Star Alliance carrier Singapore Airlines is letting members earn status credits for things other than flying through February 2022. In addition current Singapore elites earn double status credits for qualifying spend through KrisShop, KrisFlyer Spree and at Kris+ partners.

Current non-status members can earn silver or gold status without ever flying. PPS Club members can renew that status or upgrade to Solitaire PPS Club this way as well.

| Activity | PPS Club | Elite Status |

| KrisShop | 1 PPS Value for every SGD 1 spent4 | 3 Elite miles for every SGD 1 spent4 |

| Kris+ | 1 PPS Value for every SGD 1 spent | 3 Elite miles for every SGD 1 spent |

| Conversion of 10K+ Bank Points to KrisFlyer miles | 1 PPS Value for every 10 KrisFlyer miles converted | 1 Elite mile for every 5 KrisFlyer miles converted |

| Conversion of Bank Points to KrisPay miles | 1 PPS Value for every 10 KrisPay miles converted | 1 Elite mile for every 5 KrisPay miles converted |

| Co-brand Cards | 1 PPS Value for every 10 KrisFlyer miles earned | 1 Elite mile for every 5 KrisFlyer miles earned |

| Spend or Conversion with Non-Air Partners | 1 PPS Value for every 10 KrisFlyer miles earned or converted | 1 Elite mile for every 5 KrisFlyer miles earned or converted |

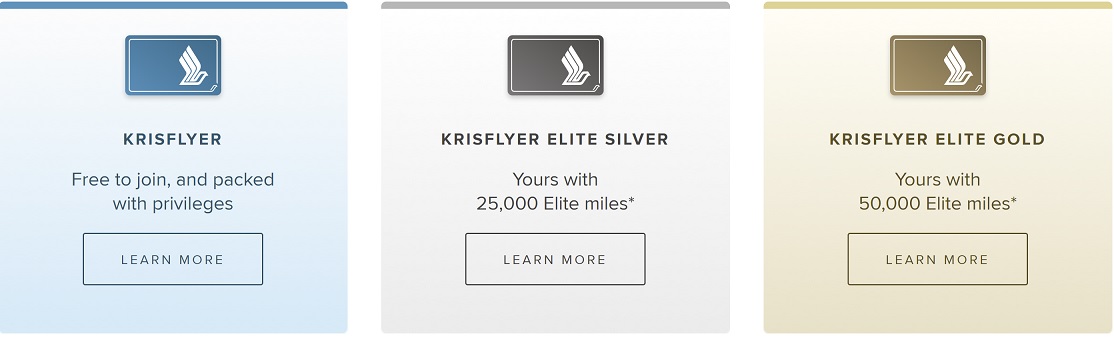

There’s no limit to the status miles you can earn this way. Converting points from Capital One, American Express, Chase and Citibank into 250,000 miles would earn Gold status (each transfer must be at least 10,000 KrisFlyer miles to count).

KrisFlyer Gold is Star Alliance Gold, which means lounge access when you fly on a Star Alliance airline. You can use this status when flying United domestically to access United Clubs.

And these miles mean access to Singapore Airlines premium cabin award seats that cannot be booked with miles from partner programs. However the miles do expire 3 years after they hit your account, not with 3 years of inactivity. So if you transfer the miles you’ll need to use them rather than using the account as a store of value into the future.

Earning Status Through Non-Flight Activity Should Be A Permanent Feature Of Most Programs

The new Air Canada program lets you earn elite status without ever flying, by engaging in points-earning with their partners. It’s expected that this program will expand, allowing members to earn higher levels of status through non-flight activity, or on a promotional basis counting earn like credit card initial bonuses towards the required thresholds for non-flight status earning.

Worldwide there’s a recognition that an airline’s best customers aren’t just those who spend a lot on airline tickets. Mileage programs are engines of profitability for large carriers, underlined with a huge exclamation point by United, Delta, and American each mortgaging their programs for between $6.5 billion and $9 billion with room to borrow more.

Arguably frequent flyer programs are the only thing that kept American and United out of bankruptcy and in normal times American was losing money flying and earning all of its profits selling miles.

It’s a long time in coming recognizing the value of an airline’s best non-flying customers. In fact in recent years U.S. airlines have reduced the value of their credit cards for earning elite status. United’s new revenue-based status program limited the contribution of its credit cards to 1000 qualifying dollars. American reduced how many qualifying dollars could be earned via spend on its Barclays co-brand cards. Delta massively increased the spend requirement to buy out of the qualifying dollars requirement for top tier elite status.

Yet for 2021 American decided to waive the qualifying dollars requirement for earning status up to Platinum Pro with $30,000 in cobrand card spend (in addition to lowering the qualifying dollars requirement for all status levels).

American, run by legacy US Airways top leaders, should be well familiar with the idea of granting status based on partner activity. In the last quarter of 2006 US Airways ran an ‘everything counts’ promotion where earning miles with partners counted towards status. That raised cash for the airline, without the need to provide immediate transportation in return.

The margin on things other than airline tickets is generally much higher than that of air transportation. Selling miles is a high margin business (American says AAdvantage as a whole has a 52% profit margin). Selling preferred seats is too. A customer with a co-brand credit card who uses it on the airline’s shopping portal and buys upgrades is a high margin customer, and a customer worth fighting over – and treating well.

You are correct in your conclusions. However, the airlines just don’t care.

Perhaps American Airlines passengers could earn Advantage miles by buying books which appear on Doug Parker’s “woke” reading list.

Naw, Too many people already game the system to earn Redeemable miles and it would swell the elite ranks if AA, DL, UA or other domestic carriers did something like this. Im sure they would waive spend requirements and go back to distance or segments for elite status qualification if they thought more elites were needed.

If you get status via this promotion , when is it good till ?

Also – a chart I saw seemed to indicate that you can also earn status points by converting “non-air” partners – this seems to indicate that hotel transfers work as well . @gary- am I right ? Is it hotel AND bank ?

@Maxie Dean yes

So if I transfer 250,000 UR ( Chase) points to SingaporeAir will that earn a Star Gold Status?

If I transfer the points in February 2022 to my new Krisflyer account, do I get the status till January 2024?

Thy 🙂

@Thrawn – that’s exactly what I would like to know – how long does the status last ? If I transferred today , is my status only good for 12 months ?

And WN/CP. But “should” is too strong a word IMO.