I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Doctor of Credit says some banks will unofficially give a grace period to meet minimum spend requirements towards a bonus. I sure wouldn’t want to test that theory. Know how much you need to spend to earn a signup bonus, and when you need to spend it by.

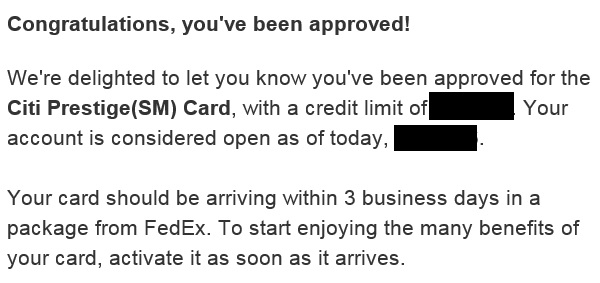

When I signed up for a Citi Prestige Card (an amazing product, here are 15 Things I Love about the card), they notified me by email. And the email said something interesting:

The email said “your account is considered open as of today” even though I didn’t have the card in hand yet! That’s important information to know, since it was the day the clock started ticking for me to spend $3000 within 3 months of account opening to earn 50,000 bonus points. (offer expired)

Notice that it’s not that I had to spend $3000 within “the first three billing cycles” or on the first three statements. It was exactly three months from the date of account opening.

Say that I were to sign up for a Chase Sapphire Preferred Card (here are 10 Things I Love About the Sapphire Preferred Card). If the account is instantly approved, that’s day one for spending $4000 within 3 months to earn a 50,000 point signup bonus. But if I’m not instantly approved, and I receive a card in the mail ten days later, I don’t know what the date of account opening was — so I don’t know exactly when I have to have spend completed by.

Most issuers don’t send the email that Citibank, so you may not know the date your card was approved and open. That’s why it can be a good idea to ask this question explicitly. I like to ask via secure messaging using the card issuer’s website so I have it in writing, not just a recollection of what a call center agent said.

Another common question is what spending counts towards the required spending for a bonus. In general an annual fee does not count as that isn’t a ‘qualifying purchase’. And spending that is rebated to you doesn’t count either.

Spending that’s rebated to you doesn’t count? Really? Didn’t know that! So, For my Premier Rewards Gold American Express card, the $100 Airline Reimbursement doesn’t count toward the minimum spend for the 25K MR points? Everyone knows the AF never counts….

I’ve lost count of how many people forgot to subtract the annual fee from their total spending when trying to hit the spending target. It’s an easy mistake to make. Merchandise returns are another hazard.

The other mistake is not meeting the target several days before the statement cutoff date. Chase in particular does not check your spending vs. the target every day, only every several days. Your bonus can be delayed a month if this happens.

My general advice is not to cut your bonus qualification close in either amount or time. Build in some margin for things to go wrong.

Roll on the day when the US banks don’t offer any airline miles to entice customers to sign up. Then we would not have articles like this with first world angst to have to cope with!

Might create a more level playing field for those who need to BUY, like, with cash, their miles!

I have had exactly two cards with bonuses for meeting minimum spends (yes, I’m new to this game), and in each instance, I have met the spending requirements within the first week of obtaining the card (in each instance, I bought a couple of airline tickets to Australia). So, I don’t ever have a problem!

I think perhaps Gary meant refunded instead of rebated. I don’t know the answer re: all rebates, but I’m pretty sure all refunds are netted against purchases.

Chase counts the day they approve you even if you don’t get the card for 2 weeks!

Another quirk with Chase seems to be that they take forever to send the card (in this case business Marriott ) and wouldn’t expedite it but when they do send it they send two a few days apart! This has happened with every Chase card I’ve received.

Thank you. My husband just got the CSP and we were wondering when the timer started ticking.

Interesting how Chase’s approval starts the clock ticking, not activation. I did not know that.

Gary, would I still receive the 1.5 % ON the $500 spent in addition to the $150 bonus?