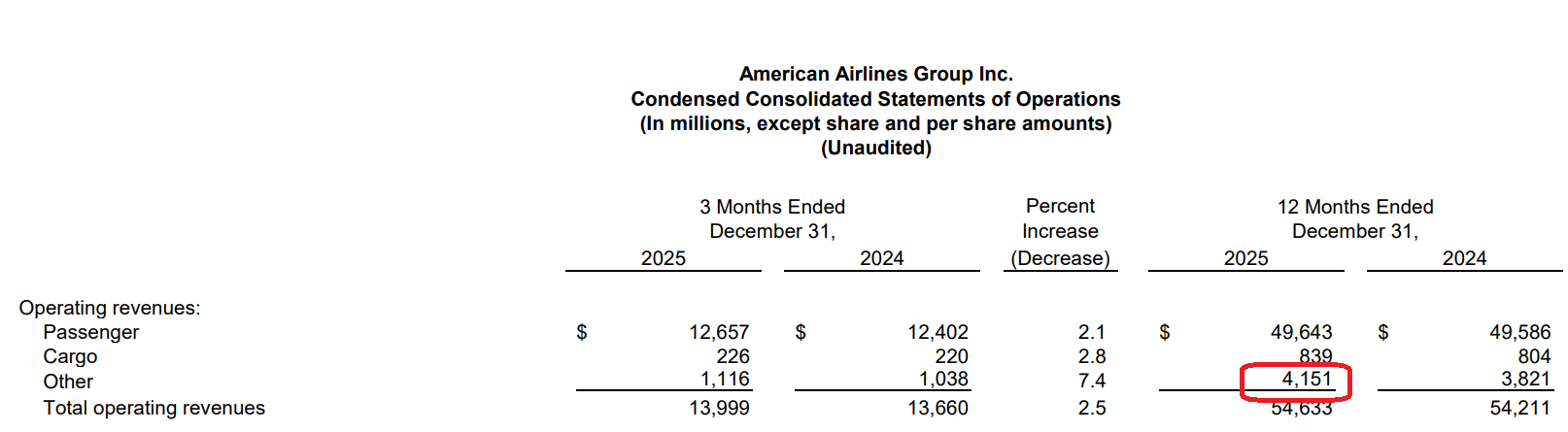

For the full year, American Airlines earned just $111 million on $54.6 billion revenue. That’s a one quarter of one percent margin. Basically break-even.

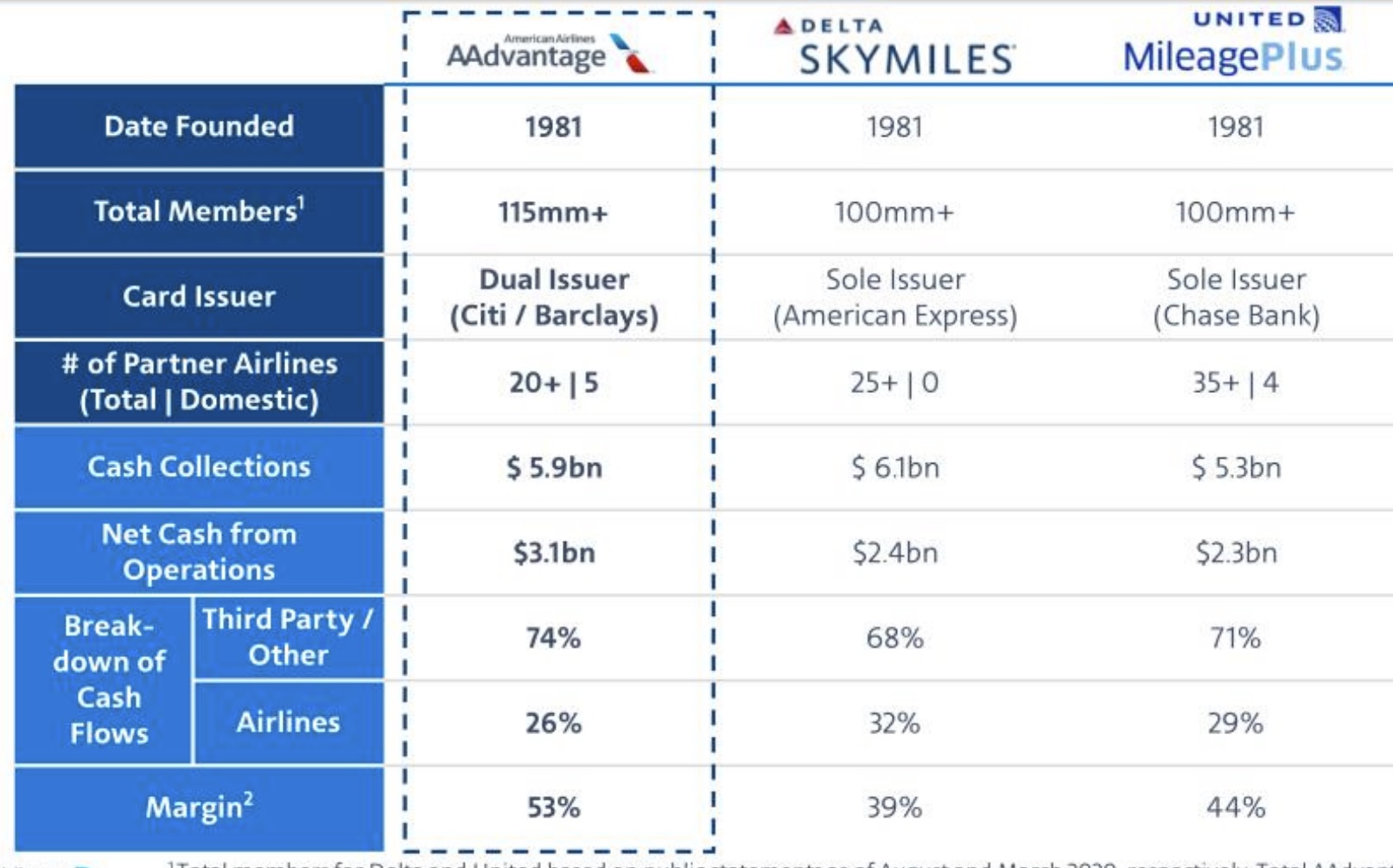

- American has previously reported a 53% margin on American AAdvantage, which is thus roughly driving $2 billion in profit. Actually flying planes is losing about $2 billion.

- It’s hard to get to exact numbers on this, airlines do not disclose a lot of detail on their programs and each does the internal accounting differently (American’s program probably doesn’t actually operate at a one-third higher margin’s than Delta’s). But it gives us an order of magnitude. They aren’t really making money on the miles ‘sold’ internally for flying, or sold to partner airlines. It’s the banks. For back of the envelope, just look at other income.

- You wouldn’t want to shut down the airline and just sell AAdvantage miles to Citibank. Nobody would want them. In fact, the more American flies in a market the more relevant they are to customers and that’ll drive greater spend on their Citi products.

- Nonetheless, it’s clear that American has been offering the wrong airline product, chasing the wrong customer, for the past dozen years.

They are trying to change this, with better reliability and a better product. That takes huge investment and takes time.

At its core, American has been:

- Flying to the wrong markets. American’s Sun Belt strategy has been worthwhile, but not at the expense of top cities. American has lost its position in key markets – New York, Chicago, Los Angeles (where they have hubs) and the Bay Area and Pacific Northwest where they’ve never been especially strong. But that’s where the most consumer spending is. They make their money on credit card business, and charge volume on their card product has gone from number one amongst airlines to number three.

- Lacking the right aircraft. American hasn’t had the planes to build back in these markets. They retired too many during the pandemic, including widebodies that could have allowed them to take advantage of the boom in Europe travel and higher profit opportunities in Asia with Chinese carriers no longer offering as much capacity.

- Pivoting away from premium at the exact wrong time. They focused on competing with Spirit and Frontier, walking away from product investment right as customers were looking for more premium options. They added seats to planes, taking premium seats out and adding coach with less space and few extra legroom seats as well.

Operationally, they’ve not just failed to meet Delta and others in on-time reliability, they’ve lost more wheelchairs and mishandled more bags and they’ve been unwilling to make investments like RFID tracking (as Delta does) because it’s too expensive. There hasn’t been enough line maintenance, either.

They’ve been adding premium seats, and – recognizing that most passengers actually fly coach, coach passengers are also premium passengers on long flights and are tomorrow’s prmeium passengers – they’ve been adding modestly to food for sale on board. And they’ve added free wifi, matching Delta and JetBlue and the direction United and Alaska are heading (and Southwest offers, with poor wifi). And they’re investing in the operations of their DFW hub.

If they’re willing to make the big investments – in new planes, in clubs, in food – and if the top leaders of the airline are willing to sell a vision to customers and especially to employees out at their stations – then a several years-long effort could turn the airline around. Without profits, though, it’s unclear how much runway they’ll have to make the investments.

And until we see the capital expenses and the CEO on the road with employees, we won’t know how committed the airline is to this kind of turnaround.

When we pause to think about where these numbers get “made,” the real story is less “one business line subsidizes another” and more “the CFO picks a transfer price and the segment margin follows.” Under ASC 606, selling miles creates a very real deferred revenue liability, but the profitability of the loyalty segment is highly sensitive to how the airline prices internal redemptions (what the program “pays” the airline for an award seat), which can be set closer to marginal cost in off-peak markets or closer to market yield in constrained hubs. If you normalize that internal rate to true network opportunity cost, you learn fast that the only durable lever is protecting high-spend origination markets and operational credibility, because that is what keeps Citi willing to pre-buy miles, fund acquisition, and renew at attractive economics when contracts reset. In other words, the “loyalty engine” is not a magic standalone profit center, it’s a capital markets and distribution instrument whose economics get repriced the moment the airline loses relevance in the exact ZIP codes that drive charge volume.

AA needs new leadership, one that understands not only today’s travellers but is willing to take the risks and costs to move forward. It is evident that Isom can not do either.

As it’s long been said (some claim by Albert Einstein): “”We cannot solve our problems with the same thinking we used when we created them””. Absolutely zero question, until AA CEO Robert Isom is terminated, AA doesn’t stand a chance.

It’s truly astounding that the Board and executive leaderhsip does not understand this point (that you’ve made for years) about how they need to plan their strategy based on AAdvantage, co-brand spend, etc. I would have thought with all the finance bros on the Board that they would have grasped this, even if most really don’t understand the airline business. So totally avoidable.

Day by day, it seems clear, the credit cards are the business; fortunately for Delta, people actually spend on their Amex; unfortunately for American, no one really uses Citi as much; same goes for United and Chase more or less. Barclays is the biggest joke of all. Credit cards with wings, for real. Epstein.

Now the airline is in a pinch. Investing in the product may or may not bring dividends. Remember MRTC? Albeit that was before the days of 29-30 inch seat pitch. Would something better than a 7/11 meal in domestic first (other than the few transcon routes) entice more people to pay for upgrades rather than give them away free? Management is frozen because they want to solve all these problems with spending little money. Some better brand of coffee onboard (WTF cares) and spending 50 cents more on a different bottle of wine. The concrete investments that have been made, expanding/remodeling clubs and a competitive business class product on International and transcon routes (NYC/BOS to JFK/SFO/SNA) are fairly safe bets.

True in a way but also not true. If you end flights, the credit card miles are worth zero, nothing to use them for. (haha, Skypesos is getting that way….worthless….but not quite yet)

As others have said, the wheels fell off when lAAbor supported Doug Parker over Horton. AA was once a greAAt and proud airline. Everyone is demorAAlized from passengers to mgmt to frontline employees.

The only reAAl question is where and how this AAll ends

Basically, AA is the cowardly airline. For the past 10 years or more, their strategy has been to run and hide. Do not compete. In the face of competition, run and hide. Pull back routes. Pull back service. Pull back meals. Pull back gates. Never , ever innovate. I’d say they have accomplished their strategy very well.

The airline industry is so competitive that making mistakes costs dearly. That’s the cause of AA profitability problem. And when you get in trouble, then is painful to get out of the hole. One mistake after another, and Isom is still at it.

Kirby has been quite the opposite. Big daring, winning decisions since the pandemic and Isom decides to challenge him in his hometown.

They’re so desperate to grow and fight for the premium market now that, being break-even, they go and pick a fight at ORD with an airline which is highly profitable and the fastest growing. An airline which can afford to lose money at ORD and has the planes to increase capacity sharply just to make you bleed. The fight at ORD is gonna cost American a lot of additional red ink and I don’t see how they can afford it with the numbers and the fleet they have now.

Just as an example, ORD-MCO they’re flying basically 737-8NGs, while UA is flying mostly A321neos and even have a 777 on the route.

Go figure.

What is the news here? The big four’s business models are dependent on loyalty program revenue. Core business alone is inadequate ensure long-term viability. Sad state of affairs, but the alternative if fewer flights that are a lot more expensive.

This is what the various unions (especially the APA-where the head of the APA at the time was even bragging about it) wanted when they voted for Parker to “merge” AA with Useless Airways. They got what they wanted, actually, they are getting what they deserve.

Apropos, I’m a loyal AA/OneWorld flyer however no sympathy from me.

Your charts really show something terrifying for US airlines in general. If that much of their revenue is dependent on points and credit cards, what is the potential risk to their business?

Legislation like the Credit Card Competition Act (CCCA), AKA “Durbin-Marshall Bill,” could theoretically wipe out billions of dollars in revenue. Let alone the potential actions the current administration may take (e.g., interest blocks) or whatever else seems to negatively “pique his attention.”

Why…Oh why are Isom and other US lackies still allowed to run this airline? So much potential, so little talent…and a nearly criminal BOD.

@ Potsey Weber If the credit card income game ever hit a serious road bump every single airline out there would be in serious financial jeopardy if that persists for more than six months to a year. The industry meltdown after 9/11 would pale in comparison. Every single airline would go into Chapter 11, shed tons of airplane leases, fire workers and set up aside labor contracts. The industry would need to substantially raise fares.

Agree with this article 100%. They need to go after major markets (Chicago competition I view as a potential good sign) and HNWIs. Hard to do when you barely even offer extra legroom seating on their newest planes and think the XLR is what people want to fly TATL – their priorities are all wrong. Where are the widebody orders? And they need to get together with Citi and formulate a Citi lounge strategy that is complements the AA clubs. Delta/Amex do this very well, and the biggest failure of the Strata Elite was the lack of any announcement about future Citi lounges. (UA/Chase don’t do this well because they have a dysfunctional relationship, although Chase at least does have its own lounges in some overlapping locations).

@Tim Dunn — So, your solution is… scapegoat the workers? Gosh, that’s awful, but not surprising coming from you (and a few others).

@Peter — I think they can still reconfigure for more MCE, regardless. XLR is good for TATL, especially if it gets us to more specific airports, instead of having to connect in major cities, on either side of the pond.