United Airlines filed their 10-K annual report to the SEC (.pdf), and a couple of things stood out to me in their disclosures about the MileagePlus program. The most significant supports my explanation from yesterday of why frequent flyer program profits will fall.

First United assumes 18% of the miles they issue will expire unused. Miles expire after 18 months of inactivity in an account. Don’t let your accounts go dormant!

- Bear in mind this doesn’t mean that 82% of miles will eventually be used. Delta doesn’t expire miles but discloses in their 10-K that they assume a certain percentage of miles never get redeemed. After all not everyone will earn enough miles for the award they want, and even when miles do get redeemed people don’t draw their balances down to precisely zero.

- Oddly United discloses an assumption of 16% expiration in the prior filing, but 18% the year before that. These assumptions affect the profitability of the program, so it’s interesting to see the assumptions adjusted both down and up.

Second and more importantly United just isn’t growing the number of miles it sells to partners.

Last April United President Scott Kirby shared that credit card signups were lagging. American Airlines revealed something similar in an SEC filing.

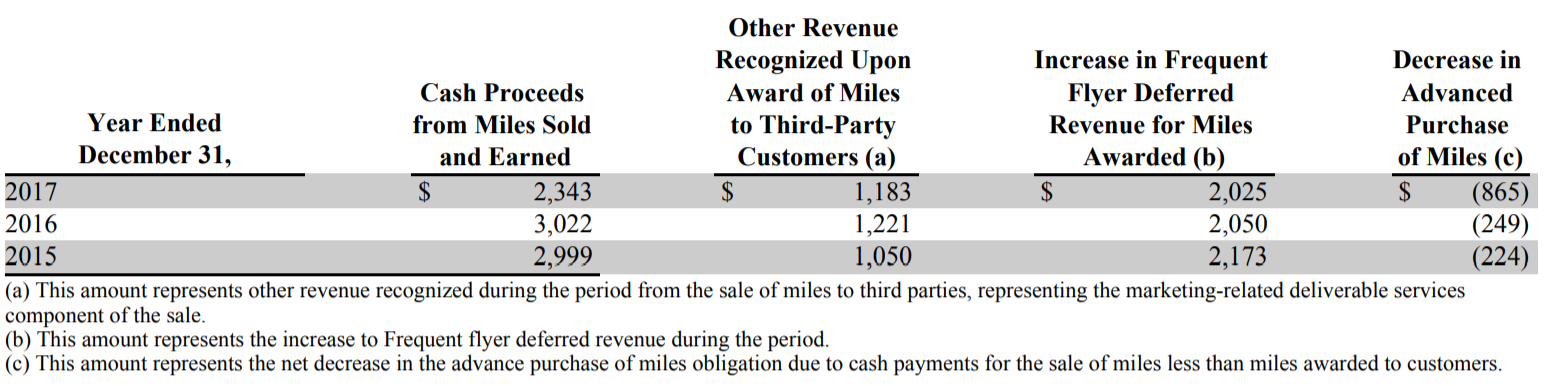

That’s taking its toll in revenue, as we see on page 63 both marketing and deferred revenue from mileage sales fell year-over-year in 2017.

Taken together with American’s disclosure in their 10-K of the risk of being outcompeted by bank proprietary programs like Ultimate Rewards and Membership Rewards this is very significant. I’ve been saying for some time that there’s a limit to how much airlines could devalue their programs without financial consequence. It seems like we’ve reached that limit.

The claim that frequent flyer programs are more valuable than the airlines that own them (and thus the case Stifel analyst Joe DeNardi makes for spinning off programs to unlock value) rests on an assumption of 4% – 5% annual growth but United’s mileage sales revenue doesn’t appear to be growing at all, in fact we see it shrinking slightly. I’ve argued that the era of spinning off frequent flyer programs should be over.

Wow, reading this was really tough. Please check you grammar as you’re missing commas everywhere.

I liked the article and the grammar didn’t bother me a bit. I like the Gary is one of the few boarding area bloggers that looks at the 10ks and give some insight into what they say.

What is the impact of 5/24 on the credit card factor? Why does it apply to United and not BA? Is that Chase’s call? Are the contracts different? Could United push for a change? I can understand 5/24 on Chase’s proprietary cards but have wondered about the inconsistent dynamics on the co-branded ones.

“United just isn’t growing the number of miles it sells to partners.”

This is simple to fix: Just offer a 100k mile signup bonus on the Explorer Visa card!

It is just common sense. You cannot continuously deflate miles and expect the demand to be same. To the airlines, DUH.

Gary you are missing the point. I don’t think it’s because UA miles are less valuable per se. There are more attractive cards out there including those issued by Chase. If sales of miles to Chase is the biggest category of revenue it makes sense to assume that it’s the card benefits of the Sapphire card and other cards are just more attractive than the UA cards based on value proposition alone. You cannot jump straight to redemption cost increases as the sole reason why profitability is stagnant.

Regarding Mike’s comment: If I’m reading the 10K right, the miles sold to third parties (primarily Chase I assume) went down as well, seemingly supporting Gary’s thesis.

Maybe this has to do with the psychology of people earning less United miles on flights. The revenue based program will cost them in the long run. They should have incentivized through bonus miles for premium/more expensive tickets not drastically reduced how much you earn on a single flight. That alone makes United’s program feel less valuable.

My Chase Sapphire Reserve earns me more miles than United’s actual frequent flying program and the points are flexible that I can use them with other programs.

It just feels like frequent flying programs or loyalty programs don’t deserve the name. There really is no special treatment worth caring about or trying to earn. Just buy the best deal for the price. Premium fares in particular, so many fare sales, have become so much more reasonable and that that point who cares about the respective airlines program.

I think Mike nailed it here. UA miles haven’t been devalued to the same extent as DL’s or AA’s (time will tell if their dynamic pricing pushes into deval territory, but so far it hasn’t). And if you are a frequent traveler the earn structure is still as solid as the other guys. It’s the credit card offering that lags behind some of the competition, especially Chase Sapphire. UA has historically made a killing off of their Chase deal. Without a strong credit card offering (e.g. 2x on dining, groceries, gas) they won’t get their Chase money and their profits will disappear.

United Credit Cards are subject to 5/24, and the AA cards aren’t churnable unless you haven’t had a citi/barclay card for 2 years.

So its no wonder they aren’t selling more card signups – anyone who wanted those cards already has it,.

Good points. I’m holding about 50k miles on UA, and 150k on Chase UR, which I may transfer to UA. But devaluation? I also, unfortunately, have a bunch of Delta miles. Give me UA, AA, or Alaska any day instead!

@B – excellent point. That, combined with the fact that UR cards are better for most every day spending (overall) than the MP card (aside from the initial spend bonus), less incentive to get the MP card.

Gary does a great job with articles on SEC filings and analyzing statements in these filings. Put that MBA to some use. Nice reporting.

Gary, I feel dumb asking this, because all the other comments show that others understand it well: What do these column-headings (“Other Revenue Recognized ….”, etc.) mean? Thanks – and sorry if this wastes time.

@Peter not dumb at all. When an airline sells miles it considers part of the sale a liability for future transportation (and defers that revenue until the miles are redeemed to cover the transportation cost) and part of the sale payment for things they are delivering now, like use of the airline’s brand and marketing list (and they recognize that revenue now). That’s why it’s broken up into two pieces.

@Mike thanks – full disclose, no MBA here

@B — Chase’s 5/24 might hold back the United card from ~ 5% of applicants, but those applicants wouldn’t have spent a material amount on the cards beyond what’s necessary to earn the signup bonus.. I don’t think that’s the driver here.

@Mike – my contention is that there’s more competition from highly valuable programs, and United’s program has gotten less valuable. As a result they’re being outcompeted, and will need to spend more on redemptions to attract and retain customers.

@nsx — increasing signup bonus miles don’t necessarily generate more revenue, the incidence of cost for the acquisition bonus isn’t always or only on the bank

OK, Gary, but even if United gets the same amount from Chase for a 100k signup as from the regular 50k signup, the number of signups will surge. Total revenue will surely increase. That revenue should be weighed against the additional liability of all those 100k bonus in members’ MileagePlus accounts.

I agree that it might not be a net win for United. But in the wacky world of accounting, it might look like a win anyway.

I purchased close to 2 million points over time as there cost effective for flying premium on Star Alliance airlines. Now its close to 4k for enough points to fly from Australia to Europe. There are now fares available for purchase close to that amount without the restrictions of using points. I dont need to buy points now to fly premium in premium cabins at ok Prices.

Sounds like it’s time for United to devalue transfers from UR. I realize the relationship between Chase and UA is complex and symbiotic so devaluing is easier said than done, but the cost of UR to UA (in lost Explorer cards) is increasing.

@Jwalter it’s not that simple. If United devalues (and remember they’ve already devalued their miles last year by increasing the number of miles for award redemptions) Chase will just not be willing to pay them as much when they purchase their miles.

@Gary re: your comment below:

“my contention is that there’s more competition from highly valuable programs, and United’s program has gotten less valuable. As a result they’re being outcompeted, and will need to spend more on redemptions to attract and retain customers.”

No doubt spending more on redemptions is part of the equation. And that’s why you continue to see all airline programs make more opportunities available across the spectrum (aside from air travel) to members. However, it would be foolhardly to forget that since sale of miles to Chase is directly impacted by competitiveness of the credit card itself when compared to other cards out there. If a consume has the ability to earn 3x on travel and dining through UR, which can be redeemed across multiple hotel/airline programs including United’s, aside from the free checked bag and priority benefits, the 2x on United and 1x on everything else doesn’t quite stack up in the mind of a consumer who has disproportionate spend on travel and dining (3x). When that happens, acquisitions and retention become harder, which directly impacts sale of miles to Chase because fewer people are earning them on the United cards.

United is losing customers who can’t earn miles with a credit card because of the 5/24 rule. Its potential clients are shifting carriers where they can double dip. The United card is also not the preferred card within the 5/24 category but yet, its subject to Chase’s regulation. United should consider removing the restriction. United’s participation helps Chase’s clients, but United doesn’t benefit. It’s time for United to renegotiate its contract.

I have been a delta diamond since inception of program but have found that being a diamond does bot mena a lot. I changed to regular credit cards rather than the expensive Delta and United cards – save 800-900 a year

And now fly whatever airline works well. So instead of Delta or United Ticket for 4k , I bought a quatar biz ticket for 2500.

Still Delta platinum and United gold but not loyal anymore

I originally got the MP Club card for its x1.5 rate and used it for all my bills, taxes, and everything else that I wouldn’t get bonuses on with other cards like the Sapphire Reserve.

All that spending went to the Chase Freedom Unlimited instead when that card came out.

I still keep the MP Club card for its benefits but I wish it had unique spending incentives like x5 on United Wifi & onboard meals.

This all makes sense. Fliers that fly in the back earn practically nothing anymore. To top that off, UA has made it significantly morr expensive to redeem miles. That has several consequences…one, when fliers begin to believe they won’t earn RDMs, they won’t care about earning them with partners because it no longer provides enough benefit jointly. Second, even if they still care, there will be fewer members that are close to an award which destroys demand for top up mileage purchases.

Of course, both real and perceived lack of inventory for mileage redemption (or only at ludicrous levels) adds further to the erosion of goodwill towards the programs.

The fact that the banks are issuing better cards than their cobranded ones is just the icing on the cake.

In the next recession, even despite the obvious de facto collusion among the legacies, the airlines will be taking a brutal hammering. And they deserve every bit of that.

United airline devalued the mileage by 20-30% in Nov 2017.

And they put more restriction on miles. If mileage does not show

any advantage, why I care this complex program?

They deserve a big failure of the devaluation.

@AAExPlat You nailed it regarding next recession and impact on airlines. I am former AA Exp and now AS 75K. I used to spend most of my CC on AA cards and these days it’s Amex followed by hotel credit cards and then Virgin Atlantic (2x per $ spending) and Chase BA for companion tickets. I don’t even transfer these points to any US legacy carriers but to foreign carriers. Flew SQ to Singapore a month ago and flying to Tokyo on ANA. So, no more ticket spending on AA, no credit card spending on AA cards and no more miles transfer to legacy airlines.

Maybe people are finally figuring out that UA, you know, sucks.

As with everything else, where one stands depends on where one sits.

For me, lifetime Marriott Platinum Pro (or whatever it is called tomorrow), gives me UA Silver MP status as long as their marketing alliance continues. As a result, the collateral benefits of a UA card are non existent. And my CSP and Amex Plat cards give me enough potential MP points to fly wherever I need on United, so the UA card is completely superfluous.