I’ve had a renewed interest in shopping portals (mileage malls) since American Airlines changed how elite status is earned, with miles for online purchases through AAdvantage eShopping counting both towards earning elite status and towards rank-order on the upgrade list (starting in March).

In the past I’ve viewed these portals as ‘a way to get miles for things you’re going to buy anyway’. And if the offer doesn’t work out you really haven’t lost anything.

Of course some people would use shopping portals to earn miles or cash back and that would be their margin reselling whatever they purchased. It was a way – if everything worked – to earn miles or cash at little to no cost, but there was risk that the miles or cash would not post and there’s risk that you won’t be able to resell items for what you paid for them.

Things are getting more interesting, and more complicated, though for AAdvantage flyers since,

- Sometimes it’s now worth buying things just for the miles since those miles don’t just count towards award tickets but also towards elite status

- There are more ‘stacking’ opportunities than ever, so that deals are either less costly (Amex Offers, Chase Offers, Citi Offers that reduce the out of pocket cost of buying something) or more lucrative (SimplyMiles and other ‘card-linked offers’ that give you additional rewards for the transactions you’re making).

When you can earn miles clicking through a shopping portal, get money back via an offer on your credit card, and earn additional miles for transactions tracked not via a click-through but through transactions on your card these deals can be really lucrative. In each case the merchant is usually paying and they’re now sometimes paying 3 or 4 times to incentivize the same transaction. When that happens their costs rise, they’re unhappy, and they may be unwilling to pay.

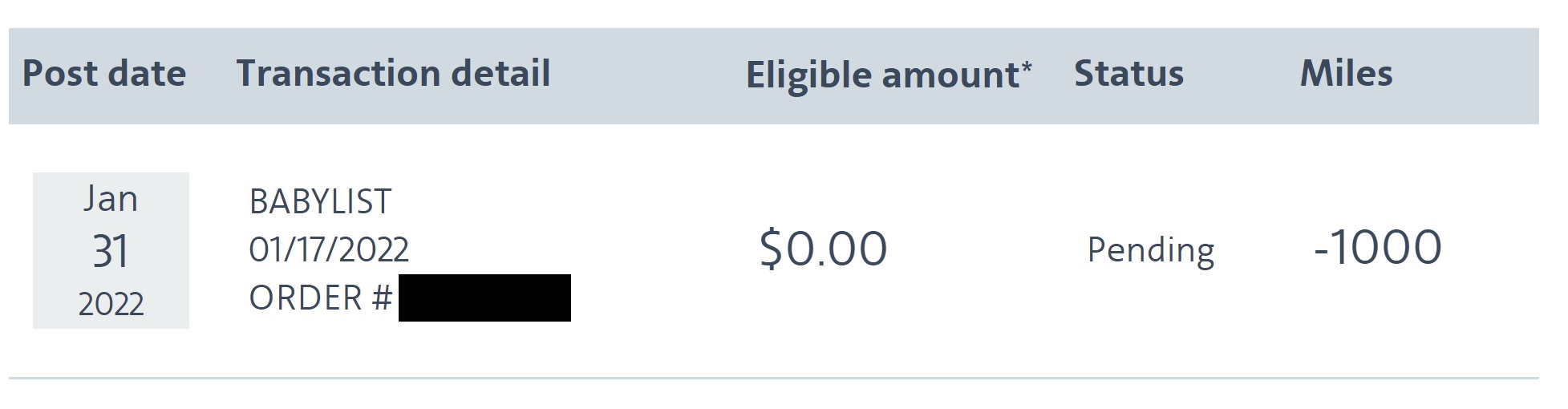

Many people who earned 1000 AAdvantage miles through the shopping portal by signing up with Babylist now show those miles in their shopping portal account as pending for claw back (HT: @brabbworld).

Frequent Miler wrote about a potentially lucrative offer with Motley Fool through the AAdvantage shopping portal. What made it so attractive isn’t just the miles for a $99 trial, but also that there are SimplyMiles offers for paying with a Mastercard and targeted Citi Offers that may apply to paying with a Citi Mastercard, as well as other card-linked offers available. However Motley Fool has reportedly reneged on its offers in the past, and has added a rule to its shopping portal offer that excludes miles when stacking with other offers.

Following the rules of an offer alone isn’t always enough to have points-earning honored. And this isn’t new. A decade ago the most lucrative shopping portal offer ever ended not being honored and frequent flyers sued. There was eventually a settlement. Fortunately they found the only lawyer I know with a history of taking payment in miles.

That same year the AAdvantage shopping portal offered over 83,000 miles for purchasing a Verizon accessory. They didn’t honor it, but gave everyone 2500 miles instead.

Shopping portals license the travel brand’s name. They’re actually run by third parties. Here’s how they work,

- They market offers to consumers.

- The providers of those offers pay the shopping portal company for business

- And the shopping portal companies buy miles from the travel brand, giving those to consumers as incentives

- They’re rebating much of what they get from the merchant to the consumer

The difference between their cost of licensing and miles from the airline or other travel business, and what they give to the customer, is their profit. But they aren’t earning anything if the merchant making the offer in the first place doesn’t pay. And they have only limited control over those payouts.

So if Motley Fool was offering the shopping portal company $100 per new customer, and the shopping portal company pays out $70, everything works out. But if Motley Fool refuses to pay, the shopping portal company is going to refuse to pay too. Even though they’re making the offer to the consumer, and the consumer followed the rules. Moreover they’re doing all of this opaquely in the name of the travel company, using their brand.

The only way to get the shopping portal company to honor a deal, when it’s not being honored to them, is to raise the cost of reneging – by making it costly to the travel company’s reputation, such that the relationship with the shopping portal company gets put on the line.

For years the issue would arise largely when an offer was published with a mistake that consumers took advantage of. Now there are more offers that will just be more expensive than retailers have budgeted for. And consumers may have more of an interest in spotting these opportunities both because stacking makes them more attractive, and because American’s Loyalty Points scheme makes doing so more rewarding.

They’re also clawing back Bespoke Post miles (1,200) on my account, despite having to enter a CC and sign up for monthly service.

This will get real interesting a year from now when people may have miles clawed back that will cause them to drop down a status level just as the qualification window closes

Cartera have been doing this for years.

Never expect a Barron’s, WSJ, or Motley Fool deal to actually post to your account unless you keep those services for well longer than what’s required by the terms of the deal. It’s a bait and switch.

IMO, with the new Loyalty Points scheme, American Airlines must ultimately be accountable for the unethical hi-jinks and broken promises of the business that AA *advertises* as their partner and the conduit for earning status and miles. If AA Shopping has an offer to earn 1,000 miles to sign up for a service (for example Babylist), then AA better make their customers whole in terms of miles and loyalty points when AA Shopping and Babylist refuse to honor the original offer as written. I predict a class-action lawsuit will happen this year over this.

Schemes!

I expected these problems with Cartera (which I believe is now owned by Rakuten) since the very beginning. Trying to get miles for transactions with the shopping portal is often a nightmare and the terms and conditions are not well defined. I suggest to complain directly to the Advantage customer service because it involves your Elite status with the airline and the future service you receive as a member of AAdvanrage. Overall, it was a foolish move from AA to move Elite qualification to LPs as they have no control over the shopping portal business. They should simply keep it based on $ spending with the airline with some bonuses from CC spending if they are interested in stimulating the latter.

This is utter nonsense, I signed up for babylist, filled out a baby registry, sent it to friends and family who bought items from the registry, and my miles were still clawed back. I abided by the terms, got in long before the blogs picked it up (not that that should matter) and am having an actual baby and they still clawed back the miles. Ridiculous!

I switched from using an airline portal to the Chase shopping portal. Now my bonus shopping points and credit card points are both issued by the same provider. I’ve never had a problem getting the points added to my Chase account. And I can transfer those points to every major airline alliance.

Glad to see you bring attention to this. I have several FTD bonuses that have never posted. The AAdvantage e-shopping customer service has been horrible in trying to get it addressed. With this now being a key part of how status is earned, AA will increasingly face pressure over inaccurate/non-existent transaction posting and poor customer service from the e-shopping provider.

These companies risk reputational damage in all of this I think. I already think less of Motley Fool and I haven’t even bought anything from them yet. I want to sign up with them to check out their product but they are already telling us on the front end they won’t let offers stack so I have to be careful to not pay with a MasterCard linked to my simplymiles offer in order to get the higher AA offer and I still risk them not paying out.

It also seems ironic that these portals and airlines have such a hard time crediting legit offers completed properly with the correct cookies, etc. yet they don’t seem to have any problems clawing back miles.

Just had a similar problem with Payless rent a car. When I rented the car, AA was advertising 1,500 for a rental. They only credited me 500 miles, and now the website also dropped the promotion to 500 miles. So, I had to endure Payless’s long lines (over an hour at the Kauai airport) for a value of about $6. Worse off, they added a $4 mystery fee over the estimated amount, so the value was $2. Going back to either Hertz or National/Enterprise where you can just pick up your car and go without waiting.

I agree with the above. So what should we do? Email portal first, then AA? I don’t mind doing a little paperwork but if they tell me to pound sand I will sue. I file half a dozen arbitration cases a year and have recently branched into small claims.

As they say, time is money and having to jump thru hoops to get 1000 AA miles ($10-15) for signing up for Babylist is not worth your energy. If it takes just a few seconds to click through a portal to buy something you were going to buy anyways, I’m in. When I was stiffed by Rakuten for a Gap Factory purchase, I just use something else and not sweat it.

“Time is money” is not true for all people all the time.

If you have the option to earn marginal wages in lieu of spending the time to get your miles, then, yes you should forget the miles. But myself, like many others, are paid a salary — a fixed wage — and do not have this choice.

Mine are gone too. What the heck? I just wrote them. No explation. Just a reversal. That may be it for me. I have been going and forth over switching airline loyalty. Status matches after July 1 will get me through next year. Shopping, credit cards. ENOUGH. HOW ABOUT FLYING. Everything is about greed, while customer service is DEAD.

*explanation

(that’s what I get for typing mad!)

I’m done with shopping portals. I have carefully followed the rules for different promotions, and on several occasions have not received the bonus miles. Most recently in December, when SimplyMiles did not credit my 240 miles/$ on a Conservation International donation. I even have email confirmation that the bonus miles would be forthcoming, but 8 weeks later, nothing.

I’d advise others to avoid SimplyMiles. Using the contact form on their site, I’ve emailed them multiple times about not receiving credit for two separate transactions in December and January at BP and byte. They don’t even bother replying. Do they even have a competent customer service department?

Hey Gary, didn’t you say in one of your recent posts that the new AA LP program was going to be fun? and didn’t you tout all those great deals via shopping portals? Boy, it is so much fun to go through the registry process for Babylist (and be excited) and get 1,000 miles and then have these miles taken out of your account. Wow, so much fun! Have my Naked Wine miles posted or even registered? Or my Chewy order? Man, what a pathetic scam this is, and you in your unfettered enthusiasm for this new LP program happily pour the Cool-Aid. Have fun falling for the next worthless promotional scam! I’m done with it.

Perhaps its time for one of those class action lawyers to get involved. Class action lawsuits are always a big money maker for attorneys.

I gave up on AA miles through the shopping portal years ago. It was a hit and miss if the miles were even credited in the first place.

Rakuten on the other hand always tracked the purchases and if something was missing they added it no problem (vs. maybe after 4 weeks “investigation”).