Yale School of Management Senior Associate Dean Jeffrey Sonnenfeld has a piece out arguing that, actually, American Airlines CEO Robert Isom is great and just misunderstood. The level of spin in the piece reminds me of Isom being named World’s Best Airline CEO by CEO World in 2023. Check this out:

The real facts are that Robert Isom is leading American to new heights despite the potshots of misinformed critics and those with their own motivations. Isom’s leadership is a remarkable model of resilience on all dimensions.

He acknowledges that American isn’t making money, “while Delta generated $5 billion and United $3.4 billion in pure profits.” But he argues that American didn’t lose money last year, either!

- He says it’s not fair to compare American’s profit to United, because United benefits from $1 billion in savings from not updating its labor agreements. American’s contracts were done earlier. On the flight attendant side this was literally the strategy of the United Airlines flight attendants union which lent American’s union its chief negotiator, figuring another union’s employees could suffer a strike if need be to get a better, benchmark contract to negotiate from. And United flight attendants voted down the contract its union did negotiate.

Get this:

Isom has chosen to invest in his people. American has more than 130,000 employees, some 87% of whom are unionized, which is nearly 15x the private sector average for unionized workers in the United States. American has more unionized employees than any airline in the world. Isom paid them fairly, ahead of the competition, because it was the right thing to do.

This isn’t about Isom being noble. American isn’t allowed to outsource as much as competitors, for instance in maintenance. This is something they tried to change in their mechanics contract seven years ago, and backed off after mechanics forced a slowdown at the airline. Their flight attendant negotiatons moved faster than United’s, but their contract became amendable first and United’s union slow walked theirs mistakenly thinking it would get them better leverage (a Trump presidential win shifted the balance of power at the National Mediation Board).

Regardless, this doesn’t explain even one-third of the variance in profit between the two airlines and doesn’t explain Delta. And in any case, profits at American declined 87% year-over-year.

- He says that Isom is “beloved by his employees.” Robert Isom doesn’t generate the level of vitriol that some in the industry have over time. Not even close! In fact, he comes across as a nice, decent guy. His performance in the wake of the January 29, 2025 disaster of flight 5342 was truly exemplary.

But I don’t think I’ve ever heard an employee describe Isom as beloved. He is well-practiced. He’s stopped taking open questions at employee forums. He’s cut back on the number of those forums. He doesn’t spend his time out at the airline’s stations, with front line employees, nearly as much as some other CEOs do. I just don’t know what he’s basing his claim to the truth here on.

- American is actually the best airline. He says that “American has the strongest network in the U.S.” though he doesn’t offer anything that Isom has done specifically to build the airline’s domestic network since becoming CEO in 2022? American failed to restore service after the pandemic in Chicago, and lost gates as a result. They lost their key partnership in New York to antitrust. They’ve scaled back in Los Angeles. American has a strong domestic route network, but weakness in the country’s largest markets (and little presence in Northern California and Pacific Northwest).

He argues that American has “a fantastic product and experience for international, business, and premium flyers.” The airline’s pivot to premium is only a year old. They’ve suffered financially precisely because they haven’t been premium enough – they didn’t have enough premium seats on widebodies because they took out those seats (admittedly, that happened while Isom was President and not CEO).

- American’s Citi credit card deal will save the day. Sonnenfeld offers that their “new partnership with Citi, which is on track to bring in $10 billion-plus annually by the end of the decade, a partnership that will put American in a very competitive position with its peers at Delta (American Express) and United (Chase) as it continues to pursue higher-margin growth markets.”

Where do I begin?

- American’s partnership with Citi dates to 1987 – the “partnership” isn’t new. The renewed cobrand agreement started paying cash last year, but Citi exclusivity only just started.

- American projects $10 billion from all partners, not just Citi, so Sonnenfeld just errs here.

- Eight years ago American Airlines had the biggest co-brand credit card in the industry. Its charge volume outstripped both Delta and United. At their 2024 investor day, they revealed it had fallen to number three.

- $10 billion is actually weak sauce. It was Delta’s 2029 goal announced before the pandemic, and before 20% inflation.

- American’s co-brand contract terms are already more favorable than United’s. United doesn’t get a new deal for another 3 years.

- American’s partnership with Citi dates to 1987 – the “partnership” isn’t new. The renewed cobrand agreement started paying cash last year, but Citi exclusivity only just started.

- American’s problems are really Boeing’s fault. American “is one of the largest customers of Boeing equipment” and “no carrier absorbed more disruption than American” from Boeing’s delivery issues. Exsqueeze me, baking powder?

- American’s aircraft shortage was of their own making. While Doug Parker was CEO and Isom President, they chose to retire all of their Airbus A330s, Boeing 767s, Boeing 757s, and Embraer E190s.

- They’re a big airline, so they’re exposed to Boeing and Airbus. They’re the largest operator of Airbus narrowbodies. They hardly have unique exposure to Boeing. Indeed, while their widebody fleet is Boeing-focused, they had fewer widebodies on order than United and Delta.

- And you can’t blame American’s lack of widebodies on problems at Boeing when American deferred delivery of two-thirds of the 787-9s it had on order!

- American’s problems are all the fault of Winter Storm Fern. Sure, that happened in January 2026 and American didn’t earn money in 2025 but American’s poor operational performance – which extends to mishandling more bags and wheelchairs and involuntarily denying boarding to more passengers than any other carrier year after year – is all because Chicago O’Hare and Atlanta weren’t as badly hit by the storm at Dallas and Charlotte? Although New York and Boston were badly hit, and American lost track of crews and left some sleeping in airports during the meltdown. The problem last month wasn’t just the weather, it was how they handled the aftermath.

Talk of Isom’s vulnerability – he even cancelled participation in a golf tournament last week – comes after simultaneous meltdowns in operational performance (cancelling nearly 10,000 flights) and financial performance (declining profits, just breaking even for 2025, as Delta and United earn billions). This is not just manufactured outrage and bad weather luck.

- Isom’s accomplishments are amazing. Whoa, boy, he has a list and feels it’s unfair that “Isom receives little to no credit.”

- “Isom has paid down debt well ahead of schedule” seems like the soft bigotry of (their own) low expectations, when if they’d earn money they could pay down more, faster. They were saddled with debt thanks to a predecessor who borrowed over $12 billion to fund stock buybacks.

- “He ordered 260 new aircraft in 2024, the second-largest fleet investment in American’s history, with options for 193 more.” He hasn’t ordered widebody aircraft, and has fallen behind United and Delta with a future order book – and as the author notes, airframe manufacturers are a choke point so delivery positions matter. I have to think American will be forced to order widebody jets sooner than later, and to get decent delivery slots it seems like that would mean Airbus A330s – the very aircraft they retired during the pandemic.

- “He is also rolling out free high-speed satellite Wi-Fi across the entire fleet” as Delta, JetBlue and Southwest had already done and United and Alaska are doing also. American Airlines was poised to be a leader in 2019, the press release on free wifi was literally drafted, because they thought they’d have to make the move in response to Delta. But Delta deferred, because their aircraft didn’t yet have enough bandwitch. So American became a laggard. Meanwhile, United, Southwest, JetBlue and Alaska are all committed to faster wifi than American offers today (Starlink and Amazon Leo).

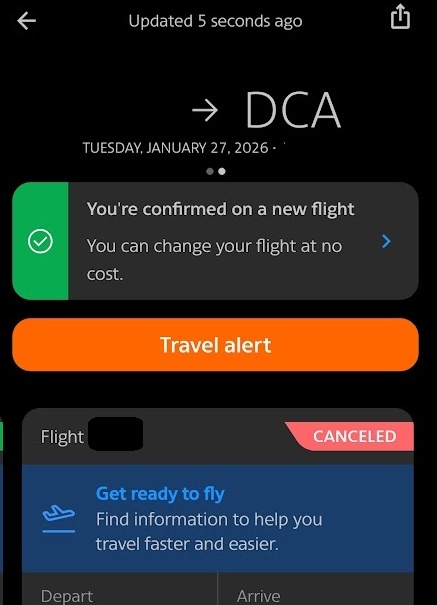

- “He has introduced new technology that lets passengers instantly self-rebook disrupted flights, an innovation that no other major carrier has deployed at scale.” Most of the technology American announced for this last month isn’t new or improved, and while the color coded status in the app is new that actually doesn’t work properly. You’re both rebooked and cancelled at the same time!

- “He expanded biometric screening, deployed next-generation kiosks, and built a connection-risk prediction tool operating across seven hubs that flags at-risk passengers and recommends departure holds in real time.” American Airlines started holding some flights for passengers last year but this follows a move by United Airlines six years earlier. So I’m not sure this is leadership? Nor am I sure that American’s kiosks can reasonably be characterized as ‘next-generation’ except, I suppose, in comparison to the last generation?

- “American reached its 1,000th mainline aircraft milestone in August 2025, giving it not only the largest but also the youngest fleet among U.S. network carriers.” American has lots of planes. They had lots of planes before he became CEO. The planes delivered during his tenure were ordered before his tenure. So I’m not sure what to make of this, exactly, other than he didn’t refuse deliveries?

- “And he placed the largest-ever conditional order for hydrogen-electric engines in aviation history, positioning American at the frontier of zero-emission flight.” United’s order was described as worth $1 billion and so was American’s. For the same ‘money’ American ostensibly would acquire more planes. Neither order may ever turn into actual deliveries. And they happened before Isom became CEO.

- “He also has expertise in partnerships – growing relationships with key international partners, expanding the oneworld alliance, and pursuing a creative partnership with JetBlue that was working well before it was struck down because of the regulatory environment at the time.” His example of Isom’s strong partnership is with JetBlue which (1) was announced in 2020, before Isom became JetBlue and (2) he acknowledges did not survive. Okey dokey. I guess Isom’s track record is better than Doug Parker’s, since he ultimately lost JetBlue to United but Parker lost joint venture partner LATAM to Delta.

New partnerships inked under Isom’s tenure as CEO, I think, would be limited to Porter Airlines and Fiji Airways. Do we count Oman Air, which announced its intention of joining oneworld before Isom became CEO, but which was formally approved afterward?

- “Importantly, he has also taken on a leadership role in advocating for reforming air traffic control in the U.S. and working across government and industry to make the aviation system even safer. And he is the driving force behind billions of dollars of investments at major hub airports in the U.S., including the new regional concourse at Reagan National and a critical $5 billion project to expand and upgrade Dallas Fort Worth International Airport”

The new regional concourse at National airport was completed before Isom became CEO. As CEO he signed off on a poor excuse for terminal F at DFW but gets credit for recognizing the error and agreeing to a far superior plan.

Meanwhile, Charlotte remains a pit of despair. And as for air traffic control, he – along with other CEOs – argue for more taxpayer funds rather than user fees that would actually provide a stable source of revenue, and they’ve jettisoned the idea of a more efficient system like Canada and many other countries have for greater state control.

- I think this author just doesn’t know what he’s talking about? He gets key dates wrong in attributing accomplishments to Robert Isom, but I’d expect a business professor not to lavish such praise on Isom’s predecessor Doug Parker who has the worst legachy of any airline CEO in history destroying more shareholder value than any other, furloughing more employees than any other, and shattering the passenger experience.

These unheralded accomplishments reflect why Robert Isom was picked as the successor to his legendary predecessor, Doug Parker, in the first place. The architect of the modern U.S. airline industry, Parker navigated mergers and restructurings to build American Airlines into the world’s largest airline, working alongside flight attendants and pilots in rescuing the industry through challenges ranging from 9/11, to the Great Recession to the COVID pandemic. The seamless succession from Parker to Isom reflected a textbook leadership handoff, with Isom building on Parker’s successes in playing to American’s strengths – even if those strengths are sometimes underappreciated by business media.

The real error that Robert Isom made was in misreading the industry and the consumer, and taking American Airlines down the wrong strategic path. In 2018 he outlined that he believed their focus had to be on competing with Spirit Airlines and Frontier – that passengers wanted low fares most of all – just as the consumer had shifted to wanting (and being willing to pay for) a better and more differentiated product.

Upon assuming the role of CEO in 2022, he told employees never to spend a dollar they don’t have to – rather than investing in premium. And now they’re playing catch up.

In other words, it was his vision for the company that was exactly wrong. Now it needs to turn around, but he hasn’t yet been on the road selling a new vision to employees or to customers.

Jeffrey Sonnenfeld is clearly laundering American Airlines talking points. He attributes unsourced virtues to the CEO and uses sleight of hand, offering facts that are (sometimes) true in the narrow sense but misleading. I do not know whether he simpy doesn’t know the subject matter that he’s writing about, whether he’s been duped, or whether this is offered in bad faith. But none of those explanations reflect well.

(HT: One Mile at a Time)

How much does a business degree from Yale cost?

“Yale professor” says it all. If you wonder how the MBA class destroyed so many industries and the middle class in the US look no further than this clown.

@Thing 1 – ~ $175k tuition for the two year program, plus living expenses

Does AA sponsor any of his research? If not, they should!

Gary – glad your opinionated self knows more about business and management than an Ivy League business professor. Maybe you should be teaching future business leaders. SMH

Opinions are like a@@holes. We all have them and most of them are ugly.

I’m curious as to his motivations around drafting this POV. It is clearly out of the norm. Strong on narrative. Weak on support.

@Retired Gambler – this business school professor is laundering the airline’s talking points, not doing actual analysis, and they’re doing it while getting facts and dates confused. If you want to cast aspersions and appeal to supposed authority, you might go farther if you also… suggested something that I’ve gotten wrong here?

He got fired from Emory University before he signed on with Yale.

Key details of the Jeffrey Sonnenfeld Emory scandal include:

The Accusation: Emory officials alleged that Sonnenfeld defaced new woodwork and walls in the business school in retaliation for being passed over for a promotion.

The Evidence: Surveillance video reportedly showed Sonnenfeld brushing against or hitting walls while walking down a hallway, which he described as “meandering” while lost in thought.

Consequences: The accusations caused Sonnenfeld to lose his position at Emory and a prospective dean position at Georgia Tech.

It’s like a parallel universe, where Delta is Isom, and Jeffrey Sonnenfeld is Tim Dunn.

My guess is that Jeffrey A. Sonnenfeld got paid for his remarks, some way, some how. Maybe he will end up being a paid keynote speaker.