For many years Chase operated a pop up lounge around at the holidays for United Explorer cardmembers at the Mall at Short Hills, New Jersey. They wanted to be where there customers are.

Coming soon is a network of Chase airport lounges co-branded with Collinson’s The Club, the same company that brings you Priority Pass.

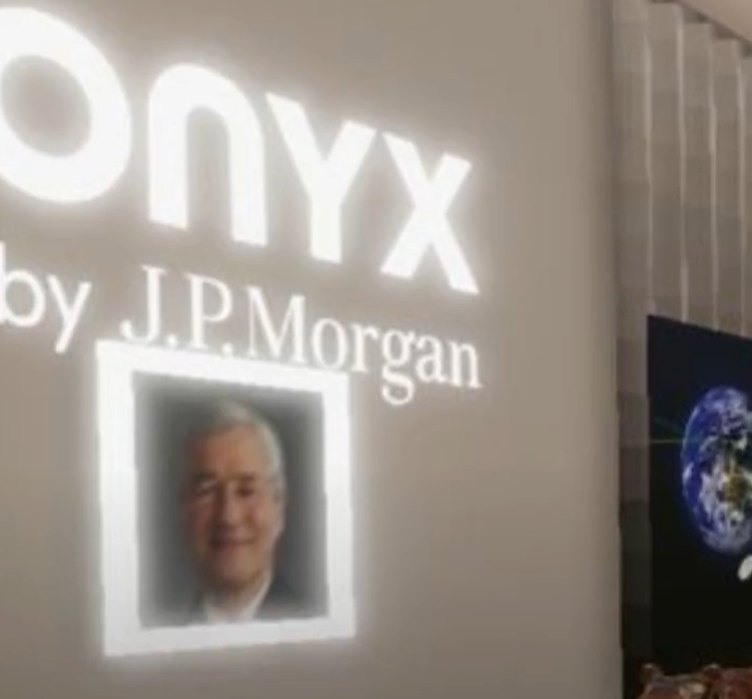

But before we see the opening of the first Chase airport lounge, the bank has opened a lounge in the Metaverse. J.P. Morgan’s new Onyx lounge is now operating in Ethereum-based world Decentraland.

Chase has acquired a virtual piece of land (an NFT) and welcomes members of the community into the area inside a replica of a Japanese shopping district. Inside the Chase Onyx lounge there’s a tiger roaming around. And there’s a portrait of Chase CEO Jamie Dimon hanging on the wall.

This is a stunt, of course, and it helps promote a paper they released about opportunities to invest in the Metaverse, and a way of staking themselves out as a leader in the space as the ‘first bank in the metaverse’. Dimon, of course, has frequently trashed bitcoin calling it worthless as recently as last fall. (Decentraland is based on Ethereum’s blockchain.)

They see banking opportunities inside of virtual worlds just as in the physical world. Chase built up its retail business through branches, reaching customers where they are and getting their checking accounts and then cross-selling other products like investments and mortgages. There are metaverse opportunities to finance purchases even via mortgages (virtual real estate!) as well as provide for transactions between virtual worlds (foreign exchange and trade!). And they want the business of NFT creators and other cutting edge technology-focused consumers.

J.P. Morgan Chase points out that consumers spent $54 billion on virtual goods annually “almost double the amount spent buying music” and the GDP of long-standing online community Second Life was $650 million last year.

JPMorgan ventures into the #metaverse with a virtual lounge in the popular blockchain-based world #Decentraland.

The “Onyx lounge” was unveiled along with a report from the bank outlining metaverse-related growth opportunities. pic.twitter.com/Hmw5qU9isw

— Felix Mago (@FelixMagoCrypto) February 16, 2022

(A thread) #JPMorgan becomes the first bank to enter the #metaverse by opening a Decentraland lounge called "Onyx".

So, why should you care? pic.twitter.com/acG0OYoAyI

— CIS_Crypto (@cis_crypto) February 15, 2022

The value of real estate comes from scarcity. In some cases that’s driven by limited supply of a particular kind of property. In other cases it’s driven by legal limits on how much you can build on a property (zoning rules, such as density and height limits, that constrain supply). And in other cases it’s driven by scarcity of property in proximity to other things, people, activities that may be desirable to be near. However in all cases it’s driven by scarcity of some kind.

Without the physical world, what kind of scarcity is there? There might be scarcity inside an individual world – being in the most popular place, where customers are, in a world that’s artificially constrained supply and raised price as the monopoly seller of space where those customers are would potentially drive prices. It’s about figuring out which ‘online game’ will attract the attention of the people you want to socialize with or sell to. But traditional notions of scarcity, where they’re ‘just not making more land’, doesn’t really apply in the same fashion.

Right now crypto isn’t a very good store of value (prices fluctuate wildly) or a very good medium of exchange (it’s difficult to spend in the physical world). It has the potential to enable low cost transactions that outcompete traditional payment systems like Visa and Mastercard, but is still far more expensive. However prices of the top crypto names have fallen substantially numerous times and recovered, so they don’t exhibit classic bubble behavior. And some of the smartest people in the world are working in crypto and ‘Web3’ – people much smarter than I am – so there’s surely something there.

It’s not clear to me what that is, yet, and much of what exists now won’t make it. Counterfeit NFTs are already a problem. And Facebook is already having to deal with complaints of rape inside its metaverse. As with any innovation, we’ll look back on the early adopters who make it as geniuses but the world will be littered with others that didn’t make it and who will be forgotten along the way.

The Metaresort fees can’t be far behind. :rolleyes:

Delta’s new Meta-Pesos are already racing to the bottom.

#Ridiculous.

Chase Bank also has a great affiliate program on the LinkShare – Rakuten affiliate network paying handsome affiliate commissions to ambitious affiliate marketers. Just thought I’d share that with you. 🙂

Is a crime in the Metaverse real?

How do I actually visit the lounge?

This is literally the most retarded thing I’ve read on the internet today… and there is a lot of retarded on the internet.

This is quite the bizarre publicity stunt (though it appears to be working in that regard). I agree that the value of virtual real estate seems to be worthless due to the fact that more can be created very easily, but perhaps the tech companies will continue to make money there tracking our every moves. Additionally, one thing to think about regarding virtual real estate is proximity. So, for example, if there’s a super in demand club and you open a store next door selling item next door, that could raise the value of your store. So proximity and its relationship to demand, not just scarcity, could also play a role.

However, that assumes that you cannot just materialize from one part of the metaverse to another instantaneously — you have to “walk” from one place to another. I, for one, am not currently interested in the virtual world in that way, so I do not have enough knowledge to know whether that is the case, but that could have an impact.