My county takes credit cards for property taxes, but they charge a 3% fee. I could have Plastiq charge my credit card for the rewards and send the county a check, but they now charge a 2.9% fee.

Property taxes in Texas are a big deal. I pay about 1.5% of my home’s assessed value each year (the assessed value is likely lower than current market). There’s no state income tax in Texas, of course. The biggest component of the property tax is school taxes, with a large portion of school property taxes in my county going back to the state to redistribute (in part) to less prosperous districts (they call this “recapture”).

- Fortunately, if I’m going to pay high property taxes I can earn rewards.

- And there’s a way to do it paying with a credit card while avoiding high (and, indeed, any) fees.

Paypal’s billpay feature allows me to pay Travis County property taxes at no charge, either online or through their app. This may be available for your property taxes as well, and in some cases for other bills where the vendor would charge you a fee directly.

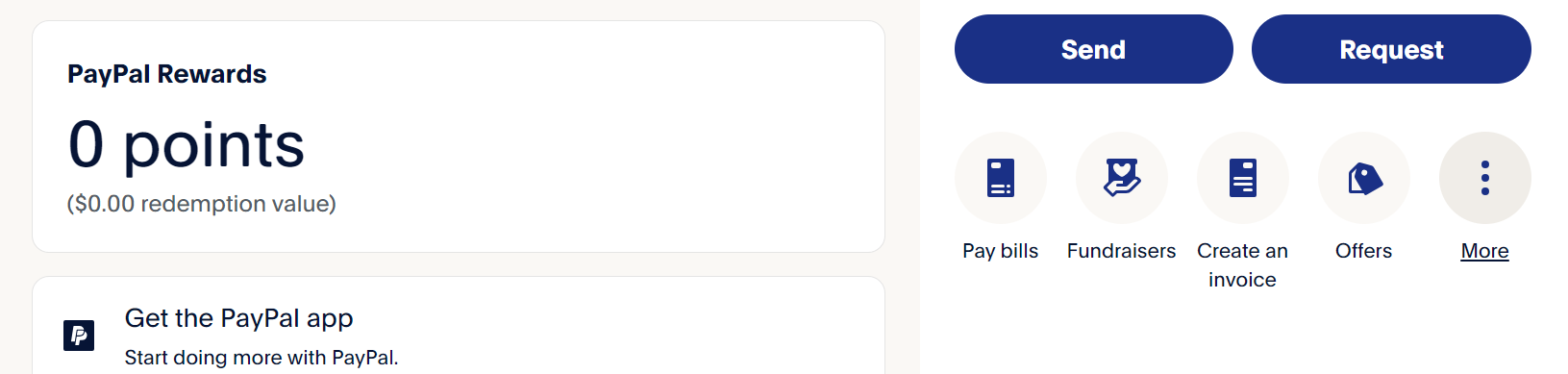

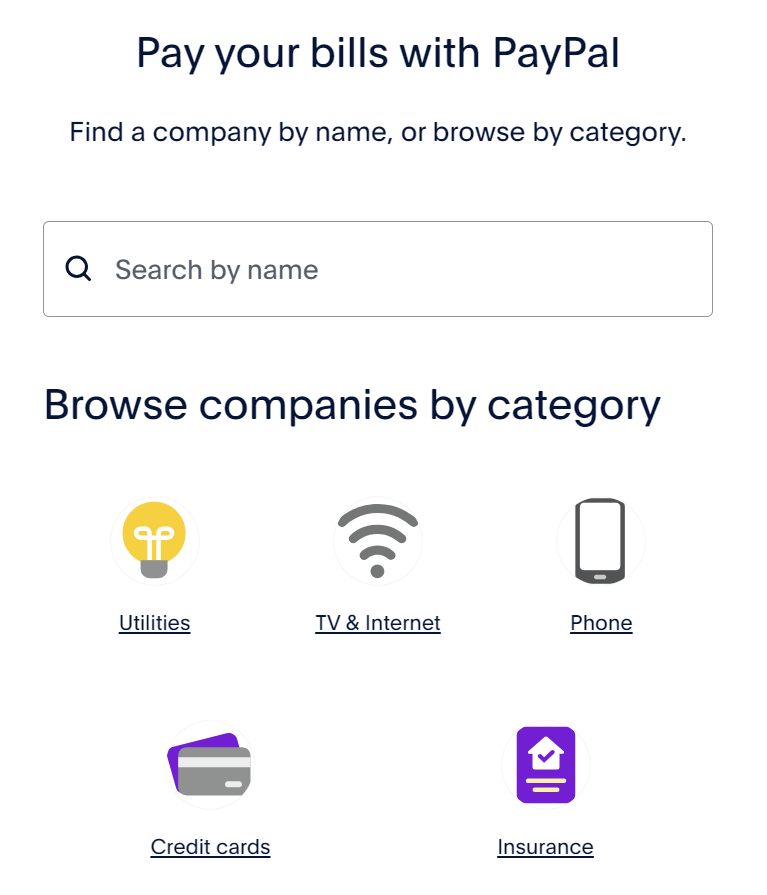

Choose “Pay Bills” on the right hand side of the website. If you’ve never paid the vendor before, choose “add a new bill.”

Then search for the vendor.

You’ll need to have the card you want to use already entered into Paypal. And you want to clear out any Paypal balance before you do this, because it will draw your balance before charging a credit card.

Another nice thing here is that Paypal is sometimes part of a quarterly or targeted spend offer for rewards cards, so you may earn in an accelerator category. I’m making my payment on the first of the month for Bilt Rent Day so that I earn double points that way.

This has been somewhat under the radar for some time now… but as nothing good ends up lasting, I can see PayPal eventually restricting their Bill Pay to funding via bank account only.

Haven’t heard about this option before. Does this billpay feature work for most jurisdictions? Where I live, I can pay some of my property taxes online with a credit card, but for others I have to bring Visa/MC gift cards (acquired free free at Staples with an Ink card) to the county office building and have them run as debit for no charge. Kind of a PITA, but it works out to a more-than-five-percent rebate, so worth the modest hassle. I’m sure in most places there’s a creative game you can play to get something back for paying your taxes.

Does PayPal not charge any fee for the credit card?

Our county has long demanded 2.5% for debit or credit, everything except e-checks or paper checks. So I miss out on a huge amount of spend each year 🙁

It’s great that some “game” the system. For me I just do an electronic transfer…no points and no fee…less complications…I’ll pick up points through “normal” purchases. I am a fan of “brainless” purchases…lol…

Nice, hadn’t heard about this before. Just about to get back into home-ownership so I’ll try this for our property taxes when they’re due.

Darn! I was excited to see this post, but unfortunately Burnet County, Texas is not included. Maybe in the future seeing how close to Austin we are (and sadly, how fast we are growing).

Denver charges no credit card fees on any tax payments.

Tarrant County does not accept PayPal, Zelle, Venmo, etc but it was still a great way to get about ~10K loyalty points last year for the price of the 2.5% fee. Easier and cheaper than an old milage run

Paypal burned their bridge for many folks. They have supports far left liberal groups like SPLC and many others, then in 2022 you had to give them rights to monitor and control your social media. You agree that they can fine you $2,500 or more if they discover that you spread misinformation, in their opinion of course. Gary that’s dangerous ground for a main stream blogger such as yourself.

@DaninMCI – you may wish to reread your post… it’s intimidation of a journalist.

A freedom guaranteed by the first amendment., that freedom of the press.

Gary was sharing how to get a points for travel

The slippey slide into fascism is something, ain’t it… bogeyman everywhere.

DaninMCI, stop spreading fear, uncertainty, and doubt. PayPal issued a statement saying the fine print in their terms were over-broad. PayPal has not fined a single person. SPLC is a mainstream organization, not “far left” and in any case, to be “liberal” in 2023 going into 2024 is to be a decent and respectful person.

If you wish not to use PayPal that is completely your prerogative as the rest of us will enjoy our rewards points and continue to travel and broaden our horizons instead of succumbing to fearmongers and falsehoods.

@DaninMCI: Exactly. They claimed the power to fine you, as though they were some kind of governmental organization. Unheard of outside communist countries.

Accounts closed — permanently.

SPLC “mainstream”???? They themselves are a bigger terrorist organization than those they falsely accuse of being “racist”. So far left its driving in reverse…

This over an article about paying property taxes for points?

The southern poverty law center charter is:

“The SPLC is a catalyst for racial justice in the South and beyond, working in partnership with communities to dismantle white supremacy, strengthen intersectional movements, and advance the human rights of all people.”

Now, I wonder who would find themselves opposed to that?

Happy holidays, y’all.

History:

THE SPLC WAS FOUNDED IN 1971 TO ENSURE THAT THE PROMISE OF THE CIVIL RIGHTS MOVEMENT BECAME A REALITY FOR ALL.

By the late 1960s, the civil rights movement had ushered in the promise of racial equality as new federal laws and decisions by the U.S. Supreme Court ended Jim Crow segregation. But resistance was strong, and these laws had not yet brought the fundamental changes needed in the South.

African Americans were still excluded from good jobs, decent housing, public office, a quality education and a range of other opportunities. There were few places for the disenfranchised and the poor to turn for justice. Enthusiasm for the civil rights movement had waned, and few lawyers in the South were willing to take controversial cases to test new civil rights laws.

Alabama lawyer and businessman Morris Dees sympathized with the plight of the poor and the powerless. The son of an Alabama farmer, he had witnessed firsthand the devastating consequences of bigotry and racial injustice. Dees decided to sell his successful book publishing business to start a civil rights law practice that would provide a voice for the disenfranchised.

“I had made up my mind,” Dees wrote in his autobiography, A Season for Justice. “I would sell the company as soon as possible and specialize in civil rights law. All the things in my life that had brought me to this point, all the pulls and tugs of my conscience, found a singular peace. It did not matter what my neighbors would think, or the judges, the bankers, or even my relatives.”

His decision led to the founding of the Southern Poverty Law Center.

Dees joined forces with another young Montgomery lawyer, Joe Levin. They took pro bono cases few others were willing to pursue – the outcome of which had far-reaching effects. Some of their early lawsuits resulted in the desegregation of recreational facilities, the reapportionment of the Alabama Legislature, the integration of the Alabama state trooper force and reforms in the state prison system.

The lawyers formally incorporated the SPLC in 1971, and civil rights activist Julian Bond was named the first president. Dees and Levin began seeking nationwide support for their work. People from across the country responded with generosity, establishing a sound financial base for the new organization.

In the decades since its founding, the SPLC shut down some of the nation’s most violent white supremacist groups by winning crushing, multimillion-dollar jury verdicts on behalf of their victims. It dismantled vestiges of Jim Crow, reformed juvenile justice practices, shattered barriers to equality for women, children, the LGBT community and the disabled, protected low-wage immigrant workers from exploitation, and more.

In the 1980s, the SPLC began monitoring white supremacist activity amid a resurgence of the Klan and today its Intelligence Project is internationally known for tracking and exposing a wide variety of hate and extremist organizations throughout the United States.

In the early 1990s, the SPLC launched its pioneering Teaching Tolerance program (now Learning for Justice) to provide educators with free, anti-bias classroom resources such as classroom documentaries and lesson plans. Today, it reaches millions of schoolchildren with award-winning materials that teach them to respect others and help educators create inclusive, equitable school environments.

As the country has grown increasingly diverse, our work has only become more vital. And our history is evidence of an unwavering resolve to promote and protect our nation’s most cherished ideals by standing up for those who have no other champions.

@ DaninMCI — Thanks for letting us all know that you hate black people.

My property tax is around $11,000 annually and can be paid first week of January. They charge a 3% fee but I still put it in a credit card. In my case I use my Hilton Surpass which gives me 3x points at .05 cent (my value per point) so that covers half the fee. Then that essentially meets the $15,000 spend for a free night (any category) with some additional spend in Jan/Feb. then I focus on my Hyatt card to get $15,000 for the bonus free night.

It is a personal decision but I feel I get sufficient value paying with a credit card, even with the fee.

Bill pay includes certain credit cards as well. Does that mean you can pay a credit card through PayPal with the same or another credit card and keep the rewards rolling in? Seems too good to be true.

(sigh)

Living in New Jersey, whenever I hear someone say that their “property taxes are a big deal” I want to jump through the screen and slap them. 🙂

The SLPC “may” have started as a noble purpose but they have been corrupt for years. Hotels, web platforms, and credit card companies have blacklisted law-abiding Americans because the SPLC disagrees with their political views. It’s not about racism (Well except for people like Gene calling people racist). Paypal supports many political viewpoints and organizations that cause real harm to people and they get the money to push their agenda from customers that use that platform. In just one of many examples, they only recently cut ties to the ABSPP where they openly supported terrorists AND also allowed donations to the same via Paypal.

As a result of PayPal’s termsand conditions as well as support for organization that I do not support, they are dead to me. And don’t believe PayPals BS defense of their T and C. They could change them…but do not.

It was my understanding that the paypal does not allow reward points through amex to accrue! Please let me know if I am mistaken. We pay lots of tax on 4 properties.

WARNING- I’ve done billpay with paypal before with no problem. However, the last time I tried, I got to the last page confirming the charge would come from my card. Instead PP charged my bank account. No I did not accidentally pick the wrong thing. I don’t see any option to stop this if the primary method doesn’t work for whatever reason.

Had to happily get rid of my PayPal account and haven’t looked back. So this is not helpful to me.

@DJ,

Yes, it is. I tried and it said I couldn’t use my linked card to pay, just my linked bank account.

I tried to pay my HOA fee and got the same result.

And my county’s Property Tax can’t be found, although a few others in the state (FL) do turn up.

@Gary – I have an SBA loan from Covid days that I’m paying back but it won’t allow me to use a credit card from my Paypal account. Any thoughts or ideas?

Technically isn’t Travis a county of California, that state quite to the left of Texas? Merry Christmas and ’tis the season that all y’all back in Austin should be enjoying those fine Hill Country self-flocking Christmas trees, mistakenly called Mountain Cedars, but actually Ashe Junipers, a tree only a mother golden-cheeked warbler could ever love.

“DJ says:

December 25, 2023 at 12:43 pm

Bill pay includes certain credit cards as well. Does that mean you can pay a credit card through PayPal with the same or another credit card and keep the rewards rolling in? Seems too good to be true.”

Yes… I would like to know the answer to this too.

Thanks for this tip! Going to see if I can get this to work for me in Louisiana.

I wish I knew about this earlier. I just paid my bill a few weeks ago and it’s supported in south Fla . Also wondering about paying credit card bills. I think that might be high risk and PayPal will not allow that. I hope I can pay the taxes next year.

I agree with Mark above. I’d rather not pay a fee but, on the other hand, I get miles or hotel points for the fee as well, so not such a bad deal. Plus, using a credit card gives me an extra month to actually pay the taxes. It doesn’t appear that Fairfax County, VA property taxes can be paid via PayPal so I will likely have to continue paying directly with a credit card/additional fee. But I still think the benefits (points/miles/extra time to pay) outweigh the cost of the fee.

Would rather have much lower residential property taxes than be in a position to earn lots of loyalty program points from creatively paying property taxes.

Property taxes are high everywhere in the US where I have lived, including in Texas. And nowadays it seems like the cities/counties across the country are much more into doing property value reassessments than they used to be, and so I am seeing big increases in assessed values and property taxes coming due in 2024 and more expenses for that than was the case at the start of this year.

For what it’s worth, the annual residential property tax bill on a hypothetical $3 million dollar home in “socialistic” Sweden is negligible compared to the average residential property taxes on even a hypothetical $300,000 home in Texas and everywhere else I live or have lived in the US.

Saw your article and decided to try it out myself since I also own property in Travis county. However when I try to pay “Travis County Tax Assessor-Collector” (I think that’s right) I just get an error saying “Things don’t appear to be working at the moment.” I set up Discover as a Bill Pay and it seemed to accept an amount. Was this the right entity or are they just broken at the moment? Seems no amount works so it doesn’t seem to be a limit and since Discover looks like they works it seems to be specific to them and not me.

Gary

Do I denote the middle finger on the left hand of the gent in the image that accompanies this story??

Man up…..and pay Caesar what Caesar is due! 🙂

One consolation, at least you don’t pay auto & homeowners insurance in Louisiana like I do…..now that’s a crime!!!

I always pay my property taxes in Palm Beach with credit card in order to get my AA Miles although the city of Palm Beach charges me a 2% convenience fee. It’s like 430$ for the convenience…lol

Oh I wish I could do this. I have to pay $6000 to the county by Dec 31. My Chase freedom card currently has 5% back at PayPal through the end of the year, which would be a nice $300 back! Alas, my county is not available as a payee under the PayPal bill pay. ☹️

@Jeff: See my response to DJ. When I tried it PayPal said I could only use my bank account to pay, not a credit card. Same for paying my HOA fee.

Thanks for the article! Was useful info.

@Gary, i get an error when i try to do a smaller test payment to Travis County. Does it only allow payment of the full bill? i’d like to test the link first with a smaller payment vs. doing > $10K in 1 shot. any tips you can provide?

My county and most I checked in California and other west coast states – is not available as the payee under the PayPal bill pay add feature. (Neither is my HOA….). 🙁

@GUWonder Not in Florida as you state. There are provisions that prevent steep increases even when values rise for the owners once they live in the primary house a while. Newer buyers will pay more but still capped on increases. People in the US want services. What do you think pays for that? Money raining from the sky? Everyone wants a paradise that costs nothing. You want home ownership with no taxes? But if you have kids you want public schools most likely?

PayPal will only allow me to link a debit card. I’ve tried several times to either link a credit card or fund a transaction with a credit card and I am always blocked. Doesn’t matter what card. I’ve had my PayPal account for…many years.

I learned the hard way that using a credit card for PayPal payments can be treated like a cash advance by your credit card company and they charge interest from the day of purchase until your credit card bill is paid. These fees can easily and quickly add up to more than the 3% fee the county may charge for credit card payments. I think the only way around this would be to reimburse the credit card company immediately. Has anyone else experienced this?

I used to work for a large county in Texas. The county does not want to pay the merchant fees for the property taxes. Some systems won’t separate the charge from the fee and the county must receive the full amount.

Fairfax County, VA also not available as a PayPal payee. I have a feeling that the counties that do allow this are the exception. Plus, as I mentioned earlier, credit card companies usually treat PayPal payments like a cash advance and charge interest from the day of purchase until the credit card bill is paid. And that can easily end up being way more than the 3% counties might otherwise charge for credit card payments. So, I’m not sure just how useful this advice is….you may be better off paying the 3% fee to the county if you want the miles/points since you will get miles/points for the fee as well.

The Travis County web site lists a 3% fee for using PayPal

Too good to be true?

@Brittex – going through Travis County and paying with paypal vs going throgh Paypal billpay are two different things

This doesn’t seem to be working. I just tried to pay my Travis County property taxes via Paypal billpay, and got the message “Things don’t appear to be working at the moment.”

I’m hoping it’s just a temporary problem, but guessing that it’s more than that. Is this still working for anyone else?