I receive compensation for content and many links on this blog. Be aware that websites may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. Citibank is an advertising partner of this site, as is American Express, Chase, and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

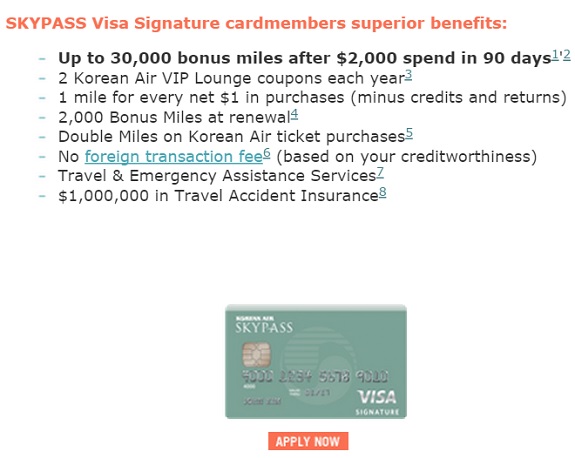

The signup bonus for the Korean Air Visa from US Bank has increased to 30,000 miles. Normally that wouldn’t seem like a big number, but I find Korean Air miles to be exceptionally useful. And the usual offer for their US co-brand credit card is much lower. (I last signed up for the card when I was targeted for a 40,000 mile offer.)

Since Korean Air is one of my favorite Chase transfer partners, I see this as as being like extra Chase points… that are already in their ultimate destination, and that you can get from a different bank.

The Chase Sapphire Preferred Card offers 40,000 points after $4000 spend within 3 months, and another 5000 points for adding a no fee authorized user. So meet the minimum spend on the card and you’ve got at least 49,000 Chase points (more if some of that spend was for travel or dining where the card earns double points).

Then pick up the Korean Air Visa with 30,000 miles after $2000 spend, and you’ve got 32,000 Korean points. Together that’s 81,000 miles.

80,000 Korean miles is enough for:

- Roundtrip business class US-Europe

- 2 US domestic first class awards or 2 Hawaii economy roundtrips

- One-way first class US – North Asia via Seoul

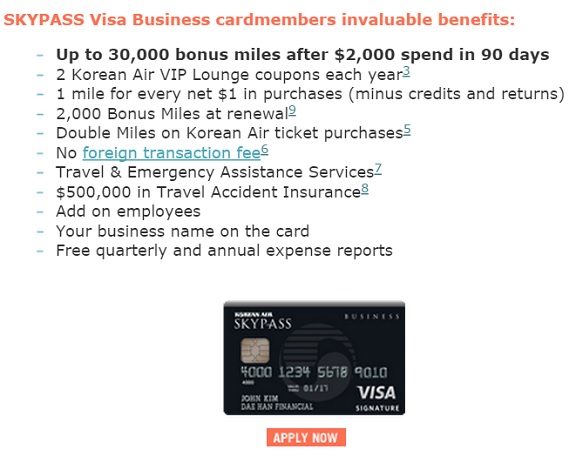

There’s also a 60,000 point offer for Chase Ink Plus and a Korean Air small business visa with 30,000 point signup bonus.

US Bank can be tough on approvals, and I don’t like that they reserve discretion to approve applicants for less premium cards with lower bonuses.

Korean Air’s program is really good, but they do add fuel surcharges onto awards (whatever that amount would be on a comparable paid ticket) and partner awards cannot be booked online. You can only book awards for yourself and for a family member, you can’t book for friends.

My view is it’s a good play to pick up the Chase Sapphire Preferred Card and the Korean Air SKYPASS Visa.

(HT: Doctor of Credit and Million Mile Secrets)

So, the title of the post is “why they’re useful.” And the answer was “because I like them?” Is that really it?

@ Marcus: Oh come on, he’s a travel authority…

Basically a click bait authority.

Excellent post Gary. This is not click-bait at all. Always good to think about unorthodox points earning options like this one!

@Marcus how about ‘because they have great availability to Asia, cheap business class to Europe, and are useful for domestic US too?’

@ Gary

Thanks for the heads up. I’m wondering if US Bank combine the credit pulls if I apply for both personal and business on the same day using two browser method trick?

i am so relieved by this post. when i saw the title i feared this would be the first post ever here without chase sapphire preferred referral link… but i was wrong… phew.

Annual fees:

Skypass VISA Signature $80

Skypass VISA $50

Skypass VISA Business $75

I find it interesting that a US bank card client allows chase card point transfers.

Lantean, go jump off a bridge doche bag.

@DaninMCI I think you’re clear that it doesn’t, US bank issues the Korean Visa, and Korean is also a transfer partner.

@George please be polite. Best to ignore trolling comments. @Lantean’s was absurd on face, but yours is IMHO worse.

yes this is a mostly useless post and not informative. That being said, Korean points can be pretty cool actually. They impose fuel surcharges — so a trip to Europe that would cost you 125k delta miles, might be only 80k on Korean plus $700-900 in fuel surcharges. It could be worth it for you, or not.

Fuel surcharges are much better to Asia, and their first class availability is amazing. (I think 80k points each way, which is a decent price). The redemption process is the biggest pain, so be prepared to spend HOURS on the phone. The last time it took me 4 days to get the ticket finally issued! If it’s entirely on KE, you can start the redemption process online at least.

Getting to enough points to get a good award is quite hard though – the only way is if in addition to this card (with 30k points), you also transfer lots of chase points. I would only get the card if you have a plan in place, and specific flights in mind (like a year from now)

I think they’ll need to bring their redemption process forward into the 1990s. Odd they’re so behind the times, given that South Korea is so technologically advanced.

@ Gary

I saw you replied to troll post that was posted after me but you have not replied to a serious question that I have asked.

I am your fan and loyal reader, and I always try to use your affiliate links as a way of saying thank you or giving back to you. But in order to do that I need your guidance and response first. Back then, I have always use MMS/bowtie’s affiliate link back when he actively reply and helping us his reader, until he never respond at all now then I am just using his blog to get information and take my business of using affiliate link to other bloggers who work hard to reply the reader’s comment because I think they deserve it more than MMS or other blogger who never reply. I always encourage my friends and family to always never use affiliate links from the blogger who rarely or never reply like TPG or MMS, eventhough their blog post sometimes full of affiliate links, but we just ignore them….take the good heads up or info on the new increased sign up bonus credit card, and open other blogger’s website who always respond and help us, and use his link because he deserve it more. That’s why we like you because you still reply to your reader’s comment. Ok so here is my question.

I am interested on this card and plan to apply soon as I dream of flying Korean Air. Please help me on my question below:

1. Does US Bank combine the credit pulls if I apply for both personal and business on the same day using two browser method trick?

2. Do you have a post or primer on how to redeem Korean Air miles or on Korean Air F class? If so, please kindly share the link.

Thank you.

@John over the past week my responses have been limited – I’ve been in Atlanta for the Freddie Awards and hosting the Travel Executive Summit. I have been on flights and underwater with work. I do my best.

I have written on the process of redeeming Korean Air miles

http://viewfromthewing.com/2012/08/30/the-strange-process-of-redeeming-awards-through-korean-air-skypass/

I have never tried multiple US Bank cards at the same time, US bank hasn’t had many great cards and is difficult to get multiple approvals from.

@ Gary

Thanks a lot for your response ! Now I understand your situation, thanks for explaining, I admire you still try your best to respond despite your busy schedule!

I just want to let you know that it really means a lot and helpful for us!

I will check the link to your primer and will let you know if have any more question pertaining Korean Air. What is the best way to reach you, by post here or direct email to you?

@John you’re always welcome to email me (gary -at- viewfromthewing.com) or comment here

It would be useful (to me, at least, who wants to travel as cheaply as possible) to get a better sense of what the fuel surcharges amount to. I know that each airline has their own formula and, even then, the formula may depend on whether you are flying to Europe or to Asia. So, Gary, maybe that would be a good topic for you: comparing fuel surcharges for some of the more popular foreign airlines to Asia and Europe from a few U.S. departure cities. Until the British Airways suit is resolved, we are all left paying these nebulous charges on foreign carriers. As one reader above noted, they can be quite substantial – certainly not free travel, alright.

@Gary,

Thank you so much!

And I vote for TomSAN’s idea! it would be very useful for many!

Fuel surcharges vary by destination rather than program (there are a few programs that incur reduced fuel surcharges, eg Iberia on Iberia’s own flights, Virgin Atlantic for economy redemptions) but otherwise you will pay whatever the fuel surcharge would be on a paid ticket. It’s about the destination.

I did this exact strategy last year using Sapphire, Ink and KAL Visa for KAL points. ATL to IST to ATL with stopovers in Rome, IAD and Paris. All business class and CDG to IAD was on brand new AS 380.

Is it normally easy to find availability US-EU using Korean points? They’re SkyTeam, right? I’ve heard KLM/Air France has barely been releasing seats in J US-EU lately. Can you give an example of how much fuel surcharges would be on a typical US-EU flight? I’m in Denver if it makes a difference, and I don’t mind backtracking to fly out of LAX either, I love Tom Bradley 🙂

Hi Gary

Very interesting, thanks! I never was interested in transfering UR points to KE as I find it’s harder to get hotel points than air miles. But if I just needed to top up, that would be different.

Do KE miles expire?

@beachfan 7 years

@Ken I find that AF availability is pretty good if you aren’t using Delta miles. Fuel surcharges (I’ll have a post later today) are dependent on airline and destination. But AF US-EU is usually pretty steep (over $800 roundtrip)

Yowsa! That’s some pretty hefty YQ! Looking forward to the article later, thanks.

Just got my call back from KA about booking MSP-AMS (direct) on Delta (business – O) round trip using Sky Pass miles (80k).

They quoted me $600 in taxes/fuel surcharges? The exact same flights/dates, bookable through the Air France or Alaskan Air sites, only charge $85 and $76 respectively?

Would Delta assess fuel surcharges to some partners and not to others? Could this be a mistake by KA?

Does anyone else happen to have a similar experience? Something just doesn’t seem right…

@chad – Korean adds fuel surcharges to awards. Alaska adds them only to BA flights. Air France adds them to everything but Delta.