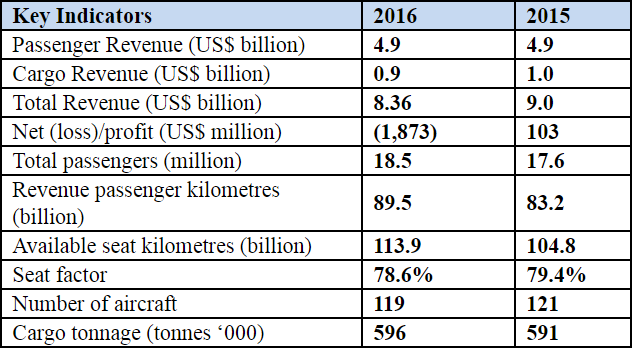

Etihad posted a loss of $1.87 billion for 2016. Yet carrying passengers on the airline (so excluding special items) they actually made money.

That’s a contrast with Qatar Airways which reported a slim profit, but profits are likely driven by their businesses other than carrying passengers. They own hotels, they own the exclusive rights for distributing alcohol in the country, among other things.

And the news of Etihad’s performance comes after Emirates reported the first decline in profits in five years.

All three major Gulf carriers are struggling. These are the carriers that Delta, American, and United claim are an existential threat. Never mind that,

- US airlines are the most profitable in the world

- US airline industry employment at historic highs

- These Gulf airlines support US jobs and buy Boeing aircraft (Delta does not)

- US airlines receive significant government subsidies already

Peeling back the onion on Etihad’s financial performance they took a charge of $1.06 billion for phasing out aircraft and lower values of remaining planes; an $808 million charge due to hits they’ve taken on foreign airline investments including Alitalia and air berlin; and they took losses on fuel hedges.

Many people would be surprised that Etihad was hedging fuel costs, not just receiving free fuel from the government like Delta wants you to believe.

The airline reported that business class yields have suffered as companies have traded down to economy fares for employee travel.

Of course 2016 performance was before the US travel ban and the electronics ban which would have diminished financial performance on their US routes, so 2017 will suffer additional drag (in addition to continued losses from Alitalia and air berlin) though the US is a very small portion of their route network.

When the Gulf carriers were expanding and making money, that was proof of their threat. Losing money is proof they aren’t viable businesses. Either way the largest US airlines want protection — from Etihad’s frightening six daily flights to the U.S. And US airlines are no stranger to losing money, each of Delta, United, and American have been through bankruptcy (and airlines each has merged with have as well) and cumulative industry losses over the last century nearly equal its profits.

Etihad’s airline’s chairman, in a statement, says “The record passenger numbers in 2016 affirm Etihad’s role as a significant economic enabler for Abu Dhabi, and our airline business continues to support Abu Dhabi’s vision to develop tourism, grow commerce and strengthen links to key regional and international markets.” The strategic purpose of the airline is more than just making money.

In some sense that’s what Delta is complaining about. Although it’s how most of the world has viewed the aviation industry since its inception, even in the United States.

Delta itself absorbed Northwest Airlines (formerly Northwest Orient) which built a hub in Tokyo as part of the spoils of World War II. They absorbed much of Pan Am, also known as the The Chosen Instrument a tool advancing US foreign policy interests and also driving elements of foreign policy itself.

The fact that they made money flying passengers is a good sign, in my opinion. Everyone knows Alitalia and Air Berlin are bleeding.

Before taking Etihad’s numbers as anything more than promotional material I recommend giving this a quick read.

https://www.forbes.com/sites/martinrivers/2016/04/23/one-simple-reason-not-to-believe-etihads-claim-of-profitability/#5741e2196d60

OH YES! They really ABSORBED PAN AM! Like not coming up with the money they promised to pay Pan Am at the last minute for their routes,etc so Pan Am could at least fly their original routes in the Caribbean – so they stole the routes and killed a much smaller Pan Am. A REAL bargain to get all their routes for free.

The ex-CEO is the one who created this. Good he finally got fired. He just spent money left-right-and-centre on everything and didn’t care at all about costs and returns. Stakes in Alitalia? Air Berlin? Air Seychelles? WHAT? And then all the useless “fashion show” and shoots for the inflight’s clothing. Hiring his Aussie cronies (Nicole Kidman and Danii Minogue) as spokespeople. And more Aussies in senior management who have no clue what they are doing – just a nice cushy job.

Then sponsoring Washington all sports and NY soccer. All with $0 return.

Peter Baumgartner (the new CEO…who was the COO) is more level-headed. But he also has lined the pockets of his fellow Swiss colleagues.

Let’s see what happens!

@Rob — Believing Etihad’s financials is a lot like believing in the Tooth Fairy.

I do not think I have ever come across anyone who thinks they present an accurate financial picture of the company. I doubt even Gary believes them, and given Gary’s biases, that’s saying a lot.