My county takes credit cards for property taxes, but they charge a 3% fee. I could have Plastiq charge my credit card for the rewards and send the county a check, but they now charge a 2.9% fee.

Property taxes in Texas are a big deal. I pay about 1.5% of my home’s assessed value each year (the assessed value is likely lower than current market). There’s no state income tax in Texas, of course. The biggest component of the property tax is school taxes, with a large portion of school property taxes in my county going back to the state to redistribute (in part) to less prosperous districts (they call this “recapture”).

- Fortunately, if I’m going to pay high property taxes I can earn rewards.

- And there’s a way to do it paying with a credit card while avoiding high (and, indeed, any) fees.

Paypal’s billpay feature allows me to pay Travis County property taxes at no charge, either online or through their app. This may be available for your property taxes as well, and in some cases for other bills where the vendor would charge you a fee directly.

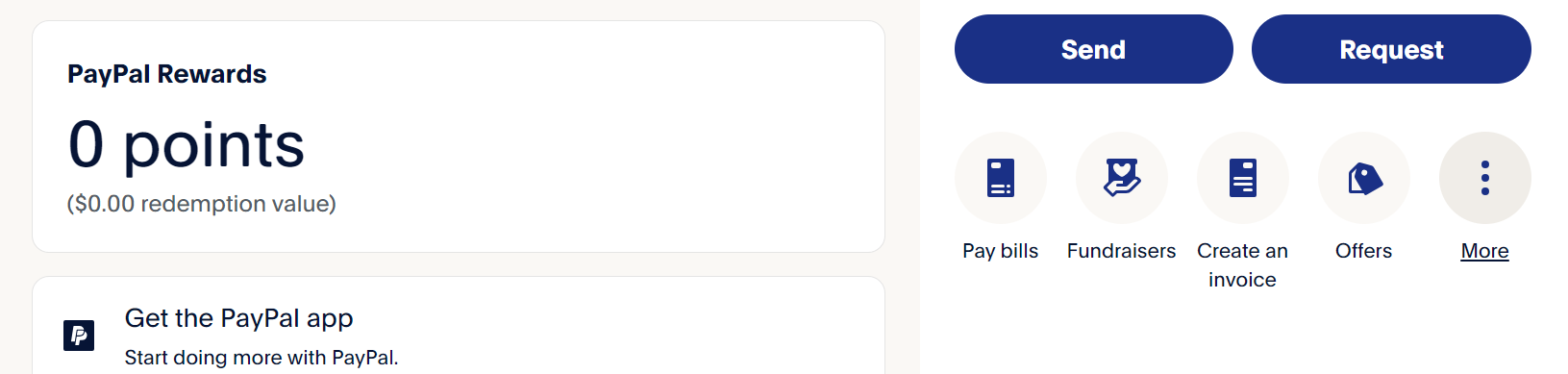

Choose “Pay Bills” on the right hand side of the website. If you’ve never paid the vendor before, choose “add a new bill.”

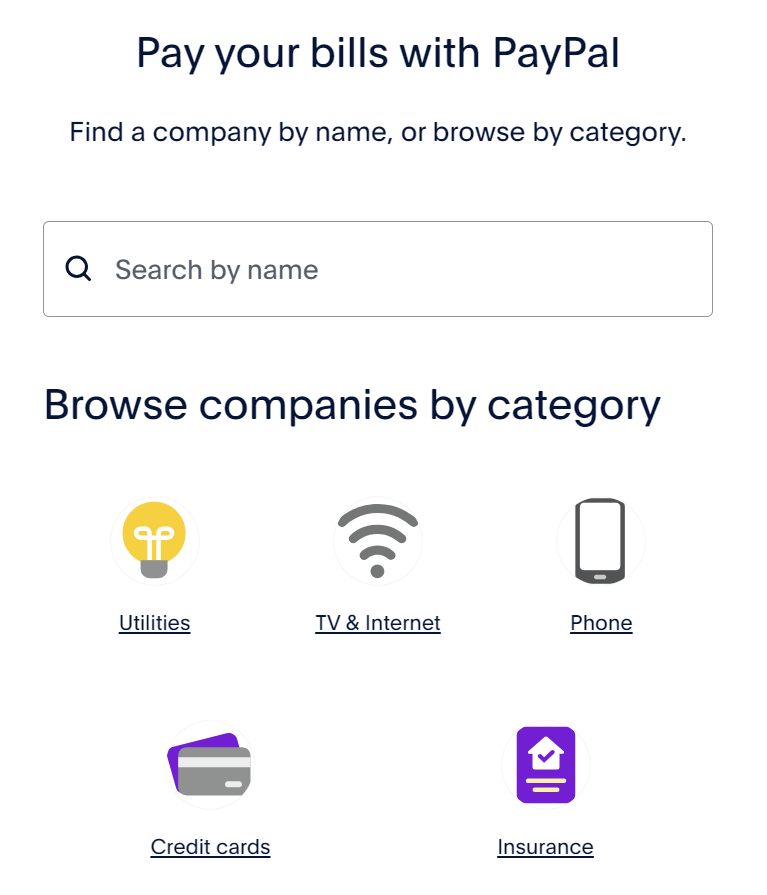

Then search for the vendor.

You’ll need to have the card you want to use already entered into Paypal. And you want to clear out any Paypal balance before you do this, because it will draw your balance before charging a credit card.

Another nice thing here is that Paypal is sometimes part of a quarterly or targeted spend offer for rewards cards, so you may earn in an accelerator category. I’m making my payment on the first of the month for Bilt Rent Day so that I earn double points that way.

Yes, I was watching this too but it doesn’t seem to work for me either for Travis County. @Gary did it work for you this year?

Ryan & Rob: I received the same generic “Things don’t seem to be working at the moment” error when I attempted to pay my property tax bill for Harris County, TX. It turns out that because the average amount of my PayPal transactions are typically ~$60 the PayPal security algorithm flagged my attempted transaction as potentially fraudulent. PayPal customer service was ZERO help. So much for this idea. Useless unless you already are a heavy PayPal user.

Not working for me either.

But Gary, you can pay with a Chase Freedom Flex card now and get the 5X on the quarterly bonus, way better points than built if you have the card already!

@ss_flyer – 5x is limited to $1,500 in combined spending per quarter (and it’s late in the quarter, I don’t have any tasks left here)

I tried the same for Fort Bend County, but it seems like a scam. You can’t see the payment details (email address, postal address) for the vendors when searching through the PayPal portal – only the name and a phone number. I called PayPal for the payment address of Fort Bend County (currently listed in their database), and they said the payment address was “cebc48aa2534@paymentsus.com.” That’s all the info they had…

Paymentus does process a lot of these types of local bills.

Gary, I was especially excited to see your tip as a fellow Travis County resident. Unfortunately it didn’t work for me. The tax office came up in the biller list and Paypal said the account was set up after entering my account number. Unfortunately, after hitting “Pay” I’d get a message saying it wasn’t working right now and the option to try again. Did that a few times, reset the biller a few times and varied the entry of the account number with and without divider hyphens but to no avail. Perhaps I missed something or it was too late to work this year but I’ll try again next year.

For all of you trying to use PayPal to pay your property tax bill — is this only possible if the relevant county assessor/taxman comes up as a hit on the PayPal page when you search for companies to pay? In other words, does PayPal have a way to enter a company that is not in their list of payees?

What PatS said. I am in the same county. Gary won’t say if it’s working for him… or maybe it worked last year.

Politically blue states send an awful lot of Federal “recapture” to red states. The red states tend to complain about the Federal Government – and the states helping them out – a lot but somehow they always forget to return the money.

I found that I got that error message several times, but when I switched credit cards, it went thorough just fine. I’ve had good luck twice now with the Hyatt Biz card, but the personal didn’t go through.

I’m also in Travis County. I never even get the opportunity to pick HOW I’m going to pay the bill. I select Travis County Tax Assessor from the list, put in my account number, click on PAY and it goes directly to “Things don’t appear to be working at the moment.” – I’ve tried for about 6 days now. Giving up on this, seems to fall into the ‘too good to be true.’

I also got the “things don’t appear to be working” message when trying to pay Travis County property taxes today. Gary, were you able to pay your taxes with BillPay this year? I’m wondering whether to keep trying or go ahead and pay with the 3% fee.

My suggestion is related to a problem I had in December with Zelle. I added a new person to my payee list and tried to send a payment. I tried 6 times and it wouldn’t go, with no explanation from the bank. I finally went to the bank and my rep called their back office. The problem had to do with more scams in December, a new payee, and sending an amount over $100. The bank’s back office said to send a smaller amount first. We did that and this time it was at least put on hold. My banker and I filled out an online form and my payment processed the next day. Last year I sent a payment to a new payee and it was on hold for 4 days. Systems are skeptical about sending larger than normal payments to new payees, especially in December.

Most property taxes can be paid in smaller amounts up until the deadline. My suggestion is to set you assessor up as a new payee, then try to send $10. If it goes through, you can send them smaller amounts than what is due, or be bold and try to send the balance of the property tax.

I’m running into the same “Things don’t appear to be working at the moment.” error when trying to pay Travis county property taxes. I’ve tried account number with and without dashes, I have tired the billing number as account number, and I have tried lower amounts, all produce the same error.

@LR Been trying to pay a $1 since the beginning so it’s not the amount.

I had concerns about paying my Texas county (Fort Bend) through PayPal since you can’t see very many details about the vendor other than their name (I wanted to see phone number, address), but I can confirm my $12,600 payment was processed by the county on 12/31 two days after payment was made.

Worked for me for two properties in Harris County for their taxes and for the schools taxes! Awesome tip.

I’m not sure this has ever worked for Travis County.

Any updates from Travis County residents that this has worked? Due in 2 days…

it’s officially dead. Many counties and other large vendors have been removed.