A month ago Alitalia doubled the price of many partner awards overnight and without notice. At the same time, they brought partner award booking online and did not increase the price of awards on Alitalia’s own flights and promise not to through the end of 2017.

However they do appear to be overcharging taxes on Alitalia awards, and misrepresenting fuel surcharges as a fee imposed on them rather than one the airline is charging itself.

Under 14 CFR 399.84, a price can be broken down between taxes, government-imposed fees, and airline-imposed fees, but an airline cannot do this in a way that is false or misleading.

Although charges included within the single total price listed (e.g., government taxes) may be stated separately or through links or “pop ups” on websites that display the total price, such charges may not be false or misleading, may not be displayed prominently, may not be presented in the same or larger size as the total price, and must provide cost information on a per passenger basis that accurately reflects the cost of the item covered by the charge.

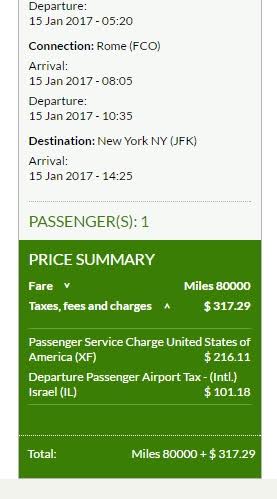

Reader Yanky points out to me that Alitalia award redemptions appear to be misrepresenting taxes on award tickets, or rather collecting fees that they are calling taxes. Here’s what they show as a tax breakdown for a one-way business class award from Rome to New York:

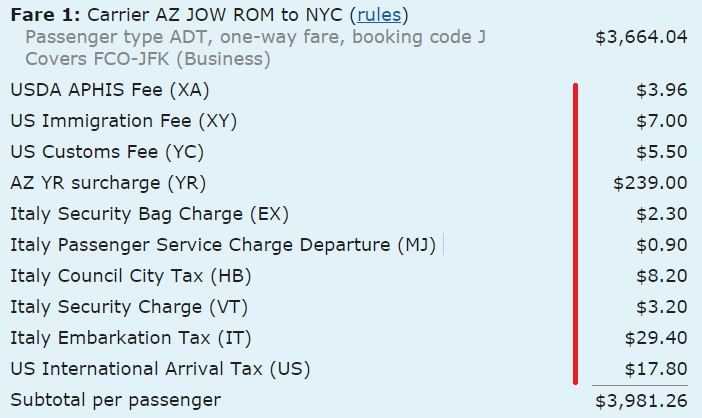

When I pull up a fare for Rome – New York one way in business class, I get a much more detailed breakdown (and a price that comes up within 3 cents of what Alitalia is charging, perfectly acceptable for differences in currency conversion):

Now, a paid fare includes a $239 fuel surcharge or carrier-imposed surcharge. Regardless of what it’s called, in order to get to $317 you’ve got to include a $239 amount that is not a tax and is in fact a fee charged by the airline itself.

However when booking an award Alitalia is charging the full $317 and describing it all as either:

- Passenger Service Charge labeled as XF which generally is a US airport facilities charge, or

- Departure tax — the total of taxes that could at best be described as departure taxes is $41, and the sum total of all taxes that ought to apply on the ticket is $81.26, yet they are assessing $101.18 for this.

If they’re representing this as all taxes, or at least all taxes and fees imposed on the carrier, then that is false. The only way they get to the total they are charging is by including the ‘YR’ airline-imposed surcharge. They appear to be misrepresenting the breakdown of charges and fees. They appear to be reporting more taxes than are imposed on the booking. And they appear to be calling the bulk of the fuel surcharge a Passenger Service Charge (XF) which seems misleading at best.

Interpreted in the most generous way possible for Alitalia, Passenger Service Charge includes fuel surcharges, isn’t represented as a tax, and ‘XF” doesn’t have meaning (although in aviation fees it does). At that point they’re merely overcharging on taxes by $20, which is a problem in itself.

However I don’t think it’s reasonable to include an airline-imposed fuel surcharge in ‘passenger service charges’. And they’re clearly passing along the fuel fuel surcharge here.

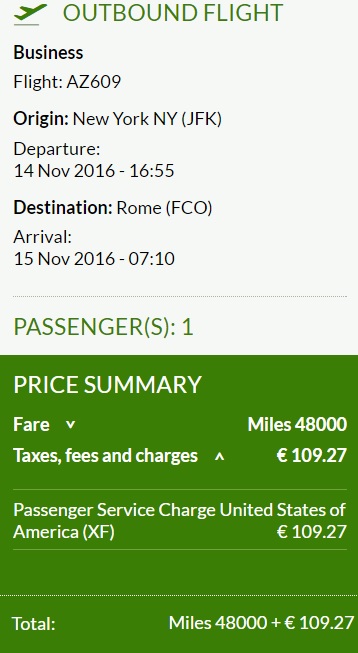

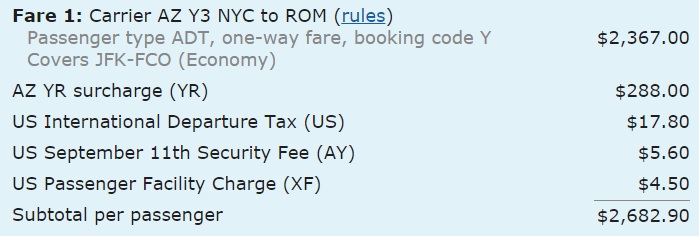

I pulled up a flight from New York to Rome and see they want US$118 in ‘passenger service charges’ for the itinerary.

Clearly these refer to taxes, since it’s the only broken out line. However taxes on a paid ticket would only be $27.90:

Oddly they’re either collecting $90 in ‘additional taxes’ or just $90 in fuel surcharges mislabeled as taxes when the fuel surcharge on a paid ticket would be $288.

They label these taxes again as XF, which is incorrect since the total XF on the itinerary appears to be $4.50.

Anyone redeeming Alitalia miles (for instance, who took advantage of last month’s Membership Rewards transfer bonus) may want to escalate the issue of taxes being charged, because it appears on first glance that the amounts in question aren’t correct and may even be considered potentially misleading.

I will be following up with Alitalia, and look forward to sharing any explanation that they offer.

You should see Turkish Airlines then. When redeeming miles for an award ticket on a partner airline, Turkish Airlines charges sales tax based on cash value of the ticket. For example charges and fees for an award ticket on United, will include US sales tax based on the cash value of the ticket at time of sale.

BTW, US Passenger Facility Charges (XF) are capped at $4.50 per segment and $18.00 per itinerary. It is not like an airline can include (or mislabel) other fees under XF name and go above the cap.

Any update on this? I booked an award last month and would definitely be interested in knowing if they overcharged on my taxes. Thanks!