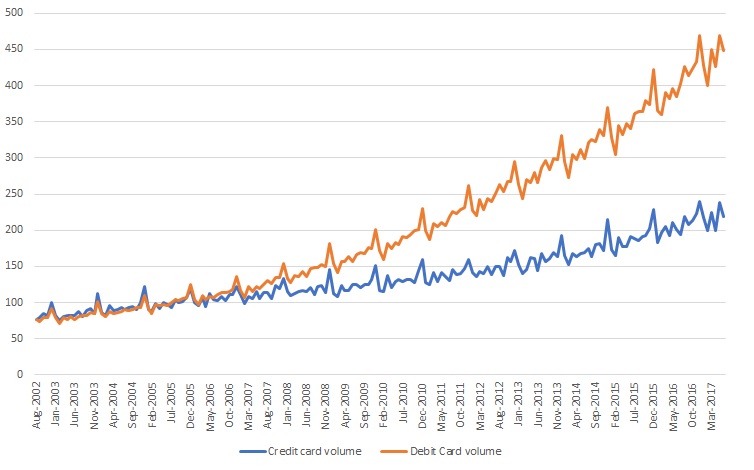

- Consumers shifted their spend to debit cards.

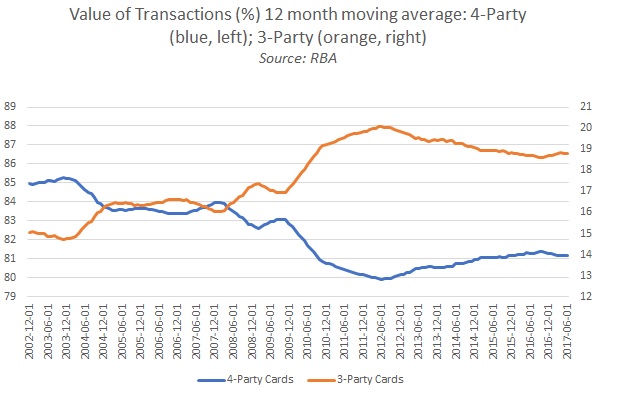

- And they shifted towards American Express, which wasn’t initially covered by these rules. Some Visa and Mastercard rewards card issuers even offered a ‘companion’ American Express customers could use and generate greater rewards.

Issuers in Australia capped the awards that could be earned by consumers. Instead of creating incentives to use the rewards card more to achieve specific additional benefits, Australian credit card issuers began to incentivize rewards card holders to switch cards once they reached the cap. In that way, they generated more annual fees.

Interchange isn’t likely going to go to near zero in any new legislation (the way it did with debit). Instead we’re likely to see lower volume of charges, lower margins, and so lower rewards.

Consider The Logic, Not The Politics

I’m criticized regularly in the comments for my negative outlook on the President of the United States. Anyone who reads this site regularly knows I haven’t been an enthusiastic supporter. So don’t take this as a political post, that I’m somehow carrying water for Donald Trump against Joe Biden. I’m not even telling you this should influence your vote.

Instead I think it’s important to understand the forces at work that will influence how rich rewards programs are, or whether they become less lucrative, in the coming years. And as we’ve seen around the world, limiting credit card interchange rates reduces the value of programs.

Gary: Do you still see an extra charge when you pay for a hotel stay in Australia by CC?

I am wondering whether mobile payments would take off in US the same way as it happened in China.

Any interchange regulation (it seems to me) would fly in the face of our current monetary policy. Aren’t the central banks desperate to get people to go out there and spend money so we can hit our inflation targets? If people can only get 0.25% cashback on their credit card they won’t be spending as much. I know I get a little fast and loose with my spending when there’s a fat sign up bonus on the line. If you take that away I’ll just buy groceries.

Another way of saying this is credit card users (who are primarily wealthI er) subsidize cash and debit card users (who are primarily poorer), because the merchants have to make up the cost of interchange fees by raising prices overall.

https://www.brookings.edu/opinions/how-credit-card-companies-reward-the-rich-and-punish-the-rest-of-us/

Another thing: if corporate travel goes down dramatically long term as a result of companies substituting videoconferencing for travel and pocketing the money they save as profits, you’d have to think that a lot of airline premium inventory will disappear (we’re already seeing this as A380:s and 747s disappear from fleets). So you could end up with pressure on the “hobby” from two directions: less miles and less seats.

I’d think the equilibrium is going to be using miles for coach travel closer to home.

I beg to differ. If you already have a whole stach of points, then lower volume of rewards in the future is a good thing, otherwise there will be points inflation.

I need rewards, it’s my only form of bailout.

This might be best read as an argument for divided government. If Americans elect Biden with a Republican Senate, we are unlikely to see legislation that significantly alters any portion of the economy. If Biden wins with a Democratic Senate, it is likely that the filibuster is killed and the party goes on a spree of left-wing legislation that could radically alter significant parts of our economy and even society.

Before we cry for our losses under a Democrat administration we should remember that under the last Democrat administration we saw the Presidential coin opportunity flourish. It was arguably the best damn income transfer program the government ever devised. To flatter Pelosi’s grand ego, Democrats should push to make dollar coins of all the Speakers of the House and reinstate the circulating coin program!

gary

your intergy is going thru the floor yeah the southwest union stupid crap & if that f*ing idiot destroys america

were all going to be growing patatoes & pushing carts let alone trying to earn points & status

did you notice the a-holes appempted to abduct the govenor of michigan ol’ I bet they could help you earn status on north korean airlines

in my option only stupid useful idiots , russian traders & crimials could vote for the white trash in the white house

Typical of our federal government. Let’s subsidize the airlines and at the same time pull out the one prop that’s keeping them afloat. Other examples that I can recall:

Subsidizing tobacco farmers while trying to Reduce tobacco use by taxing it.

Spending Federal money to promote more cheese consumption while spending money on nutritional awareness programs

which point out more cheese comport some isn’t good for you

“These limits would destroy the value of frequent flyer programs, which sell miles to banks.”

Good! Maybe we can get back to frequent flyer programs actually being about flying. Credit card miles are the single biggest reasons that frequent flyer programs have been devalued so much over the last several years. The credit-card pushing blog-o-sphere refuses to acknowledge this or that they are complicit in it.

Great post and thanks for the advance warning; the only problem is that in these plague ridden times, one cannot plan any award travel to interesting, faraway places. Foreign travel as we have known it, will change dramatically regardless of who wins.

And the sooner Trump goes the better it is for all Americans and indeed for all citizens of the world. Some other reasonable GOP President may not be bad, but that rules out so many of the present crop.

@ David Duff

I’m guessing that English is not your first language.

Although many see the credit card industry as one that helps the rich. I differ in this opinion. I am a 30 year veteran in the Fintech industry. My observation of the Durbin amendment was that it made bank accounts out of reach for the poor. Banks used to offer free checking to customers with no monthly minimum balance. They did this by offering debit cards with full interchange rates. The average bank account was yielding ~$12-15 a month in interchange fees. This was wiped out overnight with the Durbin amendment. I’d love to understand how this “helped” lower income workers. In fact, it caused them to flee from banks to prepaid debit cards which carry their own litany of fees. In addition, most debit cards were exempt from Durbin as they put a clause in place that exempted banks from regulated interchange if they have less than $10 billion in assets Did anyone see any change/lowering of consumer prices after Durbin? The strong merchant lobby used lower consumer prices as their argument for lowering debit Interchange fees and the profit margins for the biggest retail supporters (namely Home Depot and Walmart were 2 of the big ones) of this agreement have continued to increase. So sad seeing politics at work…

@David Duff You left out racists and environmental polluters.

Imagine what this would do to CC referral compensation……and Gary’s income.

Disclosing your potential conflict of interest should be at the beginning of the post.

This is America, we adapt.

I just cleaned out my Lifemiles for two bus class tickets on Lufthansa for the 2020 Christmas Markets in Germany.Plan to use Hilton/IHG/Marriott points to hotel two weeks for free.

It’s called earn em & burn em.

I would give up lucrative credit card rewards to remove the racist, human excrement occupying the presidential oval office.

Don’t forget the impact off the Dodd-Frank act on Mileage earning debit cards. Don’t even have to look outside of the US to see what could happen.

Is it the President or the Congress that writes legislation? So difficult to remember in these difficult days when nobody reads the Constitution despite having excess time on their hands due to COVID

Adding politics to your blog will destroy it!

With travel at 30% of last year’s volume, and our government in shatters, neither credit card swipe fees nor frequent flier programs are in my top 25 reasons to pick a candidate.

Probably good click bait though.

#TimConway

You are the racist ! The joke is on you!

Also in New Covenant, but in Old Covenant it says.

“Thou shalt not curse the ruler of thy people.” Exodus 22:28

Beware!

ha, the racist Airfarer (above) chimed in….the bigot has his insulting say but they are on there way out, him and the Pussy Grabber

@Davidduff thanks for speaking out against the racist insane trash in the White House

Am I the only one who has switched all non-airline credit card spend onto non-mileage cards? I get 2% cash back each month on my Fidelity CC, although I still use my Citi AAdvantage card for airline tickets. But none of my cards have annual fees & I never pay interest charges.

Normally Wall Street always supports the Republican agenda and this year that sentiment

is in short supply….smart money is now saying Biden will be better for the economy

then what Trump is doing to our country.

Talk about everything becoming politicized….even The New England Journal of Medicine has joined the fray….. Amazing! The most respected and apolitical source of scientific and medical knowledge on the planet has called out Trump and blames him for 10’s of thousands of deaths and a complete failure as to how he handled the pandemic….let’s see Trump call them fake news!

What does it actually cost to process a credit card transaction? Does a $1,000 purchase really incur 100x the costs of a $10 purchase? That doesn’t make sense to me, although I do understand there may be some costs such as fraud which would scale with transaction amount.

There is no way I’m voting for Trump, or for a Republican Senate, and certainly not to prop up points earnings on credit cards. In general the economy does better during Democratic (not “Democrat”; nouns do not modify nouns) administrations as the emphasis is putting more money in the hands of the poor and middle class who actually go out and spend it and thereby stimulate things, as opposed to giving money to those who will only use it to buy back stock or stash it in Cayman Islands offshore accounts.

The business about debit cards means nothing to me as I refuse to use them; if the card number gets out my entire bank account can be emptied out before I even realize it happened. I use a straight credit card and pay it off instead.

The lobbyists will prevent this from happening. Banks and airlines make a ton of money on program miles. Nope, fake news.

Stan S, you said….

“You are the racist ! The joke is on you!

Also in New Covenant, but in Old Covenant it says.

“Thou shalt not curse the ruler of thy people.” Exodus 22:28”

Does that apply to 1930’s Germany too???

Gary writes the blog, then logs out and logs back in as @David Duff , posting something disjointed and incoherent just to generate more traffic and clicks.

IT’S BRILLIANT , I SAY

#Allen

#JohnW

#1. You don’t curse anyone. Laws of sowing and reaping are still in effect.

Nobody gets away with anything. I repeat, nobody gets away with anything! Don’t worry about others. Examine your own hearts.

We have all sinned. We have all said or done or even thought things we are ashamed of. But we can be forgiven. There is hope. You don’t want to carry any sins into eternity. Not good.

The lunatics suffering from Trump Derangement Syndrome have really come out today on this blog. There never has been a President that has been more pro-American worker and good for business at the same time as Trump. He doesn’t sell out American workers to China and Mexico, and he doesn’t seek to overwhelm businesses with excessive regulations, bureaucracy, and high taxes. Trump seeks to make everyone richer and more prosperous even if some make out better than others. Democrats want to make everyone poorer so everyone is more equally poor.

As always, Democrats’ meddling hurts the public including the poor and working class it claims to support. More regulation and taxation on loyalty programs will just kill the opportunities available to consumers. A cap on swipe fees will just eliminate the often lucrative credit card rewards programs that can help families travel the world. These things don’t do anything positive and create more trouble for businesses and consumers and another layer of bureaucracy and red tape. It’s the same with California’s attack on independent contractors. What are the effects: less people working as Uber and other ride share companies aren’t going to take on as many employees as contractors, less schedule flexibility and thus less workers able to work , more travel time, and less convenience. Keeping government out of anything is often a good idea. Government makes problems where there is none.

Gary do you have any stats on the income credit card issuers make on merchant fees vs income generated from their loan shark type 20% plus interest rates? I thought that credit cards earned a substantial amount from interest?

David and Tim you both are Confused and evidently meant to post on the Daily Beast or some other rag. Perhaps you need the proper link. This is not a political forum but a travel blog.

Based on experience with numerous Democratic Presidents, Senate, and House of Representatives, this blog is not based on facts, is pure speculation, and based on a particular political agenda. Please stick with travel advice or risk losing many of your followers.

The airlines are up to their necks in the criminal cartel of banks and credit card companies. They actively participate in a conspiracy to addict those who can least afford it, to the ‘advantage’ (…pretty much chicken feed) of those who spend their lives obsessing over points. The real winners are the airline and bank executives who continue to pay themselves massive salaries, bonuses and stock options. I hope Biden deals with them: throwing a few in jail would be a good start…

tim conway liberal idiot JIm h u get it ..why are so many of the travel blogs readers,liberal left wing brain dead Trump haters It is amazing to see..what happened to these horrid angry people

Writing from Australia here… my AMEX has ok rewards – the earn rate was reduced about a year ago but it’s still not nothing. (I wasn’t using credit cards back in 2002 so no idea how the situation compares to before – but comparing anything that far back is a fool’s errand, there have been so many other changes in the world.) So everyone panicking about Biden abolishing credit card airmiles should calm down, the market will adjust and adapt.

OTOH, the conclusions aren’t surprising. There’s no such thing as a free flight, it has to be paid for somewhere. The extra cc charges that paid for more lavish air mile earn rates were paid for by retailers who presumably shouldered some and passed the rest on to consumers. It seems a bit simplistic to assume customers will be worse off rather than better off in some ways and worse in others.

Well said Andy….nice dose of reality for the narcissistic myopia that has infected about

40% of seppo land

Here in the UK the interchange rates are very thin. So there are few rewards cards and the ones that exist have paltry benefits. And yet the percentage of card transactions is so high that ATMs are disappearing and the government is trying to figure out how to make cash available for those who prefer it. The mint has a 10 year stockpile of unused coins.

So if the US goes like Europe and the UK, people will still use cards but won’t be interested in paying a premium fee for them.

>>adding politics to your blog will destroy it!<<

ADDING?

where you been, buddy boy? gary oozes politics with every post.

Gary, your newsletter is excellent and I always read it. I have always felt that your obvious political bias towards Trump has been an unnecessary detraction. Indeed, your apology for saying something positive about the Trump administration in this issue is more proof of what I am saying.

I would encourage you to stick with the fine information you give on travel and leave politics out of it. It would make your publication even better.

Thanks

@Ronald Jackson “our obvious political bias towards Trump” I think you materially misread me… 😉

@ Doug,

I think you meant to say “If Americans elect Biden with a Republican Senate, we are unlikely to see legislation.” Once the Senate changes hands we might get back to normal.

I could never vote on this one issue. I had a chance to use miles and hotel points to go to Greece this summer but Covid stopped that. I don’t blame the E.U. I blame the crazy man in the White House. Much more important issues to vote on!