IHG and Hyatt both offer “Milestone Rewards.” American’s concept is “Loyalty Point Rewards,” formerly called “Loyalty Choice Rewards.” Of these, Hyatt was first. They award benefits for progress as you progress through the program, not just on achieving status tiers. That makes earning your next award closer than before, more accessible and keeps members wanting more because the next thing is achievable.

Bilt Rewards has introduced its own Milestone Rewards. This is separate from new elite benefits which I am told are being announced next week. These are the rewards you’ll earn as you approach status, between levels, and for going above and beyond.

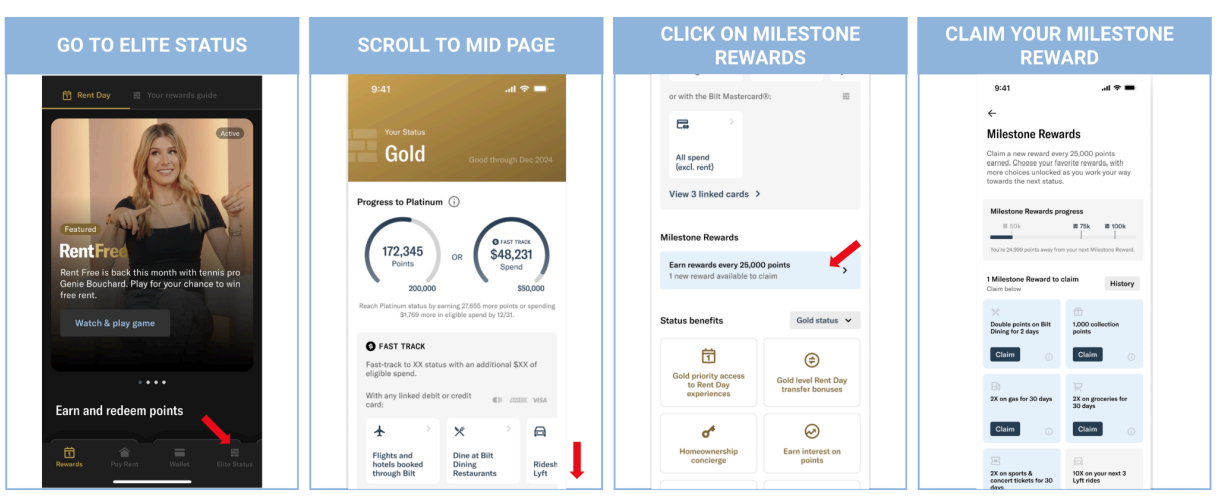

When you earn a Milestone Reward, you can claim it in their app. You’ll want to choose strategically because where there’s an earning period – like extra points for a week or a month – the clock starts once you claim it, and you can do so at your leisure during the calendar year.

What Are The Milestone Rewards?

These are rewards earned before first earning status for a year, and then for going 25,000 points before and beyond a status level (as well as 50,000 points beyond the top level). Note that earning a Milestone Reward is based on points earned in a calendar year in the program, and not based on non-rent card spend (which is another path towards status).

Here’s how status is earned in the Bilt Rewards program:

| ANNUAL POINTS EARNED | NON-RENT CARD SPEND | |

| Silver | 50,000 | $10,000 |

| Gold | 125,000 | $25,000 |

| Platinum | 200,000 | $50,000 |

With Milestone Rewards, then:

- You earn something along the way to Silver (25,000 points)

- You earn something going past Silver (75,000 points)

- You earn something on the way to Gold (100,000 points)

- You earn something going past Gold (150,000 points)

- You earn something going past Platinum (225,000 points; 250,000 points)

Here are the rewards at each level:

- 25,000 Bilt points:

- Double points on Bilt Dining for 7 days, up to 1,000 bonus points

- 1,000 points towards the Bilt Collection items (can be claimed no more than 3 times per year)

- 2X at grocery stores for 30 days, up to 1,000 bonus points (Bilt Mastercard cardholder exclusive)

- 2X at gas stations for 30 days, up to 1,000 bonus points (Bilt Mastercard cardholder exclusive)

- 2X on sports & concert tickets for 30 days, up to 1,000 bonus points (Bilt Mastercard cardholder exclusive)

- 75,000 Bilt points:

- Choice of one the Milestone Rewards at prior Milestone

- 10X on your next 3 Lyft rides, up to $25 spend per ride

- 2X on digital wallet purchases for 7 days, up to 1,000 bonus points (Bilt Mastercard cardholder exclusive)

- 100,000 Bilt points:

- Choice of one the Milestone Rewards at prior Milestone

- 5,000 point status boost

- 150,000 Bilt points:

- Choice of one the Milestone Rewards at prior Milestone

- $10 towards your next fitness class that’s bookable through the Bilt app

- 225,000 Bilt points:

- Choice of one the Milestone Rewards at prior Milestone

- 7,500 points for the Bilt Collection, can be claimed only once per year

- 250,000 Bilt points:

- Choice of one the Milestone Rewards at prior Milestone

- 4X at grocery stores for 30 days (Bilt Mastercard cardholder exclusive), up to 3,000 bonus points

- 4X at gas stations for 30 days (Bilt Mastercard cardholder exclusive), up to 3,000 bonus points

If you select two offers from different Milestones in a way that covers the same period, the better offer applies. They do not stack. They also do not stack with offers outside of Milestone Rewards, for instance earning double points on rent day for gas station spend and 4x on gas station spend as a Milestone Reward earns a total of 4x.

Rewards must all be claimed by end of calendar year, and I can see that becoming dicey in edge cases where someone qualifies for an award and they have hours at most to claim it on December 31.

Bilt Rewards Launch Party, March 2022

How Valuable Are Bilt Rewards Milestone Rewards?

I really like Bilt Rewards, and they’re giving you more benefits than you had yesterday which is a good thing! But this is the first effort from them that I’ve seen which seems like really weak sauce.

They built a great structure. It rewards and encourages members as they work towards status. A lot of people in most programs tend to be “almost elite” and this helps them to stretch, and it encourages them not to stop earning once they’ve hit a level.

However the value of what’s being offered just isn’t very significant, and I don’t see how it will drive much incremental earn in the program. For example,

- If you max out the 10X Lyft offer at $25 per ride for 3 rides, that’s an additional 8 points per dollar on $75 total spend or… a whole 600 points. You could choose it 5 times at different milestone levels, and then you’d earn 3,000 extra points. And maybe as a Platinum there’ll be another 125% transfer bonus, turning that into 7,500 miles with an airline, if you take 15 Lyft trips in the eligible periods and everything breaks just right…

- At the 150,000 point level you can choose $10 to spend towards a fitness class. They aren’t even giving you $10, just a $10 coupon for one type of spending.

- At the very top – upper echelon – a member hitting 250,000 points who also has their co-brand credit card can earn 4 points per dollar on groceries. But… only for one month. I’d probably choose that!

But… it’s capped at only earning 3,000 bonus points. Will 3,000 bonus points for doing additional spending move the needle for someone already earning 225,000 points in the program? Will it move the needle even on pushing for that extra 25,000 points in earning necessary to unlock the benefit?

It’s an extra 12% on top of the 25,000 points and you have to do more work for it. That isn’t even as good as a “3,000 point bonus” as an option at the very top reward level in the program.

- I actually think the most valuable item on here is 7,500 points towards a merchandise item in teh Bilt collection, after earning either 225,000 or 250,000 points.

My Bilt Rewards Mastercard

The value at each level compels me to quote my late grandfather: this is “better than a loch in kop.” I’ll take it! But the juice just doesn’t seem worth the squeeze. I’d love to see more useful encouragements, and I’d love to see encouragements for customers that go far beyond 225,000 points. Give heavy spending engagers something to shoot for!

After $1 million spend in a calendar year on the Chase Aeroplan card in a year, you get unlimited companion award tickets for the rest of that calendar year and the next one – valid even on partner first class awards. Chase doesn’t have to buy many of those, but it gives us something to dream about!

Maybe my standards for Bilt are just a bit unfair. They’ve added feature after feature, offering more and more points, transfer partners, and elite status opportunities. This is just the first thing they’ve done that doesn’t feel worth going out of my way for. But I’ll still pick up a few extra points along the way and that’s a good thing.

My reaction is pretty much the same. Bilt Rewards MasterCard is certainly a worthwhile card to have, if you rent, but these Milestone Rewards add practically no value. They need to go back to the drawing board if the purpose of these rewards is to increase spending on the card.

WARNING: Saying the quiet parts out loud

Bilt is good for rent and 5 meals a month. I do not transact beyond that. Bilt is a venture funded gravy train that is not going to rip off the bandaid (a la Turkish Airlines), but will instead slow to a stop. Higher minimum spends, lower flexibility in point transfers — already, basic Bilt members can only transfer a minimum of 2,000 points instead of the industry wide 1,000 point minimum that every other card rewards program follows. Already, you have to make 5 purchases a month to earn the advertised points on rent, and that could be a real challenge.

There’s also a practical issue here. Bilt is not backed by Chase or Amex. This means:

– Fraud is more of an issue. In 2021-2022 we saw a lot of Bilt cardmembers hit with fraudulent charges and having to get replacement cards. You, Gary Leff, defended this as not Bilt’s fault, which may be true. From the perspective of a consumer, Chase, Amex, Citi and Capital One did not have this problem.

– Support is very bare bones. You cannot dispute charges online. You cannot report your card lost or stolen online. You have to call and they’re not even open 24/7. That’s too much hassle.

– General infrastructure is more of an issue. Chase, Amex, Citi, and Capital One have always given me the points promised. I’ve had several Bilt transactions that never accrued points. I’ve made Rent Day transactions that did not earn the Rent Day bonus.

Remember the fraud issue? I had $20k of fraud charges, with 20k points, post to my account. When those $20k of charges were reversed, 40k of points were reversed!!!

Yes to Bilt’s credit they did eventually solve my issues but there’s too much hassle. So I pay my $6,000/mo Manhattan rent on the card and little else.

I am not confident charging high value things to my Bilt card. I still use my Amex for that because Amex has always had my back.

Oh and I have had Bilt points take days to transfer to airlines and hotels even when those same airlines or hotels have instant transfer partnerships with Chase and Amex.

BE CAREFUL WITH BILT. I do think everybody who rents should have the card and charge rent to it because there is nothing to lose there, but be aware that charging high amounts on your Bilt card is akin to depositing large sums to your Robinhood account.

Just as serious investing should be done with a serious broker, serious purchases should be made with an established financial entity — ideally Amex, second-ideally Chase, then all the others.

@Dignity – much of what you say is wrong, and some clearly missing context.

“already, basic Bilt members can only transfer a minimum of 2,000 points instead of the industry wide 1,000 point minimum that every other card rewards program follows.”

they don’t want folks just taking advantage of the free points you can easily rack up without engagement, transfer them out, rinse repeat.

remember bilt gives you points for linking your accounts, which other programs don’t do. and they give you free trivia points each month, too.

“Already, you have to make 5 purchases a month to earn the advertised points on rent, and that could be a real challenge.”

How is that a real challenge?

“There’s also a practical issue here. Bilt is not backed by Chase or Amex”

Bilt’s co-brand card issuer is Wells Fargo which is a pretty large bank and which offers the features you seem to be looking for. Perhaps you have a legacy Evolve account from pre-March 2022? I wish Wells would acquire that back book.

“Fraud is more of an issue. In 2021-2022 we saw a lot of Bilt cardmembers hit with fraudulent charges and having to get replacement cards. You, Gary Leff, defended this as not Bilt’s fault, which may be true. From the perspective of a consumer, Chase, Amex, Citi and Capital One did not have this problem.”

This wasn’t an issue of the bank, it was a function of a brand new card so a BIN attack is easier – you can guess everyone’s card expiration dates.

In any case, (1) Bilt isn’t just their co-brand card, and (2) I don’t know why you’re saying the card is issued by a bank that isn’t an “established financial entity.” Say what you wish about one bank versus another, but Wells is pretty clearly an “established financial entity.”

I have the Bilt card and actually think it’s pretty good compared to the CSP/CSR. The double points on rent day are great and the transfer bonuses have been fantastic. With that being said, I think the milestones rewards are a swing and a miss.

I will keep my Bilt card top of wallet but with the high standards set previously within their program, the milestones rewards just don’t offer the same level of excitement in my opinion.

Weak as water! as Mrs. Slocombe would say.

This is the beginning of the end of the ride that has been Bilt.