American Airlines Loyalty Points is the new program for how elite status is earned. You’ll be able to earn status with most of your activity in the program, not just flying. And they’ve actually created a fairly simple system, where almost everything counts and the “Loyalty Points” you earn over the course of 12 months determines your status.

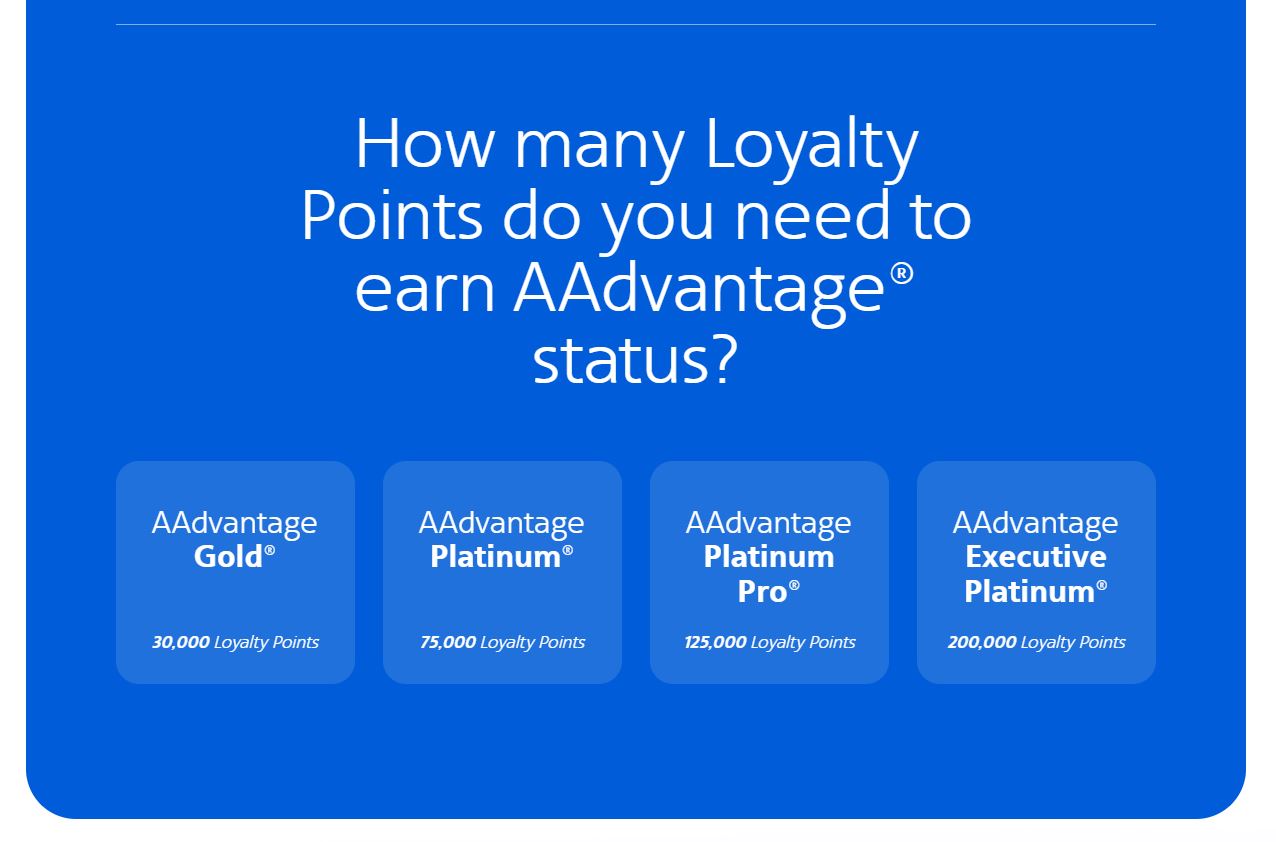

- Gold: 30,000 miles earned

- Platinum: 75,000 miles earned

- Platinum Pro: 125,000 miles earned

- Executive Platinum: 200,000 miles earned

This system is going to mean more elites, and most members will be able to qualify for the same or higher status than they’ve had in the past, although there are exceptions.

I spoke with Heather Samp, the American AAdvantage program’s Managing Director of Member Engagement, about the program.

The New Status-Earning Year Runs March Through February

The new system will be based on points earned March through February. Status will be valid through March of the following year. So if you earn 200,000 points March 2022 through February 2023, you’ll be an Executive Platinum through March 31, 2024.

Heather Samp explained that the change is a “reflection of something we’ve noticed for years,” that members are “incentivized by status, but the end of the year is the holiday period, and the last thing we want them to have to remember is to requalify for status.” She then offered that credit card statements which include the holidays generally close in January. They want holiday co-brand spend to be included at the end of an earning year.

Two Months Of Extended Status And Double Dipping

All current status is being extended through March 31, 2022. Instead of seeing elites who didn’t requalify (easy as American made it) lose their status January 31, 2022 they’re giving two more months to qualify for status, and also using those two months as a head start on earning the next year’s status too.

- Members get an extra 2 months (January and February 2022) added onto the 12 months of 2021 to earn 2022 elite status on top of their 2021 activity. It’s effectively two more months of the 2021 elite program.

- And its an extra 2 months (January and February 2022) added onto the 12 months beginning March 2022 to earn 2023 elite status by acquiring Loyalty Points..

Choice Awards Available Starting At 125,000 Loyalty Points

“Loyalty Choice Rewards” are the new name for Elite Choice Rewards, a selection of benefits like miles and confirmed international upgrades, awarded at 75,000, 100,000 qualifying miles and beyond. Earning these will come at Platinum Pro and above for members who fly at least 30 segments on American Airlines and qualifying partner airlines (oneworld, JetBlue). AAdvantage awards for travel on American count towards this 30 segment requirement.

As long as a member has 30 flight segments they’ll earn a choice of benefits at,

- 125,000 points (Platinum Pro qualification)

- 200,000 points (Executive Platinum qualification)

- 350,000 points

- 550,000 points

- 750,000 points

Options include systemwide upgrades, bonus miles, Admirals Club day passes and more to be specified. They’ll presumably offer things like an Admirals Club membership and gifting status.

What Counts As A Loyalty Point Gets A Bit Complicated

A truly simple system would say that all miles count, but so far that’s not the case. They’re saying that flights on American, oneworld airlines and JetBlue count. They’re saying credit card spend counts, as well as miles earned through their online shopping portal, Rewards Network dining partnership, and SimplyMiles count. For now though nothing else counts though they expect the list to grow. Heather samp said they’re still talking to other partners.

Unsurprisingly credit card initial bonuses don’t count as Loyalty Points. In fact it’s only base miles earned through credit card spend – category bonuses don’t help either. You may earn 3 miles per dollar spent on American Airlines with a co-brand card, but only one of those miles will be a Loyalty Point.

And ancillary spending with American Airlines generally doesn’t count. So if you pay for a seat, buy up to Main Cabin Extra, or take them up on a post-purchase upgrade offer, that spending doesn’t earn Loyalty Points. That’s because they award miles for flights based on a ticket being issued, and American Airlines ancillaries don’t attach to ticket numbers.

Heather Samp pointed out that in some sense awarding points for these would be unfair to elites, who often get these items free and thus don’t have the opportunity to earn these Loyalty Points. But since flight bonuses count (6 extra points per dollar for Executive Platinums) qualifying under this program seems substantially skewed towards existing elites rather than away from them.

This new program no longer has a minimum earning guarantee towards status (so this is the end of the 500 minimum qualifying miles guarantee for shorter flights). However Basic Economy tickets will earn Loyalty Points. They only just eliminated Basic Economy earning towards elite status for 2021.

Specifically excluded from Loyalty Points are purchased, transferred and gifted points; credit card earning accelerators, multipliers, and acquisition bonuses as well as other promotional bonuses.

American Airlines Loyalty Points Will Determine Upgrade Priority

Currently American Airlines awards upgrades based on elite status and then rolling 12 month qualifying dollars. In other words, the more you spend the higher on the upgrade list you’ll be.

Since elite qualifying dollars are going away, upgrade priority is changing. Loyalty Points will be used as the upgrade tie-breaker instead of qualifying dollars.

The brilliance here is that every dollar of spend on their cards potentially improves a cardmember’s upgrade chances. Previously only Barclays cards earned qualifying dollars, and only at specific dollar thresholds ($25,000 for business, $50,000 for Aviator Silver). The amounts were out of reach for some, provided no reason to stretch beyond for others.

To determine your initial Loyalty Points in the program (for upgrade purposes only) they’ll take your rolling ‘EQD’ total as of February 28 times value times your elite status bonus.

Gold and Platinum members who earn 500-mile upgrades from their flying will have their clock reset March 31, 2022 instead of January 31, 2022. American hasn’t said whether earning 500 mile upgrades will change at all in this new system.

Miles Flown Still Matters

There’s one dimension in which miles flown will still matter for elite status: lifetime status. That’s still granted after 1 million miles (Gold) and 2 million miles (Platinum) with additional rewards for each incremental million miles.

American AAdvantage knows their lifetime status offering is uncompetitive (topping out as it does as Platinum status) and was looking at ways of fixing this prior to the pandemic. Hopefully that project still moves forward.

No Devaluation Coming

I’d heard about other changes that the program was working on and those had me nervous. After all the former head of the program said that award charts were on the way out. Apparently the other projects have been put on ice.

There’s no redemption changes being announced today. And Heather Samp says any other big changes won’t be “a 2022 thing.”

Some Elite Qualifying Scenarios

At an earn rate of 11 miles per dollar spent on flights, an Executive Platinum member would need just over $18,000 in flight spend to keep their status. That’s higher than today’s ‘normal year’ $15,000 spending requirement. And it’s about what United requires. But that’s without adding in a single mile from credit cards, online shopping portal, etc.

Take my 2019. I spent $40,000 on the premium Citi card and $50,000 on the Barclays Aviator Silver in order to earn 20,000 qualifying miles and $3000 qualifying dollars. That meant I needed to fly 80,000 miles and spend $12,000 to keep my Executive Platinum status. With that same $90,000 card spend (and no shopping portal or other relevant earn), I’d need to spend $10,000 to keep Executive Platinum with no mileage requirement.

Put another way I was earning 20% of my qualifying miles and 20% of my qualifying dollars from credit card spend. Going forward the same spend will earn 45% of the way to Executive Platinum.

On the other hand, though, someone starting with no status and earning Executive Platinum has a potentially long and expensive road. If they did it on flying alone it would take $27,012 worth of tickets.

- $6000 spend to earn Gold (at 5 miles per dollar to earn 30,000 points)

- $6429 more spend to earn Platinum (the next 45,000 points at 7 miles/dollar)

- $6250 more spend to earn Platinum Pro (the next 50,000 points at 9 miles/dollar)

- $8333 more spend to earn Executive Platinum (the next 75,000 points at 11 miles/dollar)

In this new program it’s easier to keep status from flying than it is to earn new status since a base member earns just 5 miles per dollar until they become a Gold, and elite flying bonuses grow with each higher tier. And the high cost of status using flying alone is also the point, since other forms of activity are frequently higher margin.

It is also worth noting that card and other partner activity goes relatively farther for lower-status elites because flights earn less for those elites.

Thing about Gold, the lowest level of status. $30,000 in credit card spend will earn Gold in this new system. It used to take $40,000 of spend to earn 10,000 qualifying miles (40% of the way to Gold, but without helping with qualifying dollars). For non-flyers low levels of status are easy(ish), and for big spenders high levels of status are easy. Bottom-line is that the program rewards a mix of spend and flying more than flying alone.

American Airlines Loyalty Points Are Fairly Revolutionary

A year ago I wrote that it’s time for airlines to award elite status based on non-flight activity. Today it’s possible to earn status on Air Canada and other airlines with nothing but non-flight activity. That’s usually limited to the lowest-tier of status. US Airways (whose management now runs American) experimented with this at the end of 2006. I was surprised it never caught on until now.

Frankly there’s just not been a lot of innovation in the U.S. airline loyalty space in several years, except for finding ways to require more of customers while giving them less. This is one of the more interesting things we’ve seen in awhile.

Seven years ago (and indeed even earlier) I wrote about why the highest ticket revenue passengers aren’t the best or most profitable customers. The salient points were that,

- Many corporate customers bought tickets because of a sales agreement, many business travelers bought tickets because an airline offered the only non-stop on the route, and rewarding those customers more for their flying spent money on them without incremental return to the business.

- On the other hand airlines don’t do a good job rewarding higher margin activities like co-brand credit card spend, buying seat upgrades, and engaging with other partners who buy miles at higher prices than the banks do.

The simplicity of “everything counts” is fantastic and recognizes the highly profitable role ancillary mileage sales play at the airline. Prior to the pandemic the profitability of the airline was almost entirely attributed to the AAdvantage program. Only everything doesn’t yet count, and I surmise they’re trying to extract additional revenue from partners to award Loyalty Points and not just miles for transactions – the question of exactly what counts is still up in the air beyond flying, credit cards, online shopping portal, SimplyMiles, and dining.

Making qualification run March through February, an transaction dates on partner activity (shipping dates rather than purchase dates on merchandise, statement close dates rather than spend dates for credit cards) is going to be confusing.

So it seems like there’s still some work to do on the program but this seems like a bold step, and that alone energizes me a bit about the program.

American Airlines Loyalty Points – Good Or Bad For Members?

There are going to be a lot of people earning status off of credit card spending alone (though without 30 flights they won’t earn choice benefits like systemwide upgrades). There’s a reason that back when American used to award lifetime elite status based on all miles earned in an account people were becoming 70 million milers… business credit cards, and big business expense reimbursements off of consumer cards.

Overall this is going to mean more elite members. Heather Samp explained that it’s not clear yet how 2019-style flying returns, and what routes or even travel days are elite heavy. The Monday-out, Thursday-back flying may not be the same. They think that elites will be more spread out across their system on this program, not all flying the 5 p.m. Thursday LaGuardia – Dallas Fort Worth flight. But she acknowledges that the elite “population may grow,” but thinks they’re well-positioned to handle that growth.

A lot of members are going to benefit from the new American Airlines Loyalty Points program for earning status. A few won’t like it. But if this is it, and we keep our award charts and most importantly partner award pricing, then it seems like a pretty good outcome. And they’ve broken out of he box of ‘doing what everyone else does’ and I have to like that.

A lot to digest please keep updating this post as you analyze further

Any word on Bask?

Lots of mentions of “fair” here. However, as a global airline, how is it “fair” that “everything counts” when “everything” = flights only in markets like the UK / APAC where there are no co-branded AAdvantage credit cards!??! Major weakness and UNFAIR bias IMO

Thanks Gary. Any word on Citi Thank You transfers to AA? I believe the trial run ends next week, right?

So $200,000 in spend on AA cards gives me EXP? Do I need any flights?

Will award flights and or award flights on jetBlue count towards the 30 segment minimum? How do partner flights earn loyalty points? Are other oneworld carriers communicating the dollar amount you spent? Additionally just to clarify, the redeemable miles you earn and the miles required for status are now completely disconnected from the distance flown?

1

Lost Cash Back 2.625% = 200k spend = 200,000×2.625= $5125

Value of AA mile never above 1c nowadays except partner awards

So real cost 3125 for 2 yrs if you do it by MS in March 2022

About 150 a month for free upgrades and a free drink on AA while in economy

hhmmm…….

I think if they cared for partners spend, they would have given a lower value to miles on free or low cost AA cards and more value on miles from Citi Exec – and raised the fee on exec to 1000$ to account for the free lounge – but I am giving too much thought

2

Overall not much different from DL process but a bit cheaper

There 250k spend + 2 reserve cards @ 600 each gets DM = 125k MQM

250k spend = lost cash $6562+1200 for 2 cards = $7762

Less 2500$ in value of DL miles (max value at pay with miles) = $5262 for 2 yrs of DM

As a non US frequent flier whose country banks dont offer an attractive cobranded AA credit card and makes his status only flying, these news give me anxiety.

Please gently remind them to look at lifetime status – they are indeed not competitive.

First thoughts: 1.) too complicated. 2.) Too hard for me as a DL Diamond to move over to AA and qualify for the higher ranks in this system. 3.) Needing to fly 30 segments is more onerous on hub dwellers than for people who don’t live in hubs, where one RT typically yields 4 segments.

It’s finally gone, rewarding “frequently flyers” for actually flying. The idea of rewarding and making the act of flying a little bit easier for the people who frequently fly the airline is dead. Now any corporate credit card number is prioritized for their once a year flight over the frequent flyer. Welcome the age of the Frequent Buyers Program.

Agreed, too complicated as well.

So in theory as a contractor:

– Earn 1 loyalty point per $1 spent on AA card

– Earn .5 to 4 loyalty points per $1 via shopping portal purchases at Home Depot/Lowes

I’d be able to earn EXP after just $100k in materials costs. That seems too easy.

@ Gary — 30 segments? Been EXP forever and stopped flying 30 segments with AA years ago. QR paid business WAS the way to go.

Seems like most earning top status will be those (like you Gary) who can put $90,000 on a credit card, while most people will look at this as a steep hill to climb and choose some other carrier. As you note, a very high cost to entry if you have no status. Seems like a poor way to market. I actually think that because of this last fact, they will end up with less elites not more.

I don’t understand complaints that this is too complicated. The current EQD plus EQM or segments is ridiculously complicated, especially with various/conflicting thresholds for bonuses on the various credit cards from two different issuers!

Wish they would count Bask Bank miles too!

I’m so confused! LOL So basically it’s harder for elites to earn via flying the old fashioned way but easier for credit card people? Meow? So we’re back in the 90s!

Any word on bask bank?? thanks!

Gary – I have both the AA lounge access card from Citi and the barclays Silver card, I see no reason to keep the Barclays card going forward. Am I correct?

They forgot to rebrand this to: American Advantage Frequent Buyer Program.

@JFKPHL – probably doesn’t make sense to keep both since spending on either counts the same way at this point (I had both to earn qualifying miles on both plus qualifying dollars from aviator silver),personally I have both and will keep them until I see what card changes come with cobrand deal renewal.

@Sam Murthy – none yet, not all of the deals on this are inked yet

Honestly, I do not understand why AA is putting so much emphasis on CC spending? How much they are getting for selling 1 mile to City? $0.01 or less? Is this the only way AA makes money nowadays?

@Edward – boy, I agree! I put my quarterly tax payments and property tax into a bask savings account until those need to be paid

@Glenn (The Military Frequent Flyer) – not sure I agree, *most* current Executive Platinum members spend more than the required $15,000 minimum, so increasing that to $18,100ish to requalify without any card or other activity doesn’t mean *most* flying-only members drop out.

@Gene – QR segments will count

@Jim Baround – correct, 200k spend on cobrands = EXP but you won’t earn choice rewards like systemwide upgrades without at least 30 flights on some combination of AA + oneworld partners + JetBlue

@Daniel – no word on their continuation, I wonder if we might need to wait to see what happens with a cobrand deal extension?

@Leo Fig – AA does have cobrands in many markets though fwiw

Great analysis Mr. Leff

Thank You

So the first bullet point on the AA news release is “American is eliminating complicated elite qualifying metrics, introducing Loyalty Points where one qualifying AAdvantage® mile earned equals one Loyalty Point.” YET 2 miles earned on an AA card ONLY EQUALS 1 LOYALTY POINT WTF?!?!?!

Also how come if you do have status you don’t get the Loyalty points bonus on spend. So if you’re an EXPLAT you’d get 2.4 Loyalty points per dollar spent on their CC.

Gary, how will premium econ/business/first revenue tickets accrue loyalty points? Will they continue to earn 1.5/2/3 EQMs/points ?

This week I’ll have ~85,000 butt-in-seat EQMs in my account (not including bonuses and 500-mile minimums), and $16k spend, so I qualified for EXP weeks ago with the reduced metrics. Based on the double-dip for Jan-Feb I think EXP for 2023 shouldn’t be a problem. But I only spend ~$50k on credit cards, so getting to 200k points after that is going to be tough. Bonuses on paid business and first would probably push me over the top, otherwise I may be dropping back to Plat Pro.

Give it to American to continue to implement ways that devalue the benefit of lifetime elite status in the airline. At least AA didn’t jump in and say “AAdvantage is dead, and along with it is the death of lifetime elite status in AAdvantage and the airline”.

Wow, great work, Gary!

It does seem like butt in seat flying and heads in beds hotel nights continues to not matter as much.

@Diego Dave – yes premium fares still earn at a higher rate, for instance when flying American it’s based on fare and when flying partners it’s a multiplier of distance based on fare class

For simplicity take your $16,000 spend and say it’s on American Airlines. You’ll be an Executive Platinum, that earns 176,000 points. With $50k credit card spend (no online shopping, no dining, no SimplyMiles) that gets you 226,000 points – more than 10% above the threshold needed to keep Executive Platinum.

@Scott – the simplicity seems to be only using a single metric (loyalty points) rather than (qualifying miles OR segments) AND qualifying dollars…. not that loyalty points are themselves totally simple 🙂

What is a Bask Savings Account?

Thanks.

Gary – Is the “Platinum for life” status (with 4 million miles flown in the past) gone by the wayside? Your lengthy discourse may have addressed that issue. My travel frequency has hit the skids. and I was curious if the benefits that went with my Platinum for life status have withered away. Please

@Nellapalli Dharmarajan – there are no changes at this point to the lifetime elite status program

@Maria Rychlicki – see https://viewfromthewing.com/bask-bank-savings-account-earn-miles-for-saving-money/ .. you earn miles instead of interest for your savings account

Maybe I missed it, but will this work with status challenges?

.

The only way to win is NOT to play the game

Will be interesting to see what benefits are replaced on the Citi and Barclay cards now that some benefits are essentially worthless

Right now, everyone is wringing their hands wondering how their own situation will pan out. My sense is that for most individuals — you can’t please them all — elite status will be easier to come by and to track. So, everyone take a deep breath, go on with life, and then check back in a year. At the end of that year, I think most individuals will be happy.

(None of these changes have an effect on my status with AA, so I’m not speaking from a self-interested position.)

@Gary_Leff,

Regarding your comment about “premium fares still earn at a higher rate.” that seems not true for AA flights since the Eligible Miles are based on dollars spent, regardless of cabin, correct?

It would matter on partners, as you say. Seems that, unless rules change, it would matter for Special Fares, even if on AA, since that is distance and fare-class (not just cabin) based as well. It will be interesting to see if there are any changes here.

Cheers.

WTH, did Marriott and AA get together to make 10/26 the “F the loyalist” day!?!?

A quick back-of-the-envelope calculation shows that this is sort of a bad deal for me – having qualified for PlatPro status this year using the EQD waiver via CitiCards and the 10,000 mile EQM bonus, meaning I only had to squeeze out 50,000 EQM this year for only a little over $4400 actual EQD, and some of that was boosted by using AAVacations.

Prorating my spend this year to the normal 75,000 mile requirement means I would have had to spend $6650 on travel. That’ll be worth 66,500 Loyalty Points, plus a few more for airline taxes on the card. That’ll still leave an additional $57,000 or so spend on the card, which if I route all my CC spending through the card, might be possible. Which may be what they’re trying to achieve.

It’ll be interesting to see what other wrinkles get added, like the AAVacations one for EQD, that may make this more attractive. Personally, I think they’re going to have to add in earning 1 point per mile earned on the card, not just the base, for AA purchases, as it’s confusing, and it would make the program a lot more attractive.

Wow its gonna be insanely easy (and cheap) to get EXP with manufactured spending.

Crazy.