There are a number of things wrong with Marriott Bonvoy. It’s bad enough that the chain lets hotels charge fees to guests who are redeeming awards. With Marriott, free nights aren’t free. In fact that free night can run up to $99 per night.

But Marriott doesn’t have control over its hotels, and properties tend to run amok. Whether it’s charging guests 4% for lightbulbs in their rooms, charging resort fees only to guests paying with points, or adding unexplained ‘sustainability fees’ onto bookings, the chain suffers from hotels that charge guests what they want. And when it violates policy they may get caught, thanks to reports from bloggers, but they benefit from the extra revenue they’ve extracted from Marriott members while the policies were in place. Some hotels would even charge you extra for paying with a Marriott credit card.

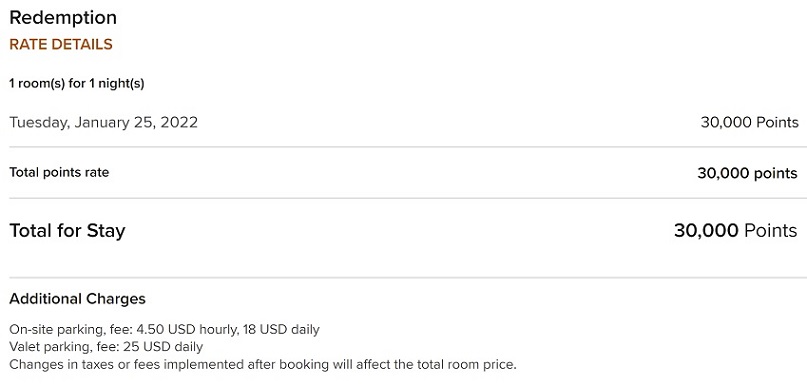

So it really shouldn’t come as a surprise – yet still seems more egregious than most anything that I’ve seen – when a reader shared that the Sheraton Puerto Rico Hotel & Casino has been adding two separate fees onto award redemptions,

- “A destination fee equal to 18 percent of the daily rate or USD 30 per day on Bonvoy redemption stays” – so to make sure that the resort fee isn’t included for guests spending points they add a fixed amount, even though for everyone else it’s charged as a percentage of the room rate, and

- A “Marriott Bonvoy Rewards Service Fee”

I’ve never heard of a hotel charging a fee for using its own chain’s loyalty program! Not only that, but the fee didn’t even appear to be disclosed during booking (disclosure is the hotel industry’s defense to state attorney general suits over deceptive practices, and Marriott has entered into a settlement with Pennsylvania to do better in any case).

Moreover such a fee is forbidden by Marriott’s own terms and conditions. Bonvoy program terms item 3.2.e states that free night redemption “includes.. room tax/service charge.” A Bonvoy service charge, if it were allowed to exist, should be covered by the points redemption!

I asked Marriott about the practice on Tuesday. By Friday they let me know that the hotel had stopped charging the fee. Then they let me know that, in fact,

- This is intended to represent government tax on the resort fee

- They acknowledge it was incorrectly labeled as something completely unrelated and impermissible

In addition this fee was not disclosed to customers at the time of booking! I’m told the labeling and disclosure issues have been addressed (Update: It does not appear to me that the property is disclosing this rather odd charge, that’s supposed to be a tax but that other similarly-situated properties do not appear to charge). However I’ve asked whether guests who were charged an undisclosed Bonvoy service fee will have that money refunded, and will update if I hear back.

When is there going to be a class-action lawsuit? Surely, there has to be a trial lawyer out there somewhere willing to take these issues on.

Is it really any worse than Avis charging a fee to credit rentals to airline miles.

My God it is $3.30! Don'[t make it a Federal case. BTW, I don’t like resort fees but Marriott properties charge them for award stays so this isn’t anything new. Also, I can understand a flat $30 for a points stay instead of 18%. $30 is 18% of $166.67 so I suspect that is their typical rate. Again – not a fan of resort fees but this is not new so don’t act so offended.

What makes this worse is the fact that the Sheraton Puerto Rico is managed by Marriott. So this isn’t a case of a rogue franchisee. This is a Marriott-managed hotel.

The Sheraton Puerto Rico Hotel and Casino has won the coveted “Double Bonvoyed” award for intentionally scamming guests. I wonder how many more Marriott Hotel properties with deplorable policies are striving to be nominated for a “Triple Bonvoyed” trophy.

They market a loyalty program based on certain promises and expectations and then lie and cheat. Not a company I have any intention of dealing with. I expect it continues until someone gets charged with fraud.

Thank you for reporting this and trying to hold Marriott accountable!

I’m all for holding rogue properties accountable, and charging a fee for using points would be egregious. But if you look at the two dollar amounts, the second sure looks like a tax related to the first to me. So they charge a resort fee, the government gets to impose a tax on this, and they were sloppy with the language. I hate the practice, but Bonvoy has clearly established they’re ok with it, so I don’t see much to be outraged with here other than the ongoing “resort fees suck” argument.

@DaninMCI – that’s totally different. You have a choice as to whether you want to receive award miles or not

@AC – you miss the point. How much should a “Rewards Service Fee” be before it becomes wrong?

Thank you Gary for making everyone aware of these egregarious fees. Hopefully the more people are aware of what these hotels are doing the noisier the problem will get

@Darin: $3.30 is 11% of $30. 11% doesn’t appear to be the tax rate. In fact, Gary linked to a post about resort fees at the Ritz-Carlton Reserve and St. Regis properties also in Puerto Rico. They charge 9% tax on resort fees. So, why 11% here?

If it were a tax on the resort fee, the labeling of the tax as a fee for point redemption suggests that they were not turning this revenue over to the government. Of course, they wouldn’t be the only Puerto Rican business or individual not properly filing taxes.

@Darin: The Hyatt Place San Juan, which is a block or two away from the Sheraton, charges $69.23 in taxes and fees. This breaks down as $38.24 for a service charge, $5.54 for a district fee, and $25.45 for an occupancy tax. There is no 11% tax on the $38.24 service charge.

Similarly, the Hyatt House (also a block or two from the Sheraton) charges $75.03 in taxes and fees. The taxes and fees break down to $41.44 for a service charge, $6.01 for a district fee, and $27.58 for an occupancy tax. Again, the Hyatt House doesn’t charge an 11% tax on the service charge.

Looking at the Hyatt Regency Grand Reserve Puerto Rico, the taxes and fees total $125.64. That breaks down as $79.02 for a resort fee and $46.62 for an occupancy tax. No tax on the resort fee.

Whether it is Marriott itself or an independent property owner, these people know exactly what the rules are and they know exactly what they are doing. There is conscious intent. They are crooks. If you still play their game, you deserve what you get. Find a different path and move on.

There are other Marriott hotels in San Juan still charging this.

The AC Hotel Condado San Juan says “18 pct resort fee added to room rate… /Fee USD 25 per day Bonvoy redemption stays”

Has not been changed or removed and they’ve been charging this for quite some time

It’s Marriott – accept that they hate you as a customer and you’ll be fine.

For me the bigger surprise if the Destination Fee being charged as 18%! I have seen fixed $ destination fees but coming across a % Destination Fee for the first time. That too 18%!

Bonvoyed again!

So how can Marriott’s Sheraton claim the extra charge is for the tax on their resort fee when non-Marriott hotels don’t collect a separate tax on the resort fee?

We all should make a list of all properties and surcharges they charges to make a case out if it

It’s the point and not necessarily the amount…Free is, well, free! I booked a Holiday Inn hotel just this past week and noted a $10.00 “service fee” added to the confirmation page. I tried to find out what this fee is to no avail. Bait and switch is my thought! Thus, HI’s daily rate was less than the Hilton Home2 down the street. Guess what??? The Hilton was actually cheaper with all fees included than the Holiday Inn after the “service fee”. And that fee??? Of course, there’s no daily room service either. Buh bye Holiday Inn!

The Sheraton Times Square does the same fbi f

FYI. A majority of the Marriott-flagged hotels in Puerto Rico are owned by the same company. Some are operated by Marriott; others by third-party operators. This partly explains why there is uniformity in charging absurd daily resort fees that vary based upon cash rate and also apply to point stays. If Marriott, which manages the Sheraton in question, was smart they would eliminate the fee at this property since it’s older and not on the beach. If you’re going to pay the same rates and fees as a beach hotel, stay at the beach.

Hyatt hotels are getting in on the scam. Just looked at what the 16% resort scam fee (adds up in the summer when rooms are $500+) gets you. Such things as “24 hour security.” https://www.destinationhotels.com/wild-dunes/charleston-sc-resorts/resort-policies

@John – Hyatt does not charge resort fees at all on award redemptions, and doesn’t charge Globalists even on paid nights

Resort Fees are taxable at the same percentages as the room rate in most jurisdictions. If your tax on hotel rooms is 11%, then the tax on a resort fee of $30 is $3.30. Not sure whether the tax in PR is 11% or not, but seems to be an explanation

Charging a resort fee on redemption stays is another matter, entirely

Two points: IVU in PR is 11.5% (includes san juan municipal tax and territorial sales tax).

Recently stayed in PR, and had a wonderful time in a beautiful suite a few blocks from the beach in Santurce. Oh, right, AirBNB of course. Why the heck would I pay more to receive less at a hotel? Yes, AirBNB has its own “cleaning” and “service” fees. However, when you compare the all-in costs, it’s increasingly difficult to justify hotel stays longer than a day or two.

My company stopped using Marriott specifically due to.the hidden charges.