Last month United Airlines President Scott Kirby told financial analysts that co-brand credit card signups were lagging and they were going to change their marketing strategy as a result.

Kirby relayed that United didn’t pitch credit cards onboard because Chase wasn’t paying extra to market in that channel. I think that’s the wrong way to look at a co-brand credit card relationship. The airline and bank issuer want to acquire card customers together, each customer has an expected lifetime value, and they work out the relative split over the value. Anything standing in the way of acquiring more card customers is a problem for both sides.

Kirby relayed they had a relationship reset with Chase and would be improving things going forward. We do not yet see flight attendants pitching cards (for which they receive a commission) the way we do at Kirby’s former employer American Airlines. However there’s a softer pitch: breath mints.

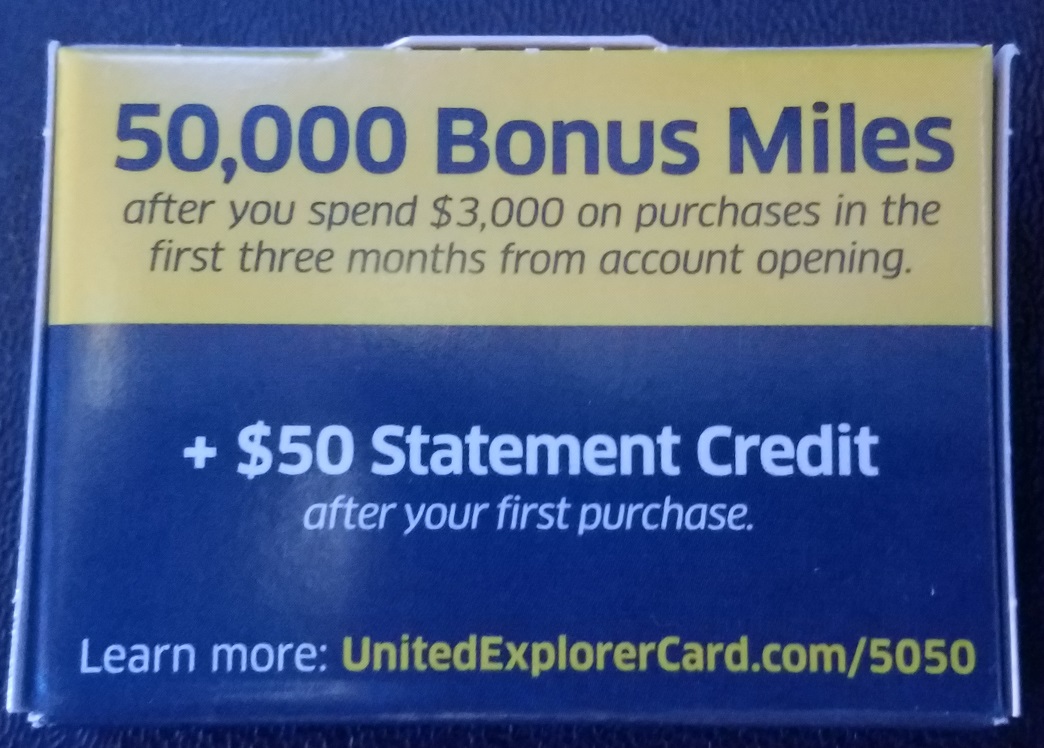

Flight attendants distribute a box of mints with an ad for the card and a website URL with a ‘special offer’. The offer is for a 50,000 mile signup bonus.

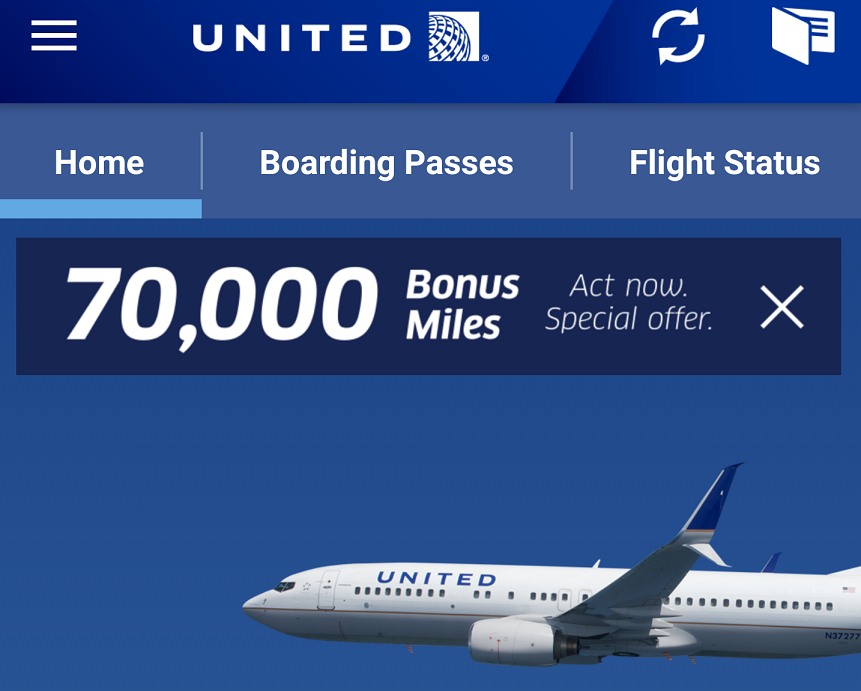

Meanwhile, it’s a targeted offer, but United is more aggressively soliciting card applications in other channels as well. Each time I open the United app I’m offered a 70,000 mile signup bonus offer.

Chase is more aggressive both with signup bonuses for the card and with opening up marketing in a new channel that Kirby says was the most effective one at American.

Unfortunately, as much as they want new cardmembers ‘5/24’ restrictions will still apply to the product.

Following…..

I’ll gladly help push the in-flight offer based on my seat mate last week….

Surely they can lift the 5/24 rule. At least for the business card like they did for Marriott.

Seems like another bank should swoop in and grab UA’s Chase business…

The priority boarding perk on this card is much better than the equivalent on AA or DL.

UA cardholders get the same boarding position as 50,000 mile (Gold level) flyers.

On the flipside, if you’re UA Gold, this card not only offers no value — it dilutes the value of your Gold benefits.

Only 50k for me.

They should have the FA’s make the offer and anyone refusing to fill out an app should be dragged off the plane.

I agree with Robert. I personally have been denied credit from Chase for a United Introductory 70,000 points because they claim I have opened too many accounts in the last two years. Well, I recently have an 826 FICO score on Experian, I pay all my bills before they are due. I have a lot of credit available to me, over $250K, but not outstanding balances because I pay they off each month. And, my oldest revolving credit account is 35 years old.

So, I would like the opportunity to get 70,000 points in my United account, but Chase doesn’t see the whole picture.

One more data point. I was/am targeted for the 70k offer. If I sign in and go make a dummy booking, it offers 70k plus $50 statement credit.

The on board hawking starts July 1…:

http://unitedafa.org/news/details.aspx?id=18866

As someone from Houston who grew up flying Continental and watched United destroy any good will I had towards the company, I looked at this and though “70k miles, that’s great! But I’d have to fly United. So no thanks”

I’ll take the 60k SW card offer any day of the week and twice on Sundays.

Just for the record, though, you don’t have to fly United just because you have a bunch of their miles. You can book one of their partners.