The Barclays-issued AAdvantage cards are officially converting to Citi on April 24, and Citi just published the full playbook — including new cards with new account numbers and a no-login window April 24–26.

The sleeper detail is that for now your existing card’s legacy perks stay in place while you also pick up the standard Citi-version benefits, creating a temporary stacking window (especially valuable for Aviator Silver moving to Globe).

American Airlines renewed its credit card deal with Citibank and went exclusive. That means an end to Barclays-issued AAdvantage cards. Citi bought the Barclays back book, meaning existing Barclays cards transition to Citibank AAdvantage cards.

We now know the full plan for this.

- The changeover happens April 24.

- Customers receive new Citibank cards with new account numbers.

- Existing credit limits and card anniversary dates remain the same.

- No account login April 24 – 26.

And this is how the Barclays cards map onto Citibank-issued AAdvantage cards:

| Barclays Card | Becomes Citi’s: | |

| Aviator Red ($99) | AAdvantage Platinum Select ($99) | |

| Aviator Silver ($199) | AAdvantage Globe ($350) | |

| Aviator Blue ($0) | AAdvantage MileUp ($0) | |

| Aviator Business ($95) | AAdvantage Business ($99) | |

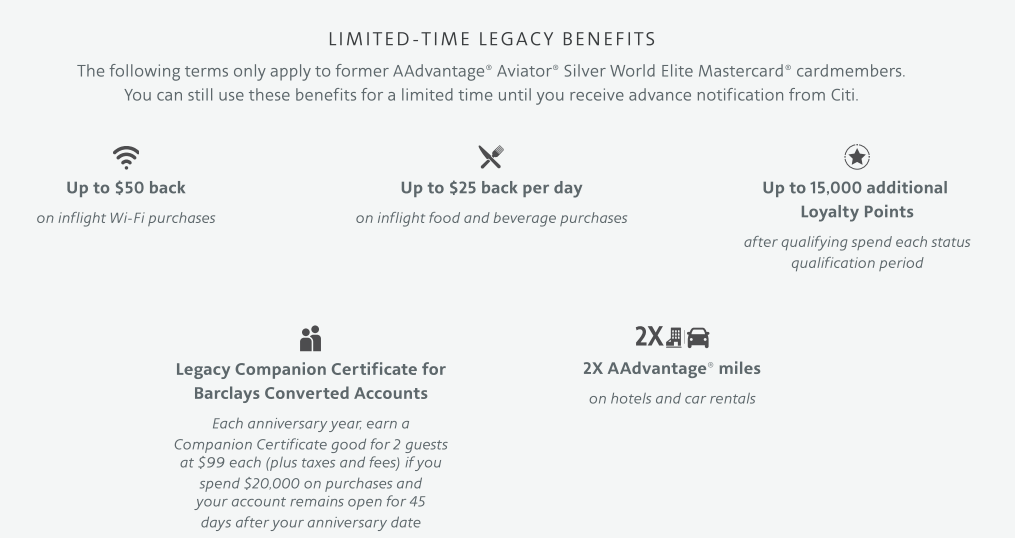

Each card keeps its unique benefits for an undisclosed period of time, in addition to getting the benefits of the Citibank version of the product. So for now, Aviator Silver keeps its unique benefits and gets Globe benefits, which is going to be great for status-earning in the coming year. Plus, the card keeps its existing $99 companion certificate at $20,000 spend in addition to the Globe’s card renewal companion certificate.

- Globe: “Earn a 5,000 Loyalty Point bonus after every 4 qualifying American Airlines flights (up to 15,000 additional Loyalty Points each status qualification year)”

- Aviator Silver: “Up to 15,000 additional Loyalty Points after qualifying spend each status qualification period” (5,000 Loyalty Points at each of $20,000, $40,000 and $50,000 spend)

Between my AAdvantage Executive card, Globe Card, and Aviator Silver -> Globe card that’s 65,000 Loyalty Points I will earn in bonuses in 2026 if it’s possible to stack Flight Streak bonuses from two Globe cards (I have inquired). I’ll spend $50,000 on the legacy Aviator Silver-cum-Globe product as part of this in addition to flights I take anyway, and that alone generates Platinum Pro, which makes requalifying for Executive Platinum super easy.

(HT: Danny Deal Guru)

Has anyone said what happens to cardholders of both? For example if you have the globe and silver. Red and platinum select etc.

You will have more than one of the same card, if that is what you are asking?

Yes

The implications of Chris’ question may be, “What is the optimum path for a cardholder to take who ends up with 2 Globe cards (one as a result of the bank conversion)?” It wouldn’t make sense to pay the $350 AFx2 at the first renewal, would it? What is the best downgrade path? Do we have any sense as to what Citi will allow?