American Airlines has said that they believe their path to profitability is doubling down on their current approach which hasn’t worked so far. They should be changing their approach to invest in better service and a better product, especially domestically and in economy, and to build up their route network in key business centers, because that’s how they’ll grow the key profit center of their business – co-brand credit cards.

American Earns Money By Selling Miles, Rather Than Flying

I’ve written in the past that I believe American Airlines does their network accounting wrong. The airline doesn’t make much money – if any at all – from flying, they make most of their money selling miles to Citibank and Barclays.

That doesn’t mean they should ‘cut out the middle man’ and stop flying. It means they should be focusing their flying on maximizing credit card revenue. That means they need to attribute the credit card revenue to their markets.

- Downsizing their operation in New York, becoming less relevant to New Yorkers means giving up the lucrative New York spending market

- They are weak in the Bay Area. Walking away from their Alaska Airlines partnership makes them even weaker, when they should be going after Bay Area spend.

American Is Focused On Price More Than Product

When you realize the source of the airline’s profits, that has implications for their product as well. Remember that American’s President Robert Isom is chasing Spirit and Frontier,

[T]oday there is a real drive within the industry and with the traveling public to want to have really at the end of the day low cost seats. And we’ve got to be cognizant of what’s out there in the marketplace and what people want to pay.

The fastest growing airlines in the United States Spirit and Frontier. Most profitable airlines in the United States Spirit. We have to be cognizant of the marketplace and that real estate that’s how we make our money.

We don’t want to make decisions that ultimately put us at a disadvantage, we’d never do that.

Delta’s Co-Brand Card Succeeds Because Of Its Brand

I believe that American’s AAdvantage program is better than MileagePlus and SkyMiles, yet which airline’s co-brand card is punching above its weight?

It makes zero sense to spend on Delta co-brand cards unless you’re trying to use that spend to earn elite status. If you want SkyMiles you do better with other Amex cards, that earn points faster, and transfer to SkyMiles as well as giving you other (better) transfer options. Sure, get the card for free checked bags, but that doesn’t require spending on the card. And yet American Express and Delta keep growing their portfolio and growing spend.

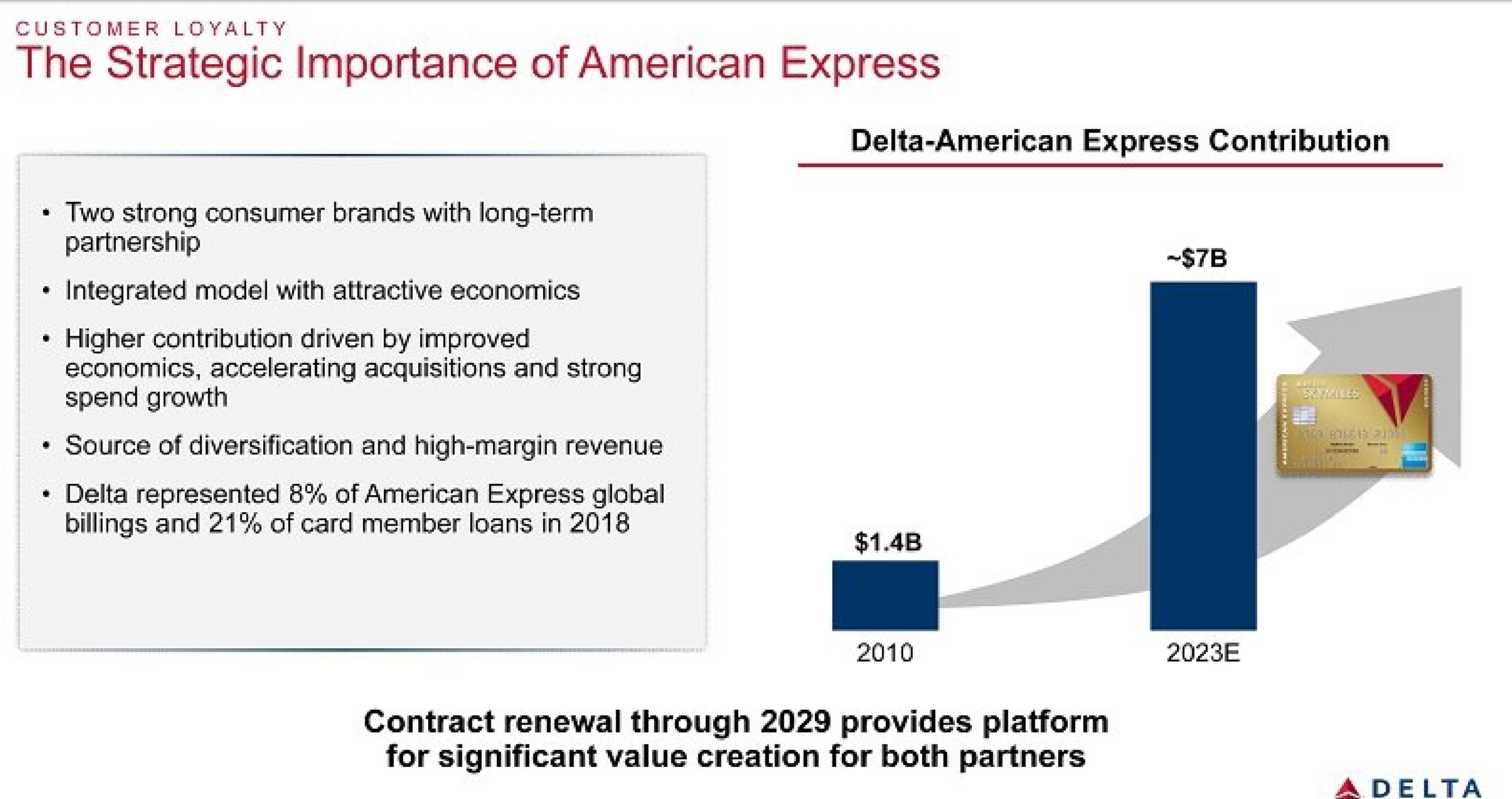

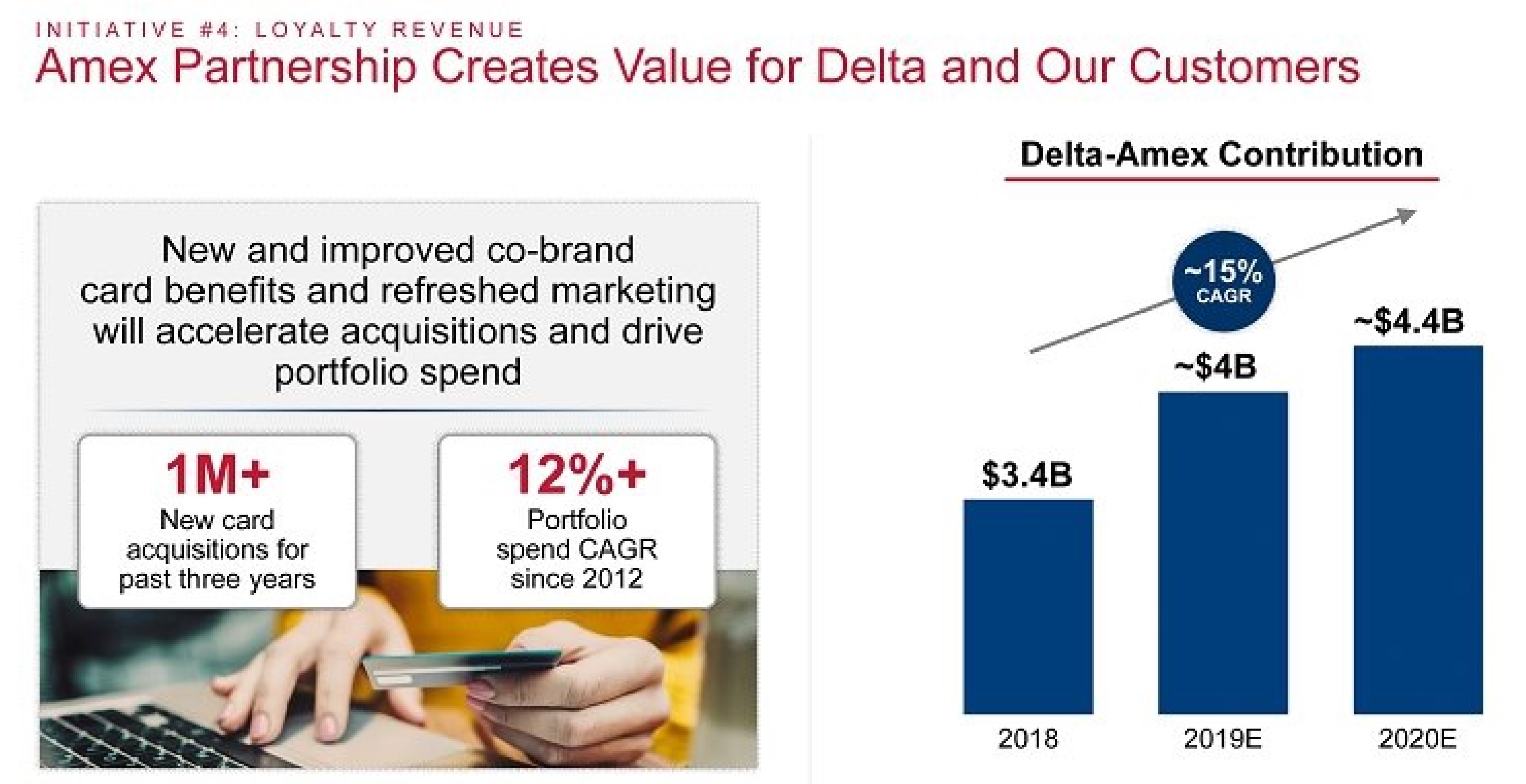

Delta shared some details on the growth of their card portfolio at Thursday’s Investor Day.

And the only explanation that makes any sense is brand, it’s why people get and use the weak Apple card.

Scott Kirby has suggested a better domestic route network would give them the credit card portfolio he wanted, that the airline’s size alone determines its credit card success and yet 18 months to two years later Kirby still found himself unhappy with his credit card deal.

What’s the issue here, and the difference between American and United on the one hand and Delta on the other? Delta offers the least valuable card proposition to the median member of the three airlines, yet it’s seeing huge growth.

The only answer that squares the circle is brand. Delta has even revamped the international coach experience with hot towels, cocktails, and flight attendants who say thank you and new amenity kits.

Ed Bastian said at Investor Day that they’re giving customers loyalty by engaging them, a brand customers like, rather than making them feel trapped. In other words, customers used to stick with the loyalty program in spite of the airline, now they are loyal to the airline (and, I think, stick with the loyalty program because of the airline rather than because the loyalty program is any good – except in terms of treatment of Diamond members).

The Delta Lesson Is Grow Credit Card Profits By Improving Product And Service

If American wants to grow its card portfolio and spend volumes sit should be taking a lesson from Delta, investing in better service (which means making work rule changes a priority in flight attendant negotiations) and better inflight product especially in coach because most passengers sit in coach and most international business class passengers buy coach domestically.

Enough of the NY / SF bubble argument

You think Delta’s number slook good – how about if Southwest were to disclose – those would be off the charts

It’s simple – Delta lowered the price of run of the mill domestic awards with dynamic pricing, got rid of the expiration gotcha, and that made it a better value prop for the 90% of people who don’t care about cents per mile value

For those who care they have a high spend incentive for elite status via card spend

And for the biz traveler, they are ON TIME more often

This is not about food and blankets or ads

UNITED is the one to watch these days

AA’s deliberate death spiral should be a chapter in MARKETING WARFARE by Ries & Trout.

In AA’s case, they have forfeited any favorable position in the market they once enjoyed. Any enhanced deal on their credit card or miles is meaningless when their product and catering is like a train ride into the Gulag.

I was a “road warrior” in the ‘70s and ‘80s when FC was still an important customer experience beyond a bag of pretzels. Today, I’ll let the corporate millennials worry about maximizing their mileage; for me, I’ll book DL FC whenever I need to fly.

Unless management is rudely shaken up soon, it may be too late to save AA. Most travelers with any brains seek consistency in their comfort, service, quality of food, and a glass never empty.

Like Amtrak, AA also belies in having a necrotic marketing dept. oblivious to the old axiom that if somebody has a good experience, maybe they will tell 5 other people. But should they have a bad experience, you can count on their telling at least 25 people! For me, the physical pain created by the seats in all classes on AA negates any consideration to fly them again, despite being an ex-Platinum.

The Apple Card is really not weak. Use it the same as any other by focusing in the types of purchases that yield the best reward. Right now they have 6% Daily cash on Apple products and even better, 0% interest plus 6% daily cash if financing an iPhone with monthly payments.

I’ve always assumed that Delta was more engaged with it’s customers because, due to fewer hubs, it has fewer captive customers. American has hubs freakin’ everywhere. United has two sizable ones on each coast and one huge one in the middle. Delta has one on each coast, 2 smaller ones in the middle and SLC, for whatever it’s worth. Delta doesn’t have the captured pop that United or American have at their fortress hubs, even with them sharing ORD. They have to get ppl to transit through ATL instead of MIA, CLT, DFW, etc. (or ORD, IAD, DEN…take your pic).

I think Isom and Parker feel like they have a huge pop in MIA, CLT, DFW, 1/2 of ORD, PHX that don’t have a choice, other than the LCCs. So, you compete against those. It’s rational, but I think it’s wrong. I’m considering moving to Delta next year, and I live in DFW.

Good stuff, Gary

Is there any clarity as to how the AmEx – Delta relationship works financially? Does AmEx slide Delta a fraction of annual fees on cobrand cards? Percentage of spend on the card, beyond those who use their Delta cobrand cards to purchase flights?

I would have to imagine AmEx gets something from the relationship, though it’s not immediately obvious. Maybe it’s all those HENRYs onboard, who may graduate from cobrand to personal Gold or Plat cards? (I don’t sense that the old complaint about AmEx merchant fees are grossly out of line compared to Visa/MC)

Thanks for any info you can provide.

Wow — what insight! We’ve never previously seen you express these opinions, so thank you for sharing!

Back to reality, let’s see how DL’s actual business acumen stands up over time to what I will call the America West School of Airline Management since alumni Doug Parker and Scott Kirby are currently running DL’s two major competitors. Personally, based on history, I would not bet on DL maintaining their financial outperformance. It is very difficult to do in this industry. Heck, just a few years ago, Bastian’s DL had to take a several billion dollar charge because he hadn’t yet adopted Doug Parker’s “fuel hedging is for suckers” strategy. He’s also responsible for other dubious investments, including the notorious purchase of a Philadelphia oil refinery. DL has had a nice financial advantage over AA and UA this year simply through the dumb luck of owning no MAXes. Bastain seems better than Parker or Kirby in spouting the marketing gobbledygook you like; let’s see if it actually makes DL more money over time.

Meanwhile, the one thing DL has truly excelled at over its rivals is its reliability. There “zero cancellation policy” always seemed extremely impressive. But now that AA has gotten its mechanics back to work, AA also runs a zero cancellation airline. Is the rest of DL’s “advantages” similarly ephemeral? We’ll find out more next year. In the meantime, I don’t expect Kirby and Parker to be taking your marketing advice.

Gary, agree completely. I live in an AA hub and used to fly them exclusively as well as having the AAdvantage platinum card.

I started growing tried of the new AA interior and substandard crews (plus, if I wanted a Spirit experience, I’d fly Spirit), so tried Delta.

Had an excellent experience on Delta (great crews that go out of their way, great first class seata, and most importantly in seat IFE). Now I fly Delta exclusively and have the Delta Reserve AMEX card.

Apple card is not weak. what other credit card is giving you 3% cash back at walgreens? 2% back any apple pay merchant is powerful when you go overseas where pay by tap/mobile wallet is more common. The spending bonuses on amex/chase sapphire are really only good for travel or dining. There are other things to spend money on.

I just got off a DL international flight in Y, and I was pleasantly surprised at the experience. My impression is that they are trying hard to make it as pleasant as possible. Huge upgrade from UA (and the bottom of the barrel, AA).

@Tony, maybe our “thought leader” doesn’t get referral incentive for the Apple Card so he talks it down.

This is not a space to find fair reporting. Bloggers create their own dynamic and that’s ok. It’s just important to realize the difference.

And a pat on the back for this genius headline about American could make more money by improving product and service. Seems like common knowledge advice for any business.