I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Get Early Access to Zerocard, and Earn Elite Status for Rewards

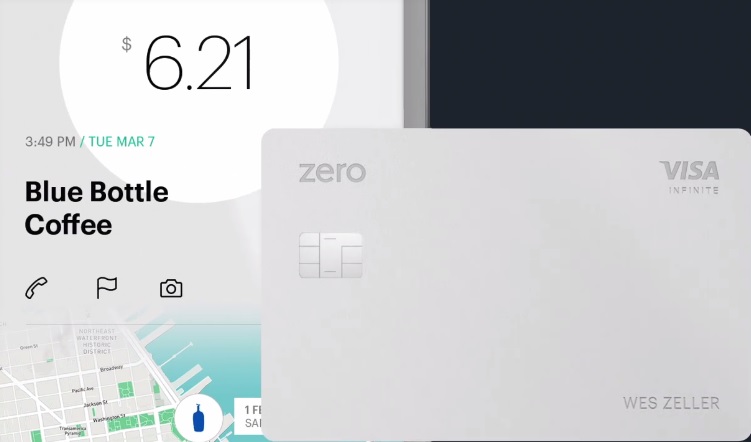

Zerocard is a product planning to launch next year — it works like a debit card but pays up to 3% cash back. It’s an FDIC-insured bank account, with charges deducted from your balance. But it processes like a credit card so they can pay out strong cash back. And the card is all metal.

The account pays interest, allows direct deposit, bill pay and ACH and wire transfers. There are no ATM fees in-network.

- The Durbin Amendment to Dodd Frank financial regulation destroyed debit card rewards. By capping fees for processing payments, it no longer made sense for banks to offer rich rewards for debit transaction.

- But the Durbin Amendment did even more than this. Since debit transactions were no longer profitable for banks, checking accounts alone often weren’t either. Banks started imposing higher minimum balances to avoid monthly fees. After the law was implemented we saw a rise in the ‘unbanked’ — people without access to the banking system, who pay high fees to use shadow banking like check cashing stores.

- American Express had what looked on paper like a brilliant play — Bluebird and Redcard products were basically debit cards with added banking features that got around Durbin Amendment limits on interchange fees. They partnered with Walmart and Target to get access to customers. And yet it didn’t take off the way Amex had hoped.

Zerocard is the new “let’s circumvent the Durbin Amendment” play — a debit card that processes as a credit card and pays up to 3% cash back. (HT: Hans Mast)

It offers cash back at four different status levels:

- Quartz earns 1.0%

- Graphite earns 1.5%

- Magnesium earns 2.0%

- Carbon earns 3.0%

Registering now for early access (just giving your email address) gives you Graphite and an easy way to start out at Carbon.

- Share your link on social media and get 2% cash back (Magnesium). (Hint: you can post to Facebook with a setting that only you can see the post.)

- Refer 3 people to sign up (give their email address) and 3% cash back (Carbon). This is my referral link to zerocard, feel free to leave yours in the comments.

This status lasts through the end of the year that you open your account plus the full next year.

Otherwise, your annual spend level determines your cash back percentage: $25,000 for 1.5%, $50,000 for 2%, and $100,000 for 3%.

Starting out at 3% cash back could be very lucrative, although it’s a limited audience for which it will make sense to earn lower levels of cash back through the program unless they really want their charges automatically withdrawn from their bank account (although most credit cards offer an automatic payment option).

Hi- Thank you! I just signed up but how do I create the referral link? Thanks and I appreciate any help.

Sam, if you go to the Check Status page, its near the bottom, looks like:

https://zerofinancial.com/EARLY17445

Don’t forget to share on facebook also to get to the 3rd tier.

Please use https://zerofinancial.com/EARLY21513

Hi- Thanks! I think I figured it out. Here is my referral link:

https://zerofinancial.com/EARLY21481

It would be greatly appreciated if it is used!

Thank you!

I appreciate if my referral link is used. Thanks!

https://zerofinancial.com/EARLY21486

This looks promising – can’t wait to try it out.

Please use my link: https://zerofinancial.com/EARLY705

Thanks! My link is:

https://zerofinancial.com/EARLY21613

Please use mine

zerofinancial.com/EARLY1043

Thanks! My link is:

https://zerofinancial.com/EARLY17336

Rex- Thank you!

Would appreciate if you would use my referral link. zerofinancial.com/EARLY17181

Thanks in advance!

Please use my referral link:

zerofinancial.com/EARLY21759

Thanks!

Thanks (and good karma)to anyone willing to use my link!

Here it is:

zerofinancial.com/EARLY21794

referral link https://zerofinancial.com/early21546

THINK OF THE CHILDREN!

And use my link 🙂

https://zerofinancial.com/EARLY21805

Be kind to every one 😉 Here is my link for signup.

zerofinancial.com/EARLY21827

I would really appreciate the help if anyone wanted to use my link~

Thanks

zerofinancial.com/EARLY21794

Does look interesting.

Please use my link https://ZEROFINANCIAL.COM/EARLY21881link

Thanks in advance!

https://ZEROFINANCIAL.COM/EARLY21526

gotcha Dee Spee — you are one closer!

Please use my link

zerofinancial.com/EARLY21954

gotcha Dee Spee — you are one closer!

Please use my link

https://zerofinancial.com/EARLY21954

working link this time!!

ta-da. Durbin amendment was a big lose for people who would rather pay with their own money. My link is

zerofinancial.com/EARLY22108

Please add me to the conga line: zerofinancial.com/EARLY22353

Hmm… I wonder if this could become an MS thing…

https://zerofinancial.com/EARLY22372

Would appreciate somebody using my link:

zerofinancial.com/EARLY22423

Thanks!

Would love for people to use my referral link. Thanks!

https://zerofinancial.com/EARLY22583

I was having difficulties to get it to work and found a few things to help:

I used internet explorer to open the site:

(Here’s my link zerofinancial.com/EARLY22621 )

It looks like you need to add your e-mail address as well as someone else’s code in the links eg. EARLY22621

Maybe the servers were just impacted more than they thought but figured I share what I knew.

Here’s my referral link if anybody is still looking for one. Thanks!

http://zerofinancial.com/EARLY22774

Here’s my referral link:

https://ZEROFINANCIAL.COM/EARLY17154

I’m just looking for one more person. Thanks!

The links weren’t working for me last night (flash problem?) but I was successful using explorer/edge this morning. Please feel free to use my link too as you work your way down the line. Thank you!

zerofinancial.com/EARLY22876

code: EARLY22876

Thanks for using mine!

https://zerofinancial.com/EARLY22989

Signed up a few days ago myself…the 2% from referral and sharing on Facebook is good, though the 3% makes it a near no-brain option for non bonus spend (if 100k spend to reach can be avoided.)

My link – https://ZEROFINANCIAL.COM/EARLY18337

I used Lucas’ so in conga line fashion, please use mine zerofinancial.com/EARLY23172

thanks!

https://zerofinancial.com/EARLY23172thanks!

Conga!

https://zerofinancial.com/EARLY23219

Thanks!

Hope folks keep passing it on – zerofinancial.com/EARLY23273

Don’t you people have any friends, or family that can send their email rather than posting it here?

My question is how the company knows the link was posted on social media rather than just emailed to someone?

Keep passing it on – thank you, Dan. https://zerofinancial.com/EARLY46714

This card makes little sense. All the purported “benefits” that they tout are entirely illusory. Everything is in one spot… yay! No need to pay a monthly bill… yay! But, you have to deposit money into your account in order to cover your purchasing, which is *exactly* the same thing as paying a bill. The only difference here is that you’re not exposed to potential finance charges. But, if you pay your bill every month (which you should be doing), then this is no benefit at all. The spending requirements required to beat readily available cards right now are outrageous, and they will leave your awards accrual well behind what you’d get with those cards. And, in the event of problems (like theft or disputes with merchants), it is *your* money on the line. While you wait for someone to make a decision about a charge with a shady online merchant… that’s *your* money, rather than a bank’s money, that is held hostage out there in the cloud. And, this little startup… what if they go belly-up in six months?

I’ll stick with my Double Cash and make 2% on every single dollar, without having to act as a marketing agent for the card company.

Yeah, seriously. Read the early access FAQ before blindly signing up like a lemming. Just sharing a referral link gets you *nothing.* The front-end language all just refers to referring people “to sign up,” which sounds like just sharing gets you level-up opportunity. But, look at the early-access FAQ, and it’s clear that you can “level up faster if [you] successfully invite friends to also sign up.” If people don’t actually get the card with your link, you get nothing, and you just sit at 1%. You have to constantly work on their behalf to get new customers for them in order to level up. (Think about that math… you need three sign-ups to get your higher earn, so does everyone else… every year… ).

This card is dumb.

Just get an Alliant cash back card. 3% the first year, 2.5% from then on. Easy as pie. I learned about this originally on a blog post, but they must not give any referral bonus because none of the bloggers mention it anymore.

Thanks!

https://zerofinancial.com/SECURE23238

I like 16x better on every new credit card I get – right now working on 5 cards.