News notes from around the interweb:

- Warren Buffett bought the dip at Delta

- Taiwan, which has pretty much kicked coronavirus butt and has very few cases compared to its neighbors, is preparing subsidies for the aviation industry calling it the epidemic’s ‘biggest victim’.

- Etihad’s losses shrink to ‘only’ $870 million

- Changes to the Hilton premium credit card resort credit basically saying the credit is for cardholders who keep the card for a year or more, and who actually use the credit for real Hilton spending.

- Troubled UK domestic airline FlyBe was taken over last year with an intention to rebrand it as Virgin Connect. However it continued to struggle and was looking for a government bailout. In the midst of coronavirus drying up bookings it’s entering receivership. Really the only asset of value is airport slots.

- The American mechanic in Miami who tried to sabotage a plane has been sentenced

- As if Cathay Pacific didn’t have enough problems they’ve been hit with a £500,000 GDPR fine

All the news that fits!

How much did Etihad lose on my 6 long haul Apartment award trips (CMN-AUH-SYD, SYD-AUH-IAD, ICN-AUH-IAD, with 3 trip to the Louvre Abu Dhabi) last year? 😉

My AmEx HH Aspire is in my second year with the Airline credit already used and the resort credit is next week 🙂

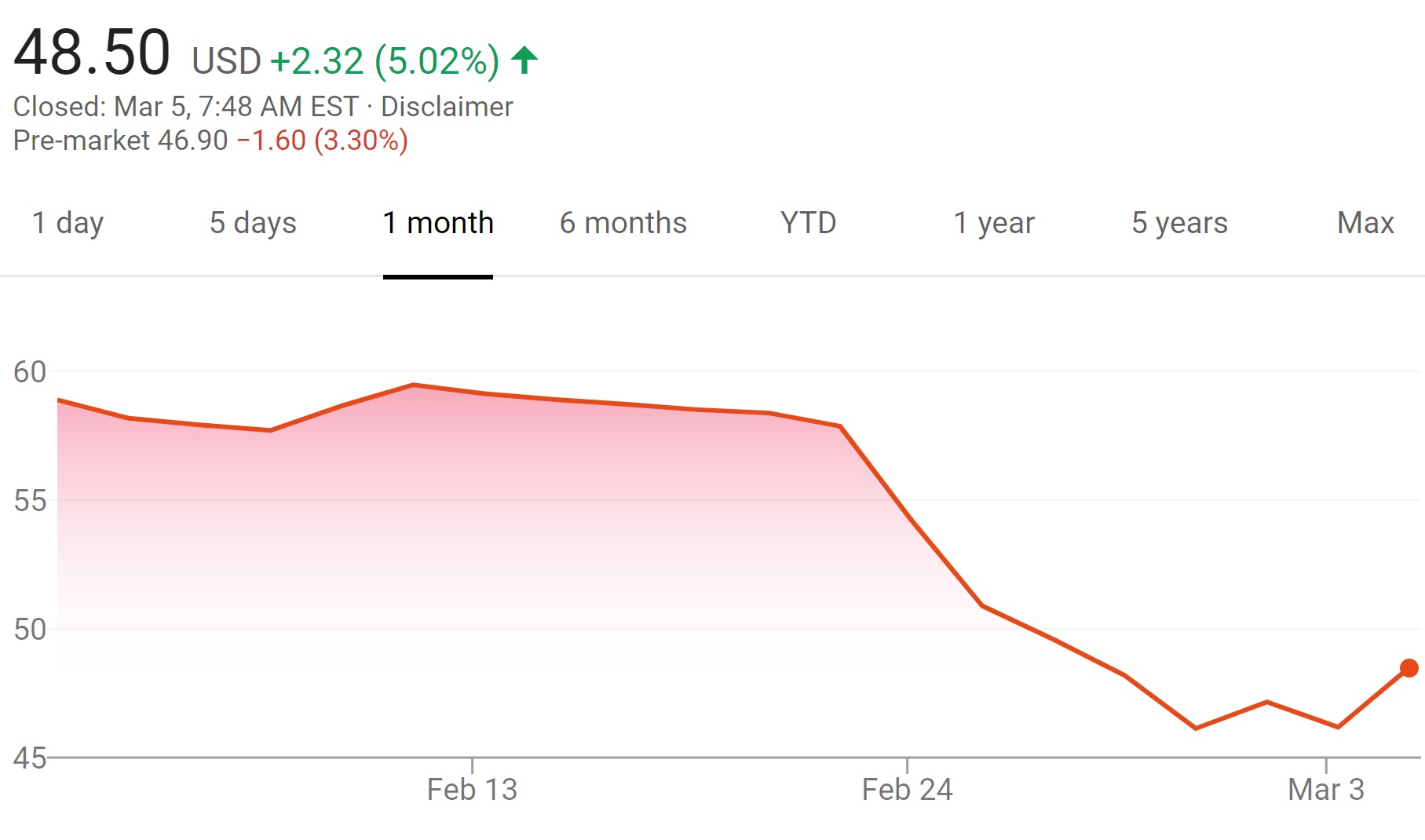

I’ll buy DAL & UAL when they are < $20.

Even better DAL dip today, $45- at the close.

I’ve been holding substantial cash now waiting for the ‘dip’, and snapping up undervalued, safe stock that pays dividends AND has a long-term incline (appreciation) chart. NEE, DAL, and ED are three that fill those criteria.

Buffett bought only $45,000,000 in DL stock.

That’s like me buying a candy bar.

It’s not even a secret that when the investment is under $1B, it’s one of Berkshire’s asset managers doing the investment, not Warren himself.

Feels like airline stocks will continue to drop. No one is booking travel beyond 30-60 months from now, if anything they’re cancelling.