American Airlines announced its fourth quarter earnings this morning and held its earnings call.

Pre-tax earnings were up $90 million in the fourth quarter. AAdvantage revenue was up about $40 million during the quarter. Some key data points that let us break apart flying from non-flying performance.

- Passenger Revenue Per Available Seat Mile (PRASM): 14.72 cents

- Cost Per Available Seat Mile (CASM): 15.06

- Cargo Revenue: $216 million

On 51.675 billion revenue passenger miles, passenger revenue failed to cover $176 million of American Airlines costs for the quarter but passenger revenue and cargo together combined for a $40 million profit – basically break-even on $11 billion in revenue. Once again it’s AAdvantage that drove American’s profit but to their credit they didn’t actually lose money flying airplanes in the fourth quarter.

During the call Senior Vice President Don Casey noted that this is the last quarter where American gets a boost from changes resulting from frequent flyer accounting changes.

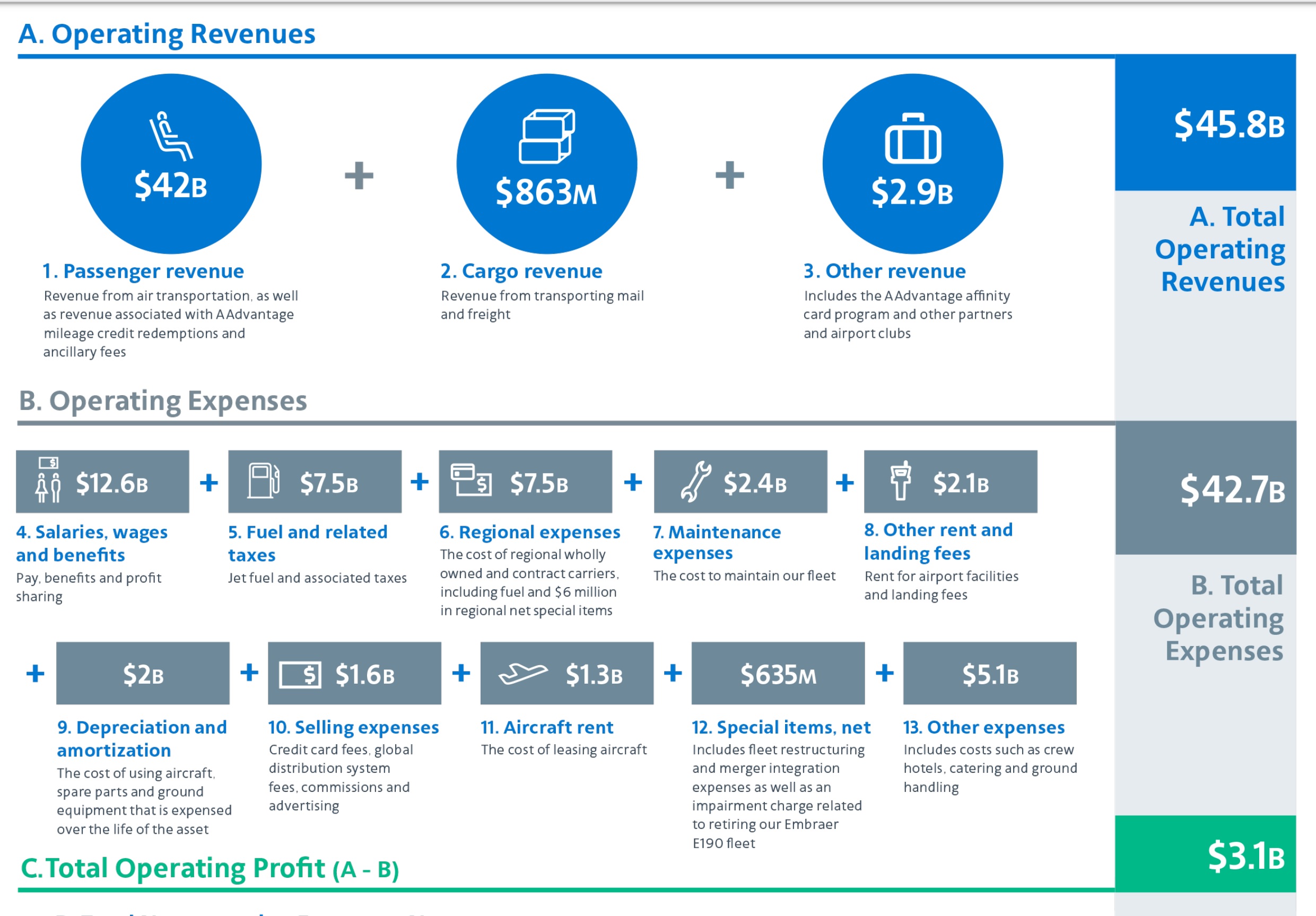

Here’s how American explains their full year results to employees:

During the earnings call American reported on AAdvantage:

- Largest number of new members since the merger

- Record number of co-brand cardmembers

- Record card acquisition

- Record card spend

- Record award redemptions

We know from past disclosures by American that most redemptions (85%) are domestic, and more redemptions are for economy. American’s frustrating revenue-based redemptions, that lop off value from the top end of the program, likely do help redemptions for members not looking for much value out of their miles.

I expect that record acquisition is a function of the record public initial offers that have been in the market. More acquisition is going to mean more cardmemnbers, holding cancellations constant. And redemptions have been up over the past two years as American has made the miles eligible to use on low dollar tickets.

“Helps”

“American’s frustrating revenue-based redemptions, that lop off value from the top end of the program, likely do help redemptions for members not looking for much value out of their miles.”

That’s a selfish phrase there where you imply that what you want to get out of miles is what others need to value similarly. I use my AA miles almost exclusively for premium partner redemptions similar to you, but my cousin takes her family on a trip once or twice each year. This year they were able to go nonstop PHL-SFO for under 70k for the 4 of them (I think it was 17k r/t each). Tickets were about $400 each, so they got about 2.3cpp.

Not an insane redemption, but they get airfare covered for a group of 4 for around the same miles price as flying one of them in one direction to most of Asia without having to scour multiple websites, setting up inventory alerts, and/or booking really far out or really close in. I’d argue most families would see far more value in a redemption like that vs spending hours and hours trying to find a good business class redemption for a family of four without crazy fuel surcharges, routings, etc.

Especially when they can nuke accounts and recoup billions(?) of AA miles they sold and got revenue from Citi on.

+ Revenue & – Liabilities….it’s so good it’s almost criminal!

You know, I just got a flight home from Asia, a couple of weeks hence, for 37,500 AA miles. Then, I booked a flight back to Asia, one or two weeks later, also for 37,500 miles.

In economy, yes. But easy. No fuss. And if I need to make changes, I can, for little or no cost — depending on the changes. What’s wrong with that?

No need to scour for business or first fares. If I want that, I just buy it at the best fares available through the Amex Platinum International Airline Program — and earn 5X MR points for doing that.

Something wrong with that? I’m supposed to spend hours and hours and hours hunting for “free” business or first fares?

Not necessary. I’ll let others play that game. No time for it.

17k AA miles for PHL – SFO IS a very good redemption and not one that I think you would see very often from AA. PHL – SFO is available now a month in the future for 24,000 miles or $337 – about 1.35 cents per mile.

When you can get 2 cents CASH per dollar of spend with several credit cards, that should be the baseline for air ticket redemptions. (Very simple – put spend on Citi Double Cash if AA travel redemptions are not going to consistently be worth 2 cents)

In practice, people are addicted to airline miles and are willing to accept less – sometime far less – than their optimal value. Maybe its the possibility of a great 9 cent per mile business class redemption to Asia that keeps people interested? However, that’s not typically how miles are redeemed. It’s a classic behavioral science phenomenon where people make choices that aren’t in their best financial interest…and its what keeps marginal airlines like AA from competing on customer services, PaxEx, , etc.

Choices are good. Capitalism and the free market wins….again.

Does the fact that “card acquisition” is treated as a KPI explain AA and Citibank’s decades-long strategy of turning a blind eye to card churning?

“American’s frustrating revenue-based redemptions, that lop off value from the top end of the program, likely do help redemptions for members not looking for much value out of their miles.”

Most people redeem miles for economy. Most people redeem transferable miles in the travel portal. Get over it

The ability to book international flights on short notice — and to the flexibility to make changes at no cost or modest cost — is of great value to some of us, certainly me. Those of us in this category hardly qualify based people “not looking for much value out of their miles.” We simply do not see much value in hunting for hours and hours and hours on end for “free” business or first-class fare.

Interest observations. I just wonder how sustainable profits from the frequent flyer/credit card acquisitions are?

So there is no cost to Advantage, partners and airport clubs? Why do you continue to trot out this silly theory?

“Record number of co-brand cardmembers” LMFAO – kind of ballsy to say that, given they’re shutting down people for contributing to that “record number” – largely generated by Citi’s practices (to which AA turned a blind eye for years).

Your accounting is flawed. If you listen carefully to the earnings call, you’d notice that the company said they intentionally took a material hit to unit revenue by making more seats available for AAdvantage award redemption. So I guess you can twist the numbers to show whatever you want, It is certainly true that the AAdvantage program boosts AA’s financials, as frequent flyer programs also boost the financials of their major competitors.

@chopsticks – read the actual financials, and listen to the call, because Don Casey agrees with me that this is the last quarter of the material benefit to current revenue from ASC 606

Well, it’s not just premium redemptions that have gotten more difficult–if you don’t have much flexibility in schedule (as families with school-age children often don’t), it’s hard to redeem reasonable economy flights too. We were looking to go somewhere during one of my daughter’s school breaks and we were open to visiting many destinations domestic or international, flying AA economy, but we didn’t have any luck.

@josh rogan

“Other Revenue” is exceptionally high-margin (~90%).

So while there is a small marginal cost that should be applied to that revenue – it does not materially change Gary’s argument at all.

In fact – “Passenger Revenue” also includes deferred redemption revenue which is also significantly high margin. This is due to the fact the the fair value of deferral is an amount “significantly in excess of the incremental cost of redemption”.

So whilst it is true that AA considers some redemptions causes displacement (displacing paying cash passengers) – they actually benefited significantly from the redemption revenue due to its elevated margin.

You also need to add the “double counted” redemption revenue that was previously recognized prior to 2018, and has since been recognized a 2nd time thanks to Topic 606 re-casting.

Gary’s article is a simplistic overview – but the accounting, math, and assessment is accurate.