I receive compensation for content and many links on this blog. Be aware that websites may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. Citibank is an advertising partner of this site, as is American Express, Chase, and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

I’m liking Citi Travel – Citibank’s online booking portal – more and more. I used to avoid it, because as an ‘OTA’ it meant that hotels I’d book wouldn’t receive loyalty points or elite status benefits. But with Citi Strata EliteSM Card (See rates and fees) coming with a $300 hotel credit to be used there, and earning 12x on hotels paid through Citi Travel, I’ve been looking at it more closely and I see a real use.

American Express Fine Hotels and Resorts and Hotel Collection bookings generally earn hotel loyalty points. So do Chase ‘The Edit’ bookings. And many Bilt Rewards travel bookings do, too. (You can even book flights through Bilt travel and earn points – which is amazing – and many of those are flagged as direct bookings so you still get customer service from the airline.)

Citi Travel is more like a traditional OTA, so had been on my avoid list. However,

- Each year, the Citi Strata EliteSM Card offers a $300 hotel credit for stays of two or more nights that are prepaid through Citi Travel. (Prepaid rates can still be cancellable and refundable.)

The credit must be redeemed by the primary cardmember and is by calendar year (based on when you book, not the dates of your stay).

$300 will be applied to your booking when you make the reservation – it’s not a statement credit that posts later. You can also use it across multiple transactions, e.g. if you had a 2-night stay that totaled only $200 you’d still have $100 to use later.

- The card earns 12x on hotels you use it to pay for with Citi Travel. And I thought 8x through Chase Travel with Sapphire Reserve was impressive!

So here’s what I’ve been seeing: I find that hotels are often cheaper booked through Citi Travel. That’s not always going to be true! But they aren’t just beating Expedia. They’re beating book direct ‘member rates’, too. Here’s an example from the Marriott LaGuardia airport.

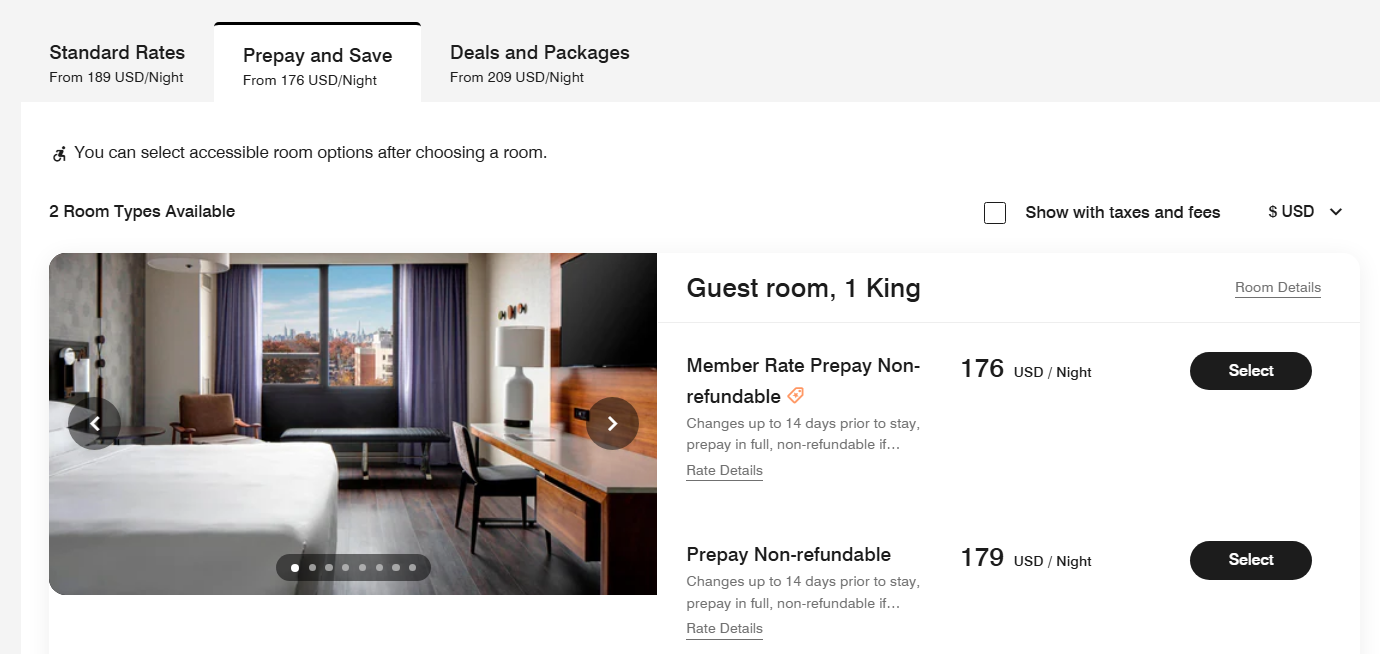

Comparing like-to-like without taxes, Citi Travel was charging $156 while Marriott.com showed the cheapest room Member Rate at $176:

That’s $20 per night difference. Now, if you’re a Marriott Platinum you have to decide whether you value the benefits. But Citi Travel isn’t just a place you book non-chain hotels to use the $300 credit where you wouldn’t get points and status benefits anyway. It’s a place to compare prices.

I suspect what’s happening here is that Citi Travel gets wholesale rates and isn’t marking them up all the way to retail.

- Normally you expect to see price parity. They use not just commission but the difference in rates to help fund that travel credit and 12x earn.

- You do see sites like HotelSlash getting wholesale rates and passing savings on to the customer. They can do this because they’re a ‘membership site’ rather than making bookings available openly to all. Citi Travel counts as this, too.

- Citi may be underpricing by accident! They may not be getting a good data feed on current, correct pricing. I’m watching to see if they sometimes overprice, too.

Whether by mistake or on purpose I’ve been seeing some hotels priced less expensively at Citi Travel than booking direct, which seems worth knowing.

Oof. Nope. Citi Travel is literally the worst portal of the major credit card companies. Amex and Chase knock it out of the park compared to Shiti.

Gary, I literally haven’t used the 4th night free benefit except for once in the last 7 years, despite trying like 5 different times, because the prices have been consistently ~20% higher than what I could find on a member website or even other card OTAs (Chase, Cap One, etc). I’ll pay closer attention, but I have literally NEVER found what you are describing to be the case.

On the multiplier – 12x is very good, no question about it. But Rakuten almost always has one or more OTAs at 10x (today’s winners are Expedia and Hotels.com) and combine that with any 2x card, it should be routine for everyone at this point to get 12x on your hotel bookings. Admittedly, you’ll get that 12x sooner with Citi versus waiting a few weeks after the travel date with Rakuten, so there’s a real advantage there.

On the travel provider – Citi uses Rocket Travel by Agoda. So does… AA Hotels (not surprising given AA/Citi partnership). Personally I’d rather take 10x with the AA Executive Card plus the often very good number of AA miles/LPs that AA Hotels offers (if you have any AA card and any AA status) versus Citi Travel.

But anyone can get a Strata Elite (link above!) – you have to work to get AA Gold status (just ask LALF…).

@1990 — Oh man, that can’t be good – I’m already muttering “mediocre” using the Chase portal…

@L737 — ‘Witness me…’ attempt to double-up on the $250 credits for both The Edit and IHG on a two-night stay… *sprays chrome* ‘I am awaited in Valhalla…’ (which, is a Six Senses, apparently.)

Re: Prestige comments I used the 4th night free on my Citi Prestige just last night. The 4th night free was totally useless until a few months ago. Now it’s like the olden times. To get 4th night + 10x TY points on the Prestige is massive. I think 12 TY P + $300 on the Strata P is dope. That’s a huge rebate to the consumer. I think the Citi portal is fine. I want the biggest discount in cash or rebate in points that I can get. Citi does that.

The sweet spot here would be to book Citi Reserve hotels through the portal to enjoy the $300 credit, similar to AMEX FHR and Chase Sapphire Reserve the Edit. The problem is that there are almost no Citi Reserve hotels on the portal – the selection is completely lacking compared to AMEX and Chase – it’s basically useless. I really wish that you would do a post on this Gary – it’s weird that you write about how amazing the Citi Strata Elite is all the time but never post about the Citi Reserve collection.

@1990 — “Oh sirrah, how deliciously absurd!”

@L737 — As long as those statement credits post timely, I’ll… ‘apologize for nothing!’