American Airlines stock has gone up substantially more than airline peers over the last 12 months.

CEO Doug Parker highlighted this in an employee meeting following the carrier’s third quarter earnings call on Thursday. However rather than being a testament to the airline’s good works as he suggests, there’s a simple reason for the growth in share price.

Shares fell more than other airlines at the start of the pandemic, because no airline was a bigger bankruptcy risk – potentially wiping out the value of the stock. Performance improved once the second airline bailout happened, and then the third, putting American in a position to avoid restructuring. Shares fell more than peers before 12 months ago and had more room to risk once bankruptcy risk was reduced.

This is a story about subsidies and bankruptcy, not about having better financial prospects than Delta, United and Southwest.

Here’s what Parker told employees at the State Of The Airline employee presentation last week:

I put this in just to, and I’m going to caveat it, this is just to show you all what our stock has done over this time. Stock prices are not the best indicator of performance. Sometimes they are, sometimes they aren’t. So we shouldn’t put too much credit in this. They’re long enough periods that I think they are relevant.

And the real point that I am trying to make is what a great job this team is doing during the pandemic. So anyway, stock can be a reasonable proxy for that and if so the market agrees that we are doing better than others.

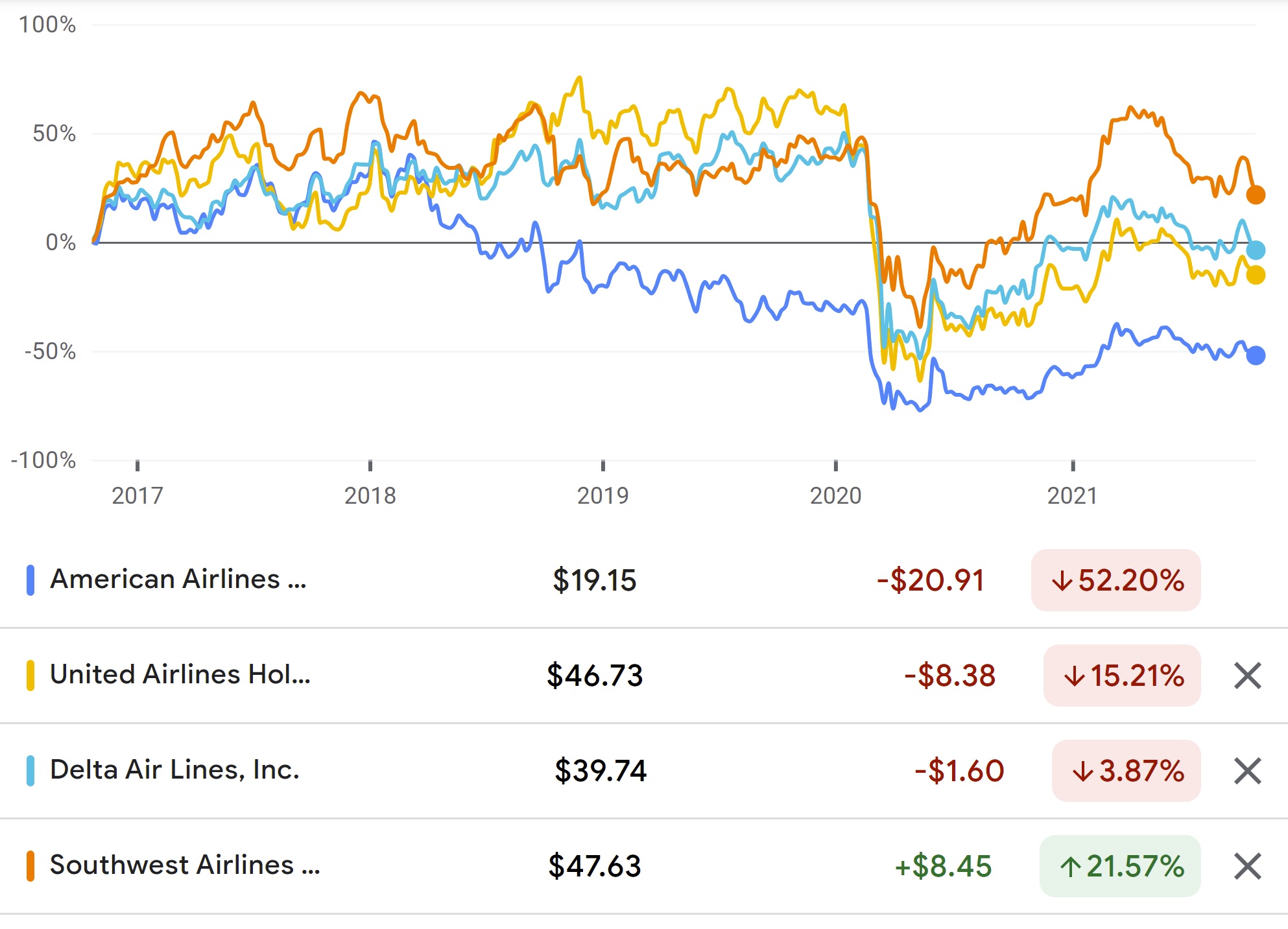

…If you take today’s price and look exactly a year ago, that’s what the returns are American’s up 56%, everyone’s up a good bit but no one’s up as much as us. And then on a year-to-date basis, just start on January 1st and then run it so far this year, you see we’re up 24% well more than the others. Again I don’t want to put a lot into that but I wanted to use that as a way to point out that others are seeing what we know, that no one’s doing a better job of managing this pandemic than the American Airlines team.

If you look at the last 12 months’ stock performance, Parker is right:

Let’s take a longer view. Here’s the five year performance of American Airlines stock, which is far below that of peers in the industry. You’ll see that American Airlines stock dropped the most during the pandemic. American Airlines was the number one airline bankruptcy risk with credit default swaps pricing a debt default above 80% likelihood within 5 years.

From the above charts you’ll see that things began to turn around for American Airline stock in January. That’s following the passage of the Consolidated Appropriations Act 2021, the $900 billion Covid relief package that contained the second round of airline subsidies.

At the point airlines received the second and third rounds of ‘payroll support’ it was clear how many jobs were at risk of being lost, since we know how many people were furloughed in October once restrictions on doing so from the first bailout were lifted.

Fewer than 40,000 employees went on furlough industry-wide, and even that number is high because by then many were on their way back. However using the most generous assumptions to the airlines these subsidies cost taxpayers over $750,000 annualized per job.

Put another way, only around 13% of so-called payroll support went to fund jobs at risk of loss while the rest went to shareholders and creditors – keeping airlines out of bankruptcy, and especially American Airlines. They also managed to raise $10 billion by mortgaging its AAdvantage frequent flyer program and paying back the $5.5 billion subsidized loan they took from the U.S. government against the loyalty business.

American Airlines stock has risen most in the last year because its risk of bankruptcy has fallen the most, meaning owning a share of American Airlines stock carries less risk of being wiped out at the courthouse.

American was never going to go willingly into Chapter 11. CEO Doug Parker owns over 2 million shares. However taxpayer money means that it can continue to limp along with higher costs and more debt for quite some time. Indeed, they’re currently carrying $18 billion in liquidity.

In any event, Doug Parker has rather anachronistic views about how the market values stocks.

One can generally prove anything in the stock market by looking backwards, you just have to pick your starting point. But you can only buy a stock today or in the future, not yesterday. That’s the key question that everyone wants the answer to – given everything you know, do you buy today, at today’s price? If you already own it, same question – would you buy it today at today’s price?

FWIW, although I know the above rules, I’m really bad at this because it’s really, really hard and takes a lot of time to “know” the answer. It’s why I turned my portfolio over to a professional money manager after selling one too winner way before their time and riding one too many loser into the ground. It’s been a very expensive lesson.

You should stick to articles about loyalty programs and leave the finance analysis aside.

I rather enjoyed the analysis. It’s a classic example of the starting point bias. Given the right starting point date, you can often prove a point in the market.

Credit Suisse has a sub-index of the, pardon the description, shittiest stocks. It’s greatly outperformed most indices of actual well-run companies(cash flow, ROE, EBITDA etc…) over the last 12-15 months(no, I do not have a link). Maybe it’s the gang at Reddit of whatever but it’s relatively well documented

Think AA is one of those.

Never invest in airline stocks. They are trash. Trade them if you must, but don’t invest.

I love American Airlines I have over 27000 miles and counting I went to Las Vegas twice this year and going to last Vegas and Jamaica next year feb

It is misleading and completely false to say the payroll support went to shareholders. To be clear, not a single penny went to shareholders and is expressly prohibited by the terms of the support.

Gary Leff is a complete joke, trying to make a living by hating AA.

American airlines should suck my large penis.

What dumb and shallow analysis you did…. Please focus in the loyalty business not in economy and stock market forecasting.

For those who say ‘I’m wrong’ you might actually try to explain *why*…