Capital One has done more than any other issuer, I think, to improve the benefits across several cards but most especially the Venture card which has a 100,000 mile initial bonus offer right now. On top of other new benefits, Capital One introduced transfer of its miles to several airline programs at the end of 2018.

Now Capital One has introduced new airline transfer partners and improved the rate that miles will transfer to some of those programs, and provided new details on its forthcoming network of airline lounges and new travel booking portal.

Improvements To Capital One Transfers

Capital One is improving the transfer rate for some airline programs and introducing new transfer partners.

Currently, outside of promotions, Capital One’s miles will transfer at 2 to 1.5 or 2 to 1 in several programs. This gets confusing because some of Capital One’s cards, Venture and Spark Miles business card, earn two miles per dollar on all spending. As a result, 2 to 1.5 means earning 1.5 airline miles per dollar spent (which is great) but seems like it’s less valuable than it is (because it isn’t ‘one-to-one’).

In other words, Capital One’s “double miles” value proposition, which has been a unique selling proposition, has made it hard to communicate the value of mileage transfers. Until tomorrow (April 20):

- Capital One is introducing a new 1:1 transfer tier, so you’ll be able to transfer Capital One miles into some airline mileage programs at 1:1, while still earning 2 miles per dollar spent.

- And they’re adding new partners: British Airways, TAP Air Portugal, and Turkish Airlines right away along with Choice Privileges later this year.

One-to-one transfers to Etihad, LifeMiles and Cathay Pacific AsiaMiles are wins. Bringing in Turkish is as well. Currently Turkish is a Citi transfer partner, but not in the Chase or American Express programs.

- Turkish offers 48 hour award holds so you can lock in an award prior to transferring points.

- Cancel and redposit fee is just $25

- First class to the Caribbean or Hawaii is just 12,500 miles one-way on United

- Europe is just 45,000 miles in business class, and India 52,500 miles (plus fuel surcharges)

- But bear in mind that the accountholder needs to appear to be traveling in order to book awards for others

Here are the new transfer rates for each partner:

| 1:1 Transfers | 2:1.5 Transfers | 2:1 Transfers | ||

| Aeromexico Club Premier | Air Canada Aeroplan | ALL – Accor Live Limitless | ||

| Avianca LifeMiles | Air France KLM Flying Blue | Emirates Skywards | ||

| Choice Hotels Choice Privileges | Singapore Airlines KrisFlyer | |||

| Etihad Guest | British Airways Avios | |||

| Cathay Pacific Asia Miles | EVA Air Infinity MileageLands | |||

| Finnair Finnair Plus | ||||

| Qantas Frequent Flyer | Turkish Airlines Miles&Smiles | |||

| TAP Air Portugal Miles&Go | ||||

| Wyndham Rewards |

New Capital One Airport Lounges Will Launch With Two Locations

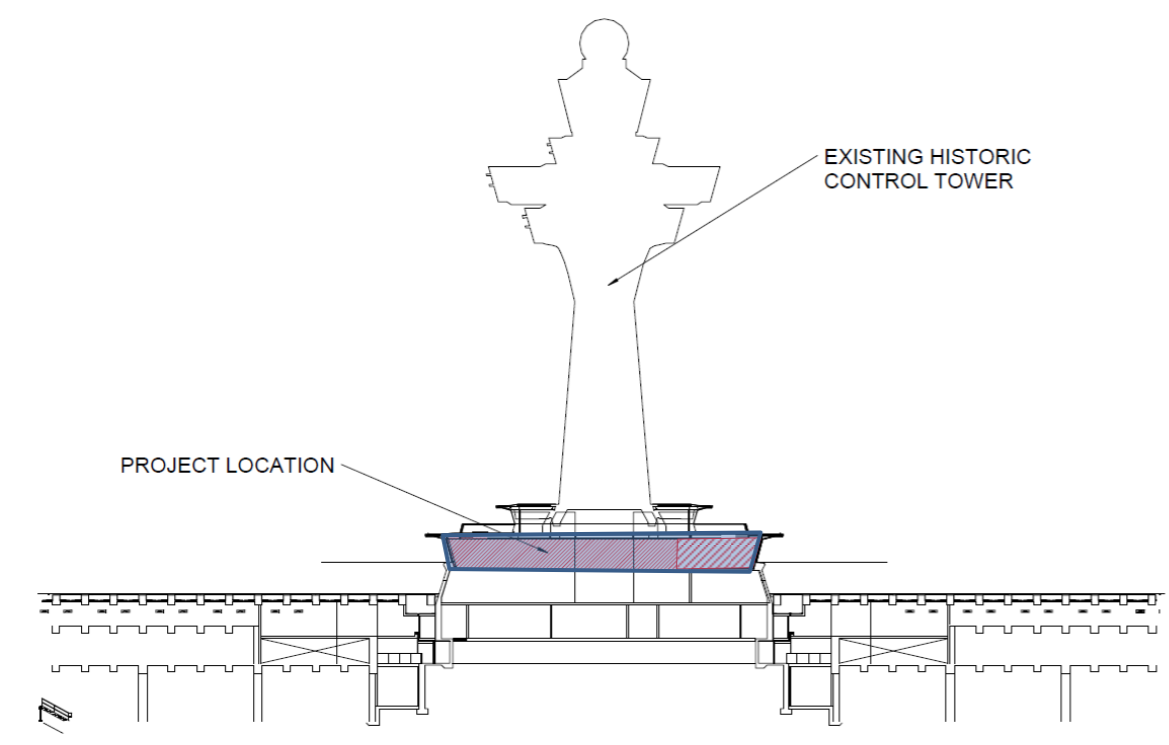

Two years ago Washington Dulles airport started looking to turn their historic control tower into a lounge, at the base of the main concourse. Capital One won that contest with planned operations by TAV Operations Services, which operates more than 90 lounges in 28 countries including Prime Class lounges at New York JFK and Palm Beach and the Turkish Airlines lounge at Washington Dulles.

It turns out Washington Dulles will be the second lounge, opening in 2022. This summer Capital One plans to introduce its first 10,000 square foot lounge at Dallas – Fort Work airport near gate D22.

Lounge access details haven’t been fully revealed, other than that Capital One cardmembers will be able to access these lounges at a discount (with rates that vary by card) suggesting they’ll be pay-in for others and that access won’t be free, which makes sense given the annual fee price point of current Capital One cards.

Lounge features:

- Sit down dining “with unique touches like craft cocktails on tap, local beers, and regional wines.”

- Grab & Go “featuring curated menus by local, up & coming chefs, healthy selections made with regionally sourced ingredients, cold brew on tap, and sustainable packaging that will make “sad salads” a thing of the past.” This will also include to go cold-brew coffee, still and sparkling water, alongside sandwiches, salads, fruit, and snacks.

- Bar and coffee bar

- Power outlets at every seat

- Cycling and yoga room

- Relaxation room with blankets, eye covers and ear plugs

- Nursing rooms with lounge chairs and footrests, bottle warmers and mini fridges with beverages and extra counter space for diaper changes

- Family area with tables and chairs for kids and a dedicated work area for adults

- Showers

- Prayer and meditation room

I love the idea of grab and go food especially, since airline meals even up front are so limited currently.

Here are renderings:

Credit: Capital One

Credit: Capital One

Credit: Capital One

Credit: Capital One

New Travel Booking Portal

Last month I wrote about Capital One leading Hoppers $170 million funding round and their plan to launch a new Hopper-powered travel booking portal. If they’re serious about their millions, there’s a real way to disrupt travel booking because current online booking engines offer such poor customer service.

The new Capital One portal will offer price prediction and price alerts to help customers get the best deal, and will be built with tools to make trip changes and cancellation easier.

And it will come with Capital One rewards-earning for bookings and redemption inside the booking tool.

We don’t know much more than this yet – whether it will offer better redemption value than existing methods of redeeming points against travel charges or what kind of customer service there will be when things go astray which – alongside not earning hotel points, elite benefits, or elite credits on chain hotel bookings – is the achilles heel of Expedia et al.

@ Gary — Three pulls for nothing? No thanks. At least Chase let’s you know the rules. These jerks just deny you without explanation.

Any word on changes to Emirates transfer ratio?

All good news but none of this will really mean much if they still continue to deny CCs for excellent credit scores for no reason. I’ve pretty much given up on them – I have one biz card but they denied 3 personal applications over 3 years. Hopefully, this development means they are finally diversifying beyond their subprime audience into a two-tier bank and will actually start approving applications.

Not wasting another hard credit pull on capital one roulette. 800 rating and denied multiple times in the past. Sticking with Amex and chase

Good news for the points program and I look forward to the additional competition! 🙂

That said, the lounge looks very generic and the drawings don’t give me confidence that they’ll have lots of windows (my personal favorite part of most lounges). I hope they distinguish themselves with food and beverage offerings and policies instead of being yet another generic lounge.

@jamesb2147 – the Dulles lounge should have nice views, the DFW lounge not so much

I guess post-COVID, buffets will be replaced by sit-down. There is likely a buffet in the back and they just bring it out.

Will this one be before or after security?

I limit the use of my Cap1 business card because they report at the end of each month balances to the credit union which kills my score. Amex and chase do not. They continue to send surveys regarding how they can approve and would I recommend the card. Frankly, I like the transfer partners, they have provided a significant LOC. Yet if I spend 10K and even if I pay the bill in full immediately I am impacted negatively. Capital One are you listening ?