Capital One Travel could revolutionize airfare booking, and certainly in the credit card rewards space. There has been very little innovation in online travel agency booking in the past decade. That’s a shame because travel is confusing, the rules are complicated, and there’s no one really offering good guidance to most travelers out there.

It’s usually a good idea to book travel directly with an airline (so no one is in the middle when you need help, since online agencies are almost never your advocate), and with hotels (because you’ll give up points and status credits otherwise, plus some hotels will give you lesser rooms).

Credit card companies have their own travel portals, but those are generally outsourced to the same companies that do it badly elsewhere on the internet. Capital One is looking to change that, and if they deliver on what they’re talking about they might just succeed.

Capital One made a $170 million investment in Hopper, the online booking service which uses machine learning to guide customers on when it’s the best time to buy a plane ticket. And they’re partnered with Hopper to roll out their new online travel tool which will layer Hopper’s prediction analytics with guarantees for the traveler. They’re offering the most guarantees of any places customers might book online – all while letting them use their points to pay for travel if they wish.

The system is launching in beta, with not all features available on day one. And it’ll start out available “in the coming weeks” just to Venture, VentureOne, Spark Miles and Walmart cardmembers although executives tell me that they may grow access more broadly. It’s good to start in a more limited fashion and make sure they’re ready to scale.

Capital One Works To Get You The Best Prices On Airfare

Capital One is about to roll out its new travel portal that should make booking airfare really attractive. And it’s available to cardmembers of specific products whether buying paid travel or using their points (to buy paid airfare). Of course those earning Capital One miles can still transfer their points to a variety of airline and hotel programs.

Key features:

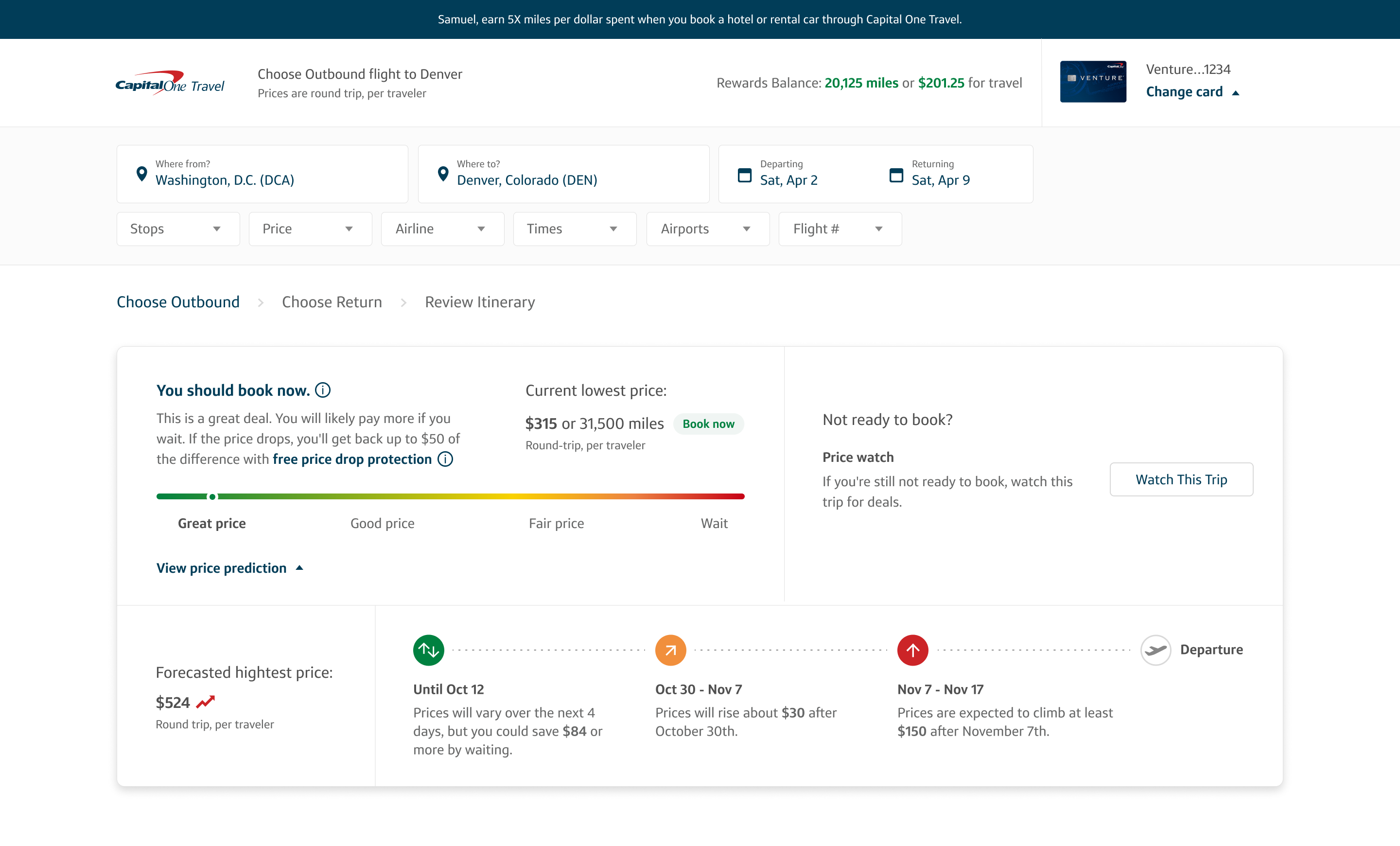

- See which dates cheapest: this is something many online travel agencies offer, a grid to show where you’ll find cheaper travel if you have flexibility in when you fly.

- Price prediction: this is the basic Hopper integration, they believe they are 95% accurate in being able to flag for customers when fares will likely go down or at least not change. Most travel booking sites (at least the OTAs) are geared towards making the immediate sale. Here they’ll often actually be encouraging customers to wait to book and setting up a “watch this trip” alert to prompt cardmembers about the best time to buy. They say they can save an average of 15% per flight.

- Price drop protection: they’ve provide a refund of the difference if they’ve told you to buy but the price drops further within 10 days.

- Price match guarantee: for 24 hours, not just on airfare but hotels and rental cars too.

They also have a best price guarantee against “Expedia, Orbitz and other travel booking sites” for hotels and adjusts their own pricing to ensure they compare as well or better.

This is a beta launch, with not all features available yet. Over “the coming months” they’ll add:

- Cancel for any reason travel insurance as a paid offering to get 80% of purchase price back up to 24 hours prior to departure.

- Price freeze: as a paid option to lock in price for 14 days without purchasing. If the price rises you can purchase the ticket and then Capital One reimburses the difference (“up to a maximum refund limit”).

Booking hotels and rental cars through Capital One Travel earns 5 miles per dollar in their program. There’s far less margin in airfare, and there’s no reward right now for booking air that way though Capital One tells me they’re “evaluating earn categories,” and that some earning for air is still a possibility.

What If Their Price Prediction Is Wrong?

Capital One is offering Hopper-powered AI advice on when to book trips and believes they’ll save customers an average of 15% on their airfare. But this advice is not guaranteed. Customers will be able to pay for price protection and eliminate their risk here. The service is also being provided by a credit card company to its cardholders, so I wouldn’t be surprised if good card customers can get some additional help here on an exception basis.

However it’s certainly possible that a customer follows Hopper’s advice, doesn’t pay for price protection, and sees fares rise. If the system has 95% accuracy predicting prices stay the same or go down, that means 5% of the time prices will rise. That’ll be fantastic if they can maintain this level of accuracy even as revenue management algorithms change due to changed consumer purchasing patterns in the pandemic, but people will frequently focus on the few losses rather than the vast majority of gains. It’s human nature.

The Best Place To Buy Airfare?

If Capital One is able to deliver on customer service – and they think they can – then their travel portal seems like it could become the best place to book air travel (whether for cash or with their points) and even a reason to be a Capital One cardmember for those who travel but who may not track prices and do their own analytics in their head.

Customer service is one of the biggest drawbacks to online travel agency sites. Calling an airline can be frustrating enough, with hours-long hold times (try their English-speaking international call centers like Delta Singapore or American Airlines Australia or U.K.). Calling an online agency like Expedia can be worse with long hold times to reach unempowered agents who themselves have to go on hold to check with sueprvisors on most requests and in my experience are even less helpful.

Capital One naturally wants customers to use self service, and their fresh website should help with that, but they tell me they’re “partnering with Hopper for a dedicated call center” – they have their own agents dedicated to the project – it will start off as international call centers, though they are “exploring adding domestic.” They’re confident they have the resources they need and emphasize that their agents are “trained for all tasks” so customers won’t wait for an agent, explain their problem, only to have to be transferred to another agent, wait, and start over.

Only use will tell if they’ve gotten staffing right to deliver great service. If they have, then the pricing features should make air booking through their portal really attractive.

For those without a Capital One card remember that Hopper itself offers price prediction, and with no change fees on most non-basic economy tickets you can always buy airfare and watch for price drops later. Then if the price falls, cancel your trip and use the credit to rebook – generally pocketing the difference as a voucher for a future trip.

Where Online Travel Booking Should Go Next

Right now there’s very little value-added booking hotels or rental cars through the Capital One site, and of course you can use their points to ‘erase’ the cost of purchases you make on travel elsewhere.

Booking hotels through their portal usually means giving up hotel loyalty points, elite status benefits, and credit towards earning status. Although they may offer better ‘private’ pricing than hotel websites will have, since this is a membership website they can pass along lower rates and aren’t bound to price parity rules (and hotel ‘best rate guarantees’ won’t generally apply).

Perhaps Capital One should acquire HotelSlash which tracks hotel prices and tells customers when to rebook their reservations to accompany Hopper’s price prediction tools, or acquire the discounting and price prediction technology behind sister service AutoSlash, although rental companies haven’t looked kindly on the latter.

Even in airline bookings there’s real progress to be made. The focus of traveler advice in the Capital One booking portal is price and there’s no question that’s important, but it’s not the only thing that matters for a great trip.

- What schedule is best for the traveler? Is an hour enough time to connect in Chicago during wintertime? What flights are most likely to be delayed? Which ones will have the best backup options in the event of delay? Capital One by the way offers more travel protections for using their cards than Citibank or Barclays products, though Chase still offers rich features in this category.

- Routehappy pioneered richer information for flights, and they’ve been acquired by ATPCO. It’s possible to show what amenities flights will have, from wifi to power, and help customers figure out what experiences are going to matter on the plane so they pick the right experience. Plus do they want extra legroom seats? And how much legroom is that? Is it possible to implement Routehappy data feeds, and adopt technologies to allow selling airline ancillary products like extra legroom, and marry that with the kind of seating advice charts available via SeatGuru? And do it all in a way that’s less complicated, rather than information overload?

The bottom line is that travelers lost real guidance from agents when airline bookings went online, and that hasn’t been replaced by online travel websites. There’s been little innovation in the space and it’s ripe for disruption. Hopper is part of the solution, and the Capital One travel portal once live may be a step up providing added value to cardmembers. And I’m excited about it because it seems liek the beginning of a potential journey where travel is made less complicated and overwhelming for the average customer – although in the long run that could put me out of business!

@ Gary — Mark me very skeptical of anything rolled out by Capital One. Plus, if they can develop AI to save 15%, the airlines can develop AI to charge 15% more. This will be great for AI software developers, and of course bad for consumers, just like pretty much everything else in our society.

Just another upcoming source of customer service complaints. I can’t remember the last time I used a 3rd party company for a booking, since resolution of problems or cancellations is such a hassle. No thanks.

The 10X rewards partnership of http://hotels.com/venture didn’t last long. I’ll be curious to learn what comes of this. Thanks for the rundown!

What could possibly go wrong?

I too remain a skeptic

They are dishonest and criminal in business behavior equal or worse than Bank of America

And good luck to disputing something if it’s something they sold you

Remember when they offered a big sign up bonus years ago then devalued redemptions

Never returned

Hopper has been around for 10+ years, raised $1B+ dollars, and has switched their business model numerous times over the years depending on what is hot (now they are on the AI train), yet I do not know a single person who has ever used them to book travel. The whole thing is very suspicious.

The AI prediction is mostly BS. It’s mostly just programmed when AP requirements are about to expire and predicts the fare to go up.

Capitol One saving 15%? What a joke! From the worst CC company out there!

Hopper has most recently pivoted from a travel company to a fintech company. If you look at their recent financing round, job listings, etc. all they talk about is how they can upsell consumers on paid services like insurance, price freezes, etc.

Their AI could certainly be used as a predictive tool to help consumers, and they certainly will push that angle, but what they are selling as the future of the company is these add-on services for an incremental fee, which, ostensibly, will be used to subsidize any of these “free” services they offer to the consumer.

Capital One is quite savvy and they will publicly talk about the consumer benefits, but as a shareholder in Hopper, and a beneficiary of any add-on sales made through their platform facilitated by Hopper, they are salivating at the opportunity to push these high-margin products to their customer base. Certainly, neither one of them is going to get rich off the airfare commissions.

Welcome to murree online hotels booking get online hotels rooms booking at murreehotelsbooking.com or +923083003888. We provide online cheap, VIP, and Luxury hotels room booking with a low budget in Murree during the winter season Murree. Come and enjoy the winter season with extreme pleasure. Contact us now {+92-308-3003888} and get the best online hotel room booking services