Yesterday we learned that:

- American Express renewed their co-brand relationship with Delta

- Delta would not be implementing its cap on points transfers into the SkyMiles program from partners.

It struck me at the time that American Express should have negotiated better for itself, I was surprised that the cap wasn’t going to apply going forward to all partners except for American Express!

Of course I’m glad that’s not what happened, I don’t want to see caps on transfers, largely because I don’t want other programs to mimic the idea thinking that if Delta’s doing it then it must be smart.

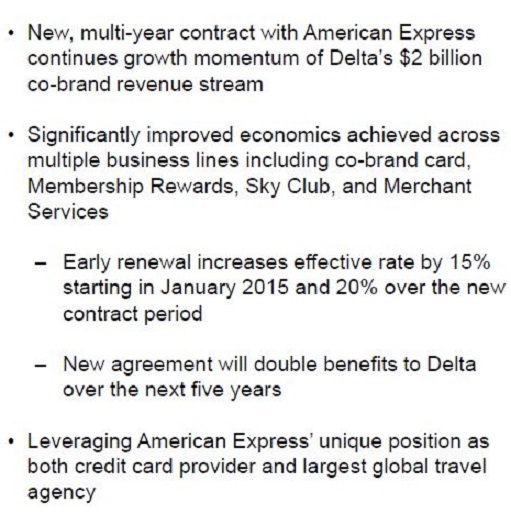

There’s not a ton of public information on the extension of the Delta/American Express relationship out there. But here, via Joe Brancatelli whose newsletter I subscribe to, Delta included the following slide in their investor presentation.

Let’s blow up the text a little:

Bottom-line, Delta is sharing that American Express is paying them a whole bunch more money for their miles as well as their product. The product is indeed getting marginally better, although they’re giving Amex access to less of it:

- American Express Platinum and Centurion cardholders no longer get guest privileges at Delta Skyclubs when flying Delta same-day

- American Express Centurion cardholders, who receive Delta’s Platinum status, will no longer receive that status’ bonus miles for their flights.

In the meantime, the miles American Express is buying keep getting less valuable.

From a business standpoint though I really do have to respect what Delta is doing: charging more for less, at the $2 billion price point. Impressive indeed.

- You can join the 40,000+ people who see these deals and analysis every day — sign up to receive posts by email (just one e-mail per day) or subscribe to the RSS feed. It’s free. You can also follow me on Twitter for the latest deals. Don’t miss out!

Any truth to the rumors that another card issuer went in hard for the co-branded Delta relationship?

@William Charles ….

* This was an early renewal. So Amex couldn’t have lost the contract right away.

* There’s almost certainly right of first refusal in the old contract

* The relationship is worth more to Delta than to other issuers, because of the existing customer base that Amex has (another issuer would be starting from scratch)

As a result, I don’t think it was ever in doubt that Amex would keep Delta as a co-brand partner.

Hpwever, moving now locks in the price at which they’ll do that. It prevents Delta from getting an actual bid.

But I’m quite certain there’s another currently aggressive bank working hard to secure their place in the co-brand space.

Rumor is for instance that Amex is losing JetBlue to Barclays…

That said, probably only Chase could afford to grab Delta, but they’d have had to overpay. Barclays’ US card operation doesn’t have the cash to commit. Citi is too dysfunctional. BofA isn’t that aggressive. In order to actually do it though Chase would have had to overpay. No idea if they’d have been willing to do it.

@Gary Leff: “Citi is too dysfunctional.”

I could not agree more!

They are all dysfunctional. They should all be bankrupt!

I’m just waiting for the taxpayers to foot the bill as usual.

I only wish that Chase would make AA a transfer partner, particularly now that they’ve merged with US Air. And you are completely spot on regarding Citi.

As long as consumers continue getting the Delta Amex card or continue transferring points to Delta, Amex will continue overpaying for the SkyPesos.

@thebone – Chase won’t be able to get AA as a transfer partner, thus far Citi – AA’s co-brand partner – hasn’t been able to do it.

Chase has United, Citi has AA, so I am not sure if Delta would have gone with either. That leaves BofA and I doubt BofA, even if they got the contract, has the class or marketing muscle to make that relationship a success. I would say that the Delta contract was Amex’s to lose. The big one for Amex is the Costco deal. Let’s see how that shakes out as I think almost 15% of its credit card loans were to Costco cardholders.