On Friday, NotiFlyer highlighted an offer from EZForex of free shipping on foreign currency orders of $500 or more with promo code AAfxKickoff (a savings of $14.50).

Ordering foreign currency online is never the cheapest way to get it. You’ll always do better using your ATM card on arrival in the country you’re traveling to. That way you will get a bank’s foreign currency conversion rate. Ideally you would even have an ATM card from a bank that doesn’t charge you to use ‘out-of-network’ ATMs.

I use BankDirect, the checking account that awards you American Airlines miles for your average balance each month. (I get 100 miles for every $1000 average balance, and there’s a $12 per month fee for the account that isn’t waived). They not only don’t charge a fee to use ATMs that aren’t theirs, they rebate the fees that the ATM’s owner charges (up to $2.50 each time, four times per month). Since there’s an additional 1000 miles as an account signup bonus if you’re referred by an existing customer (the referrer gets 1000 miles as well), I frequently get e-mails from folks looking for a referral. Unfortunately I no longer have any to offer. I suggesting folks contact Deals We Like for that.

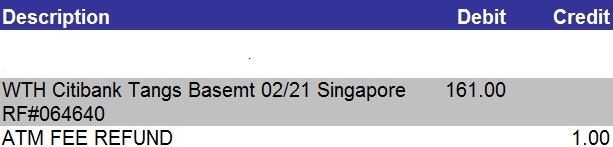

In the back of my mind I remember reading that the reimbursement of ATM charges didn’t apply outside the United States, but that’s never been my experience, here’s an example of seeing the fee rebated on a cash withdrawal I made in Singapore:

You’ll also likely do better just changing cash at your destination, outside of the major tourist spots.

But there are plenty of people who like to have cash in hand when they land. It’s useful for paying for a taxi or other transportation from the airport. And lots of folks prefer not to mess with getting cash on arrival after an 8 or 14 hour transoceanic flight. So they’re willing to pay a premium in order to have that convenience.

Personally, I pay for most things by credit card, my go-to is the Chase Sapphire Preferred because not only are there no foreign currency transaction fees but they also give double points on travel and dining which are what most of my foreign spend tends to consist of.

In no case will I allow someone to charge me in my ‘home currency’ of dollars, I always want to be charged in the local currency — my credit card company will give me a better exchange rate, and if I didn’t have a no foreign currency transaction fee card then the card company would still charge the same 3% even on the transaction in U.S. dollars because it took place outside the U.S.

I also have an American Express Platinum, Hyatt Visa, and British Airways Visa in my wallet, and these do not add foreign currency transaction fees to purchases outside the United States either.

And for cash, I’m well-traveled enough that I’ve changed plenty of currency. I used to get rid of foreign currency by paying down my hotel bill with whatever was left before leaving the country (in many countries you can also add it to your Starbucks card). But if it’s a country I’m likely to return to I’ll now just keep the cash so I have it available when I land next time. I’ll usually have a stash of Euros, Baht, Hong Kong and Singapore dollars at least.

If you do want the convenience of cash ahead of time, having it shipped to you in advance is a convenience. If you pay with a credit card you won’t get as good a rate as with an eCheck, and credit card companies will usually hit you with a cash advance fee as well.

(Note that links to credit cards in this post offer referral credit to me. The links are to the best-available offers I’m aware of for each card, though if you’re ever aware of a better one please let me know. I very much appreciate your support in choosing to use my links for your application.)

Update: Joe Brancatelli’s column last week confirms what I alluded to in the comments, that you generally can’t open a foreign transaction fee-free account with Capital One anymore. He reminds that Charles Schwab brokerage accounts, though, provide such a service.

Schwab has a ‘fee free’ checking acct that has no min balance and no forex fee and refunds ATM fees monthly. You can get one by signing up for their brokerage acct, but you dont need to invest with them. We used it extensively on our last Europe trip.

CapitalOne has a reward checking with no fee for any ATM and refund fee (up to a limit) that other ATM charged. $1500 average balance to receive this benefit.

@MichaelP – apparently Capital One is no longer fee-free at international ATMs

http://www.fodors.com/community/europe/capital-one-bank-will-charge-for-overseas-atms-or-any-non-cap-one-atm.cfm

Perhaps others can corroborate.

It’s actually been my experience in Europe at least that most ATMs don’t charge such fees. My wife and I had to drop BankDirect because we don’t keep enough in our checking account to justify $12 a month, but when we had it my observation is that the refund is automatic, and the system just assumes that any amount over a multiple of 10 is a fee and refunds it up to 2.50. This led to cases where the exchange rate would make the charge 112.23, and the system would automatically refund 2.23.

I always thought it was kind of cool, and compensated for the fact that they seem to pass along a 1% fee from Visa.

So is your plan to carry four cards that charge an annual fee?

@Pat — I won’t keep the BA Visa, I got it for the signup bonus. But yes — the Hyatt card is totally worth the annual fee for the free night alone, $75 for a $200 – $350 hotel night,. And I put my Hyatt stays on it for 3 points per dollar. The Amex Platinum is how I get lounge access (American, Delta, US Airways plus a Priority Pass). So I keep that, worth the fee. And Chase Sapphire Preferred is my go to on most travel, and all dining, plus everywhere that doesn’t take American Express.

I’ve been using my PayPal debit card for foreign withdrawals for years. They charge a 1% fee +$1 but it is much better than changing my USD at a Forex desk or using my Wells Fargo ATM.

You could also get an HSBC account if you travel to destinations that have plenty of them (Asia, UK, Canada), or even a couple of them. No ATM fees when you use their banks and pretty competitive FOREX rates. i just came back from Quebec and Montreal, both had them, and the difference in pips were in some cases less than a penny in difference.

we plan to use the Charles Schwab account that refunds the ATM fees and then carry a United Visa card because they offer free currency conversion.

However, ordering foreign currency online is a good way to hedge on currency flucuations as you’re stuck taking ATM rates at the time of travel. Right now, Wells Fargo is selling Euros for 6 cents over the $1.25 market exchange rate. I’m hedging some of my budgeted spending money that the Euro ATM exchange rate will be greater than $1.31 next April when I’ll be traveling. I’m also set up with Charles Schwab ATM for remainder of currency needs in Europe.

The easiest way to avoid this charge is to use a card that has no conversion fee.

Some great advice in this article, thanks for sharing.

Currency exchange has always been an issue. Sometimes there are no options upon arrival at the airport and you would be disheartened to find out the exchange was way too low the actual rate. What I do now is Google first the exchange rate and check if it comes near the offer. If not, I would change only few cash then just do more exchange later at some good banks.

Very helpful article. Thank you…

This is an issue for foreign travelers. But it’s just the way it is ~ I usually withdraw funds via a country’s ATM.

this is good advice Mr. Gary points out to …I have travelled to Liberia Costa Rica and well.. they always push me into buying their local currency which isn’t really necessary since they accept $ pretty much every where. I aslo point out that if you travel to Costa Rica they have a departure exit tax that you take of if its not included in your ticket…

How about an updated version because no doubt the numbers and situation has changed in the last 6 years!?

At my bank they will normally get a few hundred changed over to euros before i leave that way I will have money when I land and won’t have to scramble in the airport to exchange money. Many banks do this now a days and at least my bank doesn’t charge me a fee which is nice. Check your local bank to see if they can do this and if they charge. One thing that is good right now is the exchange rate so if you were ever thinking about a European vacation now is the time to go as our money is worth a lot over right now.

Some really nice advice in this article! Would be saving it in my pocket app for future help! 😀

This is one of the hardest areas to save money as there are a lot of choices out there! Great article!

Thank you! Time flies! But your pieces of advice are still the same useful!

Thank you, Gary!

I am the kind of person who likes to have cash in hand… and I just have started to implement useful financial habits in my life! It can be hard for a freelance writer sometimes to plan the time and money… but I travel a lot and your tips are very helpful, really! I agree with the people above!

Currently, I write reviews (you can check the official source if need help with reviews or another type of content). And often I forget about planning and during traveling often adventures with the local currency exchanges happens… Oh, I need to be more patient. And to pay by card. Thanks for tips!

Thanks for that my dear friends!