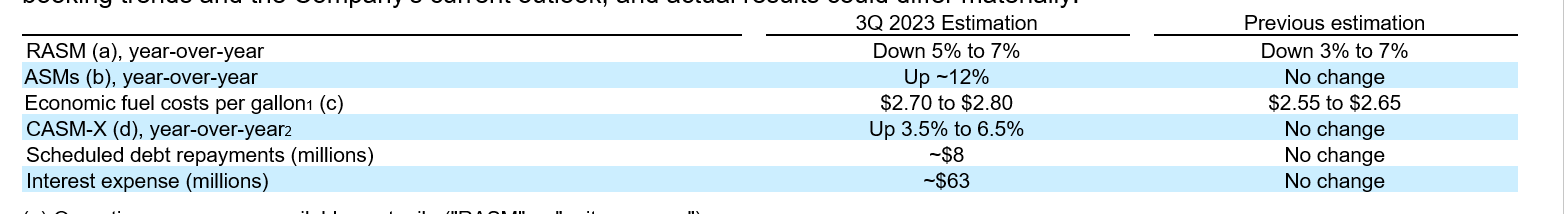

Southwest Airlines filed a form 8-K with the SEC on Wednesday morning revealing a trifecta of bad news – for them, but that’s likely to replicating itself across the U.S. airline industry.

- Capacity is up

- Revenue per seat mile is down

- Costs, both fuel and non-fuel, are up

Taken together, good times for the airline industry may be turning. That Southwest is seeing these trends should not be news to readers of this website, because that’s clearly what the airline has been revealing by introducing promotion after promotion – future discounts for fall bookings, promotional companion pass for fall bookings, and now accelerated earning towards a full companion pass. They wouldn’t be doing this unless they were seeing weakness.

Southwest says that while there was “record revenue performance for the [Labor Day] holiday weekend” August close-in leisure bookings were “on the lower-end of the Company’s expectations” and it would have been shocking if Labor Day revenue wasn’t at a record because of high levels of inflation the past couple of years.

Of course everything is at record highs in nominal dollars, it would have been an historic collapse otherwise. (People forget to inflation-adjust, and this lets companies tout bad news as good news.)

As for business travel, here’s a paragraph that sounds like good news but is actually bad news:

Managed business trends continue to perform in line with expectations, and the Company continues to expect overall corporate travel to have a modest underlying year-over-year sequential trend improvement in third quarter 2023 when compared with second quarter 2023.

Traditional business travel is in line with expectations… but those expectations were low! And things aren’t really getting better, any bump up has been “modest.” Companies may be returning to office, but most aren’t doing so every day, and that makes visiting clients a coordination problem. Companies learned that not all business travel was necessary, and some things at the margin can be done over zoom. Most importantly, the traditional client Monday through Thursday on-site work no longer makes sense when the company they’re visiting isn’t even in the office every day.

We’ve seen lower airfares, and deals, over the past couple of months and based on this guidance that should continue. That’s also good for those looking to use their miles. There should be empty seats to book into.

Looks like the other shoe has dropped and pent up demand from COVID has come and gone. From what I have read, business travel had not fully recovered from 2019 volumes. This could be the plateau!!

What’s going to happen to all these airline pilots in the training pipeline. Will there be a seat in the cockpit waiting for them or a DO NOT ENTER sign. Same thing with ground staff, gate agents, dispatch, & back office support that was recently hired in droves. Don’t be surprises if there is another employee buyout, severance, or attrition program. Also, what about all those jets that were just placed in service or on order.

Look for airlines will be stingy with redeeming miles, points, upgrades; and dropping routes just to conserve cash. Those airlines that have yet to develop a loyal following (looking at you Breeze) need to draw up new battle plans to survive.

Looks like bad timing for the B6 &NK merger. Reminds me of the Pan AM & National airlines merger. Initially looked great in 1980. By late 1981, it look like a disaster.

I do see the sales and promotions, but for me as a passenger the metrics that matter are load factor in the plane and space to move around in the airport. As an ‘instant’ proxy I use this source: https://www.tsa.gov/travel/passenger-volumes

Until such time as daily passenger numbers fall below 2019 levels, I’m going with – it’s way too busy out there for my liking.

Gary…I often find interesting and useful information in your blog and I appreciate what you do. However, as has been noted by others previously, you really need to proofread your work before publishing it. Glaring grammatical mistakes distract from your blog posts and are a distraction from the value they present.

You can do better, just take a few minutes to read what you have written.

The airlines showcased their products last year. The leisure travel crowd may have not been impressed enough to vacation the same way this year. I wish I could get the old prices across the Pacific but it may take a while to get them down to what they were.

Southwest’s latest update reflects their inability to regain premium revenue to the extent other airlines have after their December 2022 operational meltdown while also facing the reality that higher fuel prices and a return to more normal demand patterns will clip the wings esp. of predominantly domestic airlines.

The big 3 – which are still feeding off the return of very strong global travel demand – will be able to offset a portion of the domestic declines.

Add in that WN has to come up w/ labor agreements w/ both its pilots and flight attendants and the outlook for WN looks challenging well into the future.

@TimDunn…agreed. Same is true for the Big 3. I just don’t know how they will be able to afford their new contracts. Even business travel now is elastic and discretionary. Not sure what the answer is…I think it will be a bumpy ride (pun intended) for the next 5 years or so. The pick-up in International leisure travel is great…but it’s not enough.

My super-cheap domestic fares were subsidized by last-minute business travelers for decades. The best deals in 2024 will be more rare and more expensive.

A lot of people may be like me and only fly them when it’s a direct route because of their operational meltdowns. I’ve flown them enough this year to be a list, but that is only because of a favorable, direct route. I would never fly them for a vacation out of fear I’ll miss a couple of days. Plus I hate their boarding process. I fly Delta to Tokyo several times a year because of the direct flight from Atlanta. I prefer JAL or ANA but I’m on the wrong coast.

The crazy days are ending. You are seeing it already this week in airports in Europe and the U.S. Munich was a ghost town as an example and emptier than I have ever seen it. With far fewer business travelers and leisure travel bursting its bubble, there is going to be a very fast drop-off the remainder of this year and well into next.

I am also seeing MANY more close in saver redemptions compared to this time last year. Including a lot of LH F available out of ORD and IAD which had been far more difficult to find the past year.

@Tim Dunn. I don’t agree. I have not seen a Polaris cabin go out from Europe less than full in two years. This past week there were 6 seats that went out empty from ZRH-IAD that is a heavy premium market. And I would venture most were filled with plus points upgrades off economy.

I am betting a return to the old cycles of leisure during holidays and summer. With the change being that the offseason, once compensated by premium business travelers, is 60% of what it used to be. I am betting on a pretty harsh wake up the next few months for all the carriers, not just WN.

Um, GOOD. It’s about time! Airports are stupidly over-crowded and have been for at least a year now. Planes are over sold and packed. Hotels are insanely expensive. Quite frankly, it’s about time things calm down. Hotels and airlines have by far recovered financially from the pandemic, so getting back to a more normal time will be quite welcomed by many.

mikey b and stuart,

I have never said that the good times would come to an end for the big 3 – it just will be pushed back compared to the N. America -only airlines such as WN.

and the amount of passengers in premium cabins doesn’t mean they are getting top tier revenue – or even what is comparable to other carriers.

There is alot of pentup international demand including to Europe that is still going on. People with miles are upgrading. UA has jumped into alot of markets and added alot of transatlantic capacity thinking it will get a competitive advantage while other airlines used the pandemic to permanently reduce their cost base including through new and more efficient aircraft.

and the big 3 have outperformed WN even on the domestic system all year long so far; WN is suffering from self-inflicted wounds from which it simply hasn’t recovered.

Throw in the delays from Boeing on the MAX 7 and WN cannot fix its revenue shortfall problem by growing or doing it inefficiently by using the MAX 8 which their execs have repeatedly said is too large for many of their routes.

Take COVID out of the equation and note that the current administration has ruined our economy. Fuel is usually the highest cost per seat mile for most airlines. From being mostly energy self sufficient to having to dip into the federal fuel reserves and/or selling it to outside countries, the current administration has ruined (and continues to!) this country. “You” voted for this…now we all are suffering from it. It won’t get any better, regardless of whom the US elects, until we get rid of the clowns that are in Washington…ALL OF THEM! Time for term limits.

There is a lot of discounting and promotions coming out from the some of the ULCCs – my guess is forward bookings into the Fall are not great.

Breeze just came out wth 50% off base fares on all routes. Frontier (or Avelo) has waived carry-on bag fees for September.

Looks like signs of weakness to me.

@Tim I don’t read earnings and forecast reports. I just trust what I see. And I can tell you that compared to last year there is a significant shift the past two weeks. I look at redemptions, which are suddenly wide open for close in bookings less than a week, which has not been the case over the past two years. When wide open, I mean multiple flights and choices vs a few less than desirable ones. Second, as I said above, I never saw MUC so empty this past week, even pre-covid. European flights have suddenly gone from overbooked to half full. As well, my antedote as to my ZRH-IAD flight, a usually very heavy premium route, having six empty seats in J…something I have not seen other than during Covid.

Finally, I’m seeing for the first time a lot of “deals” at hotel properties open up. Both in mid and luxury tiers. This is a huge one as it really speaks volumes to determining patterns. Luxury Hotels that were getting $1200 a night last fall are suddenly $800 for the same period now. And I expect it will start to drop even more.

I realize none of this is math. Nor is it an earnings and forecast call with numbers to prove. But I have flown for enough decades to see when there is a sudden shift. And it’s always sudden. I’m telling you, all carriers, not just ULCC’s, are going to have a dismal fall and spring. And the hotel industry will start to fall as well. The ride is over. And if I were a CEO I would be seriously regretting the current pilot contracts signed and panicked.

Stuart,

there has been a season change, tons of capacity came back into the market, summer airfares over the Atlantic hit record highs along w/ demand, and the airlines are not about to throw that all out the window when the first couple flights appear w/ empty seats.

The growth curve in the form of huge returns of demand and capacity is over whether United wants to accept it or not. Airlines cannot continue to shove the capacity into the market and make money doing so as they have for the past year.

Fuel is going back up – because the US has made dumb policy decisions that hurt American consumers driven by ideology and other oil suppliers are going to do what is in their best interest.

Airlines relished in a high demand, low fuel environment even while signing costly labor deals. The curtain was bound to fall.

the guidance updates that came out today aren’t a surprise and they won’t be the last. The real truth will be in seeing who (which airlines) manage to rise above all of this because they knew this day was coming and worked to make sure there was a soft, rather than a hard landing.

My guess is we are going to see last minute discounts and award promos come late September through early December. The economy is going downhill, folks are just about out of cash, and credit cards are maxxed.

I have family traveling through Istanbul, Athens and France for the past couple of months, and they are all reporting that the crazy crowds have suddenly vanished. My nephew was on LH flight from FRA>CDG in Business, and he sent a quick video showing he was the only pax in that section!

@ Win Whitmire — The US has its strongest economy EVER. If anyone damaged the economy, it was the felon that was in the WH from 2017-2021.

Wim, Please get your facts straight. The lifting of the oil export ban was pushed through a Paul Ryan-led Republican Congress and signed by trump (sic).

I remain annoyed that enough Democrats in the Senate went along for it to pass. Big mistake, but it was a Republican idea passed mostly by Republicans. That is one reason oil and gas are too high. The second is that there is the war in Ukraine which was started by trump’s boo putin, which in itself is disgusting. Then lastly the KSA keeps cutting production because they want the price of oil to stay above $80 a barrel which is where they say it should be. They decide and the rest of the world has to pay more.

But while some of the inflation blame rightly falls on Biden, the price of oil does not.

@gary this is the type of article that put you on the map, please keep up this work!

@Win Whitmire do a tiny bit of research before spouting your Red Hat Talking points.

The crude oil export ban prohibited most crude oil exports from the United States to other countries. It was implemented in 1975 and lifted in December 2015. Under the administration of Barack Hussein Obama – prior to the Mango Menace.

The repeal of the act was passed under a REPUBLICAN congress.

You want energy independence of fossil fuels, reign in Marge 3 toes since she seems to run the “Republican House or Representatives”.

In the interim the President Biden, has made with a BiPartisan IRA …

Tax credits for Solar adoption, Building of Electric vehicles in the US and Tax credits to make our homes more efficiently heated / cooled and shielded from the weather

Effective use of a carbon neutral future, will make us “energy independent” and not dependent on Jared’s friend MBS

LOL. The B1den supporters are all out in full force in this article.

One president purposely reduced the supply of oil to promote supposedly renewable energy when all its been is a free handout to his l3fty cronies. Here’s a hint: the guy’s last name rhymes with his moniker: Hidin’.

And you all still wonder why gas is priced so high. Occam’s razor, folks.

I no longer travel for work, only leisure. I have gone free agent. But- the “insanely low fares” we are seeing right now, they really aren’t. Sub 300 to Europe! Says every blog. Sure, if you want to fly in a middle seat for 6+ hours but only from NYC, Chicago, Boston, or DC. The rest of us have to take a $300 positioning flight to get there and then spend another $200 to upgrade to main cabin to get a decent seat. That, my friends, is an $800 economy ticket. That’s not a deal. That’s a supermarket loss leader route that the rest of us pay for. Great for those who can, but not great deals overall quite yet.