American Airlines has loaded a schedule that pulls down about half the routes from its Austin focus city, as first reported by Adrian Waltz based on data available in Cirium’s Diio Mi. Eliminated in the schedule load were 21 out of American’s 46 destinations from Austin.

The latest Diio update had the following adds (Green), and removals (Red) of domestic routes by major carriers this week. pic.twitter.com/1vBJEPNbDd

— AdrianWaltz (@AdrianWaltz) November 4, 2023

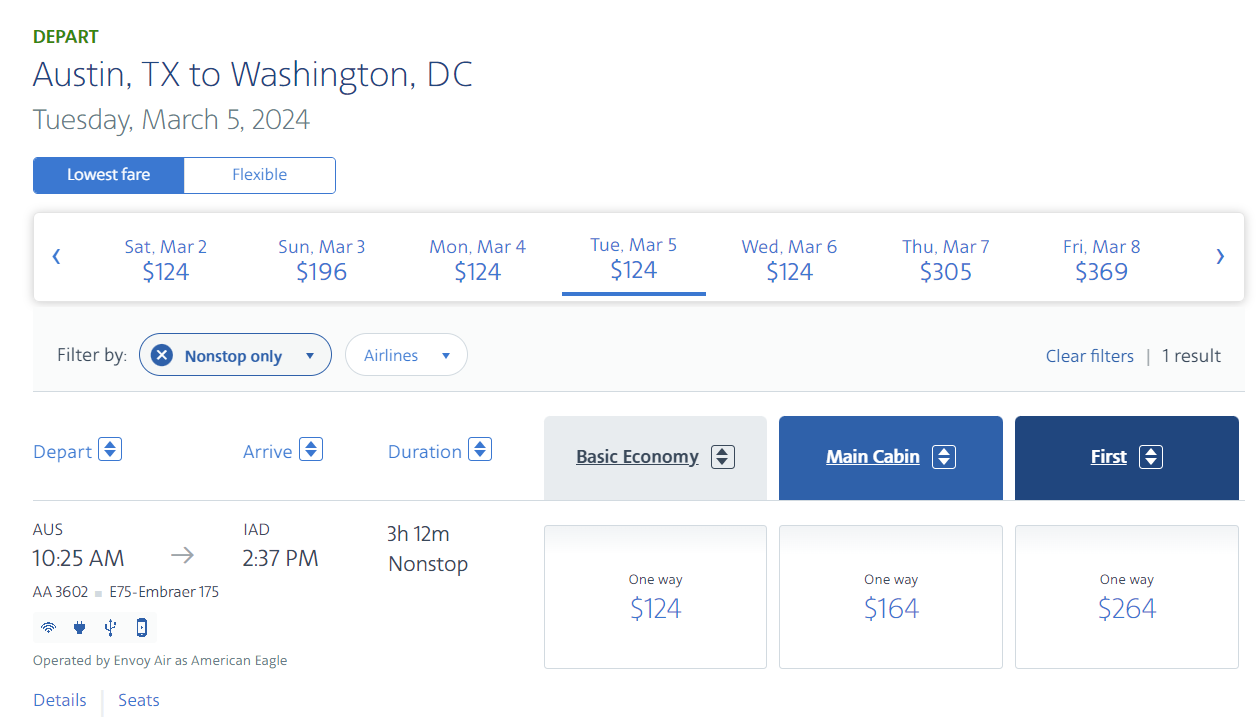

However, American Airlines is still selling some of these. Here’s Washington Dulles:

Dulles airport in particular is a flight that’s come and go from American’s Austin schedule over the past couple of years. It was once two daily Airbus A319s, and at times where it’s operated it’s been down to a non-daily regional jet. Every time the flight seems to gain traction it disappears from the schedule.

The airline began building up a significant focus city in Austin during the pandemic. In 2019 they flew to 8 cities from the Texas capital. That’s grown several-fold.

- Austin has been the fastest-growing, or in some cases second-fastest growing, airport in the country several years in a row.

- Delta had announced it as a focus city, but was slow in building its operation there. Austin and Raleigh are Delta’s only remaining focus cities and Delta is finally building modestly in Austin.

- Austin’s airport is heavily gate-constrained. Despite adding 37% more gates in 2018, common use gates are fully utilized. They’re building 3 new gates as part of a ‘West Gate Expansion’ that should complete in 2026, but those gates merely allow taking 3 other gates offline to build a connector to a planned new midfield concourse.

And the main terminal will have to accommodate Frontier and Allegiant, which are being displaced from the airport’s low cost terminal, which will be torn down as part of concourse expansion plans. The new concourse is still in pre-design, so net gate growth won’t occur until the 2030s.

- During peak times the terminal is so crowded that it can be difficult to traverse – think the end of concourses in Charlotte.

American’s expansion blocked growth by other airlines. But flight growth outpaced passenger growth, and with corporate travel still on a lower trajectory than pre-pandemic yields out of the city have been awful. Already we’ve seen several routes cancelled, though that’s natural – not everything will work. Some of the worst-performing have been San Juan and the Caribbean.

They cancelled the Reno flight I took last month. Virgin Atlantic announced the cancellation of Austin – London Heathrow. Austin couldn’t support two London flights (alongside BA) and the one without meaningful connecting feed on either side (and supported by Delta’s smaller Austin customer base) didn’t make it.

What’s going on, loading a schedule without 21 routes but actually still selling many of the flights?

American Airlines joint venture partner Qantas, on whose board ex-American Airlines CEO Doug Parker serves, is caught up in a scandal in Australia over selling tickets for flights they’d already decided to cancel. The airline is being roundly mocked for its legal claim that they do not sell seats on particular flights, merely a ‘bundle of rights’ that permits passengers to buy tickets and Qantas to keep their money whether or not the specific flight operates.

Enilria suggests that American may have made a mistake loading its schedule changes, intending to reduce frequencies but not as much as they initially did, or that the removal was premature – preparing for messaging of such a major reduction.

Austin has frequently been a cheap place to connect on American Airlines, due to light loads on many of their flights. Austin connections have also been inexpensive AAdvantage redemptions for the same reason. But that doesn’t just mean Austin performs poorly. It also drags down yields on American’s other flights, especially connections through Dallas – Fort Worth.

American has also delayed plans for a new Admirals Club. In 2021 they announced a new Austin club, including the first renderings of the new Admirals CLub design template. But they never began the project, instead entering discussions to locate one in new expansion space that the airport is building. As a result it appears we won’t see a new club in Austin until at least 2026.

Some of these routes are seasonal. Some of these flights may not be gone entirely, and some of the frequencies dropped could have been unintentional – a schedule misfile. American’s schedule also isn’t firm more than 90 days out in any case.

We’ve also seen a dizzying series of updates to Austin flying, with destinations dropped and re-added to the point where I frequently don’t know what cities American is selling from my home airport. These get added and removed from their schedule without comment. Passengers are just supposed to know them when they see them searching for travel.

Removing 21 destinations, though, might give other airlines an opportunity to grow in Austin – a reason on its own to consider squatting on current gates as the city grows into its expanded air service.

Update: In addition to losing money in Austin, the operation has been heavily regional jet-focused to many destinations. Apparently American Airlines has had regional carriers operating more than their mainline pilot union contract allows (“scope”). The airline has talked about keeping regional jets grounded.

American’s pilot scope clause limits them to flying regional jets with 66-76 seats to no more than 40% of their mainline narrowbody fleet. Retirements of Boeing 757 and Embraer E-190 fleets reduced the size of the mainline narrowbody fleet, limiting the number of 66+ seat regional jets. In the past they’ve operated Embraer E-175s with 65 seats instead of 76 seats to maintain compliance.

Note though that American’s Austin cuts include flights operated by Airbus A319s (mainline narrowbodies) as well. But the volume of regional jet cuts, focused on an unprofitable operation, make sense. From aviation watchdog JonNYC, who also says that the flights are officially cancelled even though they’re still for sale on the airline’s website.

AA not making money out of Austin is the reason for these cuts. Full stop.

There is this going on at the same time: pic.twitter.com/yBLCjucsV4— JonNYC (@xJonNYC) November 4, 2023

surprised your internal sources didn’t break this news to you first, Gary.

AA might have made a mistake but the writing is on the wall.

AUS was a quick pandemic play by American to redeploy capacity to a fast-growing metro, take on Southwest’s dominant position, and try to block Delta’s stated plans to build a focus city in Austin.

It is doubtful the flying was ever fully profitable and as AA’s system recovers and the cost of regional flying increases, those aircraft need to be redeployed elsewhere. For the 19th time, AA will probably try to rebuild its schedules at LGA and JFK so it does not lose its slots; thankfully for them, the slot exemptions give them a year to slowly add schedules.

Neither DL or WN jumped onto the bandwagon of trying to chase AA in AUS and both are more comfortable in their previous positions than ever.

I wonder if Southwest will keep many of the flights they added in response to AA?

See what happens when the Longhorns lose to the Sooners? American cuts Austin flights! 😉

Delta, the world’s #1 premium airline, would NEVER do this to Austin 😛

DL isn’t growing in AUS either. It was unrealistic to have WN, DL, and AA in a dog fight on a weakening and saturated market that thrived during the pandemic, but not so much any more. A lot of the tech companies have cut T&E and those that are growing are doing so again on the West Coast and specifically around AI and Cloud, neither of which were key cornerstones of AUS’s tech heavy presence.

AA needs the planes elsewhere for the Spring/Summer 2024 season, notably in the northeast, and specifically at PHL and LGA.

AUS is an awful airport. Overcrowded, unpleasant to use and the city’s heyday has come and probably gone. Would not surprise if LH or KL are next to cut.

Guessing WN will also drop frequencies and upgauge on routes where they had -700s at higher frequency to compete with AA. So average A/C size out of AUS will bump up measurably as a result of this. e.g. 2x-3x daily on WN to ABQ is probably toast, but the remaining frequency will reliably be on an 800/MAX8. This may not happen immediately, but I’d expect changes when the next schedule extension happens.

These drops mean AUS gets 2-3 gates worth of capacity back in Feb-Mar, which should be helpful for running an on-time operation out of the airport, and reducing the effects of fuel shortages and such.

I’d expect AA to bump gauge to DFW and maybe PHX/CLT as a result of this, so we’ll see more A321s, removal of regional AUS-DFW hops, and maybe an extra frequency to DFW.

I also figure we’ll get more ULCC traffic flowing back in, to the tune of +3-4 flights per day. NK doesn’t have enough planes right now, and these routes likely can’t fill a daily 320 anyway, so I expect the growth to be out of the South Terminal, with Allegiant flying bigger planes more often, and Frontier adding a route or two back to their map from the skeleton operation they’re at now.

Would be really interesting if this opened the door to Breeze running an operation out of here, but that feels like a pipe dream at this point.

the doom and gloom for AUS as a city is a bit overdone. There was a huge pandemic shift from California to Texas and that has stabilized. AUS airport and Austin the metro are still larger than they were pre-pandemic but it has made some dumb decisions and there was a lot of unsustainable fad-ism.

AA threw a bunch of darts to come up w/ many of these routes and it isn’t a surprise many are not working.

WN will pull back some and DL might start adding a few flights; they too are larger than they were pre-pandemic but they just didn’t jump on the fad-ism, focusing instead on growing its long-term position in BOS and LAX, where it became the largest carrier at both airports, and regrowing NYC.

ULCCs might add something but they don’t have the resources or finances to take on any of the big 4.

@ Gary — Apparently, I’m not the only one who thinks Austin has been ruined. It’s like San Francisco, only with 110 degree highs in the summer. You couldn’t pay me to live in the horrible place Austin has become. So sad how greed ruins things.

Austin?

Rather be in Boston.

Or anywhere else.

I just come here for the fights between Timm Dunn and whoevers website he’s on tbh

Austin’s lame and people are just now starting to realize it. A strip of a few hipster stores on South Congress isn’t enough to make a city worth visiting.

The property taxes are really high in Texas. I wouldn’t live there. It strikes me as too dry and dusty. Also I am cool. I don’t need to move somewhere trendy to be cool.

STEVE KEEP DRINKING THE DELTA JUICE!

LOL

AA better be adding flights to DFW. Maybe the AUS lounge will be a little less crowded? Looks like a lot of vacation destinations, those travelers will hopefully just switch to an airline with direct flights.

I don’t like admitting it but Gene is correct about Austin. I lived inside the city limits since SWA started serving AUS in 1977. 10 Years ago I said enough is enough and moved out of the CoA reach. The city council and taxing authorities have ruined Austin. It’s a shame . . . I miss the quiet little college town where if one wanted to see a major concert or event you had to go to Dallas. If you wanted to see Texas talent one went to places like Armadillo World Headquarters, Silver Dollar and Broken Spoke. Not all is lost though, Poodies Hilltop Bar is still open on Hwy 71 West.

Looks to me like AA can’t continue to staff regional jets. Perhaps the RJ pilots have taken UAL’s offer to direct hire into the left seat of narrow body mainline AC.

AA was probably tracking AUS scope clause compliance the same way it tracked the JFK slots it lost… by spreadsheet that some intern deleted!

“What’s going on, loading a schedule without 21 routes but actually still selling many of the flights?”

Historically, there’s been a lag between the published marketing schedule, as captured by OAG, Diio, etc. platforms, and the schedule loaded for sale into native CRS systems. Late Saturday/ Early Sunday has been the norm for most selling schedule updates – certainly for AA and UA, likely others as well – because those periods were least likely to be of (major) disruption for customer service purposes.

With regard to AUS, I both agree and disagree with Tim Dunn. WN’s position at AUS is unassailable. However, in DL’s past pronouncement regarding plans for AUS, AA saw an opportunity to solidify its position, while blocking DL from implementing any significant growth.

For naysayers – airline do engage in “reactive growth” when/where possible, particularly when competitors announce well in advance plans for particular markets. The AA/DL competition has been particularly feisty for the last 15 or 20 years, but stems back to 1981 with Crandall’s phone call to Howard Putnam about relative market position at DFW.

While AUS has been a “money-loser” for AA, there is a bit of nuance missing from the reportage. Simply, as long as AA was able to block DL with “relative” low cost lift (AA Eagle), margins in the…let’s say…. -2% to -6% range may have continued to be acceptable as strategic imperative. Even with APA pointing to scope clause provisions, AA still had the option of protecting at least some of the lift with mainline – but at (new) mainline costs that, ultimately, make the margins untenable. That exercise will involve current RASM performance (declining over the past couple of quarters), and forecasting revenue performance vis-a-vis labor CASM for – at company (revenue mgmt) discretion – a selected RASM period, and seeing the mathematical result.

Regarding the APA “Scope” clause limitation cited herein – Generally true, as reported by Messrs. Leff & JonNYC. Additionally, though mainline active fleet count is down, so too is AA Eagle active fleet count due to labor issues. That said, I believe this is a specific to AUS issue.

There are clauses attached to scope that can identify & specify – and thus limit – specific markets. As an example, in an old iteration of the AA-APA contract, San Francisco was once identified as a “focus city” (even though SFO hadn’t seen any significant AA attention for years). Any growth AA attempted there would have to have been mainline front-loaded.

As such, and as this pertains to AUS, there is language somewhere within AA corporate that signifies Austin’s corporate significance. My best guess is that AUS is now included contractually (between AA-APA) as a result. One clause within scope is what is contractually identified as ‘monopoly market flying’ (or, AA coded only nonstop service in given market). That provision limits the amount of AA Eagle service at the mutually agreed – a defined by contract – “hubs” and “focus cities”.

The nature of AA ex-AUS flying is such that not only is that schedule subject to the 40% of scheduled ASM provision, but also the monopoly market provision. AA is required to report to APA on a quarterly basis planned scheduled ASM’s

All-in-all, significant considerations in light of contractual obligations, which triggered other sets of decisions that have significant and wide-ranging consequences.

AA management = bunch of completely overpaid losers!!!!

@PDT – “AA was probably tracking AUS scope clause compliance the same way it tracked the JFK slots it lost… by spreadsheet that some intern deleted!”

Hehe!!! Wouldn’t be surprised.

Let’s hope AA doesn’t do that. We don’t want Gary on Delta all the time.

Despite what the article says, the Reno flights also got the axe. It appears the last flight for that route will be Jan 5th, ‘24.

AUS airport continues to shatter records on flights, it is still growing, but many of these routes just didn’t make a lot of sense. Like others, I suspect we will see a lot more flights and larger aircraft going to DFW, PHX, CLT and even ORD.

aaway,

AA didn’t succeed at blocking DL if DL wasn’t intending to grow any of its focus cities until this point. It is still rebuilding its hubs.

And I believe that DL has zero regional jets at AUS so AA could continue to fly the routes it “thinks” DL will add on mainline but AA’s history of doing things that end up helping DL in much bigger cities is rather long – BOS, JFK, LGA, and LAX

@BV – not ‘despite’ this is literally what I wrote

With American’s reduction in service, any speculation on whether Delta will resume building out AUS as a focus city? Of the four largest carriers, Delta is the only one without a hub in Texas.

@Charles – “….any speculation on whether Delta will resume building out AUS as a focus city? Of the four largest carriers, Delta is the only one without a hub in Texas.”

As specific to AUS, the immediate need will be relocation of the airlines housed in the South Terminal. That will permit a portion of the enabling for construction of the midfield concourse.